Private Credit Jobs: 5 Essential Dos And Don'ts For Success

Table of Contents

Do: Develop In-Depth Financial Modeling Skills

The private credit industry demands a strong foundation in financial modeling. Prospective Credit Analyst jobs, Private Equity jobs, and other finance jobs within this sector require candidates to demonstrate proficiency in building and interpreting complex models.

Master Excel and Financial Modeling Software

- Become proficient in building complex financial models: This includes discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis. These are core components of evaluating potential investments in private credit.

- Practice creating detailed financial projections and valuations: The ability to accurately forecast future performance and value companies is crucial for assessing risk and return in private credit transactions. This skill is highly valued in private credit analyst roles and investment jobs.

- Learn to use advanced Excel functions and shortcuts to improve efficiency: Mastering shortcuts and advanced functions like VBA can significantly boost your productivity and make you a more attractive candidate for private credit jobs.

- Familiarize yourself with industry-standard financial modeling software: Software like Bloomberg Terminal and Argus are frequently used in private credit, and familiarity with these tools will set you apart from the competition.

Understand Key Financial Ratios and Metrics

A deep understanding of key financial ratios and metrics is critical for success in private credit.

- Demonstrate a strong understanding of key financial ratios used in credit analysis: This includes leverage ratios (Debt/Equity, Debt/EBITDA), coverage ratios (Interest Coverage, Debt Service Coverage), and liquidity ratios (Current Ratio, Quick Ratio).

- Be able to interpret financial statements and identify potential risks and opportunities: Analyzing balance sheets, income statements, and cash flow statements is essential for identifying red flags and uncovering hidden opportunities in private credit investments.

- Develop the ability to analyze financial trends and make informed investment decisions: The ability to identify trends and make data-driven decisions is paramount in assessing the creditworthiness of borrowers.

Do: Network Strategically within the Private Credit Industry

Networking is essential for breaking into the private credit industry. Building relationships with professionals in the field can significantly increase your chances of landing your dream job.

Attend Industry Events and Conferences

- Actively participate in private credit industry conferences, seminars, and networking events: These events provide excellent opportunities to meet potential employers and learn about the latest industry trends.

- Engage in conversations and build relationships with professionals in the field: Don't just attend – actively participate! Engage in conversations, ask thoughtful questions, and exchange contact information.

- Follow industry influencers and thought leaders on LinkedIn and other professional platforms: Staying up-to-date on industry news and engaging with influencers will help you build your professional network and stay informed about opportunities.

Leverage Your Professional Network

- Reach out to your contacts in the finance industry to inquire about opportunities: Let your network know you're seeking private credit jobs and ask for informational interviews or referrals.

- Seek informational interviews to learn more about specific roles and companies: Informational interviews allow you to learn firsthand about the realities of working in private credit and gain valuable insights.

- Utilize LinkedIn effectively to connect with recruiters and hiring managers: Optimize your LinkedIn profile and actively connect with recruiters and hiring managers in the private credit space.

Don't: Neglect Soft Skills and Communication

While technical skills are essential, soft skills and strong communication are equally important in private credit. Successful professionals in this field are adept at communicating complex information clearly and effectively.

Develop Strong Communication Skills (Written & Verbal)

- Practice articulating complex financial concepts clearly and concisely: You need to be able to explain intricate financial models and analyses to both technical and non-technical audiences.

- Develop your presentation skills to effectively communicate your ideas to different audiences: Being able to present your findings persuasively is key to securing buy-in from colleagues and stakeholders.

- Enhance your written communication skills for preparing detailed reports and memos: Clear and concise written communication is crucial for preparing reports, memos, and other documents.

Underestimate the Importance of Teamwork

Private credit deals often involve collaboration with various teams and stakeholders.

- Highlight teamwork experience and collaboration skills in your resume and interviews: Showcase your ability to work effectively in a team environment.

- Demonstrate your ability to work effectively within a team environment: Provide specific examples of how you’ve successfully collaborated with others to achieve common goals.

- Show initiative and a willingness to contribute to the success of the team: Demonstrate a proactive and collaborative approach to problem-solving.

Don't: Overlook the Importance of Due Diligence

Due diligence is a critical aspect of private credit. Understanding the processes involved is crucial for success in this field.

Master Due Diligence Processes

- Understand the different stages of the due diligence process in private credit transactions: Familiarize yourself with the various stages involved, including financial due diligence, legal due diligence, and operational due diligence.

- Learn to conduct thorough research and analysis of potential investments: Develop the ability to gather and analyze information from various sources to assess the risks and potential rewards of private credit investments.

- Develop the ability to identify and assess risks associated with private credit investments: This includes credit risk, market risk, and operational risk, amongst others.

Practice Legal and Regulatory Compliance

- Understand the legal and regulatory framework governing private credit investments: Familiarize yourself with relevant regulations and compliance requirements.

- Stay updated on industry regulations and best practices: The regulatory landscape is constantly evolving, so staying informed is crucial.

- Ensure compliance with all applicable laws and regulations: Adhering to all regulations is not only crucial, but it also demonstrates professionalism and integrity.

Don't: Undersell Your Experience and Achievements

Your resume and interview performance are critical for making a strong impression on potential employers.

Craft a Compelling Resume and Cover Letter

- Tailor your resume and cover letter to each specific job application: Highlighting relevant skills and experience specific to each role significantly increases your chances of success.

- Highlight relevant skills and experience using action verbs: Use strong action verbs to showcase your accomplishments and contributions.

- Quantify your accomplishments whenever possible: Using numbers and data to quantify your achievements helps to demonstrate the impact you've made.

Prepare for Behavioral and Technical Interviews

- Practice answering common interview questions using the STAR method: The STAR method (Situation, Task, Action, Result) helps you structure your answers effectively and highlight your achievements.

- Prepare examples of your achievements and contributions: Be ready to provide specific examples of your accomplishments and how you’ve contributed to past successes.

- Demonstrate your knowledge of the private credit industry and specific companies: Researching the companies you're applying to and demonstrating your understanding of the industry will show your commitment.

Conclusion

Securing a successful career in private credit jobs requires a combination of technical expertise, strong soft skills, and strategic networking. By following these dos and don'ts, you can significantly improve your chances of landing your dream role. Remember to continuously develop your financial modeling skills, network strategically, and showcase your unique talents throughout the application process. Don't delay – start building your career in the lucrative world of private credit jobs today!

Featured Posts

-

Chelseas Summer Transfer Plans Focus On Victor Osimhen

May 27, 2025

Chelseas Summer Transfer Plans Focus On Victor Osimhen

May 27, 2025 -

Alteawn Aljzayry Alamryky Nqlt Nweyt Fy Snaet Altyran

May 27, 2025

Alteawn Aljzayry Alamryky Nqlt Nweyt Fy Snaet Altyran

May 27, 2025 -

Ev Mandate Opposition Grows Car Dealers Push Back

May 27, 2025

Ev Mandate Opposition Grows Car Dealers Push Back

May 27, 2025 -

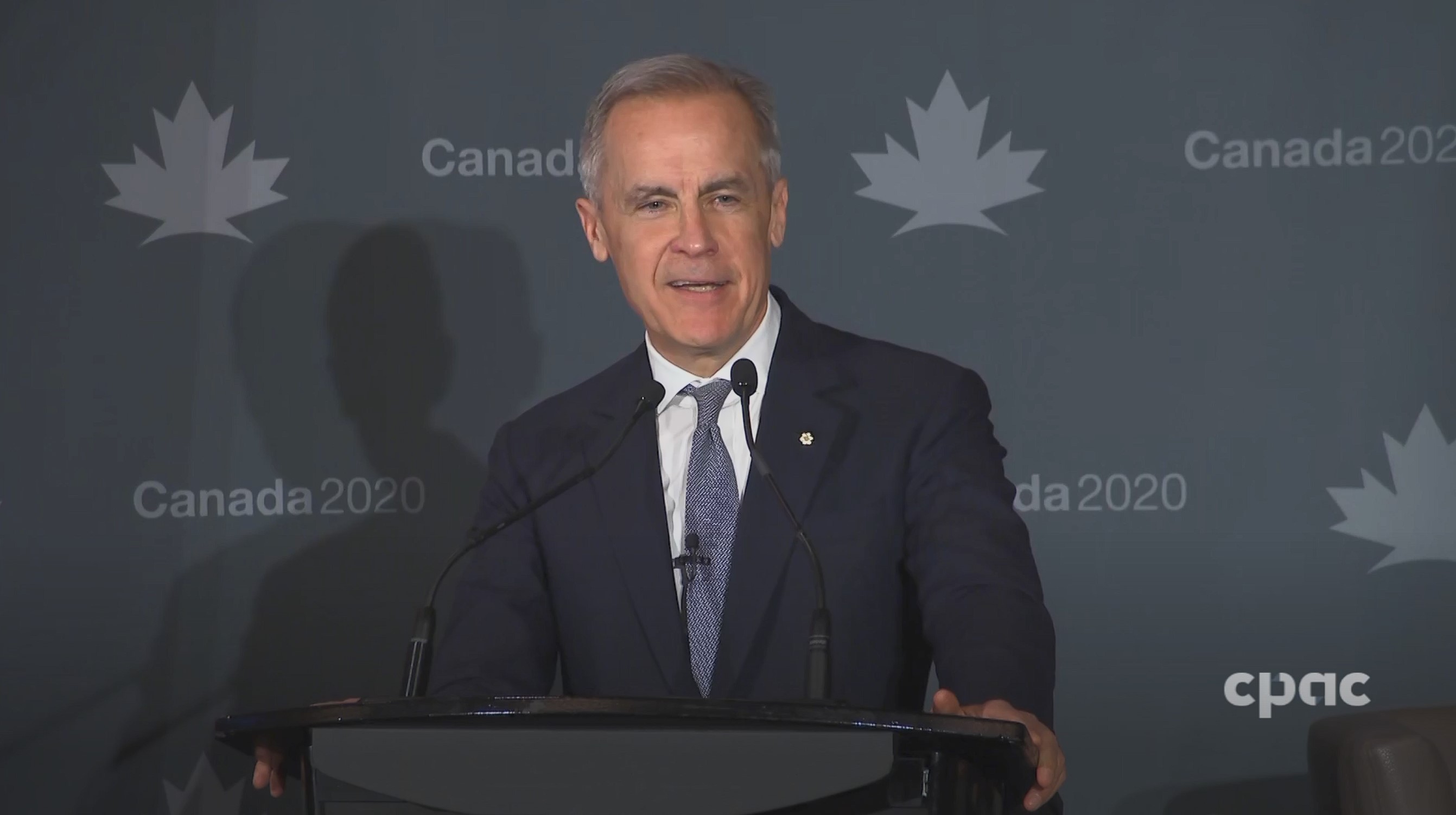

Canadas Liberals Reject Leadership Review Rules For Mark Carney

May 27, 2025

Canadas Liberals Reject Leadership Review Rules For Mark Carney

May 27, 2025 -

Watch Mob Land Season 1 Online A Guide With Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Watch Mob Land Season 1 Online A Guide With Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025