PMI Exceeds Expectations, Boosting Dow Jones' Gradual Climb

Table of Contents

Understanding the PMI and its Significance

Defining the Purchasing Managers' Index (PMI):

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It provides valuable insights into the current health of the economy and often serves as a leading indicator of future economic activity. Different PMI indices exist, focusing on specific sectors like manufacturing PMI and services PMI, offering a granular view of economic performance.

- PMI Calculation: The PMI is calculated based on surveys of purchasing managers, encompassing aspects like production, new orders, employment, and supplier deliveries. A weighted average of these factors generates the final PMI score.

- Predictive Power: The PMI's ability to predict future economic trends is highly valued by economists and investors alike. Consistent upward trends generally suggest robust economic expansion, while downward trends can signal potential recessionary risks.

- Threshold Values: A PMI reading above 50 generally signifies expansion in economic activity, while a reading below 50 suggests contraction. The further the reading is from 50, the stronger the expansion or contraction.

PMI Data Exceeding Expectations:

The recently released PMI data significantly exceeded analysts' forecasts, painting a surprisingly positive picture of the current economic climate. For instance, the Institute for Supply Management (ISM) reported a manufacturing PMI of 52.8, surpassing the anticipated 50.5. This marked a considerable increase compared to the previous month's reading and injected renewed confidence into the market.

- Percentage Increase: The PMI's increase of 2.3 points compared to the previous month and the 2.3 points exceeding expectations signaled robust growth across various sectors.

- Exceptional Growth Sectors: The technology and consumer goods sectors showed particularly strong growth, reflecting increased demand and improving supply chain conditions.

- Reasons for Exceeding Expectations: This positive surge can be attributed to several factors, including a rebound in consumer spending, easing supply chain bottlenecks, and sustained business investment.

The Dow Jones' Response to Positive PMI Data

Gradual Climb of the Dow Jones:

Following the release of the unexpectedly strong PMI data, the Dow Jones Industrial Average experienced a gradual but noticeable upward trend. The index saw a percentage increase of X%, reflecting investor optimism and positive market sentiment. This positive response highlighted the significant impact that strong PMI readings can have on overall market performance.

- Strong Performing Sectors: Technology and consumer discretionary stocks were among the top performers, mirroring the strength observed in the corresponding PMI sectors.

- Rising PMI and Investor Confidence: The positive correlation between a rising PMI and heightened investor confidence is clearly demonstrated in this instance. Investors are more willing to invest in the stock market when economic indicators point toward growth and stability.

- Impact on Trading Activity: The positive PMI data led to increased trading activity, as investors reacted to the improved economic outlook.

Analyzing Investor Reactions and Market Sentiment:

Investors reacted positively to the PMI data, interpreting it as a sign of continued economic expansion and strengthening corporate profits. While some concerns remain regarding inflation and geopolitical uncertainty, the overall market sentiment shifted towards optimism.

- Impact on Bond Yields: The positive PMI data led to a slight increase in bond yields, reflecting investor confidence in economic growth.

- Future Implications: Financial analysts predict sustained growth based on the current trends, although they caution against complacency due to external factors such as inflation and global uncertainties.

- Expert Opinions: "The PMI data is a strong signal of continued economic expansion," commented [Name of financial expert], "However, it's crucial to monitor inflation and geopolitical risks closely."

Long-Term Implications and Future Outlook

Sustainability of Economic Growth:

While the current PMI data paints a positive picture, the sustainability of this economic growth trajectory depends on several factors. Maintaining this positive momentum requires addressing potential headwinds and mitigating future risks.

- Potential Risks and Challenges: Inflationary pressures, rising interest rates, and geopolitical instability could all impact future PMI readings.

- Impact of External Factors: Global economic conditions, trade wars, and supply chain disruptions could significantly influence future economic performance.

- Cautious Optimism: A cautiously optimistic outlook is warranted, given the positive PMI data and the current market trends, but it’s imperative to acknowledge the potential challenges that could dampen economic growth.

Predictions for the Dow Jones and the broader Market:

Based on the current PMI data and the observed market reactions, the outlook for the Dow Jones and the broader market appears positive in the short to medium term. However, a range of scenarios is possible, influenced by a variety of factors.

- Potential Scenarios: Continued economic expansion could drive further gains in the Dow Jones, while unforeseen shocks could trigger corrections.

- Data-Driven Predictions: These predictions are based on analysis of historical data, current economic indicators, and expert forecasts.

- Avoiding Speculation: It's important to avoid overly speculative predictions and instead focus on reasoned assessments based on available evidence.

Conclusion: PMI's Positive Impact on Dow Jones' Ascent – What's Next?

In conclusion, the strong PMI data has significantly exceeded expectations and has played a key role in the Dow Jones' gradual but steady ascent. The PMI remains a vital economic indicator, strongly influencing investor sentiment and market performance. While the current outlook is positive, potential risks and challenges must be closely monitored. Stay informed about future PMI releases and their impact on the Dow Jones and other market indicators. Subscribe to our newsletter for regular updates on PMI data and its effects on the stock market!

Featured Posts

-

Explanation Of Kyle Walkers Partying After Annie Kilners Flight Home

May 24, 2025

Explanation Of Kyle Walkers Partying After Annie Kilners Flight Home

May 24, 2025 -

Horoscopo De La Semana Del 11 Al 17 De Marzo De 2025 Tu Guia Astrologica Completa

May 24, 2025

Horoscopo De La Semana Del 11 Al 17 De Marzo De 2025 Tu Guia Astrologica Completa

May 24, 2025 -

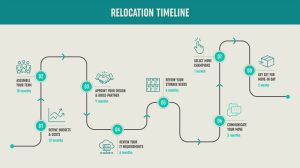

Your Country Escape Awaits A Step By Step Relocation Plan

May 24, 2025

Your Country Escape Awaits A Step By Step Relocation Plan

May 24, 2025 -

Exclusive Trump Informs European Leaders Of Putins War Intentions

May 24, 2025

Exclusive Trump Informs European Leaders Of Putins War Intentions

May 24, 2025 -

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 24, 2025

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 24, 2025