Private Equity Buys Boston Celtics For $6.1 Billion: What It Means For The Future

Table of Contents

The Implications of Private Equity Ownership for the Boston Celtics

The influx of private equity into professional sports ownership brings a distinct focus, often different from traditional owners. This shift can significantly alter a franchise's trajectory.

Increased Focus on Financial Performance and Return on Investment

Private equity firms are fundamentally driven by maximizing returns on investment. This translates into a heightened emphasis on profitability for the Boston Celtics.

- Increased pressure for profitability: Expect a more rigorous scrutiny of all operational expenses.

- Potential for cost-cutting measures: This could involve analyzing player salaries, negotiating more favorable contracts, and streamlining operational expenses across the organization.

- Exploration of new revenue streams: The Celtics may aggressively pursue new avenues for income generation, including enhanced merchandising strategies, lucrative sponsorship deals, and expansion into international markets.

Private equity's involvement necessitates a data-driven approach, evaluating every aspect of the organization through a financial lens. This could impact decision-making related to player contracts and long-term team strategies.

Potential Changes in Team Management and Strategy

A shift in ownership often leads to changes in team management and overall strategy. We might anticipate:

- New leadership appointments: The private equity firm might bring in executives with a strong financial background to oversee operations.

- Potential shifts in coaching staff: Decisions about coaching personnel may become more closely tied to performance metrics and financial considerations.

- Changes in scouting and player development strategies: The focus might shift towards identifying and developing players with high market value and potential for future resale.

- Impact on team culture: The increased emphasis on financial performance might subtly alter the team's culture, impacting player morale and the overall team environment.

This data-driven approach could lead to a more analytically focused management style, potentially impacting the team's overall approach to player acquisition and development.

Impact on Player Recruitment and Retention

The substantial financial resources brought by private equity could significantly improve the Celtics' ability to compete in the highly competitive NBA player market.

- Ability to offer competitive salaries and contracts: The Celtics will be able to compete more effectively for top-tier free agents, significantly bolstering their roster.

- Potential for attracting high-profile free agents: The increased financial clout could entice star players to join the team, potentially changing the franchise's trajectory.

- Impact on long-term player development programs: Increased investment could lead to improvements in player development infrastructure and coaching.

However, this increased financial capacity also needs careful management to avoid potential issues with salary cap restrictions and player relations.

The Broader Implications for the NBA and Sports Franchises

The Boston Celtics' acquisition sets a new benchmark, influencing the broader landscape of professional sports ownership and valuation.

Setting a New Benchmark for Franchise Valuation

The $6.1 billion price tag represents a significant milestone, profoundly impacting the NBA and sports franchise valuations globally.

- Impact on future franchise sales: This deal dramatically increases the expected value of other NBA teams, potentially leading to future sales at similarly elevated prices.

- Increased valuations for other NBA teams: Owners of other franchises will likely seek higher valuations based on this precedent-setting deal.

- Potential for attracting further private equity investment in the sports industry: This acquisition could trigger a wave of similar investments in professional sports leagues worldwide.

This transaction resets the bar for sports franchise valuations, creating a new paradigm for future transactions within the NBA and beyond.

Shifting Landscape of Sports Ownership

The involvement of private equity marks a notable shift in the traditional structure of sports ownership.

- Increased involvement of private equity firms in sports ownership: We can expect to see more private equity firms investing in sports franchises in the future.

- Potential for new ownership models and financial strategies: This could lead to innovative approaches to team management and financial operations within professional sports.

- Impact on traditional sports ownership structures: The influx of private equity may challenge the traditional family-owned or individual ownership models prevalent in the past.

Potential Risks and Challenges Associated with the Acquisition

While the acquisition offers immense potential, it also introduces potential risks and challenges.

Balancing Financial Goals with Fan Expectations

Private equity's primary goal is financial return, which can sometimes conflict with fan expectations and the team's legacy.

- Potential for conflict between maximizing profits and maintaining team competitiveness: The pursuit of profitability might lead to difficult decisions regarding player salaries and team composition.

- Managing fan expectations and loyalty in the face of potential changes: Cost-cutting measures could lead to dissatisfaction among loyal fans.

- Maintaining the team's legacy and cultural significance: Balancing financial goals with the preservation of the team's history and identity will be a crucial aspect of the new ownership.

The new owners must navigate this delicate balance carefully, ensuring that financial objectives don't overshadow the emotional connection between the team and its fans.

Regulatory Scrutiny and Potential Antitrust Concerns

Such a large transaction is subject to rigorous regulatory scrutiny and potential antitrust considerations.

- Potential for investigation into the fairness of the acquisition process: Regulatory bodies might scrutinize the deal to ensure fair market value and compliance with all regulations.

- Potential antitrust considerations regarding market dominance: Concerns about market concentration and potential anti-competitive practices might arise.

- Regulatory hurdles related to foreign investment in sports: Depending on the investors' origins, additional regulatory hurdles might be encountered.

Navigating these legal and regulatory complexities will be crucial for a smooth transition and successful integration of the new ownership.

Conclusion

The $6.1 billion private equity purchase of the Boston Celtics represents a watershed moment for the NBA and the broader sports industry. While this acquisition offers the potential for significant growth and increased competitiveness, it also presents several challenges and risks. The future of the franchise will depend on the private equity firm's ability to balance financial objectives with the needs of players, fans, and the team's rich legacy. Understanding the implications of this landmark deal is crucial for anyone interested in the future of the Boston Celtics and the evolving landscape of sports investment. Stay informed about further developments surrounding this monumental private equity deal and its impact on the Boston Celtics and the world of professional sports.

Featured Posts

-

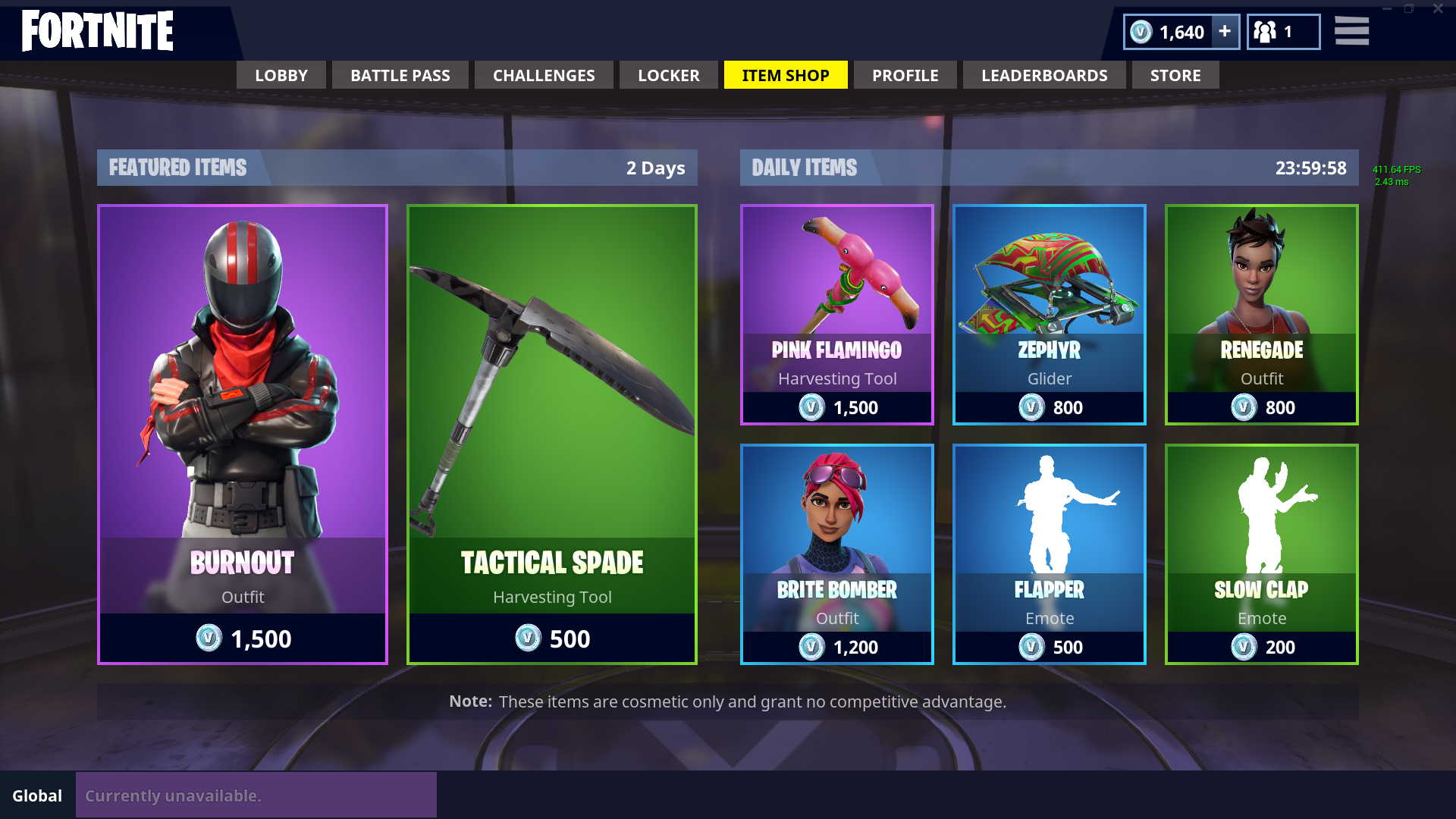

Improved Fortnite Item Shop Navigation A New Player Feature

May 17, 2025

Improved Fortnite Item Shop Navigation A New Player Feature

May 17, 2025 -

James Comeys Instagram Post Removed Following Criticism

May 17, 2025

James Comeys Instagram Post Removed Following Criticism

May 17, 2025 -

Bahia Derrota Al Paysandu 0 1 Goles Resumen Y Cronica

May 17, 2025

Bahia Derrota Al Paysandu 0 1 Goles Resumen Y Cronica

May 17, 2025 -

Hornets Vs Celtics Prediction Picks And Odds For Tonights Nba Game

May 17, 2025

Hornets Vs Celtics Prediction Picks And Odds For Tonights Nba Game

May 17, 2025 -

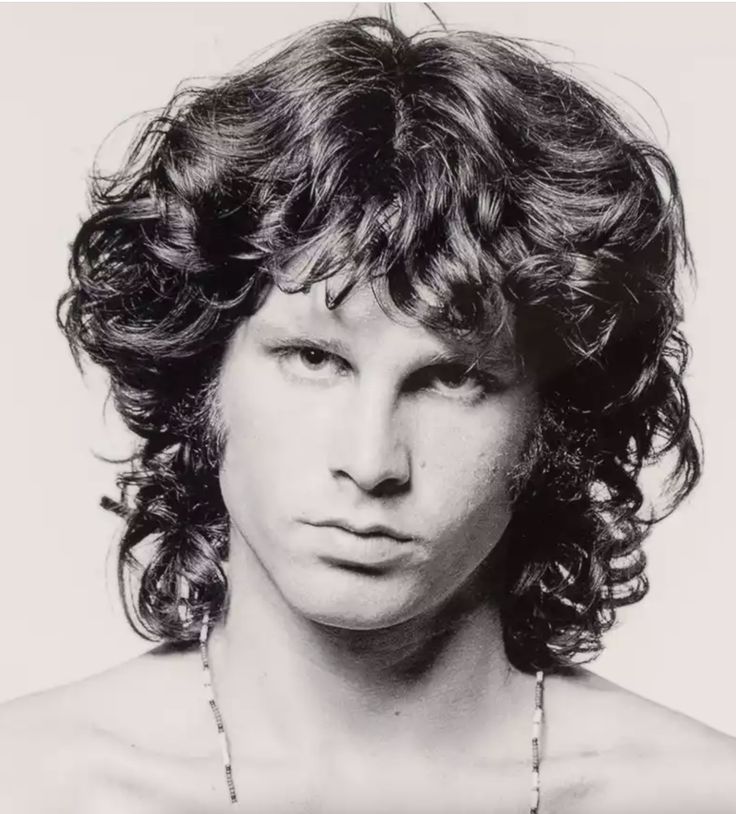

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025