Private Credit Market Cracks: A Credit Weekly Analysis

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have profoundly impacted the private credit market. Higher interest rates directly increase the cost of borrowing for private credit funds, making it more expensive to finance leveraged buyouts (LBOs) and other private credit-dependent transactions. This increased cost of capital translates into several critical consequences:

-

Increased borrowing costs lead to reduced deal flow. As borrowing becomes more expensive, fewer companies can afford to take on private debt, leading to a slowdown in deal activity. This affects both the volume and the pricing of new private debt transactions. The implications are felt across the leveraged finance ecosystem.

-

Higher interest rates make refinancing existing debt more challenging. Companies with existing private debt obligations may struggle to refinance their loans at affordable rates, potentially leading to financial distress. This interest rate risk is particularly acute for highly leveraged borrowers.

-

Increased risk of defaults for highly leveraged borrowers. The combination of higher interest payments and potentially reduced revenues due to economic slowdown significantly increases the risk of default for companies with high levels of debt. This impacts the returns of private debt funds and poses systemic risks to the broader financial system.

The impact is quantifiable. Recent data shows a significant decrease in new LBO activity, a key indicator of the private credit market's health. This decline underscores the direct relationship between interest rate movements and private debt market performance. The resulting pressure on private debt valuations is becoming increasingly visible.

Economic Slowdown and its Effect on Private Credit Portfolio Performance

A slowing economy exacerbates the challenges facing the private credit market. As economic growth slows, borrowers face decreased revenues and cash flow, making it more difficult to service their debt obligations. This leads to several negative consequences for private credit portfolios:

-

Decreased revenues and cash flow for borrowers. A slowing economy directly impacts the profitability of businesses, reducing their ability to make interest payments and repay principal. This creates significant credit risk for private credit lenders.

-

Increased risk of business failures and bankruptcies. Companies struggling with reduced revenues and high debt burdens face an elevated risk of bankruptcy, resulting in significant losses for private credit investors. This is particularly relevant for sectors sensitive to economic downturns.

-

Impact on collateral values. The value of collateral used to secure private credit loans, such as real estate or equipment, can decline during an economic slowdown. This reduction in collateral value increases the risk of losses for lenders.

Sectors particularly vulnerable include retail, real estate, and technology, many of which have significant exposure to private credit financing. The rising probability of economic recession is creating further uncertainty within the private credit markets and increasing default rates.

Increased Scrutiny and Regulatory Changes in the Private Credit Market

Recent market instability has led to increased regulatory scrutiny of private credit funds. Regulators are concerned about the potential risks posed by the rapid growth of the private credit industry and its opacity compared to traditional banking. This increased scrutiny is translating into potential regulatory changes:

-

Increased capital requirements for private credit funds. Regulators may impose higher capital requirements to enhance the resilience of private credit funds to potential losses.

-

Enhanced due diligence and risk management practices. Regulators are likely to demand more rigorous due diligence and risk management processes from private credit lenders. This will increase compliance costs and potentially reduce returns.

-

Potential for stricter lending standards. Regulatory changes could lead to stricter lending standards, making it more difficult for some borrowers to access private credit. This adds further pressure on the already strained market.

The SEC and other regulatory bodies are actively monitoring the situation, indicating a potential shift towards more stringent regulations within the private credit sector. This regulatory compliance burden is changing the operational landscape of private equity and credit funds.

Potential Strategies for Navigating the Current Market Volatility

Despite the challenges, there are strategies investors and lenders can employ to mitigate risks and capitalize on opportunities within the private credit market. A proactive approach to risk mitigation is crucial:

-

Diversifying across different private credit strategies and sectors. Diversification can help reduce the impact of losses in any single sector or strategy.

-

Focus on high-quality borrowers with strong fundamentals. Lenders should prioritize borrowers with strong balance sheets, robust cash flows, and a proven track record. Strong underwriting practices remain paramount.

-

Implementing robust due diligence and monitoring processes. Thorough due diligence and ongoing monitoring of borrowers are essential to identify potential problems early.

Opportunities still exist for those who can navigate the complexity of the current environment. A focus on undervalued assets and shrewd portfolio management can yield positive results despite market headwinds. Investment strategy should prioritize resilience and adaptability in this dynamic market.

Conclusion

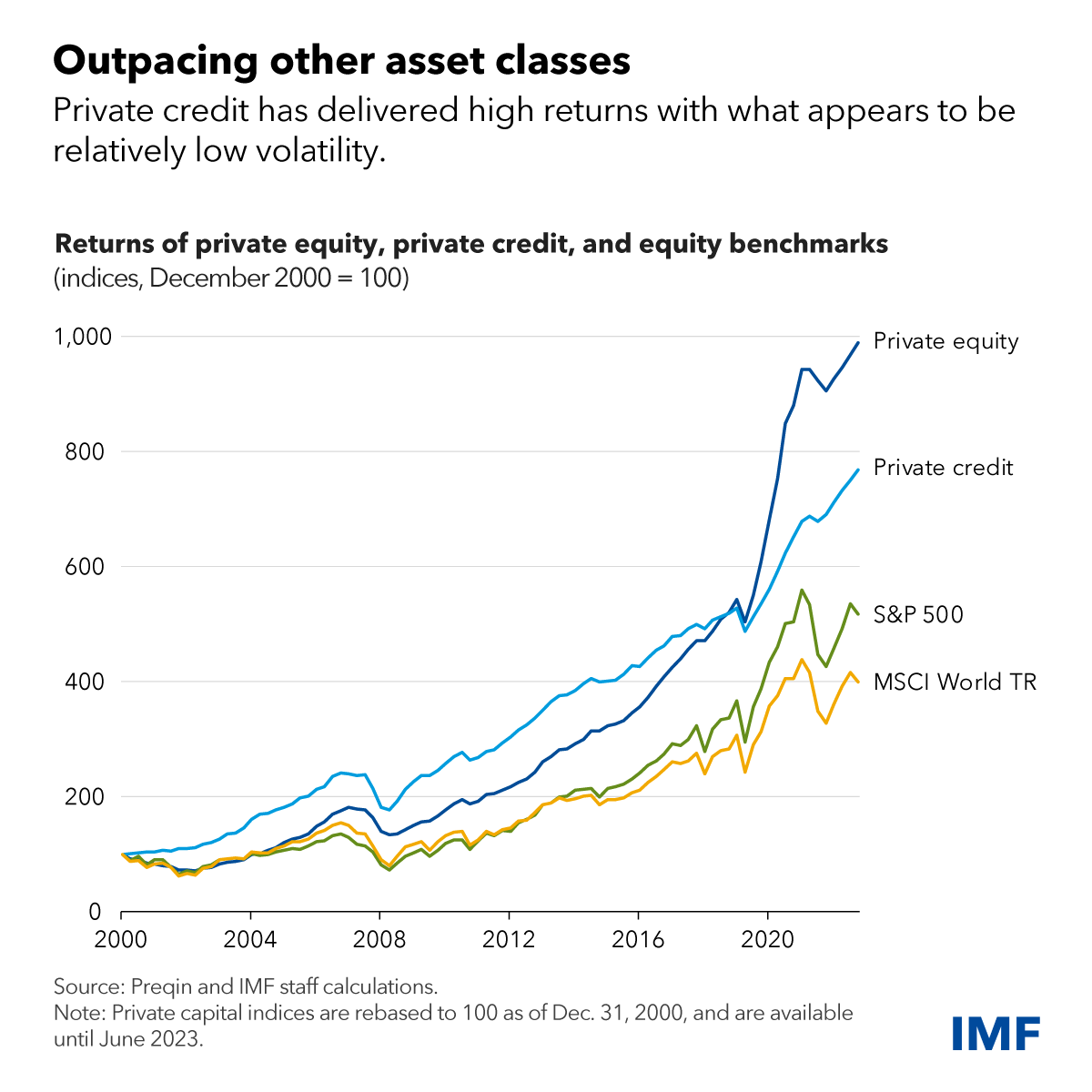

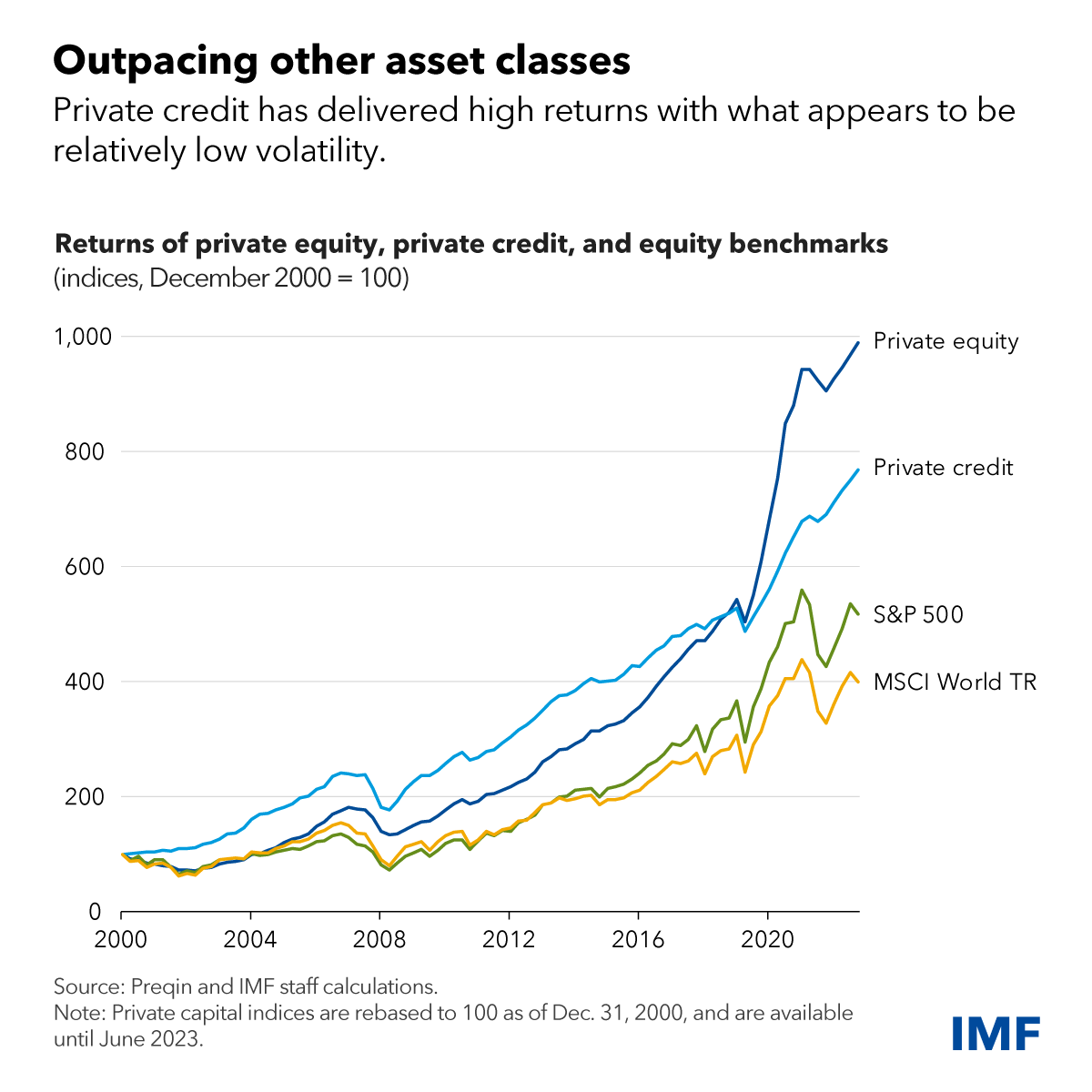

The private credit market is facing a confluence of challenges: rising interest rates, economic slowdown, and increased regulatory scrutiny. These factors are creating cracks in what was once considered a relatively stable asset class. Understanding these risks and implementing robust risk management strategies, such as diversification and focus on high-quality borrowers, is crucial for navigating the current volatility. However, opportunities for shrewd investors remain.

Stay informed about the evolving Private Credit Market by subscribing to our weekly analysis. [Link to Subscription Form]

Featured Posts

-

The Professionals Behind Ariana Grandes Drastic Image Change

Apr 27, 2025

The Professionals Behind Ariana Grandes Drastic Image Change

Apr 27, 2025 -

Alberto Ardila Olivares Garantia De Resultados En Specific Area Of Expertise

Apr 27, 2025

Alberto Ardila Olivares Garantia De Resultados En Specific Area Of Expertise

Apr 27, 2025 -

February 16 2025 Open Thread And Community Conversation

Apr 27, 2025

February 16 2025 Open Thread And Community Conversation

Apr 27, 2025 -

Russia Accuses Ukraine Of Killing General In Moscow Region Bombing

Apr 27, 2025

Russia Accuses Ukraine Of Killing General In Moscow Region Bombing

Apr 27, 2025 -

Canadas Anti Trump Sentiment A Divided Nation

Apr 27, 2025

Canadas Anti Trump Sentiment A Divided Nation

Apr 27, 2025

Latest Posts

-

Walk Off Win For Pirates Against Yankees In Extra Innings Game

Apr 28, 2025

Walk Off Win For Pirates Against Yankees In Extra Innings Game

Apr 28, 2025 -

Yankees Lose To Pirates On Walk Off Hit In Extra Innings

Apr 28, 2025

Yankees Lose To Pirates On Walk Off Hit In Extra Innings

Apr 28, 2025 -

Pirates Defeat Yankees In Walk Off Thriller After Extra Innings

Apr 28, 2025

Pirates Defeat Yankees In Walk Off Thriller After Extra Innings

Apr 28, 2025 -

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025 -

Aaron Judge Paul Goldschmidt Yankees Avoid Series Loss

Apr 28, 2025

Aaron Judge Paul Goldschmidt Yankees Avoid Series Loss

Apr 28, 2025