Positive Earnings Forecast: BSE Share Price To Rally In Indian Bourse

Table of Contents

Robust Corporate Earnings Drive BSE Share Price Upward

Recent financial reports paint a rosy picture for many Indian companies, significantly boosting investor sentiment and driving the BSE share price upward. This surge in corporate earnings is a key catalyst for the anticipated rally. Several leading companies have reported exceptional results, contributing significantly to the overall market growth.

- Increased Revenue: Many companies have witnessed substantial increases in their revenue streams, indicating strong demand for their products and services.

- Improved Profit Margins: Efficient operations and strategic cost management have led to improved profit margins for numerous companies listed on the BSE.

- Higher EPS (Earnings Per Share): The rise in earnings per share reflects increased profitability and shareholder value, further bolstering investor confidence.

For instance, companies like Reliance Industries and Infosys have shown remarkable growth, contributing significantly to the BSE Sensex and Nifty 50 indices. Their strong performances are indicative of a broader trend of improved corporate health and profitability within the Indian Bourse.

Positive Economic Indicators Fuel Investor Confidence

Beyond corporate earnings, positive economic indicators further solidify the bullish outlook for the BSE. These favorable trends are bolstering investor confidence and fueling the anticipated share price rally.

- GDP Growth: India's consistent GDP growth, despite global headwinds, signals a resilient economy capable of supporting market expansion.

- Inflation Rates: Stable inflation rates contribute to a predictable economic environment, encouraging investment and reducing uncertainty.

- Foreign Investment Inflows: Increased foreign investment signifies global confidence in the Indian economy, injecting significant capital into the BSE.

These positive economic indicators collectively paint a picture of a growing and stable economy, fostering a positive market sentiment and encouraging investment in BSE shares.

Sector-Specific Growth Contributing to BSE Share Price Increase

The BSE share price increase is not solely driven by overall economic growth; specific sectors are experiencing exceptional performance, further boosting the market. This sectoral growth is a crucial factor in the anticipated rally.

- Technology: The technology sector continues to be a significant driver of growth, with companies showcasing strong innovation and global demand.

- Pharmaceuticals: The pharmaceutical sector benefits from increasing healthcare spending and a growing global need for medications.

- Financials: Strong banking and financial services contribute significantly to the overall market health and stability.

Companies within these high-growth sectors, such as TCS (Tata Consultancy Services) in technology and HDFC Bank in financials, are key contributors to the overall BSE share price increase. Analyzing BSE sectoral indices reveals the significant contribution of these thriving sectors.

Technical Analysis Suggests Further Upside for BSE Share Prices

Technical analysis provides further support for the anticipated upward trend in BSE share prices. Several key indicators point towards a continuation of the rally.

- Moving Averages: The upward trajectory of moving averages suggests a strong bullish trend.

- Support and Resistance Levels: The market has consistently broken through resistance levels, indicating strong buying pressure.

- Trading Volume: High trading volume accompanies price increases, confirming the strength of the upward trend.

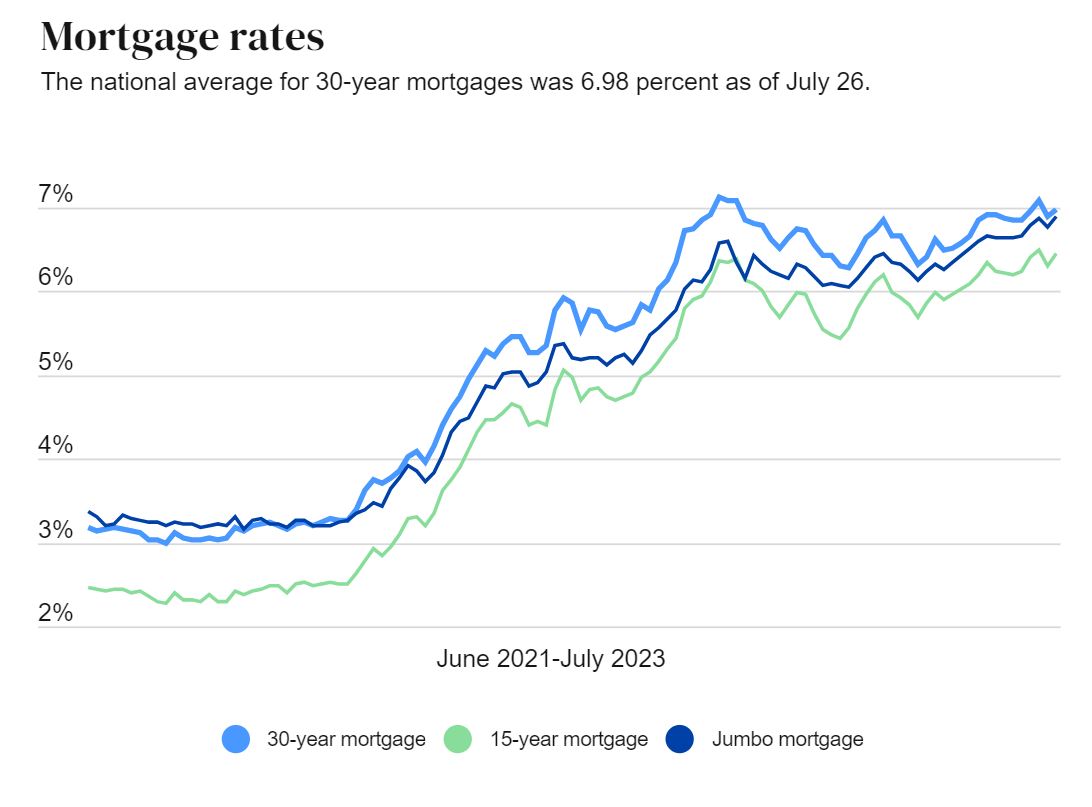

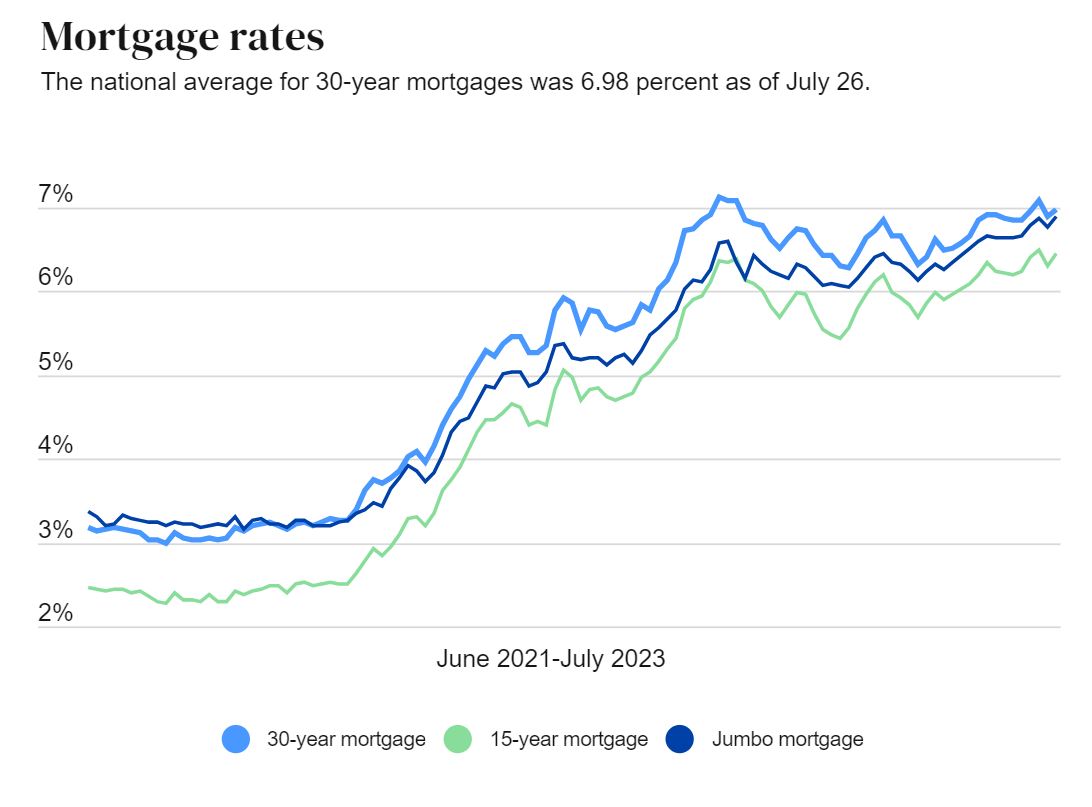

While past performance is not indicative of future results, these technical signals, when viewed in conjunction with fundamental analysis, suggest a promising outlook for BSE share prices. (Note: Including relevant charts and graphs here would significantly enhance this section.)

Capitalize on the Positive Earnings Forecast: Invest in BSE Shares

In summary, the positive earnings forecast for numerous companies listed on the BSE, coupled with strong economic indicators and sector-specific growth, paints a compelling picture for a significant share price rally in the Indian Bourse. The potential for substantial gains is evident. However, it's crucial to conduct thorough research and understand your risk tolerance before making any investment decisions. Consider consulting with a qualified financial advisor to develop a personalized investment strategy. Capitalize on this positive earnings forecast and explore the exciting investment opportunities available in the BSE share market. Don't miss out on this potential for growth in the Indian Bourse – start your research on BSE share prices today!

Featured Posts

-

Warriors Beat Kings Kuminga Returns Curry And Kerr Celebrate Milestones

May 07, 2025

Warriors Beat Kings Kuminga Returns Curry And Kerr Celebrate Milestones

May 07, 2025 -

Papa Francesco E Il Conclave Il Ruolo Del Sud Del Mondo Nella Chiesa

May 07, 2025

Papa Francesco E Il Conclave Il Ruolo Del Sud Del Mondo Nella Chiesa

May 07, 2025 -

The White Lotus Season 3 Ke Huy Quans Unexpected Voice Role

May 07, 2025

The White Lotus Season 3 Ke Huy Quans Unexpected Voice Role

May 07, 2025 -

Stan Wyjatkowy Sluchaj Nowego Podcastu Onetu I Newsweeka Dwa Razy W Tygodniu

May 07, 2025

Stan Wyjatkowy Sluchaj Nowego Podcastu Onetu I Newsweeka Dwa Razy W Tygodniu

May 07, 2025 -

Rihanna And A Ap Rocky Relationship Timeline And Latest Updates

May 07, 2025

Rihanna And A Ap Rocky Relationship Timeline And Latest Updates

May 07, 2025