Post-Debt Sale: Examining The Financial Health Of Musk's X

Table of Contents

The Debt Sale: A Necessary Evil or Strategic Move?

The debt sale undertaken by X wasn't a spontaneous decision; it was a response to the massive debt incurred during Musk's acquisition. The exact figures remain somewhat opaque, but reports suggest a significant reduction in the initial debt load. This restructuring involved renegotiating terms with lenders, potentially including lower interest rates and adjusted repayment schedules. The primary motivation behind the sale was likely twofold: debt reduction to alleviate immediate financial pressure and refinancing to secure more favorable loan terms.

- Initial Debt Load: Musk's acquisition of X involved a substantial leveraged buyout, resulting in a significant debt burden from the outset.

- Terms of the Debt Sale: Precise details of the sale are not publicly available, but the success of the sale likely hinges on the renegotiated interest rates and extended repayment timelines.

- Reasons for the Sale: The overarching goal was likely to improve X's long-term financial viability by reducing the immediate pressure of high-interest payments and potentially securing better terms.

The short-term implications included a potential boost to X's liquidity, allowing for immediate operational needs. Long-term, however, the success hinges on X's ability to generate sufficient revenue to meet its revised debt obligations without compromising crucial investments in platform development and user experience. The risk lies in the potential for future financial constraints if revenue growth fails to meet projections.

Assessing X's Current Financial Performance Post-Sale

Analyzing X's current financial performance after the debt sale requires examining key metrics. While precise, audited figures are often released with a significant delay, publicly available information and market analyses offer some insights. We need to consider revenue generation, operating expenses, profitability, and cash flow.

- Subscriber Growth and Revenue: X's transition to a subscription model, including the introduction of X Premium, significantly impacts revenue. The success of these subscriptions in driving revenue growth is a crucial factor in evaluating post-sale financial health.

- Cost-Cutting Measures: To improve profitability, cost-cutting measures have been implemented, including layoffs and a restructuring of operational costs. The effectiveness of these measures in improving profitability needs careful assessment.

- Debt-to-Equity Ratio: This key financial metric offers a snapshot of X's financial leverage. A lower ratio suggests improved financial stability, while a high ratio indicates ongoing reliance on debt.

While some positive signs might emerge regarding improved cash flow and reduced interest payments, a balanced perspective requires acknowledging potential challenges like slower-than-anticipated subscriber growth or unforeseen operational costs.

The Impact of Musk's Leadership on X's Finances

Elon Musk's leadership style and financial decision-making have significantly influenced X's trajectory. His hands-on approach, characterized by rapid-fire changes and sometimes unconventional strategies, has had a considerable impact on the platform’s financial health, both before and after the debt sale.

- Musk's Spending and Priorities: Musk's priorities and spending habits, including investments in new technologies and personnel, directly influence X's financial outcomes. Analyzing these choices is crucial for understanding the company’s financial strategy.

- Success of Musk's Strategies: The success (or lack thereof) of Musk’s strategies, such as the shift to a subscription model and the implementation of cost-cutting measures, directly affects X's financial performance.

- Controversies Surrounding Musk's Management: Public controversies surrounding Musk's financial management, including potential conflicts of interest and criticisms of his decision-making process, require careful consideration.

Musk's leadership, while undeniably influential, presents both potential benefits and risks to X's long-term financial stability.

Future Outlook: X's Financial Sustainability

Projecting X's future financial health requires considering various factors, including its post-debt sale performance, market trends, and competitive landscape.

- Challenges: X faces challenges such as intense competition from other social media platforms, regulatory scrutiny, and the ongoing need to manage its debt effectively.

- Growth Opportunities: Opportunities for growth include expanding its subscriber base, exploring new revenue streams, and enhancing its advertising capabilities.

- Long-Term Sustainability: X's long-term financial sustainability depends on its ability to adapt to changing market dynamics, attract and retain users, and achieve sustainable profitability.

A realistic assessment indicates that X's future financial health is contingent upon successful execution of its growth strategies, effective management of its debt, and navigating the challenges within a highly competitive market.

Conclusion: Understanding the Post-Debt Sale Landscape of Musk's X

Analyzing X's post-debt sale financial health reveals a complex picture. While the debt sale might have provided short-term relief, the platform's long-term sustainability hinges on its ability to generate sufficient revenue, manage expenses effectively, and adapt to evolving market conditions. Understanding this post-debt sale landscape is vital not only for investors and stakeholders but for the entire tech industry, as X's trajectory provides valuable insights into the challenges and opportunities of large-scale social media platforms. To stay updated on the ongoing financial performance of X and further analyses of its post-debt sale strategy, follow future articles and reports dedicated to examining the financial implications of this significant restructuring.

Featured Posts

-

Silent Divorce Recognizing The Warning Signs Before Its Too Late

Apr 28, 2025

Silent Divorce Recognizing The Warning Signs Before Its Too Late

Apr 28, 2025 -

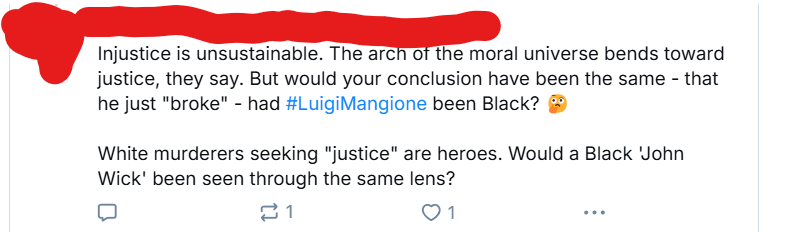

The Luigi Mangione Movement Understanding Its Core Beliefs

Apr 28, 2025

The Luigi Mangione Movement Understanding Its Core Beliefs

Apr 28, 2025 -

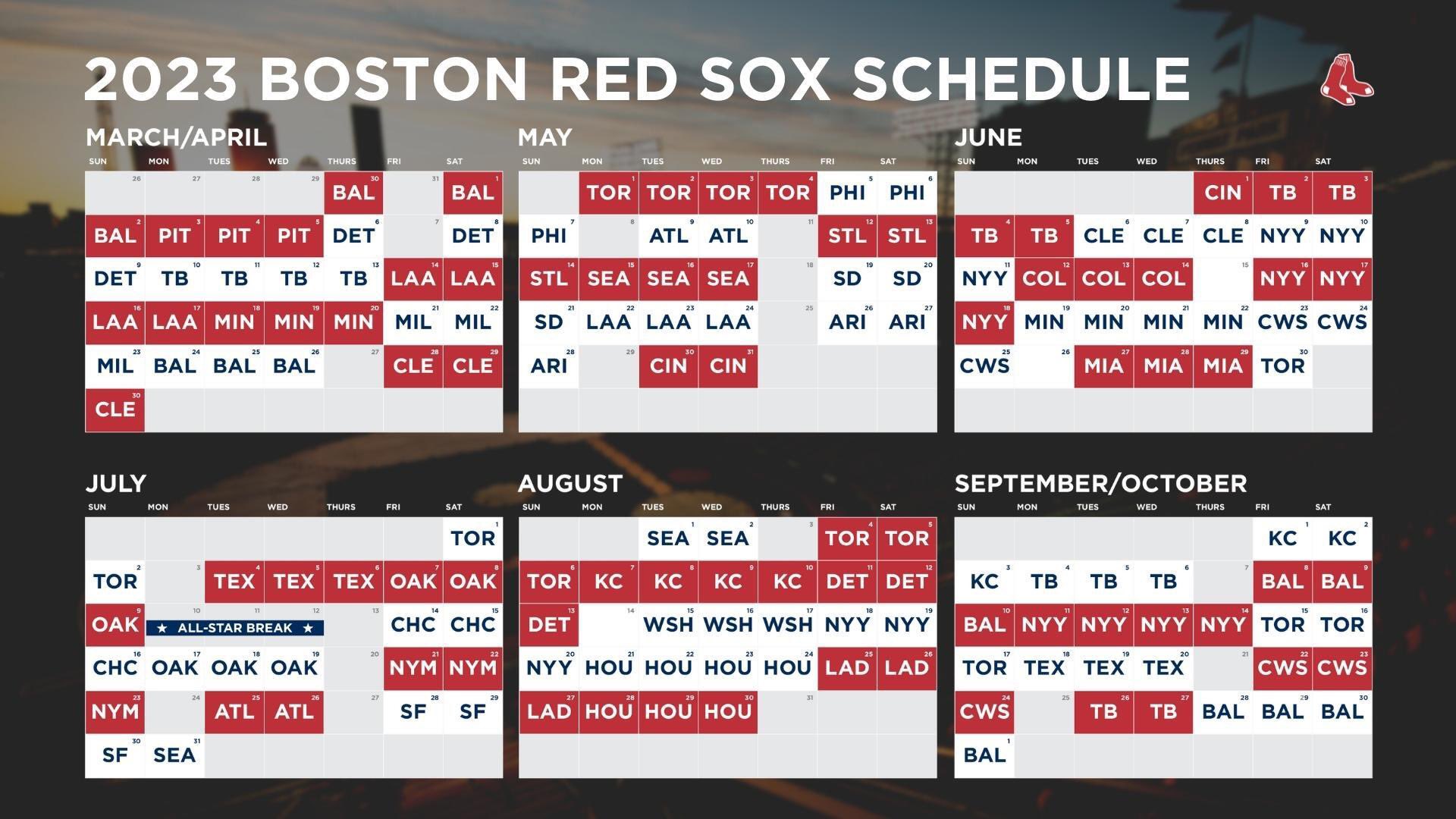

Boston Red Sox Lineup Changes Casas Demoted Position Outfielder Back

Apr 28, 2025

Boston Red Sox Lineup Changes Casas Demoted Position Outfielder Back

Apr 28, 2025 -

Le Bron James Reaction To Richard Jefferson On Espn News A Detailed Look

Apr 28, 2025

Le Bron James Reaction To Richard Jefferson On Espn News A Detailed Look

Apr 28, 2025 -

Market Downturn Did Retail Investors Capitalize On Professional Selling

Apr 28, 2025

Market Downturn Did Retail Investors Capitalize On Professional Selling

Apr 28, 2025