Proposed Tax Hike Could Cripple Harvard And Yale's Endowments

Table of Contents

The Scale of the Endowments and the Proposed Tax

Harvard and Yale Universities boast some of the largest endowments globally, representing vast pools of capital used to support their operations and missions. Understanding the scale of these endowments is crucial to grasping the potential impact of the proposed tax.

- Harvard University Endowment: As of [Insert most recent available figure], Harvard's endowment stands at approximately $[Insert most recent available figure].

- Yale University Endowment: Yale's endowment, as of [Insert most recent available figure], is approximately $[Insert most recent available figure].

The proposed tax increase, detailed in [Insert bill number or legislation name, if available], targets endowment investment income and potentially capital gains at a rate of [Insert proposed percentage]. This directly affects the universities' ability to generate returns and allocate funds towards their core functions. The specific details of the tax legislation are crucial, as variations in the tax rate and application will significantly alter the impact on the institutions. For instance, a tax focused solely on investment income would differ drastically from one that includes capital gains taxes on endowment assets. A [Insert proposed percentage]% tax on investment income alone could represent a loss of [Insert estimated dollar amount] annually for Harvard and [Insert estimated dollar amount] for Yale.

Potential Impact on Financial Aid

A significant portion of Harvard and Yale's endowments is dedicated to funding financial aid initiatives, ensuring accessibility for students from diverse socioeconomic backgrounds. The proposed tax threatens to drastically curtail these vital programs.

- Current Financial Aid: Both universities provide substantial financial aid to a large percentage of their student body. [Insert approximate percentage of students receiving aid at Harvard and Yale, if available]. The average financial aid package per student is approximately $[Insert average amount, if available].

- Potential Decrease: A [Insert proposed percentage]% tax on endowment income could result in a reduction of financial aid by [Insert estimated percentage or dollar amount]. This would directly impact the ability of low and middle-income students to afford a Harvard or Yale education, potentially reducing access and diversity on campus. The projected decrease in aid could lead to a decline in applications from low-income students and limit social mobility.

Consequences for Research and Development

Endowment funds are critical to fostering cutting-edge research at Harvard and Yale. These institutions are at the forefront of scientific discovery, and a tax on their endowments jeopardizes this progress.

- Research Funding: Examples of research programs significantly funded by endowments include [Insert specific examples of research programs at Harvard and Yale].

- Potential Cuts: A reduction in endowment income due to the proposed tax could lead to cuts in research funding by [Insert estimated percentage or dollar amount]. This would inevitably affect faculty hiring, retention, and the overall ability to attract top researchers. The loss of research funding would severely impact scientific advancements and innovation, with potentially far-reaching consequences. The resulting decrease in research output could diminish the global competitiveness of both universities.

Broader Implications for Higher Education

The potential impact extends far beyond Harvard and Yale. Other universities with substantial endowments – including [List examples of other universities with large endowments] – would also experience significant financial strain.

- Ripple Effect: A decrease in endowment income could trigger a reduction in charitable donations, as donors may become hesitant to contribute to institutions facing financial uncertainty. This could lead to a domino effect, impacting the financial health of the entire higher education system.

- Long-term Sustainability: The long-term financial sustainability of universities relies heavily on stable endowments. A substantial tax could jeopardize the long-term viability of numerous institutions, limiting access to higher education for future generations and hindering advancements in research and innovation.

Conclusion

The proposed tax hike poses a significant threat to the endowments of Harvard and Yale, with potentially devastating consequences for financial aid, research, and the broader higher education landscape. The reduction in financial aid would limit access for low-income students, while cuts to research funding could stifle innovation. The broader implications for other universities and the philanthropic sector are equally concerning. Learn more about the proposed tax and how you can advocate for solutions that protect higher education funding. Contact your representatives to express your concerns about the potential impact of the proposed tax hike on Harvard and Yale's endowments. Use your voice to protect the future of higher education.

Featured Posts

-

Can Byd Deliver 5 Minute Ev Charging A Real World Test

May 13, 2025

Can Byd Deliver 5 Minute Ev Charging A Real World Test

May 13, 2025 -

14 Billion Valuation For Exclusive Ai Startup Perplexity What It Means For The Future Of Ai

May 13, 2025

14 Billion Valuation For Exclusive Ai Startup Perplexity What It Means For The Future Of Ai

May 13, 2025 -

Beyonces Hollywood Deal The Story Behind The Five Script Revisions

May 13, 2025

Beyonces Hollywood Deal The Story Behind The Five Script Revisions

May 13, 2025 -

Explosive Courtroom Moment Tory Lanez And His Lawyer

May 13, 2025

Explosive Courtroom Moment Tory Lanez And His Lawyer

May 13, 2025 -

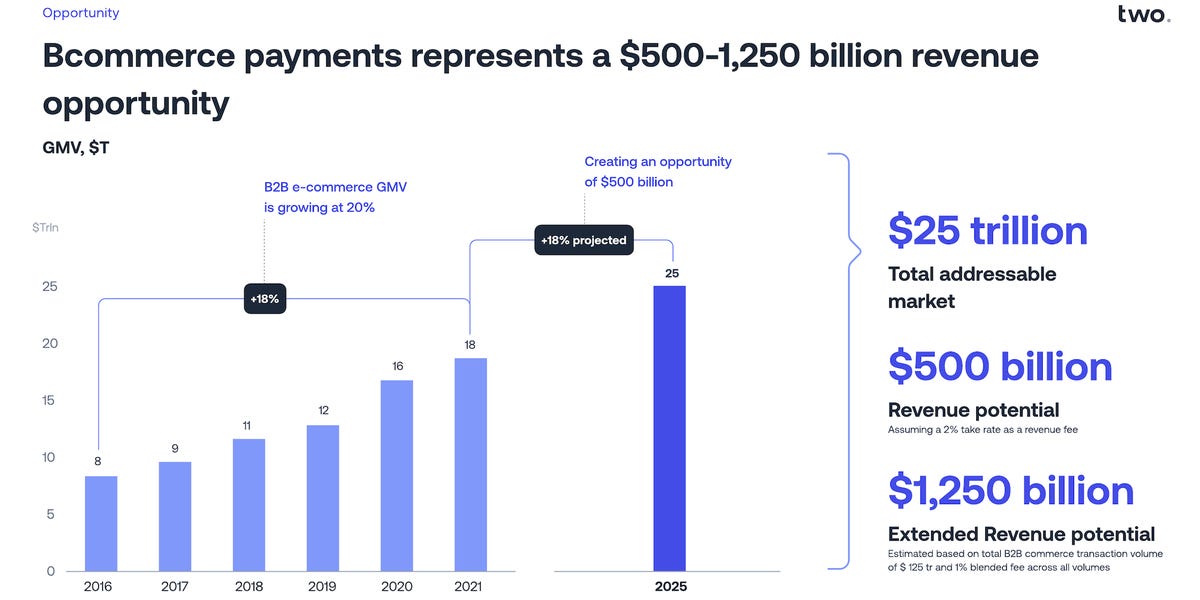

B2 B Payments Innovator Pliant Raises 40 Million In Series B Financing

May 13, 2025

B2 B Payments Innovator Pliant Raises 40 Million In Series B Financing

May 13, 2025