Private Lender Refinancing: A Guide To Federal Student Loans

Table of Contents

Understanding Federal Student Loan Refinancing

Before diving into private lender refinancing, it's crucial to understand the difference between federal and private student loans. Federal student loans are offered by the government, while private student loans come from banks and credit unions. Federal loans often come with benefits like income-driven repayment plans and potential loan forgiveness programs, features not typically offered with private loans.

Refinancing your federal student loans with a private lender can offer several advantages: lower interest rates, simplified monthly payments (by consolidating multiple loans into one), and the potential for significant long-term savings. However, it's critical to be aware of the risks involved.

The Risks of Refinancing Federal Student Loans:

Refinancing your federal student loans means losing the valuable protections that come with them. This is a crucial consideration.

- Loss of federal loan benefits: You'll lose access to benefits like deferment (temporarily suspending payments), forbearance (reducing or temporarily suspending payments), and income-driven repayment plans (IDR plans), which adjust your monthly payments based on your income.

- Potential increase in interest rates: While you might secure a lower interest rate, this isn't guaranteed. Your rate will depend on your credit score and the current market conditions. A poor credit score could lead to a higher interest rate than your existing federal loan.

- Impact on credit score: The application process itself can temporarily impact your credit score, though this is usually minor and temporary.

- Types of federal student loans eligible: Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans are typically eligible for refinancing. However, always check with the lender to ensure your specific loan type is accepted.

Finding the Right Private Lender for Refinancing

Choosing the right private lender is crucial for a successful refinancing experience. Several factors need careful consideration:

- Interest rates: Shop around and compare interest rates from multiple lenders. Use online comparison tools to streamline this process. Look for the lowest Annual Percentage Rate (APR).

- Fees: Pay attention to origination fees and other charges. Some lenders have low or no fees, while others may charge a significant percentage of the loan amount.

- Customer service: Read reviews and check the Better Business Bureau (BBB) ratings to assess a lender's reputation for customer service and responsiveness. Look for lenders with readily available customer support channels (phone, email, online chat).

- Repayment options: Consider the repayment terms offered by different lenders. Do they offer flexible repayment plans, such as shorter or longer terms?

Tips for Finding the Best Lender:

- Compare interest rates using a reputable comparison website.

- Prioritize lenders with low or no origination fees.

- Thoroughly read reviews and ratings on platforms like Trustpilot and the BBB.

- Understand the lender's customer service policies – are they easily accessible?

The Private Lender Refinancing Application Process

The application process for private lender refinancing typically involves these steps:

- Pre-qualification: Many lenders offer pre-qualification, which gives you an idea of your potential interest rate and loan terms without impacting your credit score significantly.

- Application: Complete the lender's online application accurately and honestly.

- Approval: The lender will review your application and supporting documents to determine your eligibility.

- Closing: Once approved, you'll finalize the loan documents and your new loan will be disbursed.

Essential Documentation:

- Gather your tax returns, pay stubs, and W-2s to demonstrate your income.

- Ensure you have accurate details of your current federal student loans.

Maintaining Good Credit:

A good credit score is essential for securing favorable interest rates. Monitor your credit score throughout the process to prevent any unexpected surprises.

Managing Your Refinanced Student Loans

Once your loans are refinanced, consistent responsible management is key:

- On-time payments: Make your monthly payments on time to avoid late fees and maintain a healthy credit score. Setting up automatic payments can help with this.

- Budgeting: Create a realistic budget that incorporates your monthly loan repayment.

- Understanding your loan terms: Carefully review your loan agreement to understand the interest rate, repayment schedule, and any applicable fees.

Tips for Success:

- Set up automatic payments to avoid late fees.

- Create a detailed budget to manage loan repayments effectively.

- Review your loan statement regularly for accuracy and identify any discrepancies promptly.

Alternatives to Private Lender Refinancing

Before deciding on private lender refinancing, explore alternative options:

- Income-Driven Repayment (IDR) Plans: Federal student loan programs offer IDR plans that base your monthly payments on your income and family size. These plans include REPAYE, PAYE, IBR, and ICR.

- Loan Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for loan forgiveness programs, like the Public Service Loan Forgiveness (PSLF) program or the Teacher Loan Forgiveness program.

Understanding the Alternatives:

- Research the eligibility criteria for various IDR plans and loan forgiveness programs.

- Consider the long-term implications of each option, including potential tax liabilities.

Conclusion

Private lender refinancing can be a valuable tool for managing federal student loan debt, but it's essential to proceed thoughtfully. Carefully weigh the benefits against the risks of losing federal loan protections. By diligently comparing lenders, understanding the application process, and exploring alternatives, you can make an informed decision that aligns with your financial goals. Don't let student loan debt control your future. Explore the advantages of private lender refinancing today and regain control of your finances. Remember to conduct thorough research and compare various student loan refinancing options before committing to any one lender.

Featured Posts

-

Resumen Del Partido Talleres 2 0 Alianza Lima Goles Y Jugadas Clave

May 17, 2025

Resumen Del Partido Talleres 2 0 Alianza Lima Goles Y Jugadas Clave

May 17, 2025 -

Arsenal Favourites To Sign Angelo Stiller Over Barcelona

May 17, 2025

Arsenal Favourites To Sign Angelo Stiller Over Barcelona

May 17, 2025 -

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025 -

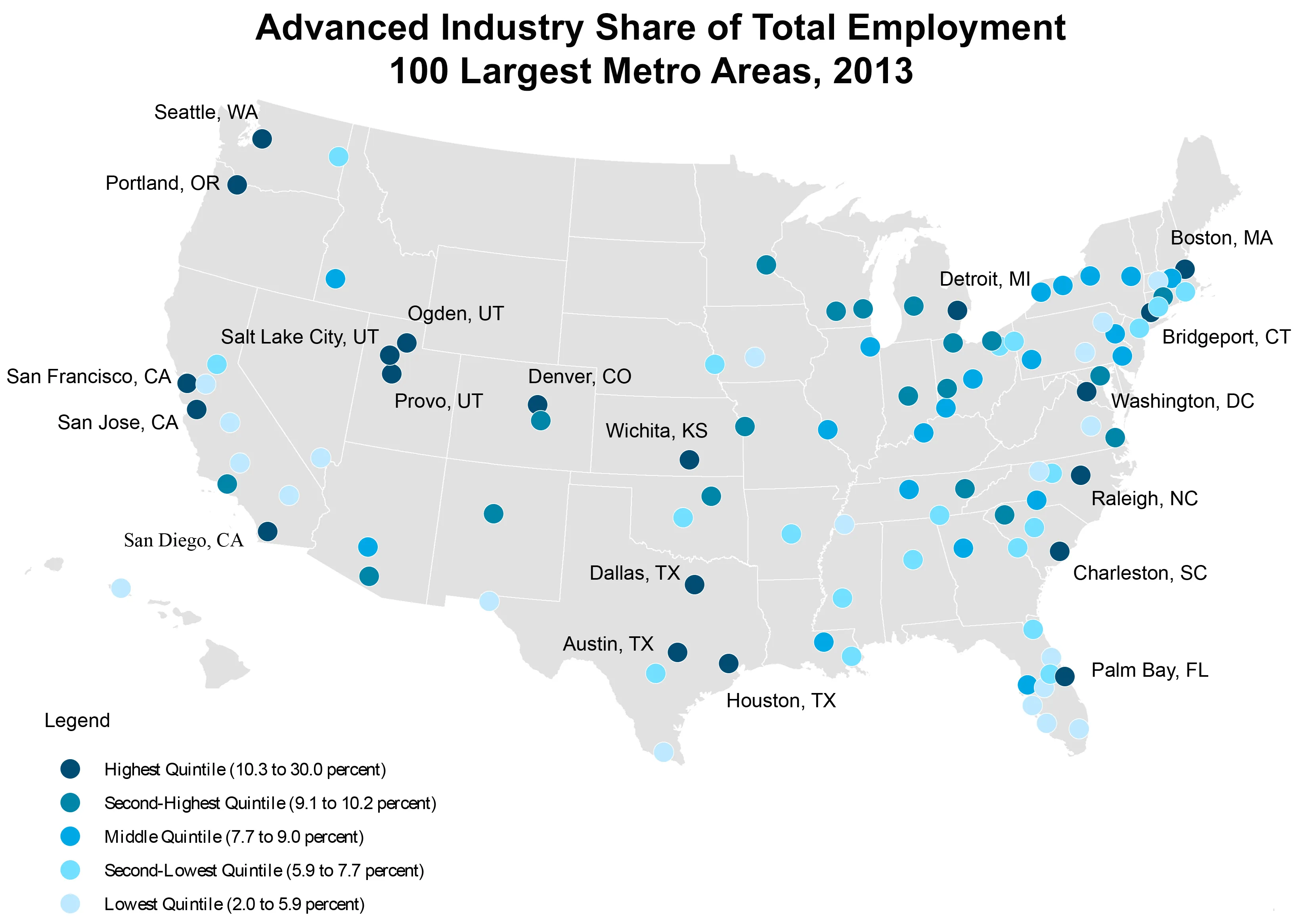

Where To Invest A Comprehensive Guide To The Countrys New Business Hotspots

May 17, 2025

Where To Invest A Comprehensive Guide To The Countrys New Business Hotspots

May 17, 2025 -

Ta Zeygaria Ton Playoffs Toy Nba Kai Oi Imerominies Ton Agonon 2024

May 17, 2025

Ta Zeygaria Ton Playoffs Toy Nba Kai Oi Imerominies Ton Agonon 2024

May 17, 2025