Private Credit Jobs: 5 Do's And Don'ts To Success

Table of Contents

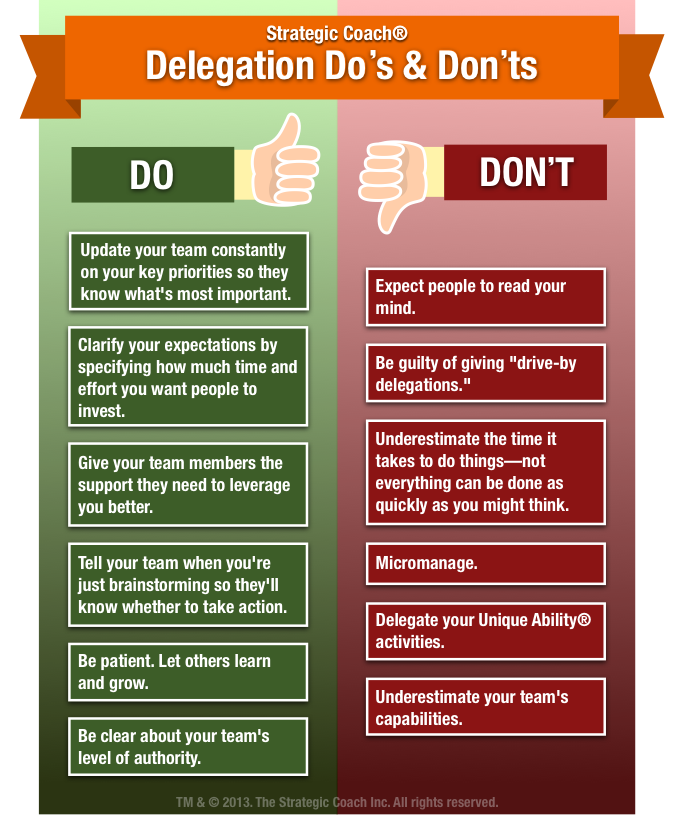

5 Do's for Securing Your Dream Private Credit Job

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in securing private credit jobs. Building strong connections within the industry opens doors to unadvertised opportunities and invaluable insights.

- Attend industry conferences: SuperReturn, industry-specific events, and smaller, more niche conferences are excellent places to meet potential employers and learn about the latest trends in private credit.

- Join relevant professional organizations: The CFA Institute, various alternative investment associations, and industry-specific groups provide networking opportunities and access to industry experts.

- Leverage LinkedIn effectively: Optimize your profile to highlight your private credit experience and connect with professionals working in private credit. Engage with their posts and participate in relevant discussions.

- Informational interviews: Don't underestimate the power of informational interviews. Reaching out to professionals for career advice not only provides valuable insights but also helps you build relationships.

By actively participating in private credit networking events and building private credit connections, you significantly increase your chances of landing your dream job.

Do 2: Highlight Relevant Skills and Experience on Your Resume and Cover Letter

Your resume and cover letter are your first impression. Tailoring them to specific private credit job descriptions is crucial to showcasing your suitability.

- Target your resume and cover letter: Don't use a generic template. Carefully read each job description and highlight the skills and experiences that directly align with their requirements. A strong private credit resume and cover letter are essential.

- Emphasize quantitative skills: Private credit roles demand strong analytical skills. Highlight your proficiency in financial modeling, valuation, and data analysis.

- Showcase relevant experience: Clearly articulate any experience in credit analysis, underwriting, portfolio management, or related fields.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "managed a portfolio," try "increased portfolio returns by 15% through strategic asset allocation."

Keywords like "private credit resume," "private credit cover letter," "credit analysis skills," and "financial modeling skills" should be naturally incorporated.

Do 3: Master the Art of the Private Credit Interview

The interview is your opportunity to showcase your skills and personality. Thorough preparation is key.

- Prepare for behavioral questions: Utilize the STAR method (Situation, Task, Action, Result) to structure your answers and effectively communicate your experiences.

- Practice technical questions: Expect questions on credit analysis, valuation, financial modeling, and your understanding of the private credit market.

- Research the firm and interviewer: Demonstrate your genuine interest by thoroughly researching the firm's investment strategy, recent deals, and the interviewer's background.

- Show your passion: Articulate your understanding of the private credit market, its challenges, and your long-term career aspirations within the field.

- Ask insightful questions: Asking well-thought-out questions demonstrates your engagement and interest in the role and the firm.

Remember to utilize keywords such as "private credit interview questions," "private credit interview tips," and "private credit interview preparation" in your research.

Do 4: Develop Specialized Knowledge in Private Credit

Continuous learning is essential in this dynamic industry.

- Pursue relevant certifications: Certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) demonstrate your commitment to the field and enhance your credibility.

- Stay updated on industry trends: Regularly read industry journals, publications, and follow influential figures in the private credit space.

- Enhance your skills: Continuously improve your financial modeling and data analysis skills through online courses, workshops, or self-study.

- Develop expertise: Consider specializing in a niche area of private credit, such as direct lending, distressed debt, or mezzanine financing.

Integrating keywords like "private credit certifications," "private credit education," and "private credit market trends" into your learning process will improve your search engine optimization (SEO).

Do 5: Showcase Your Passion and Enthusiasm

Genuine enthusiasm is contagious.

- Demonstrate genuine interest: Let your passion for the private credit industry shine through. Show that you're not just looking for a job but a career.

- Highlight your understanding: Demonstrate your knowledge of the challenges and opportunities within the private credit sector.

- Express your long-term goals: Articulate your vision for your career within private credit and how this role fits into your overall plan.

- Be proactive: Show initiative by seeking out opportunities and demonstrating your commitment to the field.

Remember to use keywords such as "private credit career," "private credit passion," and "private credit enthusiasm" throughout your interactions.

5 Don'ts for Aspiring Private Credit Professionals

Don't 1: Neglect Networking

Passive job searching is rarely successful in a competitive field like private credit. Actively engage in networking to build connections and discover hidden opportunities. Neglecting private credit networking can significantly hinder your job search. Keywords such as "private credit job search" and "private credit career advancement" emphasize the importance of proactive networking.

Don't 2: Submit Generic Applications

Submitting generic applications demonstrates a lack of interest and effort. Each application should be meticulously tailored to the specific requirements of the job description. Using keywords like "private credit application tips" and "targeted job applications" highlights this point.

Don't 3: Underprepare for Interviews

Underpreparedness is a surefire way to derail your chances. Thoroughly prepare for both technical and behavioral questions to showcase your capabilities. Avoid common interview errors by preparing for questions relating to "private credit interview mistakes" and "avoiding common interview errors".

Don't 4: Lack Specialized Knowledge

The private credit industry is highly competitive. Staying updated on industry trends and developing expertise in a specific niche is crucial to stand out from the crowd. Highlighting the importance of "private credit industry knowledge" and "staying competitive in private credit" is key.

Don't 5: Underestimate the Importance of Soft Skills

Technical skills are essential, but strong soft skills such as communication, teamwork, and problem-solving are equally vital. Highlighting "private credit soft skills" and the importance of "communication in private credit" emphasizes their significance.

Launch Your Successful Private Credit Job Search Today!

Securing a private credit job requires a strategic approach. By actively networking, tailoring your applications, preparing thoroughly for interviews, developing specialized knowledge, and showcasing your passion, you significantly increase your chances of success. Remember the key dos and don'ts outlined in this article, and start applying these strategies today to unlock your private credit career opportunities, improving your private credit job prospects and ultimately, starting your private credit career. Don't delay; your ideal private credit job is waiting!

Featured Posts

-

John Wick 5 Receives A Promising Update Release Date Remains A Mystery

May 12, 2025

John Wick 5 Receives A Promising Update Release Date Remains A Mystery

May 12, 2025 -

Payton Pritchard Key Player In Boston Celtics Playoff Game 1 Success

May 12, 2025

Payton Pritchard Key Player In Boston Celtics Playoff Game 1 Success

May 12, 2025 -

Grand Slam Tennis Wbd Announces Comprehensive Coverage

May 12, 2025

Grand Slam Tennis Wbd Announces Comprehensive Coverage

May 12, 2025 -

Piloto Argentino De F1 Y Sus Incendiarias Declaraciones Sobre Uruguay

May 12, 2025

Piloto Argentino De F1 Y Sus Incendiarias Declaraciones Sobre Uruguay

May 12, 2025 -

Usmnt Weekend Roundup Hajis Hat Trick Leads The Way

May 12, 2025

Usmnt Weekend Roundup Hajis Hat Trick Leads The Way

May 12, 2025