Private Credit Jobs: 5 Do's And Don'ts To Boost Your Chances

Table of Contents

The private credit industry is booming, creating a high demand for skilled professionals. Landing a coveted private credit job requires more than just a strong resume; it demands a strategic approach. This guide outlines five crucial "dos" and "don'ts" to significantly increase your chances of securing your dream role in this lucrative field. The competition is fierce, but with the right strategy, you can stand out from the crowd.

5 DO's to Secure a Private Credit Job

Do: Network Strategically: Building strong relationships is paramount in the private credit world. Networking isn't just about collecting business cards; it's about building genuine connections.

- Attend industry events: Conferences like SuperReturn, industry-specific workshops, and even smaller networking events provide excellent opportunities to meet professionals and recruiters.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords (private credit, leveraged finance, distressed debt, etc.). Actively connect with recruiters specializing in private credit and engage with content shared by industry leaders.

- Informational interviews: Reaching out to professionals for informational interviews allows you to learn about their experiences, gain insights into the industry, and potentially uncover hidden job opportunities. Remember to express gratitude and follow up.

Do: Tailor Your Resume and Cover Letter: Generic applications rarely succeed. Each application should be meticulously crafted to highlight the skills and experiences most relevant to the specific job description.

- Keywords optimization: Integrate relevant keywords throughout your resume and cover letter, including terms like private credit, leveraged lending, distressed debt, credit analysis, financial modeling, and deal structuring. Use keywords naturally, not just to stuff them in.

- Quantifiable achievements: Instead of simply stating responsibilities, quantify your achievements using metrics and numbers. For example, instead of "improved efficiency," write "Improved efficiency by 15% through process optimization."

- Highlight transferable skills: Even if your background isn't directly in private credit, highlight transferable skills from related fields like investment banking, asset management, or accounting. Emphasize relevant experiences that demonstrate your analytical abilities, financial acumen, and problem-solving skills.

Do: Master the Interview Process: Private credit interviews are rigorous and assess both technical skills and soft skills.

- Prepare for technical questions: Practice answering questions on financial modeling (LBO modeling, DCF analysis), credit analysis, deal structuring, valuation, and understanding of capital structures. Be prepared to walk through your thought process and justify your assumptions.

- Showcase your understanding of market trends: Demonstrate your knowledge of current market trends, economic factors influencing the private credit market, and recent industry news. Reading publications like Private Equity International and PEI Media will be invaluable.

- Research the firm and interviewer: Before the interview, research the firm's investment strategy, recent deals, and the interviewer's background. This demonstrates your genuine interest and initiative.

Do: Showcase Your Financial Modeling Skills: Proficiency in financial modeling is a non-negotiable requirement for most private credit roles.

- Develop a portfolio: Create a portfolio of your modeling projects, showcasing your skills in Excel (or other financial modeling software) with LBO models, DCF analyses, and other relevant analyses. Be prepared to discuss your modeling assumptions and methodology in detail.

- Highlight experience: If you've worked on relevant projects in previous roles (even if not directly in private credit), emphasize your experience and skills in areas such as financial statement analysis, valuation, and forecasting.

Do: Highlight Relevant Certifications and Education: Relevant certifications and education demonstrate your commitment to the field and enhance your credibility.

- CFA Charter: The Chartered Financial Analyst (CFA) charter is highly valued in the private credit industry.

- CAIA Charter: The Chartered Alternative Investment Analyst (CAIA) charter is also beneficial, particularly for those focusing on alternative investments.

- MBA or Finance Degree: An MBA or a strong undergraduate degree in finance provides a solid foundation for a career in private credit.

5 DON'Ts for a Successful Private Credit Job Search

Don't: Neglect the Basics: Avoid careless mistakes that can undermine your application.

- Typos and grammatical errors: Proofread carefully! Errors reflect poorly on your attention to detail.

- Generic applications: Tailor each application to the specific job and company. A generic application shows a lack of interest and effort.

- Unclear career objective: Clearly state your career goals and how they align with the specific opportunity.

Don't: Underestimate the Importance of Soft Skills: While technical skills are essential, soft skills are equally crucial.

- Communication: Articulate your thoughts clearly and concisely, both verbally and in writing.

- Teamwork: Demonstrate your ability to collaborate effectively with others.

- Problem-solving: Highlight instances where you successfully solved complex problems.

Don't: Lack Industry Knowledge: Staying updated on industry trends and news is essential.

- Read industry publications: Follow reputable sources like Private Equity International, PEI Media, and other relevant publications.

- Follow key players and firms: Stay informed about the activities of leading private credit firms and influential figures in the industry through LinkedIn and other social media.

Don't: Overlook the Firm's Culture and Values: Understand the firm's investment philosophy, recent deals, and company culture.

- Research the firm's strategy: Research their investment focus, target sectors, and typical deal sizes.

- Align your goals: Ensure your career aspirations align with the firm's mission and values.

Don't: Settle for the First Offer: Explore multiple opportunities before making a decision.

- Consider different firms: Evaluate different firms based on their culture, investment strategy, and career progression opportunities.

- Negotiate your compensation: Once you receive an offer, understand your worth and don't be afraid to negotiate salary and benefits.

Conclusion:

Securing a private credit job requires a strategic and proactive approach. By following these "dos" and "don'ts," you can significantly improve your chances of landing your dream role. Remember to network effectively, tailor your application materials, showcase your skills and knowledge, and diligently prepare for the interview process. Don't delay – begin your successful private credit job search today! Start building your career in private credit – the opportunities are abundant.

Featured Posts

-

Gmas Golden Anniversary Paley Center Celebration

May 20, 2025

Gmas Golden Anniversary Paley Center Celebration

May 20, 2025 -

Step Inside Suki Waterhouses North American Tour With Surface

May 20, 2025

Step Inside Suki Waterhouses North American Tour With Surface

May 20, 2025 -

Fenerbahce Nin Ilk Transfer Hamlesi Tadic In Yeni Adresi Belli Oldu

May 20, 2025

Fenerbahce Nin Ilk Transfer Hamlesi Tadic In Yeni Adresi Belli Oldu

May 20, 2025 -

The Eurovision 2025 Finalists A Comprehensive Ranked Review

May 20, 2025

The Eurovision 2025 Finalists A Comprehensive Ranked Review

May 20, 2025 -

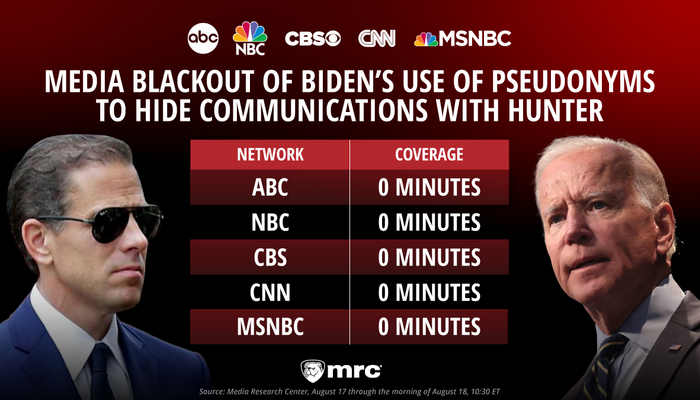

Did Abc Cbs And Nbc Censor Reporting On The New Mexico Gop Arson Attack Analysis Of Network Coverage

May 20, 2025

Did Abc Cbs And Nbc Censor Reporting On The New Mexico Gop Arson Attack Analysis Of Network Coverage

May 20, 2025