Potential August Expiration Of US Debt Limit Measures: Treasury Alert

Table of Contents

Understanding the US Debt Limit and its Implications

What is the Debt Ceiling?

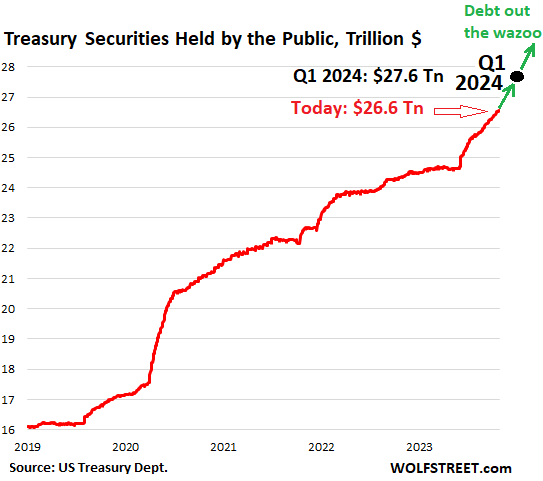

The US debt ceiling is a legislatively imposed limit on the total amount of money the federal government can borrow to meet its existing legal obligations. It's not a limit on spending, but rather a constraint on how the government finances its already-approved spending. Historically, Congress has periodically raised or suspended the debt ceiling to avoid default. The process typically involves a vote in both the House of Representatives and the Senate.

Economic Consequences of a Debt Ceiling Breach

A failure to raise or suspend the debt ceiling before the August deadline could have severe economic consequences, both domestically and globally. The potential impacts include:

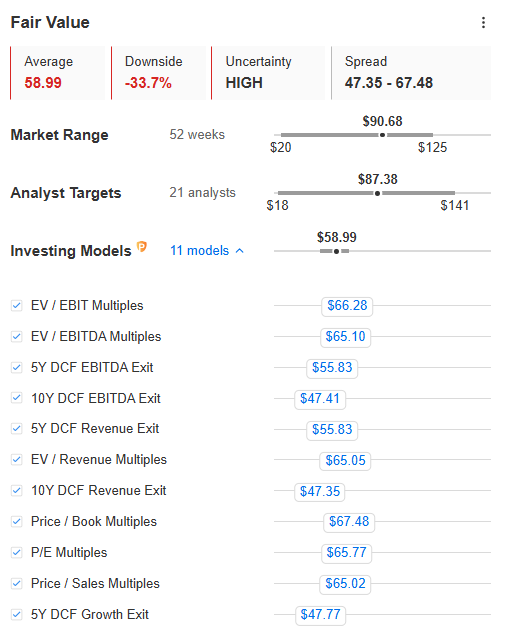

- Credit Rating Downgrade: A breach could lead to a downgrade of the US credit rating, increasing borrowing costs for the government and potentially impacting the cost of borrowing for businesses and consumers.

- Market Volatility: Uncertainty surrounding the debt ceiling can trigger significant market volatility, impacting stock prices, bond yields, and the value of the dollar.

- Government Shutdown: A failure to raise the debt ceiling could force a partial or complete government shutdown, impacting essential services and causing widespread disruption.

- Increased Interest Rates: The uncertainty could lead to increased interest rates, making borrowing more expensive for individuals, businesses, and the government.

- Reduced Consumer Confidence: The crisis could erode consumer confidence, leading to reduced spending and potentially triggering a recession.

These consequences could disproportionately affect specific sectors, including the financial markets, which are highly sensitive to government debt and creditworthiness.

The Treasury Department's Role and Warnings

The Treasury Department plays a critical role in managing the nation's debt and issuing warnings about potential crises. The Treasury Secretary actively monitors the debt ceiling situation and communicates regularly with Congress about the need to avoid a breach. They implement extraordinary measures to temporarily manage the debt, but these are temporary fixes and cannot indefinitely avert a crisis.

You can find official statements and reports from the Treasury Department on their website [Insert Link to Treasury Department Website Here]. These resources offer valuable insights into the current situation and the potential consequences of inaction.

The August Deadline: A Timeline of Potential Events

Key Dates and Deadlines

The exact timeline leading up to the August deadline is subject to change depending on political developments. However, key dates to watch include:

- [Date]: Potential deadline for the Treasury Department to exhaust extraordinary measures.

- [Date]: Potential start date for Congressional negotiations.

- [Date]: Potential deadline for Congressional action to avoid a breach.

- August [Date]: Estimated deadline for raising or suspending the debt limit.

Possible Scenarios and Outcomes

Several scenarios are possible:

- Debt Ceiling Raised: Congress passes legislation to raise the debt ceiling before the deadline, averting a crisis.

- Debt Ceiling Suspended: Congress temporarily suspends the debt ceiling for a specified period, delaying the need for further action.

- Debt Ceiling Breached: Congress fails to act before the deadline, leading to a potential default on US debt obligations. This is the most dangerous scenario.

Preparing for Potential Market Volatility

Strategies for Investors and Businesses

Given the potential for market instability, investors and businesses should consider the following strategies:

- Diversification: Diversify investment portfolios to mitigate risk.

- Risk Management: Implement robust risk management strategies.

- Cash Reserves: Maintain sufficient cash reserves to weather potential market downturns.

- Contingency Planning: Develop contingency plans to address potential disruptions.

Government Response and Contingency Planning

The government may implement several measures to mitigate the impact of a potential debt ceiling breach, such as prioritizing essential government functions or exploring temporary measures to alleviate economic hardship. However, the effectiveness of these measures is uncertain.

Conclusion: Staying Informed on the US Debt Limit Crisis

The potential August expiration of the US debt limit measures presents significant risks to the US and global economies. A failure to raise or suspend the debt ceiling could trigger a fiscal crisis, impacting financial markets, consumer confidence, and essential government services. Staying informed about the situation and monitoring developments closely is crucial.

Follow the Treasury Department's updates, engage in informed discussions, and contact your elected officials to voice your concerns regarding the US debt ceiling crisis. Understanding the implications of the August debt limit expiration is vital for navigating this period of uncertainty and protecting your financial interests. Learn more about the US debt ceiling and its potential impact today.

Featured Posts

-

100 Days Of Losses How Tech Billionaires Inauguration Donations Backfired

May 10, 2025

100 Days Of Losses How Tech Billionaires Inauguration Donations Backfired

May 10, 2025 -

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

Politiki Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025

Politiki Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025 -

Young Thug Speaks Out Post Prison Reaction To Being Mentioned In Not Like U

May 10, 2025

Young Thug Speaks Out Post Prison Reaction To Being Mentioned In Not Like U

May 10, 2025