Private Equity Buys Boston Celtics For $6.1 Billion: Impact And Fan Concerns

Table of Contents

Financial Implications of the Boston Celtics Sale

The $6.1 billion price tag underscores the immense financial value of the Boston Celtics and the NBA as a whole. This Celtics buyout signifies a massive influx of capital, promising significant changes to the franchise's financial landscape. This investment carries both opportunities and potential risks.

- Increased Investment Potential: The private equity investment could lead to substantial increases in spending on player acquisition, upgrading team facilities, and improving overall infrastructure. This could attract top-tier free agents and elevate the team's competitiveness.

- Enhanced Financial Stability: The substantial financial backing from private equity can significantly reduce existing debt and improve the team's long-term financial stability. This strong financial footing can provide a solid foundation for strategic planning and future success.

- Team Valuation and Future Implications: The record-breaking $6.1 billion valuation sets a new benchmark for NBA franchises, influencing future team sales and demonstrating the league's continued growth and financial power. This high valuation reflects the Celtics' strong brand, loyal fanbase, and rich history.

- Long-Term Strategic Planning: Private equity firms often take a long-term perspective, fostering strategic planning that extends beyond immediate wins and losses. This approach could lead to sustainable growth and success for the Celtics.

However, it’s crucial to acknowledge potential risks. While increased investment is positive, misallocation of funds could hinder the team's progress. The focus should remain on responsible spending that benefits both the team and its fans.

Impact on the Boston Celtics' On-Court Performance

The influx of capital resulting from the Celtics buyout could dramatically affect the team's on-court performance. Private equity’s involvement could lead to some significant changes.

- Aggressive Player Recruitment: The increased financial resources could allow the Celtics to aggressively pursue top free agents, potentially assembling a championship-caliber roster. This could lead to a significant improvement in their win-loss record and playoff success.

- Coaching Staff and Team Strategy: New ownership may influence changes in coaching staff and overall team strategy. A fresh perspective could lead to innovative approaches that enhance the team's performance.

- Improved Draft Strategies: The financial stability provided by private equity could enable the Celtics to make more strategic decisions regarding draft picks, either by selecting high-potential players or making shrewd trades to improve the team's standing.

- Data-Driven Decision Making: Private equity firms often employ data-driven approaches to decision making. This could lead to more strategic player acquisitions, coaching decisions, and overall team management.

However, simply throwing money at the problem doesn't guarantee success. Smart player recruitment and effective team management remain crucial factors in achieving on-court success.

Fan Concerns Regarding the Boston Celtics' Sale

The $6.1 billion Boston Celtics private equity buyout has understandably raised concerns among the dedicated fanbase. Many worry about the impact on their experience as loyal supporters.

- Ticket Price Increases: A common concern is a significant rise in ticket prices, potentially pricing out long-time fans and impacting accessibility to games.

- Fan Experience Degradation: There are worries that the focus on maximizing profits might negatively impact the overall fan experience at games, including concessions, parking, and atmosphere.

- Erosion of Team Culture: Fans fear that the corporate nature of private equity ownership might dilute the team's unique culture and connection to the Boston community, impacting the team's identity and traditions.

- Community Impact: Concerns exist about the new owners' commitment to community outreach programs and their investment in local initiatives that have historically been championed by the team.

It is crucial that the new owners address these concerns directly and transparently. Maintaining a strong connection with the community is vital to the Celtics' long-term success.

Addressing Fan Concerns and Transparency

Open communication and transparency are paramount in addressing fan concerns. The new ownership group must demonstrate a commitment to the fanbase and the community.

- Open Communication Channels: Establishing clear and open communication channels—through town halls, social media, and regular updates—is critical to building and maintaining trust.

- Fan Engagement Initiatives: Initiatives to actively engage with fans, solicit feedback, and respond to concerns will demonstrate a commitment to their well-being.

- Community Outreach Programs: Continued and potentially expanded community outreach programs are essential to maintaining the strong bond between the team and its loyal supporters.

- Accountability Measures: Implementing accountability measures, perhaps through independent fan representation or advisory boards, can foster transparency and ensure that fan interests are considered.

Conclusion

The $6.1 billion sale of the Boston Celtics to a private equity firm presents both exciting prospects and potential challenges. The increased financial resources could lead to significant improvements in on-court performance and team infrastructure. However, concerns remain regarding ticket pricing, fan experience, and the preservation of the team's unique identity. Open communication, transparency, and a genuine commitment to the fans will be essential to navigating this transition and ensuring a successful future for the beloved Boston Celtics. To ensure the Boston Celtics private equity buyout benefits both the team and the fans, open dialogue and engagement are key. Share your thoughts on the Boston Celtics buyout in the comments below.

Featured Posts

-

Foot Locker Relocates Headquarters To St Petersburg Lease Signed

May 16, 2025

Foot Locker Relocates Headquarters To St Petersburg Lease Signed

May 16, 2025 -

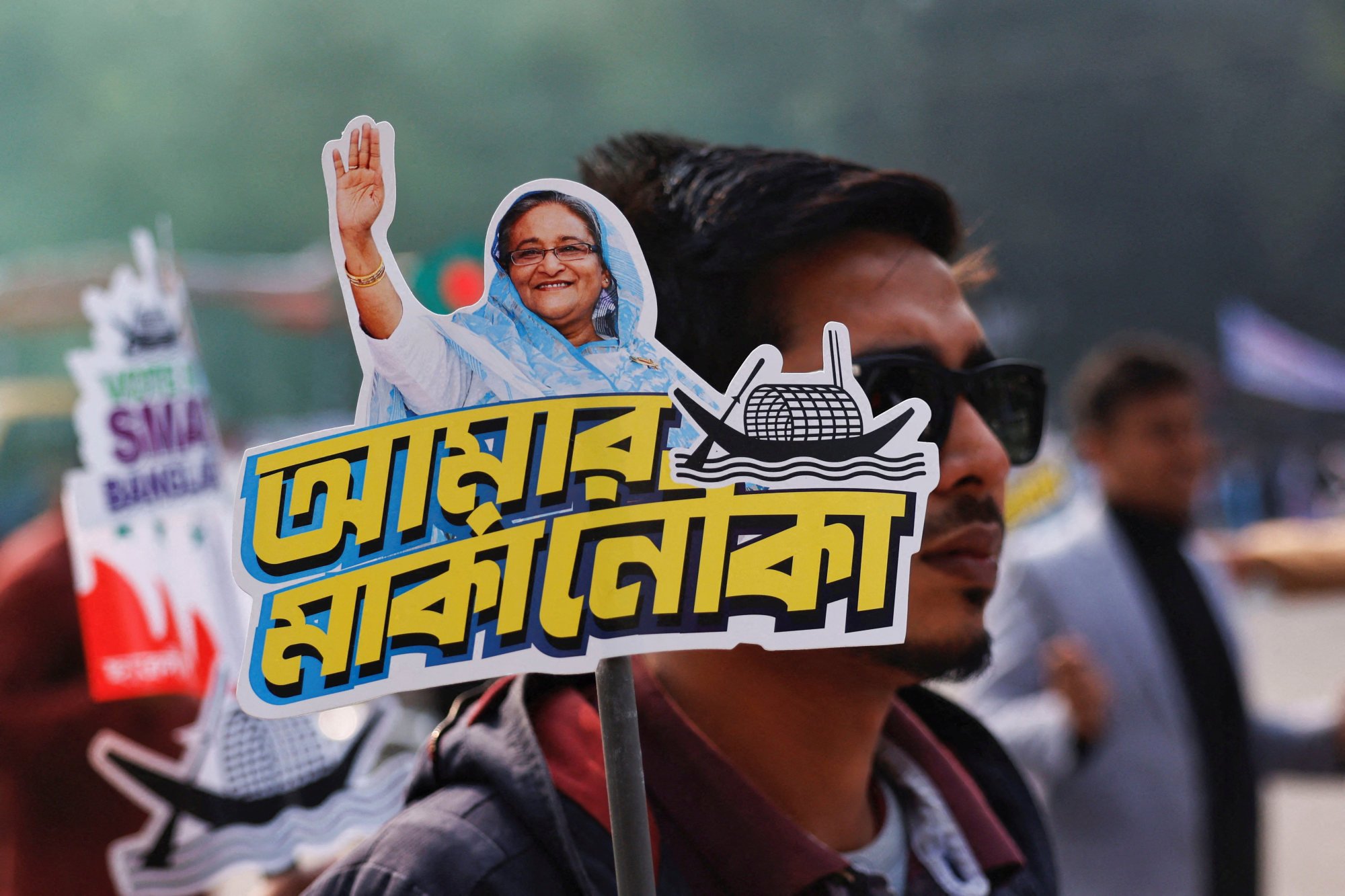

Election Ban For Sheikh Hasinas Party In Bangladesh

May 16, 2025

Election Ban For Sheikh Hasinas Party In Bangladesh

May 16, 2025 -

Gop Mega Bill Details Disputes And The Future Of Legislation

May 16, 2025

Gop Mega Bill Details Disputes And The Future Of Legislation

May 16, 2025 -

Auction Of Kid Cudis Personal Items Yields Unexpected Results

May 16, 2025

Auction Of Kid Cudis Personal Items Yields Unexpected Results

May 16, 2025 -

San Jose Earthquakes Loss To Lafc Daniels Injury A Decisive Factor

May 16, 2025

San Jose Earthquakes Loss To Lafc Daniels Injury A Decisive Factor

May 16, 2025