Proxy Statement (Form DEF 14A): What Investors Need To Know

Table of Contents

A proxy statement (Form DEF 14A) is a formal document companies file with the SEC that provides shareholders with information needed to vote on important matters. It's your key to understanding the company's proposals, executive compensation, and potential risks. The information contained within a DEF 14A is critical for informed shareholder voting and effective participation in corporate governance. Ignoring it means relinquishing your right to influence the direction of the companies in which you've invested.

Key Information Found in a Proxy Statement (Form DEF 14A)

The proxy statement is packed with information; knowing where to look is key. Here’s what you should focus on:

Understanding the Company's Proposals

Proxy statements detail various proposals requiring shareholder votes. These typically include:

- Director Elections: Review the backgrounds and qualifications of proposed board members. Look for potential conflicts of interest.

- Executive Compensation: Scrutinize the compensation packages for top executives (discussed further below).

- Shareholder Resolutions: These proposals, often initiated by shareholders, address various corporate governance and social issues. Carefully consider the rationale and potential impact of each.

Understanding the rationale behind each proposal is crucial for informed voting. Look for clear explanations of the benefits and potential risks associated with each. Pay close attention to any potential conflicts of interest that might influence the proposals.

Analyzing Executive Compensation

This section is a critical area for scrutiny. It details:

- Salaries: Base salaries for executives.

- Bonuses: Performance-based or other bonuses awarded.

- Stock Options: The value and terms of stock options granted.

Compare executive pay to company performance. Is executive compensation aligned with shareholder returns? High pay without commensurate performance is a red flag. Other red flags include:

- Excessive golden parachutes.

- Lack of transparency in compensation decisions.

- Poorly designed performance metrics.

A thorough review of executive compensation provides valuable insights into the company's governance and priorities.

Identifying and Assessing Risk Factors

The proxy statement usually includes a detailed section outlining significant risk factors impacting the company. This is vital information for assessing your investment. Common risk factors include:

- Financial Risk: Debt levels, liquidity, and potential financial instability.

- Legal Risk: Ongoing or potential lawsuits and regulatory investigations.

- Regulatory Risk: Changes in regulations or compliance issues.

- Operational Risk: Risks related to supply chain disruptions, technological advancements, or other operational challenges.

Understanding these risks is essential for evaluating the company's long-term prospects and making sound investment decisions.

How to Effectively Use a Proxy Statement (Form DEF 14A)

Navigating a proxy statement can feel daunting. Here's how to approach it effectively:

Reading and Interpreting the Document

Proxy statements often contain complex financial and legal terminology. To make the most of it:

- Take your time: Don't rush through the document.

- Use online resources: Many websites offer explanations of common proxy statement terms and concepts.

- Seek professional advice: If needed, consult a financial advisor or legal professional for clarification.

- Pay attention to footnotes and disclosures: These often contain crucial details that provide context.

Understanding the details within the document, and being aware of the limitations of the information, is pivotal to making an informed decision.

Making Informed Voting Decisions

Once you’ve reviewed the proxy statement, it’s time to vote! Shareholders can usually vote:

- By mail: Using the paper proxy card provided.

- Online: Through the company's online voting portal.

- By proxy: Appointing someone else to vote on your behalf.

Voting is your right and responsibility as a shareholder. Exercise it! Your vote reflects your investment goals and values. Consider the company’s long-term sustainability, ethical practices, and alignment with your personal investment philosophy.

Where to Find Proxy Statements (Form DEF 14A)

Accessing proxy statements is straightforward:

SEC's EDGAR Database

The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is a comprehensive database of SEC filings, including proxy statements. You can search for filings by company name or CIK number.

Company Investor Relations Website

Most publicly traded companies post their proxy statements on their investor relations websites. This is often the easiest way to access the document.

Conclusion: Taking Action with Your Proxy Statement (Form DEF 14A)

Proxy statements are not just legal documents; they're your tools for active participation in corporate governance. By carefully reviewing the information within a DEF 14A, you can make informed decisions about director elections, executive compensation, and other critical corporate matters. Remember, your vote represents your ownership stake and your voice in shaping the company's future. Don't let your voice go unheard! Take control of your investments by carefully reviewing your next proxy statement (Form DEF 14A) and exercising your shareholder rights.

Featured Posts

-

Facing Government Action For Delinquent Student Loans Heres What To Do

May 17, 2025

Facing Government Action For Delinquent Student Loans Heres What To Do

May 17, 2025 -

Ultraviolette Launches Tesseract Electric Scooter For Rs 1 45 Lakh

May 17, 2025

Ultraviolette Launches Tesseract Electric Scooter For Rs 1 45 Lakh

May 17, 2025 -

Preparing For Your Fountain City Classic Scholarship Midday Interview

May 17, 2025

Preparing For Your Fountain City Classic Scholarship Midday Interview

May 17, 2025 -

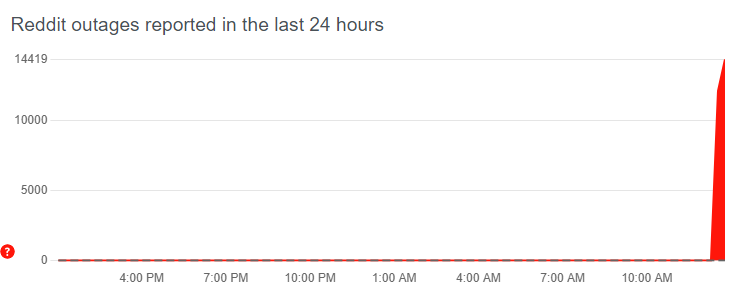

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025

Worldwide Reddit Outage Leaves Thousands Unable To Access The Platform

May 17, 2025 -

El Futuro De Los Prestamos Estudiantiles Bajo Una Segunda Administracion Trump

May 17, 2025

El Futuro De Los Prestamos Estudiantiles Bajo Una Segunda Administracion Trump

May 17, 2025