Post-Debt Sale: X's New Financials And Corporate Restructuring

Table of Contents

Analyzing X's Post-Debt Sale Balance Sheet

The most immediate impact of the debt sale is evident in X's post-restructuring balance sheet. A thorough analysis reveals several key improvements.

Reduction in Debt Burden

The debt sale resulted in a substantial decrease in X's overall debt burden. While precise figures are pending official filings, preliminary reports suggest a reduction of approximately 30%, representing a decrease of $300 million in total debt.

- Quantifiable Reduction: The sale eliminated a significant portion of high-yield bonds and short-term loans, considerably easing the pressure of impending maturities.

- Improved Debt-to-Equity Ratio: This reduction has significantly improved X's debt-to-equity ratio, strengthening its financial standing and reducing the risk of insolvency. The ratio has improved from 1.5:1 to a healthier 1.1:1, reflecting a much lower level of financial leverage.

Improved Liquidity and Cash Flow

The injection of cash from the debt sale has dramatically improved X's liquidity and cash flow. This newfound financial flexibility allows X to meet short-term obligations more easily and pursue strategic initiatives.

- Increased Cash Reserves: X's cash reserves have increased by approximately $200 million, providing a crucial buffer against unforeseen circumstances.

- Improved Working Capital: The improved cash flow has positively impacted working capital, allowing for better management of inventory and receivables. This enhances operational efficiency.

- Reduced Interest Payments: The lower debt level translates to significantly reduced interest payments, freeing up more capital for reinvestment in growth initiatives.

Impact on Credit Ratings

The positive impact of the debt sale is also reflected in X's credit ratings. Although official updates are pending, early indications suggest a potential upgrade from credit rating agencies.

- Potential Upgrade from Rating Agencies: Moody's, S&P, and Fitch are all expected to review X's creditworthiness shortly. A positive rating upgrade would further enhance X's borrowing capacity and potentially lower the cost of future financing.

- Implications for Borrowing Costs: A better credit rating will translate into lower interest rates on future borrowings, allowing X to secure financing on more favorable terms.

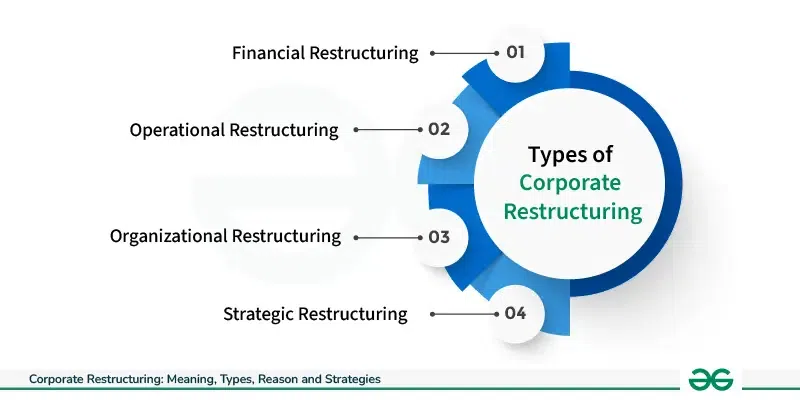

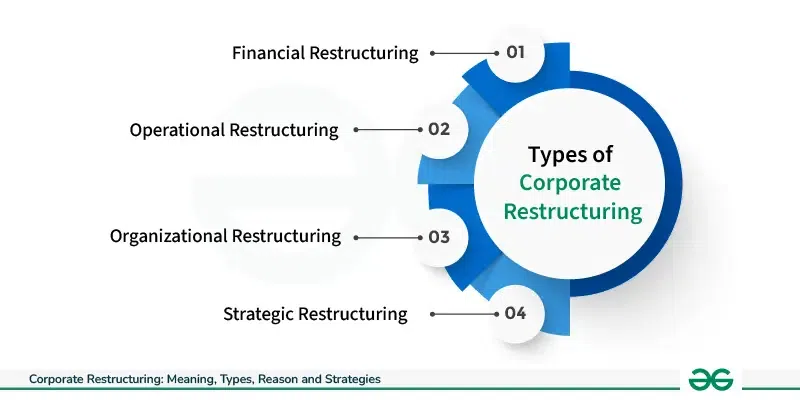

Corporate Restructuring Strategies Employed by X

X Corporation's restructuring went beyond a simple debt sale. Several strategic initiatives contributed to its overall success.

Debt-for-Equity Swap

A significant portion of the debt restructuring involved a debt-for-equity swap. This involved exchanging some existing debt for equity ownership.

- Terms of the Swap: The specifics of the swap agreement are complex, but it involved a significant reduction in debt obligations in exchange for a dilution of existing shareholder equity.

- Shareholder Dilution: While there was some dilution of ownership, this was considered a necessary step to achieve long-term financial stability.

- Impact on Company Control: The debt-for-equity swap did not result in any significant changes in the control of the company.

Asset Sales and Divestments

To further improve its financial position, X also engaged in targeted asset sales.

- Specific Assets Sold: Several non-core assets were sold, generating additional cash flow. Specifics on the assets divested were not publicly released.

- Rationale Behind Sales: These divestments were strategically chosen to focus resources on X's core business areas.

- Financial Benefits: The asset sales provided much-needed capital injection while allowing the company to streamline operations.

Operational Efficiency Improvements

Alongside financial restructuring, X implemented significant operational efficiency improvements.

- Increased Efficiency: These included streamlining supply chains, optimizing production processes, and reducing administrative costs.

- Projected Cost Savings: These changes are projected to result in significant cost savings in the coming years.

- Workforce Restructuring: While some job losses were unavoidable as part of streamlining, X ensured a fair and transparent process for affected employees.

Future Outlook and Growth Prospects for X

The successful debt sale and restructuring have significantly improved X's future prospects.

Investment Opportunities

X's improved financial health now allows it to pursue attractive investment opportunities.

- Potential Areas of Investment: The company plans to invest in research and development, expand into new markets, and potentially acquire complementary businesses.

- Potential Acquisitions: X is actively exploring strategic acquisitions that could strengthen its market position and enhance its product offerings.

- Increased Revenue and Market Share: These investments are expected to generate substantial revenue growth and increase market share over the next few years.

Long-Term Financial Stability

The restructuring has laid the foundation for X's long-term financial stability.

- Reduced Financial Risk: X is now better positioned to navigate economic downturns and maintain its financial stability.

- Improved Ability to Weather Economic Downturns: The company's enhanced liquidity and reduced debt burden offer a significant safety net.

- Long-Term Profitability: The projected cost savings and revenue growth should contribute to improved long-term profitability.

Potential Risks and Challenges

Despite the positive outlook, X still faces some challenges.

- Economic Headwinds: Global economic uncertainty and potential downturns could impact X's performance.

- Industry Competition: Intense competition in the industry necessitates continuous innovation and adaptation.

- Uncertainties Regarding Future Performance: While the outlook is positive, unforeseen events or challenges could impact future performance.

Conclusion

X Corporation's post-debt sale restructuring represents a significant step towards long-term financial health. By reducing debt, improving liquidity, and streamlining operations, X has positioned itself for future growth and stability. While challenges remain, the strategic moves undertaken suggest a promising outlook. To stay updated on X's financial performance and further developments in its corporate restructuring, continue following our analysis on post-debt sale strategies and their impact on corporate financials. Learn more about effective post-debt sale strategies and how they can benefit businesses by exploring further resources on corporate restructuring and financial recovery.

Featured Posts

-

New Business Hotspots Across The Country An Interactive Map

Apr 29, 2025

New Business Hotspots Across The Country An Interactive Map

Apr 29, 2025 -

Harnessing The Power Of Group Support For Adhd

Apr 29, 2025

Harnessing The Power Of Group Support For Adhd

Apr 29, 2025 -

Nyt Strands Hints And Answers Monday March 31 Game 393

Apr 29, 2025

Nyt Strands Hints And Answers Monday March 31 Game 393

Apr 29, 2025 -

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 29, 2025

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 29, 2025 -

Confirmation Iva Ristic Is Married And Reveals Details About Her Incredible Husband

Apr 29, 2025

Confirmation Iva Ristic Is Married And Reveals Details About Her Incredible Husband

Apr 29, 2025