Posthaste: Are Canadian Home Prices Entering A Correction?

Table of Contents

Signs Pointing Towards a Market Correction

Several indicators suggest a potential correction in the Canadian housing market, moving beyond a simple slowdown.

Decreasing Sales Activity

- The Canadian Real Estate Association (CREA) reported a [Insert Percentage]% decrease in national home sales in [Month, Year] compared to the same period last year. This decline is consistent across major metropolitan areas, including Toronto, Vancouver, and Montreal.

- Specific cities like Calgary and Edmonton have experienced even more dramatic drops, signaling a broader shift in market dynamics. This decrease reflects a reduction in buyer activity due to increased interest rates and economic uncertainty. The combination of these factors has cooled buyer enthusiasm, leading to fewer transactions.

Slowing Price Growth (or Price Decreases)

- While prices haven't plummeted across the board, the rate of price appreciation has significantly slowed in many areas. Data from [Source, e.g., Teranet-National Bank National Composite House Price Index] shows a [Insert Percentage]% slowdown in price growth compared to the previous year.

- Certain regions are even witnessing price decreases, particularly in previously overheated markets. It's crucial to differentiate between a slowdown (a decrease in the rate of price growth) and a correction (an actual decline in prices). While a slowdown is currently evident, whether it will escalate into a full-blown correction remains to be seen.

Increased Inventory Levels

- The number of homes available for sale has increased compared to the previous year, signifying a shift in the balance between supply and demand. Higher inventory levels give buyers more options and negotiating power.

- This increased inventory contributes to decreased sales prices as sellers compete for buyers. The increased choice for buyers further contributes to a slowdown in price increases and potentially to price drops in some areas.

Factors Contributing to Potential Correction

Several factors are contributing to the potential for a Canadian housing market correction.

Rising Interest Rates

- The Bank of Canada's aggressive interest rate hikes have significantly reduced borrowing power for potential homebuyers. Higher interest rates increase mortgage payments, making homes less affordable.

- This directly impacts buyer demand, as many potential purchasers find themselves priced out of the market or hesitant to take on significant debt in an uncertain economic climate.

Economic Uncertainty

- Inflation, recessionary fears, and geopolitical instability are creating an atmosphere of economic uncertainty. This uncertainty makes consumers more cautious about making large financial commitments like purchasing a home.

- Decreased consumer confidence directly impacts housing market activity. When people feel less secure about their financial future, they're less likely to invest in expensive assets such as real estate.

Government Policies

- Government policies, such as stress tests and stricter mortgage rules, have aimed to cool down the housing market. These policies limit borrowing capacity and make it harder for some to qualify for a mortgage.

- While the intent is to stabilize the market, the effectiveness of these policies in preventing a more significant correction remains a subject of ongoing debate. The cumulative effect of these policies with rising interest rates has significantly impacted affordability.

Counterarguments and Factors Suggesting Stability

Despite the signs of a potential correction, certain factors suggest that the Canadian housing market may not experience a dramatic downturn.

Strong Fundamentals

- Canada boasts a relatively strong economy with low unemployment rates and sustained population growth. These factors continue to support housing demand, even in a cooling market.

- Despite the slowdown, underlying economic strengths could lead to a continued, albeit slower, growth in home prices in the long term. The demographic trend of population growth places ongoing pressure on housing supply.

Limited Supply

- A persistent shortage of housing in many Canadian cities continues to constrain supply. This limited supply can act as a buffer against significant price drops, even with reduced demand.

- Even with lower demand, the scarcity of available properties means that prices are unlikely to fall dramatically. The imbalance between supply and demand remains a significant factor in the housing market's overall stability.

Conclusion: Posthaste: Understanding the Canadian Housing Market Correction

The Canadian housing market is undeniably slowing, with several indicators pointing towards a potential correction. Rising interest rates, economic uncertainty, and government policies have all played a significant role in this shift. However, strong fundamentals and persistent supply constraints offer some counterarguments to a dramatic price correction. Whether the current slowdown evolves into a full-blown correction remains to be seen. The interplay between these factors will determine the future trajectory of Canadian home prices. Stay informed on the ever-evolving Canadian housing market. Continue to monitor key indicators like sales activity, inventory levels, and interest rate changes and consult with real estate professionals for up-to-date information on Canadian home prices and potential corrections.

Featured Posts

-

Red Light Flashes In French Skies Unidentified Aerial Phenomena Explained

May 22, 2025

Red Light Flashes In French Skies Unidentified Aerial Phenomena Explained

May 22, 2025 -

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025

Wordle Answer Today March 16th Hints And Solution For Wordle 1366

May 22, 2025 -

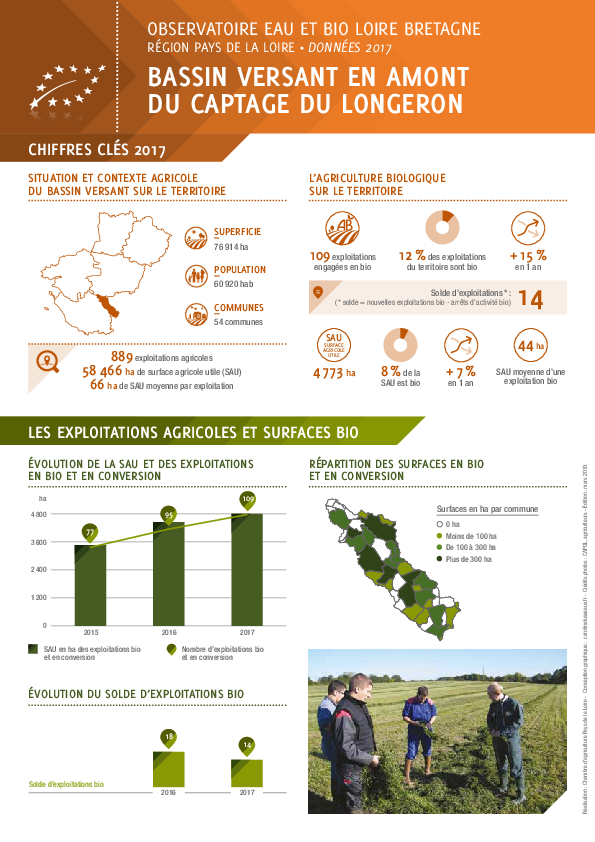

Un Siecle D Histoire A Moncoutant Sur Sevre L Evolution De Clisson

May 22, 2025

Un Siecle D Histoire A Moncoutant Sur Sevre L Evolution De Clisson

May 22, 2025 -

Pittsburgh Steelers Insider Details Reasons Behind Pickens Trade Decision

May 22, 2025

Pittsburgh Steelers Insider Details Reasons Behind Pickens Trade Decision

May 22, 2025 -

Dc Shooting Near Jewish Museum Two Israeli Embassy Employees Dead Ap Photos

May 22, 2025

Dc Shooting Near Jewish Museum Two Israeli Embassy Employees Dead Ap Photos

May 22, 2025