Pound Gains Momentum After UK Inflation Report: BOE Rate Cut Speculation Eases

Table of Contents

UK Inflation Data and Market Reaction

Inflation Figures

The latest UK inflation report revealed key figures that significantly impacted market expectations. The Consumer Price Index (CPI) for [Month, Year] came in at [Percentage]%, compared to [Percentage]% in the previous month and the forecast of [Percentage]%. The Retail Price Index (RPI), another key inflation measure, showed a similar trend. This data is vital for understanding the UK inflation rate and its impact on the economy.

- CPI lower than expected: The CPI figure was lower than most economists predicted, signaling a potential cooling in inflationary pressures.

- Decreased energy prices: A significant contributor to the lower CPI was a decrease in energy prices, reflecting easing global energy crisis concerns.

- Food price inflation remains elevated: While energy prices decreased, food price inflation continued to remain a significant concern.

Market Response to Inflation Data

The market responded swiftly to the inflation data, with the pound appreciating against major currencies. The GBP/USD exchange rate saw a notable increase of [Percentage]%, while the GBP/EUR exchange rate also rose by [Percentage]%. This positive movement in sterling reflects increased investor confidence in the UK economy.

- Increased trading volume: The release of the inflation report led to a significant increase in trading volume for GBP pairs, indicating high market activity.

- Short-covering: Many investors who had bet on a weaker pound (short positions) were forced to cover their positions, further pushing up the value of sterling.

- Stronger pound: Overall, the data painted a picture of a stronger pound and reduced concerns about further weakening.

Impact on BOE Rate Cut Expectations

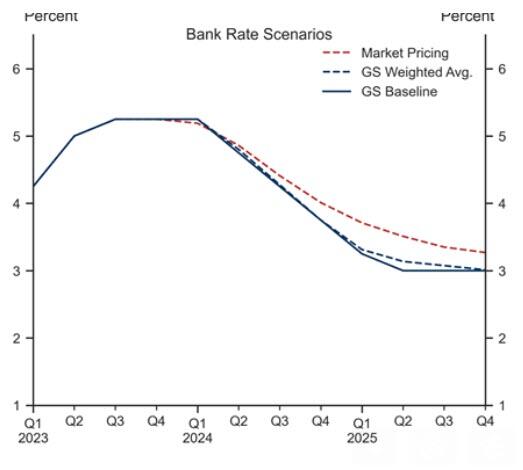

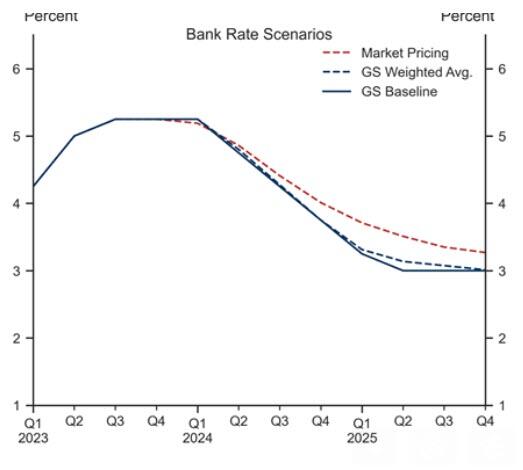

BOE's Monetary Policy

The Bank of England (BOE) plays a crucial role in setting interest rates in the UK. Its primary mandate is to control inflation and maintain price stability. The BOE's monetary policy decisions directly influence the GBP exchange rate, impacting borrowing costs and investor sentiment. Any shifts in expectations regarding BOE rate hikes or cuts can result in significant volatility in the pound.

- Previous BOE announcements: Prior to the inflation report, market sentiment leaned towards a potential BOE rate cut, reflecting concerns about persistent inflation.

- Market predictions: Economists and analysts had widely anticipated a further rate cut to stimulate economic growth.

Shifted Expectations

The lower-than-expected inflation figures significantly altered market expectations regarding future BOE rate decisions. The probability of a rate cut decreased substantially, while the likelihood of a rate hold or even a potential BOE rate hike increased. This shift in market sentiment contributed to the pound's strengthening.

- Reduced rate cut probability: The positive inflation data reduced the perceived need for the BOE to further stimulate the economy through interest rate cuts.

- Increased rate hold/hike probability: The data increased investor confidence that inflation might be under control, increasing chances of a rate hold or even future rate increases.

- Positive market sentiment: Overall, the improved inflation outlook boosted investor confidence in the UK economy, positively impacting the pound.

Further Economic Factors Influencing the Pound

Global Economic Conditions

Global economic conditions also play a significant role in influencing the pound's value. Factors such as global recession fears, energy prices, and geopolitical events can all impact sterling's performance.

- Global recession fears: Concerns about a potential global recession can lead to investors seeking safe haven assets, potentially weakening the pound.

- Energy prices: Fluctuations in global energy prices can have a significant impact on the UK economy and the pound, as the UK is a net importer of energy.

- Geopolitical risk: Geopolitical instability can create uncertainty and negatively impact investor sentiment, weakening the pound.

Brexit's Continued Impact

The long-term effects of Brexit continue to influence the UK economy and the pound's strength. Trade relations with the European Union and other countries remain a key factor impacting investor confidence.

- Trade deals: The ongoing negotiation and implementation of post-Brexit trade deals have a significant impact on UK economic growth and currency valuation.

- Economic uncertainty: The lingering uncertainty surrounding Brexit continues to impact investor sentiment, influencing the pound's value.

- Labor market: Post-Brexit changes to the labor market contribute to ongoing economic uncertainty which affects the pound's stability.

Conclusion: Pound Gains Momentum After UK Inflation Report: BOE Rate Cut Speculation Eases

In conclusion, the recent surge in the pound's value is largely attributable to the latest UK inflation report, which revealed lower-than-expected inflation figures. This data significantly eased speculation of an imminent BOE rate cut, shifting market sentiment towards a more positive outlook for the UK economy. The pound's strength also reflects other factors such as global economic conditions and the ongoing impact of Brexit. Understanding these interconnected dynamics is crucial for navigating the complexities of the foreign exchange market. Stay tuned for further updates on the UK economy and the pound's performance. Monitor the latest inflation reports and BOE announcements to make informed decisions regarding investments related to the pound and its fluctuations.

Featured Posts

-

Nyt Mini Crossword Help March 16 2025 Solutions

May 23, 2025

Nyt Mini Crossword Help March 16 2025 Solutions

May 23, 2025 -

Razvod Vanje Mijatovic Istina O Navodima O Visku Kilograma

May 23, 2025

Razvod Vanje Mijatovic Istina O Navodima O Visku Kilograma

May 23, 2025 -

Informe Meteorologico Lluvias Moderadas En Region

May 23, 2025

Informe Meteorologico Lluvias Moderadas En Region

May 23, 2025 -

Investigacion Britanica Motor De Combustion Con Tecnologia De Particulas De Agua

May 23, 2025

Investigacion Britanica Motor De Combustion Con Tecnologia De Particulas De Agua

May 23, 2025 -

Recent Photo Of Dylan Dreyer And Brian Fichera Causes Social Media Stir

May 23, 2025

Recent Photo Of Dylan Dreyer And Brian Fichera Causes Social Media Stir

May 23, 2025