Potential Fine For ABN Amro: Bonuses Under The Microscope

Table of Contents

The Nature of the Alleged Misconduct

Allegations against ABN Amro's bonus schemes are at the heart of this regulatory scrutiny. The specific details of the alleged misconduct remain under investigation, but preliminary reports suggest irregularities in bonus calculations and potential violations of financial reporting standards and internal control measures. The keywords here are bonus scheme, misconduct allegations, regulatory violations, financial reporting, and internal controls. This raises serious concerns about the bank's governance and risk management practices.

- Summary of the alleged misconduct: Reports suggest that bonuses may have been awarded inappropriately, potentially based on inaccurate performance metrics or in violation of established guidelines. The exact nature of these irregularities is still under investigation.

- Relevant regulations potentially violated: ABN Amro may have violated regulations related to fair banking practices, accurate financial reporting (potentially impacting their balance sheet and income statement), and appropriate internal control frameworks set by the Dutch Central Bank (De Nederlandsche Bank – DNB) and potentially the European Central Bank (ECB).

- Examples of questionable bonus payments (if publicly available): While specific examples may not be publicly available during the ongoing investigation, the allegations point toward a systemic issue rather than isolated incidents.

- Involvement of specific individuals or departments: The extent to which specific individuals or departments within ABN Amro were involved is still unclear and forms a key part of the ongoing investigation.

Potential Magnitude of the Fine and its Impact

The potential financial penalties ABN Amro could face are significant. Predicting the exact amount is difficult without the conclusion of the investigation, but considering similar cases and the severity of the alleged misconduct, the fine could range from tens of millions to potentially hundreds of millions of Euros. The keywords to focus on here are financial penalties, regulatory fines, impact on profits, shareholder value, reputational damage, and competitive disadvantage. This uncertainty creates a considerable impact on various aspects of the bank's operations and future prospects.

- Estimated range of the potential fine (based on similar cases): Considering fines levied against other financial institutions for similar regulatory breaches, a wide range is possible, dependent on the severity and extent of ABN Amro's non-compliance.

- Potential impact on ABN Amro's financial performance: A substantial fine will undoubtedly affect ABN Amro's profitability and financial stability, impacting their earnings per share and overall financial health.

- Effect on investor confidence and share price: News of the investigation and potential fines is likely to negatively impact investor confidence, leading to a decline in the bank's share price and potentially affecting future fundraising capabilities.

- Long-term reputational risks for the bank: Beyond financial losses, reputational damage stemming from this scandal could lead to a loss of clients, difficulties in attracting and retaining talent, and a decline in the bank's overall standing in the market.

Regulatory Response and Future Implications

The regulatory response to the allegations is ongoing, with both the DNB and potentially the ECB actively involved in the investigation. This investigation highlights the increasingly stringent regulatory environment surrounding executive compensation and underscores the need for robust internal controls. The relevant keywords here are regulatory investigation, Dutch Central Bank (De Nederlandsche Bank - DNB), European Central Bank (ECB), future compliance, enhanced oversight, and industry best practices. The outcome of this investigation will have far-reaching consequences for ABN Amro and the broader banking sector.

- Statement from ABN Amro regarding the investigation: ABN Amro has likely issued public statements acknowledging the investigation and expressing cooperation with the regulatory authorities. The tone and content of these statements will be closely scrutinized by investors and the public.

- Actions taken by the DNB and other regulatory bodies: The DNB and potentially the ECB will likely conduct thorough reviews of ABN Amro's internal controls, bonus structures, and compliance procedures. Enforcement actions could include significant fines and potentially other sanctions.

- Potential changes in bonus structures and internal controls at ABN Amro: To avoid future regulatory issues, ABN Amro will likely need to overhaul its bonus schemes and implement more stringent internal controls.

- Broader implications for banking regulations and executive compensation: This case could lead to stricter regulations and increased oversight regarding executive compensation in the Netherlands and potentially across the EU, impacting banking practices across the sector.

Conclusion

The potential ABN Amro fine underscores the increasing regulatory scrutiny surrounding executive compensation and the crucial role of robust internal controls within the banking sector. The magnitude of the potential financial penalties and the potential reputational damage highlight the critical need for ethical and compliant bonus practices. Understanding the implications of regulatory non-compliance is crucial for financial institutions.

Call to Action: Stay informed about the evolving situation with ABN Amro and its implications for banking regulations concerning bonus payments. Regularly check for updates on this case to understand the potential consequences of regulatory non-compliance and the evolving landscape of ABN Amro and its bonus practices. This case provides a critical lesson on the importance of ethical and compliant bonus structures in the financial industry.

Updated Rain Forecast Predicting On And Off Showers

Updated Rain Forecast Predicting On And Off Showers

Cassis Blackcurrant In Cuisine Recipes And Culinary Applications

Cassis Blackcurrant In Cuisine Recipes And Culinary Applications

Friisin Yllaetysvalinnat Kamara Ja Pukki Penkillae Avausottelussa

Friisin Yllaetysvalinnat Kamara Ja Pukki Penkillae Avausottelussa

Espn Uncovers The Key To The Bruins Transformative Offseason

Espn Uncovers The Key To The Bruins Transformative Offseason

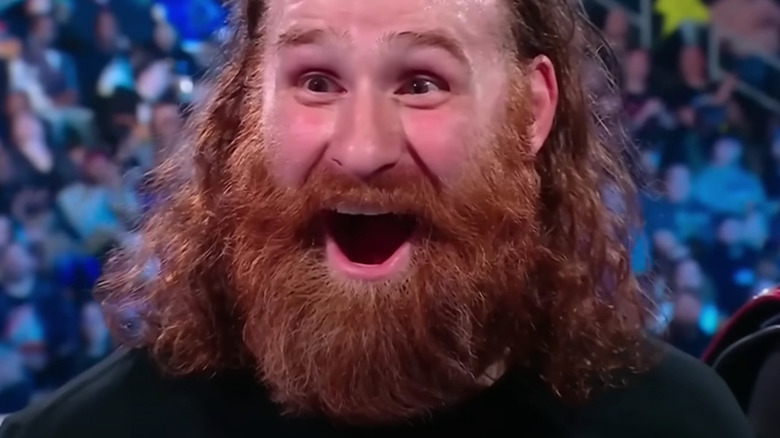

Sami Zayn Faces Rollins And Breakker On Wwe Raw

Sami Zayn Faces Rollins And Breakker On Wwe Raw