Personal Loan Rates Today: Compare & Save

Table of Contents

Understanding Personal Loan Rates Today

Several factors influence personal loan interest rates. Understanding these factors is the first step towards securing the best possible rate for your personal loan. The key elements impacting your personal loan rates today are:

- Credit Score: Your credit score is arguably the most significant factor. Lenders use it to assess your creditworthiness.

- Excellent credit (750+) typically qualifies for the lowest personal loan rates.

- Good credit (700-749) will still get you favorable rates, but not as low as excellent credit.

- Fair credit (650-699) results in higher rates, and you may face loan approval challenges.

- Poor credit (below 650) drastically increases rates or may even lead to loan rejection.

- Loan Amount: Generally, larger loan amounts come with slightly higher interest rates due to increased risk for the lender.

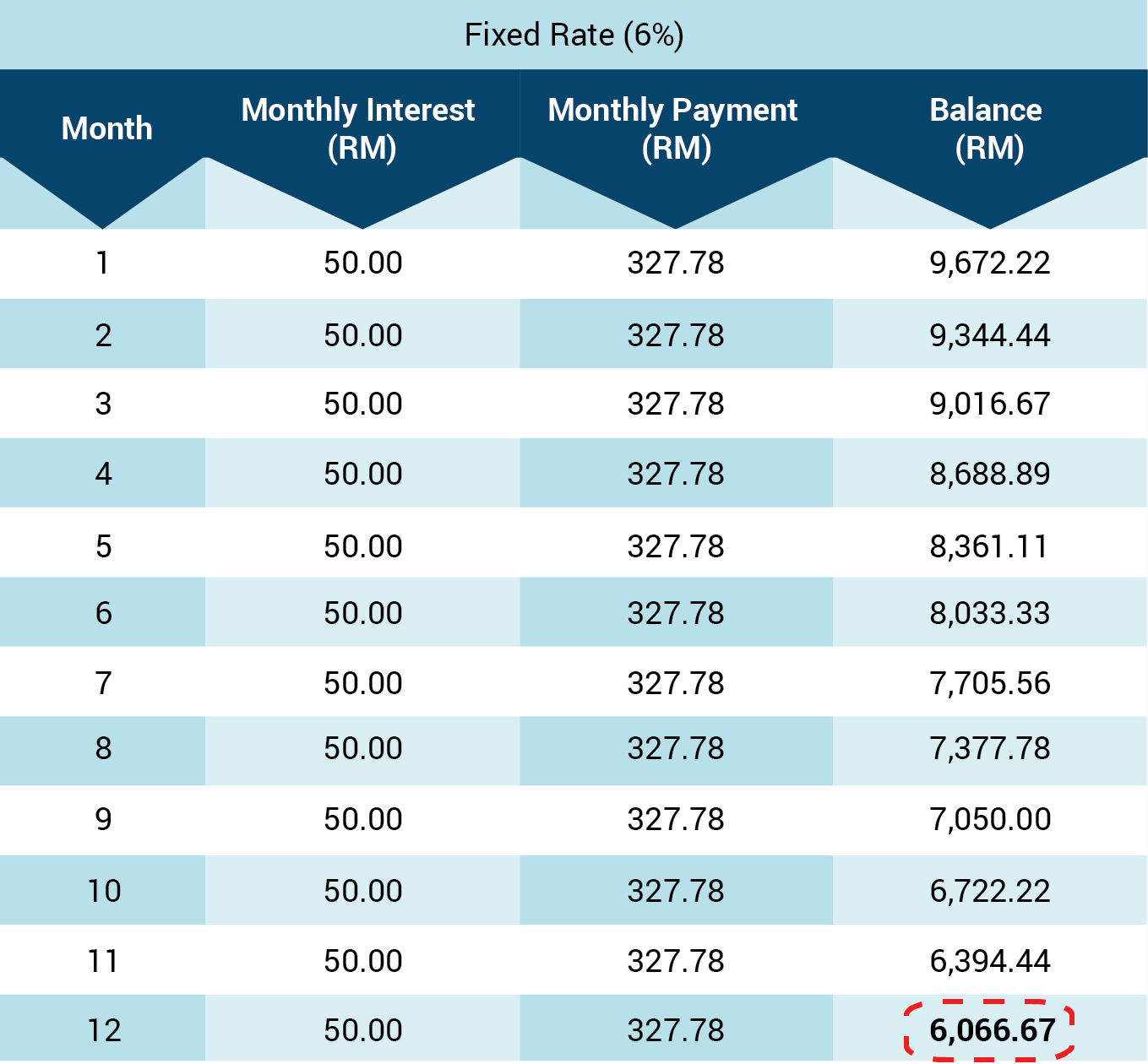

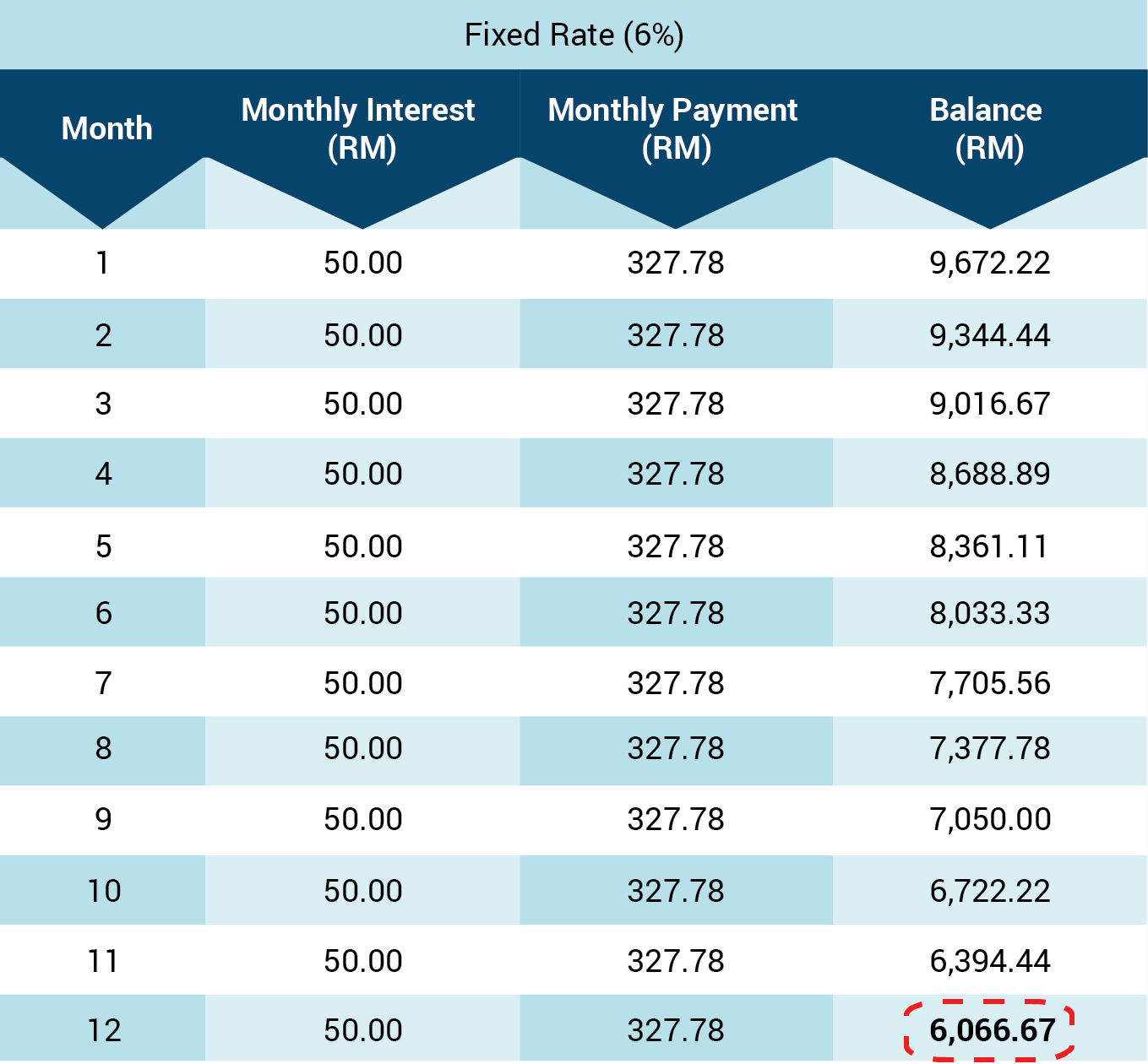

- Loan Term: The length of your loan significantly affects your monthly payments and the total interest paid. A shorter loan term means higher monthly payments but lower overall interest. A longer term leads to lower monthly payments but significantly higher interest charges over the life of the loan.

- Lender Type: Different lenders have varying interest rate structures.

- Banks often offer competitive rates but may have stricter requirements.

- Credit unions typically offer lower rates to their members, but membership may be required.

- Online lenders are often more flexible but may have higher rates than traditional institutions.

Understanding the Annual Percentage Rate (APR) is vital. The APR represents the total cost of borrowing, including interest and other fees. Always compare loan offers based on APR to get a truly accurate picture of the overall cost.

Where to Find the Best Personal Loan Rates Today

Several avenues exist for finding the best personal loan rates today:

- Banks: Traditional banks offer a wide range of personal loan options, but their rates can vary depending on your creditworthiness and the loan amount.

- Credit Unions: Credit unions are member-owned and often provide lower rates than banks, especially for their members.

- Online Lenders: These lenders offer convenience and potentially faster processing times. However, carefully check their reputation and reviews before applying.

- Peer-to-Peer Lending Platforms: These platforms connect borrowers directly with individual investors, potentially offering competitive rates.

Tips for finding reputable lenders:

- Check Reviews and Ratings: Look for lenders with positive customer reviews and high ratings from reputable financial organizations.

- Read the Fine Print: Pay close attention to the terms and conditions, including fees, interest rates, and repayment terms.

Pre-qualification allows you to check rates without impacting your credit score. This is a crucial tool to compare offers effectively.

How to Compare Personal Loan Rates Effectively

Comparing personal loan offers requires a systematic approach:

- Use Loan Comparison Websites: Several websites allow you to compare rates from multiple lenders simultaneously.

- Create a Spreadsheet: Organize the APR, fees, repayment terms, and total cost of each loan offer in a spreadsheet for easy comparison.

- Check for Hidden Fees: Be aware of potential hidden fees such as origination fees or prepayment penalties, which can significantly impact the total cost.

Remember to compare the total cost of the loan, not just the interest rate. The total cost factors in all fees and interest over the loan's lifetime.

Tips for Getting the Lowest Personal Loan Rates Today

Improving your credit score before applying for a loan can significantly impact the interest rate you receive.

- Pay Bills on Time: Consistent on-time payments demonstrate financial responsibility.

- Reduce Credit Utilization: Keep your credit card balances low compared to your credit limit.

- Negotiate: Once you've received loan offers, don't hesitate to negotiate with lenders for a lower rate.

- Co-signer: A co-signer with good credit can improve your chances of approval and potentially secure a lower interest rate.

Shopping around for the best rates is crucial – don't settle for the first offer you receive.

Find the Best Personal Loan Rates Today and Save

To recap, understanding factors such as your credit score, loan amount, and loan term is essential to securing favorable personal loan rates today. Comparing offers from various lenders, including banks, credit unions, and online lenders, and using tools like loan comparison websites, will help you find the best deal. By carefully reviewing APRs, fees, and repayment terms, and considering your total loan cost, you can save significantly on interest payments.

Don't wait! Start comparing personal loan rates today and secure the best deal for your financial needs. Use the resources and tips provided in this article to find the lowest interest rates available. Remember, taking the time to research and compare can save you thousands of dollars over the life of your loan.

Featured Posts

-

Jennifer Lopez Potential Host For The 2025 American Music Awards

May 28, 2025

Jennifer Lopez Potential Host For The 2025 American Music Awards

May 28, 2025 -

A Hideg Es A Szarazsag Kihivasai Alfoeldi Noevenykulturak Vedelme

May 28, 2025

A Hideg Es A Szarazsag Kihivasai Alfoeldi Noevenykulturak Vedelme

May 28, 2025 -

Indiana Pacers Mathurin Ejected For Hitting Clevelands Hunter Game 4 Recap

May 28, 2025

Indiana Pacers Mathurin Ejected For Hitting Clevelands Hunter Game 4 Recap

May 28, 2025 -

Gabby Agbonlahor Arsenal To Join Race For Premier League Star

May 28, 2025

Gabby Agbonlahor Arsenal To Join Race For Premier League Star

May 28, 2025 -

Roland Garros 2024 Alcaraz And Swiateks Winning Starts

May 28, 2025

Roland Garros 2024 Alcaraz And Swiateks Winning Starts

May 28, 2025