Podcast: Low Inflation – A Temporary Economic Climate?

Table of Contents

Factors Contributing to Low Inflation

Several key factors are currently contributing to the surprisingly low inflation rates observed globally. These factors, though interconnected, offer a multifaceted understanding of the current economic climate.

Supply Chain Improvements

The global supply chain disruptions that plagued the economy in recent years are finally easing. This improvement significantly impacts prices.

- Reduced shipping costs: Reduced congestion in ports and improved logistics have led to a decrease in shipping costs, making goods cheaper to transport and ultimately reducing their price at the point of sale.

- Increased production: Manufacturers are now better able to meet demand, increasing the supply of goods and reducing inflationary pressures associated with scarcity.

- Improved inventory management: Businesses have improved their inventory management techniques, leading to better stock control and a reduction in the need for emergency orders at inflated prices.

These improvements in global supply chains have directly countered the "supply chain bottlenecks" that previously fueled inflationary pressures. The resulting increase in goods availability has helped to ease inflationary pressures across various sectors.

Decreased Consumer Demand

Alongside supply-side improvements, a decrease in consumer demand is another significant contributor to low inflation. Several factors contribute to this reduced demand.

- Reduced consumer confidence: Concerns about a potential recession, rising interest rates, and geopolitical instability have dampened consumer confidence, leading to more cautious spending habits.

- Higher interest rates: Central banks worldwide have implemented interest rate hikes to combat inflation, making borrowing more expensive and cooling down consumer spending, effectively reducing "demand-pull inflation."

- Changing spending priorities: Consumers are prioritizing essential goods and services over discretionary purchases, shifting spending patterns and reducing overall demand in certain sectors.

The interplay between reduced consumer confidence and higher interest rates has significantly curtailed consumer spending, thus easing the demand-side pressures that historically fuel inflation.

Government Policies and Interventions

Government policies and interventions also play a crucial role in managing inflation. Both monetary and fiscal policies have been instrumental in influencing the current low inflation environment.

- Interest rate hikes: Central banks worldwide have aggressively raised interest rates to curb inflation, impacting borrowing costs and influencing spending patterns.

- Government spending cuts: In some regions, governments have implemented spending cuts to reduce inflationary pressures arising from excessive government demand.

- Targeted subsidies: While less common, targeted subsidies can be used to offset price increases in specific sectors, mitigating inflationary impact on consumers.

The coordinated efforts of central banks through "monetary policy" and governments through "fiscal policy" – including "inflation targeting" strategies – have played a vital role in shaping the current low inflation landscape.

Is Low Inflation Sustainable? Examining Potential Shifts

While current indicators point to low inflation, the question of its sustainability remains a complex one. Several factors could disrupt this trend.

Geopolitical Instability and its Impact

Geopolitical events can significantly impact global supply chains and fuel inflationary pressures.

- Energy price volatility: Global conflicts and political instability often lead to significant fluctuations in energy prices, directly impacting production costs and consumer prices.

- Conflict: Wars and conflicts disrupt trade routes, limit access to resources, and create uncertainty, which can trigger inflationary spikes.

- Resource scarcity: Geopolitical tensions can exacerbate resource scarcity, leading to higher prices for essential commodities and contributing to "commodity prices" inflation.

These "geopolitical risks" present a considerable threat to the sustained period of low inflation.

Wage Growth and its Influence

The relationship between wage growth and inflation is a crucial factor to consider.

- Labor shortages: In many sectors, labor shortages are driving up wages, potentially fueling "cost-push inflation" as businesses pass increased labor costs onto consumers.

- Rising wages: Increased wages, while beneficial for workers, can contribute to higher production costs and ultimately higher prices for goods and services.

- "Wage inflation" can create a positive feedback loop, where higher wages lead to higher prices, which then necessitate further wage increases.

The dynamics of the "labor market" and the "employment rate" will significantly influence whether low inflation persists.

Technological Advancements and Productivity

Technological advancements can either contribute to or mitigate inflation depending on their impact on productivity.

- Automation: Automation can lead to increased efficiency and reduced labor costs, potentially lowering prices in the long run.

- Increased efficiency: Technological innovations often improve efficiency in production and distribution, reducing costs and potentially keeping a lid on prices.

- Reduced production costs: Technologies that streamline production processes can help to lower production costs, preventing inflationary pressures from squeezing profit margins.

"Technological innovation" and "productivity growth" are long-term factors that may significantly influence "long-term inflation" trends.

Conclusion

The current low inflation environment is a result of a complex interplay of factors including improved supply chains, decreased consumer demand, and government interventions. While these factors currently support a low inflation rate, the sustainability of this trend is uncertain. Geopolitical instability, wage growth, and the pace of technological advancement will all play crucial roles in shaping future inflation trends. The uncertainties and complexities involved make predicting future inflation a challenging task.

Listen to our podcast on low inflation to gain valuable insights! Don't miss our exploration of whether low inflation is a temporary phenomenon or a more permanent shift in the economic landscape. Understanding the nuances of inflationary pressures is crucial for navigating the complexities of the modern economy.

Featured Posts

-

Exploring A Kevin Costner Less Yellowstone Spinoff The Future Of John Dutton Iii

May 27, 2025

Exploring A Kevin Costner Less Yellowstone Spinoff The Future Of John Dutton Iii

May 27, 2025 -

Jennifer Lopezs Excitement Witnessing This Iconic Performance

May 27, 2025

Jennifer Lopezs Excitement Witnessing This Iconic Performance

May 27, 2025 -

Exploring Bangladesh Your Gateway To Information Via Bangladeshinfo Com

May 27, 2025

Exploring Bangladesh Your Gateway To Information Via Bangladeshinfo Com

May 27, 2025 -

Organic Growth Drives Cenovus Decision Against Meg Bid Says Ceo

May 27, 2025

Organic Growth Drives Cenovus Decision Against Meg Bid Says Ceo

May 27, 2025 -

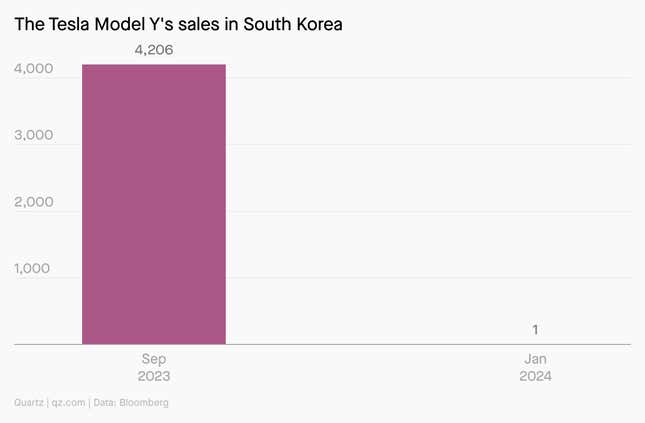

The Impact Of Elon Musks Anger On Teslas Future

May 27, 2025

The Impact Of Elon Musks Anger On Teslas Future

May 27, 2025