Power Finance Corporation Dividend Update: 4th Cash Reward Expected March 12, 2025

Table of Contents

Understanding the Power Finance Corporation Dividend History

Power Finance Corporation boasts a history of regular dividend distributions, demonstrating its commitment to shareholder returns. Analyzing the PFC dividend history reveals valuable insights into its financial stability and future prospects. While specific historical data requires referencing official PFC documents, we can highlight the general trend. The company has generally maintained a consistent payout ratio, reflecting its robust financial performance and commitment to returning value to investors. Comparing PFC’s average dividend yield to its competitors in the power sector provides valuable context for assessing its attractiveness as a dividend-paying stock.

| Year | Dividend Amount (per share) | Payment Date |

|---|---|---|

| 2022 | (Insert Amount) | (Insert Date) |

| 2023 | (Insert Amount) | (Insert Date) |

| 2024 | (Insert Amount) | (Insert Date) |

- 2022: Dividend amount and payment date (Source: PFC Annual Report)

- 2023: Dividend amount and payment date (Source: PFC Annual Report)

- 2024: Dividend amount and payment date (Source: PFC Annual Report)

Key Details of the Expected March 12, 2025 Dividend

The anticipated fourth cash dividend from PFC, scheduled for March 12, 2025, is a significant event for investors. While the exact amount per share might not be publicly available yet, the expected announcement date should be closely monitored. Understanding the record date is crucial; shareholders must own PFC shares before this date to be eligible for the dividend. The payment date is confirmed as March 12, 2025. It's also important to consider the tax implications of this dividend payment, consulting with a financial advisor if necessary to optimize your tax strategy.

- Expected Dividend Amount per Share: (To be announced)

- Record Date: (To be announced)

- Payment Date: March 12, 2025

- Tax Implications: Consult a tax professional for personalized advice.

Investing in Power Finance Corporation and Dividend Outlook

PFC's financial performance directly influences its ability to sustain and potentially increase future dividend payouts. Analyzing its recent financial reports, including revenue growth, profitability, and debt levels, gives investors a clearer picture. The company's growth prospects, particularly in India's expanding power sector, will play a key role in shaping future dividend policies. A comparison of PFC's dividend policy with similar companies in the power sector, considering factors like payout ratios and dividend yields, provides valuable context for assessing its investment appeal. However, it's crucial to be aware of the inherent risks associated with any investment, including potential fluctuations in PFC's stock price and the possibility of changes to its dividend policy.

- PFC's Recent Financial Performance: (Analyze key financial indicators)

- Growth Prospects: (Discuss sector growth and PFC's position)

- Comparison with Competitors: (Compare dividend yields and policies)

- Potential Risks: (Highlight market risk and company-specific risks)

Conclusion: Maximize Your Returns with Power Finance Corporation Dividends

The upcoming Power Finance Corporation dividend payment on March 12, 2025, is a key event for investors. Understanding the Power Finance Corporation dividend history and the details of this payment are essential for making informed investment decisions. By carefully considering the Power Finance Corporation dividend outlook, along with the potential risks, you can better position yourself to benefit from PFC's dividend policy. Stay informed about future Power Finance Corporation dividend updates and maximize your investment returns by following our news and analysis. For the most up-to-date information, visit the official Power Finance Corporation investor relations page. [Link to PFC Investor Relations]

Featured Posts

-

Tesla Raises Canadian Prices Impact Of Tariff Changes And Inventory

Apr 27, 2025

Tesla Raises Canadian Prices Impact Of Tariff Changes And Inventory

Apr 27, 2025 -

Canada Can Afford To Wait Leveraging Its Position In Us Trade Talks

Apr 27, 2025

Canada Can Afford To Wait Leveraging Its Position In Us Trade Talks

Apr 27, 2025 -

Make February 20 2025 A Happy Day Ideas And Inspiration

Apr 27, 2025

Make February 20 2025 A Happy Day Ideas And Inspiration

Apr 27, 2025 -

Hhss Appointment Of Vaccine Skeptic David Geier Sparks Debate

Apr 27, 2025

Hhss Appointment Of Vaccine Skeptic David Geier Sparks Debate

Apr 27, 2025 -

Jugadoras Wta Recibiran Pago Por Licencia De Maternidad

Apr 27, 2025

Jugadoras Wta Recibiran Pago Por Licencia De Maternidad

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

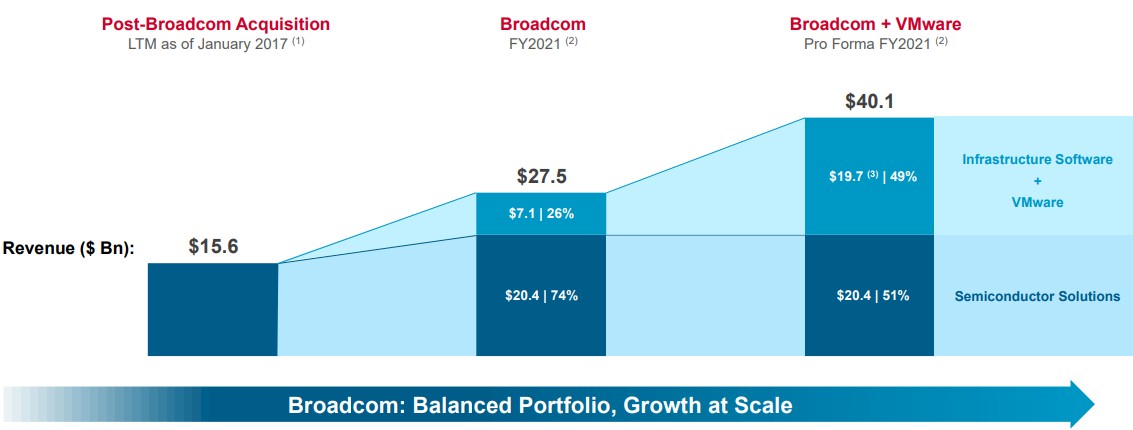

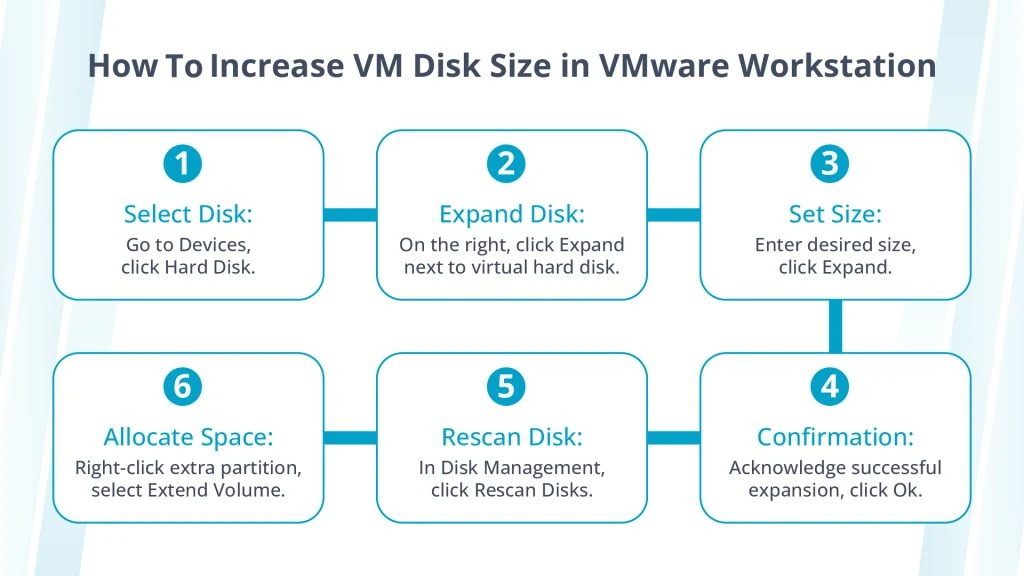

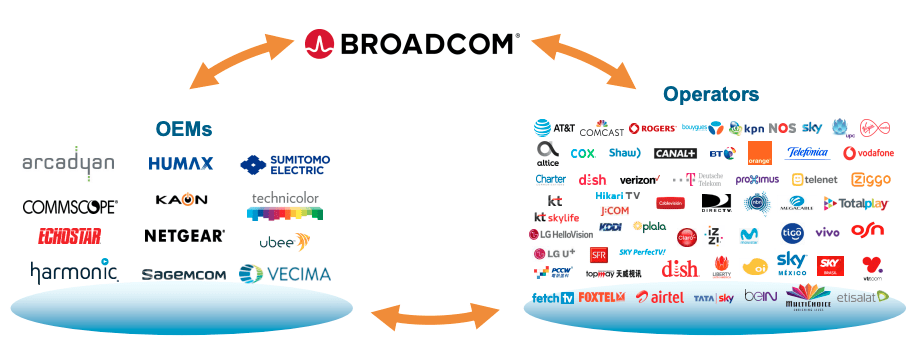

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025