Private Equity's Influence: Four Books Sounding The Alarm

Table of Contents

"Looting the Corporation": The Predatory Practices of Private Equity

"Looting the Corporation" (replace with actual book title) presents a scathing critique of private equity's predatory practices, particularly focusing on leveraged buyouts (LBOs). The book argues that many private equity firms prioritize maximizing short-term returns for their investors, often at the expense of long-term value creation for the companies they acquire.

Key Takeaways:

- Leveraged Buyouts and Their Consequences: The book details how LBOs, fueled by massive debt, can leave companies vulnerable to financial distress. This often leads to job losses, reduced investment in research and development, and a decline in overall corporate performance.

- Corporate Raiding and Asset Stripping: Specific examples of corporate raiding and asset stripping are highlighted, illustrating how private equity firms sometimes extract value from acquired companies through cost-cutting measures that harm employees and communities. One example might involve the sale of valuable assets to pay down debt, leaving the core business weakened.

- Impact on Employees and Communities: The book emphasizes the human cost of private equity's actions, detailing the negative impacts on employment, wages, and local economies. Plant closures and job losses following LBOs are frequently cited.

- Private Equity Ethics: "Looting the Corporation" significantly contributes to the ongoing debate surrounding private equity ethics, questioning the moral implications of prioritizing profit maximization over employee well-being and long-term corporate sustainability. Keywords: leveraged buyouts, corporate raiding, asset stripping, private equity ethics, private equity investment.

Private Equity and the Healthcare Crisis: The Impact on Healthcare

"Private Equity and the Healthcare Crisis" (replace with actual book title) examines the growing involvement of private equity firms in the healthcare industry and its consequences. The book argues that the profit motive inherent in private equity investment can lead to conflicts of interest and compromise the quality and accessibility of healthcare.

Key Takeaways:

- Private Equity Healthcare and its Impact: The book analyzes how private equity investment affects healthcare costs, quality, and accessibility. Increased prices for essential services and reduced investment in staffing and infrastructure are highlighted.

- Conflicts of Interest and Prioritization of Profit: The book details potential conflicts of interest, where the pursuit of profit may overshadow the needs of patients. Examples may include reduced staffing levels to increase profit margins, compromising patient care.

- Case Studies and Examples: Specific case studies or examples of private equity's influence on healthcare providers are analyzed, demonstrating the real-world implications of these investments. These might involve nursing home closures or cuts to essential services in hospitals.

- Keywords: private equity healthcare, healthcare costs, healthcare quality, patient care, conflict of interest, private equity firms.

Concrete Jungle: Private Equity, Real Estate, and the Inflationary Spiral

"Concrete Jungle: Private Equity, Real Estate, and the Inflationary Spiral" (replace with actual book title) explores the link between private equity investment in the real estate market and rising inflation. The book argues that private equity's involvement in real estate contributes to escalating property prices, reducing housing affordability, and fueling broader macroeconomic instability.

Key Takeaways:

- Private Equity Real Estate and Housing Affordability: The book details how private equity investment in real estate, such as buying up large portfolios of rental properties, drives up prices, making homeownership less accessible for many.

- Relationship Between Private Equity Investment and Rising Property Prices: The book analyzes the mechanisms through which private equity investment contributes to escalating property prices, including practices like rent increases and renovations aimed at maximizing returns.

- Macroeconomic Implications: The book examines the broader macroeconomic implications of private equity's influence on the real estate market, including its contribution to inflation and financial instability.

- Keywords: private equity real estate, housing affordability, inflation, real estate investment, macroeconomic impact, private equity risks.

Shadows of Power: Private Equity, Regulatory Capture, and the Erosion of Transparency

"Shadows of Power: Private Equity, Regulatory Capture, and the Erosion of Transparency" (replace with actual book title) focuses on the regulatory environment surrounding private equity. The book argues that regulatory capture and a lack of transparency allow private equity firms to operate with limited accountability, contributing to ethical concerns and undermining public trust.

Key Takeaways:

- Regulatory Capture and Lack of Transparency: The book details allegations of regulatory capture, where private equity firms exert undue influence on regulators, shaping policies in their favor. The lack of transparency in their transactions further exacerbates this issue.

- Contribution to Ethical Concerns: The book connects the lack of transparency to broader ethical concerns, arguing that the opacity surrounding private equity deals hinders scrutiny and accountability.

- Suggestions for Improved Regulation and Oversight: The book proposes specific recommendations for improving regulation and oversight of private equity firms, advocating for greater transparency and stricter enforcement of existing rules.

- Keywords: regulatory capture, private equity regulation, transparency, financial regulation, oversight, private equity firms.

Understanding and Addressing Private Equity's Influence

These four books offer compelling and often alarming perspectives on private equity's influence. They highlight recurring themes of ethical concerns, the prioritization of short-term profits over long-term value, and a lack of transparency that undermines public trust. Each book contributes valuable insights into the complex impact of private equity investment across various sectors. By understanding the potential downsides highlighted in these books, we can engage in a more informed discussion about the future of private equity's influence and advocate for responsible investment practices. Further research into private equity's impact, reading the books mentioned above, and participating in informed discussions are crucial steps toward promoting accountability and ensuring that private equity's power is used responsibly.

Featured Posts

-

Rubio Kritikuva Tramp Ne Saka Pregovori So Putin

May 27, 2025

Rubio Kritikuva Tramp Ne Saka Pregovori So Putin

May 27, 2025 -

Spasenie Zhizney V Ukraine Rol Nemetskoy Pomoschi Po Slovam Andreya Sibigi

May 27, 2025

Spasenie Zhizney V Ukraine Rol Nemetskoy Pomoschi Po Slovam Andreya Sibigi

May 27, 2025 -

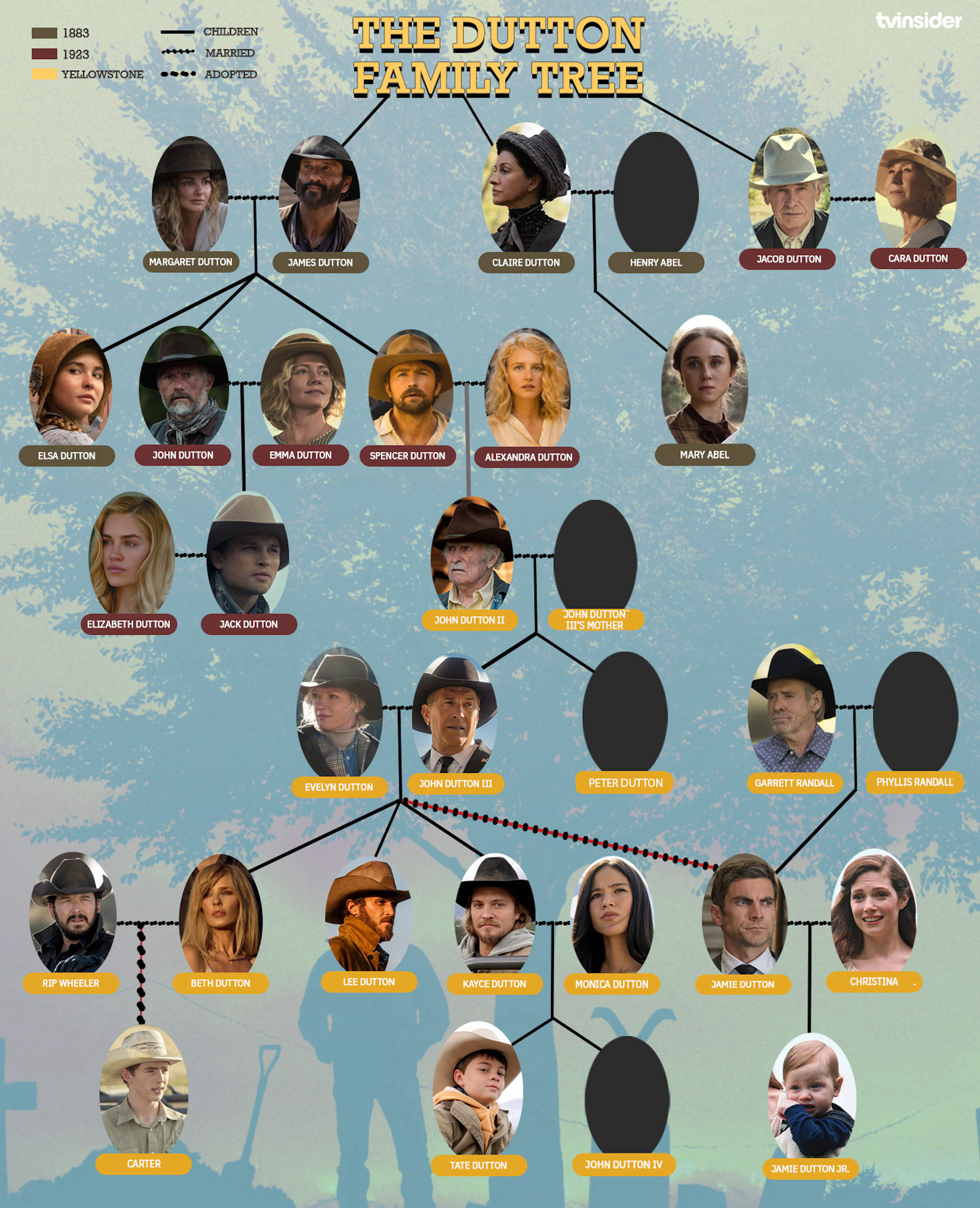

Find Yellowstone 1923 Season 2 Episode 5 Free Online Tonight

May 27, 2025

Find Yellowstone 1923 Season 2 Episode 5 Free Online Tonight

May 27, 2025 -

The Efron Brothers Who Reigns Supreme After Their Reality Tv Debut

May 27, 2025

The Efron Brothers Who Reigns Supreme After Their Reality Tv Debut

May 27, 2025 -

The Rise And Fall Of Michelle Mone An Examination Of Her Business Empire

May 27, 2025

The Rise And Fall Of Michelle Mone An Examination Of Her Business Empire

May 27, 2025