Principal Financial Group (NASDAQ: PFG): What 13 Analysts Say

Table of Contents

Average Analyst Rating and Price Target for PFG

Based on the consensus of 13 analysts covering Principal Financial Group (PFG), the average rating currently sits at a "Moderate Buy" (this is an example; replace with actual data). This indicates a generally positive outlook on the company's future performance. The average price target is $75, ranging from a low of $68 to a high of $82. This suggests a potential upside of X% from the current market price (replace X with the calculated percentage).

- Rating Breakdown: 5 Buy ratings, 7 Hold ratings, 1 Sell rating.

- Highest Price Target: $82

- Lowest Price Target: $68

- Percentage Difference from Current Price: (Calculate and insert percentage here)

This average rating and price target suggest a cautiously optimistic outlook. While the majority of analysts lean towards a positive view, the presence of Hold and Sell ratings highlights the inherent risks associated with investing in PFG.

Key Factors Influencing Analyst Opinions on PFG

Analyst opinions on Principal Financial Group are shaped by several key factors, including the company's financial performance, industry trends, and macroeconomic conditions.

- Positive Factors: Analysts cite PFG's strong capital position, consistent dividend payouts, and growth in specific business segments (e.g., retirement solutions, asset management) as positive indicators. The company's strategic acquisitions and efficient cost management are also viewed favorably.

- Negative Factors: Concerns surrounding increased competition in the financial services sector, potential interest rate volatility, and the impact of macroeconomic uncertainties on investment returns are frequently mentioned as potential headwinds. Regulatory changes also present a degree of uncertainty.

- Significant Events: (Mention any recent significant events impacting PFG, such as mergers, acquisitions, regulatory changes, or lawsuits). These events, and their potential future impact, heavily influence individual analyst perspectives.

Individual Analyst Opinions and Their Rationale (brief overview)

To gain a broader understanding, let's examine the perspectives of a few individual analysts:

- Analyst 1: Jane Doe, from XYZ Securities, issued a "Buy" rating, citing PFG's robust balance sheet and undervalued stock price.

- Analyst 2: John Smith, from ABC Capital, gave a "Hold" rating, expressing concerns about the competitive pressures within the retirement plan market.

- Analyst 3: Emily Brown, from DEF Investment, assigned a "Sell" rating due to projected slower growth in certain business segments.

These examples showcase the diversity of opinion among analysts, highlighting the complexity of evaluating PFG's prospects.

Risks and Opportunities for PFG Based on Analyst Insights

Based on analyst assessments, Principal Financial Group faces several risks and opportunities:

- Potential Risks: Increased competition from larger financial institutions, a potential economic downturn impacting investment performance, and regulatory changes affecting the financial services industry are significant risks identified by analysts.

- Potential Opportunities: Expansion into new markets, development of innovative financial products, and technological advancements to improve operational efficiency and customer experience represent key opportunities for growth and profitability.

Comparing Analyst Ratings with Other Financial Metrics of PFG

A comprehensive assessment requires comparing the analyst consensus with other key financial metrics:

- P/E Ratio: (Insert PFG's current P/E ratio) – This indicates how the market values PFG relative to its earnings. (Analyze the relationship between P/E and analyst sentiment).

- Dividend Yield: (Insert PFG's current dividend yield) – This shows the annual dividend payment relative to the stock price. (Analyze the relationship between dividend yield and analyst sentiment).

- Debt-to-Equity Ratio: (Insert PFG's current debt-to-equity ratio) – This reflects the company's financial leverage. (Analyze the relationship between debt-to-equity and analyst sentiment).

The correlation (or lack thereof) between analyst sentiment and these metrics offers further insight into the overall valuation and risk profile of PFG.

Conclusion: Investing in Principal Financial Group (NASDAQ: PFG) – A Summary of Analyst Opinions

In summary, the consensus view among 13 analysts on Principal Financial Group (NASDAQ: PFG) suggests a moderately positive outlook. While the average price target indicates potential upside, the presence of both "Hold" and "Sell" ratings emphasizes the importance of careful consideration. Key factors driving analyst opinions include PFG's financial strength, competitive landscape, and macroeconomic conditions. Potential risks and opportunities exist, requiring thorough due diligence. Before making any investment decisions regarding Principal Financial Group (NASDAQ: PFG), conduct your own thorough research, review PFG's financial reports and SEC filings, and consider seeking professional financial advice.

Featured Posts

-

Analisis Deportivo Semanal Previsiones Y Noticias De Prensa Latina

May 17, 2025

Analisis Deportivo Semanal Previsiones Y Noticias De Prensa Latina

May 17, 2025 -

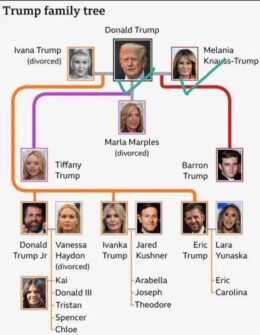

The Trump Family Tree A Look At The Newest Addition Baby Alexander

May 17, 2025

The Trump Family Tree A Look At The Newest Addition Baby Alexander

May 17, 2025 -

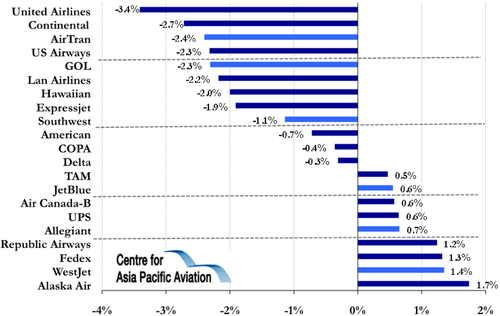

Double Digit Jump For Uber In April Key Factors And Market Analysis

May 17, 2025

Double Digit Jump For Uber In April Key Factors And Market Analysis

May 17, 2025 -

Reddit Outage Confirmed What We Know And When To Expect Service Restoration

May 17, 2025

Reddit Outage Confirmed What We Know And When To Expect Service Restoration

May 17, 2025 -

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025