PwC Banned: Saudi PIF Halts Advisory Work For 12 Months

Table of Contents

Reasons Behind the PwC Ban

The PIF, responsible for managing hundreds of billions of dollars in assets and spearheading ambitious projects like NEOM, has not publicly disclosed the precise reasons for the 12-month suspension of PwC's advisory services. However, reports suggest several potential contributing factors:

- Potential Conflict of Interest: Speculation points towards a potential conflict of interest arising from PwC's involvement in multiple projects simultaneously, potentially blurring lines of loyalty and impartiality. This highlights the increasingly complex regulatory landscape within Saudi Arabia and the need for stringent adherence to ethical guidelines.

- Breach of Confidentiality: Another possibility is a breach of confidentiality concerning sensitive information related to PIF's investments or strategic plans. Such a breach would be a serious violation of trust and could have far-reaching consequences.

- Failure to Meet Certain Standards: The PIF may have found PwC's performance or adherence to contractual obligations lacking in certain areas. This could encompass issues related to project delivery, quality of advice, or regulatory compliance. A thorough internal investigation by the PIF is likely underway.

- Ongoing PIF Investigation: Reports suggest an ongoing investigation is actively reviewing PwC's past conduct and engagement with the PIF. The full scope of this investigation and its ultimate findings remain undisclosed, adding to the uncertainty surrounding the ban.

These reasons, while speculative until official confirmation from the PIF, underscore the crucial importance of robust ethical frameworks and transparent practices within the advisory industry, particularly when working with entities of the PIF's scale and significance. The implications for other consulting firms are clear: meticulous adherence to regulations and the highest ethical standards is paramount to maintaining a strong working relationship with the PIF and the Saudi Arabian government.

Impact of the Ban on PwC

The PwC ban carries significant implications for the firm, impacting both its financial performance and its reputation:

- PwC Financial Impact: The loss of revenue from PIF projects represents a substantial financial blow to PwC. The PIF is a significant client in the region, and the lost contracts will undoubtedly affect PwC's overall financial performance, particularly in the Middle East.

- Reputational Damage: The ban significantly damages PwC's reputation and credibility. A loss of trust with such a significant client casts a shadow over the firm's ability to secure future contracts, not only in Saudi Arabia but potentially globally. The impact on investor and client confidence requires careful management.

- Business Consequences: The long-term business consequences are difficult to predict but could include a loss of market share in Saudi Arabia and increased scrutiny from other clients and regulators. PwC will need to implement robust corrective actions to restore trust and prevent similar incidents.

Implications for the Saudi Arabian Business Environment

The PwC ban has wider implications for the Saudi Arabian business environment:

- Foreign Investment in Saudi Arabia: The decision may raise concerns among foreign companies operating in Saudi Arabia, leading to increased scrutiny of regulatory practices and potential delays in decision-making. The clarity and predictability of the regulatory landscape are crucial for attracting foreign investment.

- Regulatory Changes: The ban could prompt changes in the regulatory oversight of advisory services in Saudi Arabia, leading to stricter rules and more thorough vetting processes for consulting firms. Increased transparency and accountability could become the norm.

- Investor Confidence: While the Saudi government is actively pursuing economic diversification, this incident could temporarily dampen investor confidence. However, a robust response from the authorities could reassure investors about the Kingdom’s commitment to transparency and good governance.

Future Outlook and Potential Changes in the Advisory Sector

The PwC ban creates a ripple effect throughout the advisory sector:

- Advisory Sector Reform: This event could be a catalyst for broader reform within the advisory sector in Saudi Arabia, promoting greater transparency, stronger regulatory frameworks, and enhanced ethical guidelines. Greater emphasis on compliance is likely.

- Future of Consulting in Saudi Arabia: The competitive landscape will shift, with other consulting firms likely vying for opportunities previously held by PwC. This could lead to increased competition and potentially drive innovation in the sector.

- Competitive Landscape: Firms will need to demonstrate robust compliance and ethical practices to secure future work with the PIF and other significant clients in Saudi Arabia. The emphasis will be on trust and a demonstrable commitment to integrity.

The long-term impact on the relationship between the PIF and the global advisory sector remains to be seen.

Conclusion: Understanding the Implications of the PwC Ban

The 12-month suspension of PwC's advisory services by the Saudi PIF is a significant event with far-reaching consequences. The reasons behind the ban, though not fully disclosed, point towards the critical need for strong ethical practices and unwavering compliance within the advisory industry. The impact on PwC’s finances and reputation is substantial, and the broader implications for the Saudi Arabian business environment and the global advisory sector require careful observation. Stay updated on the latest news regarding the PwC ban and its impact on the Saudi PIF and the wider advisory sector by following reputable financial news sources.

Featured Posts

-

Bundesligas Italian Impact The Success Stories Of Grifo Immobile Toni Barzagli And Rizzitelli

Apr 29, 2025

Bundesligas Italian Impact The Success Stories Of Grifo Immobile Toni Barzagli And Rizzitelli

Apr 29, 2025 -

Is This The New Quinoa Exploring The Latest Superfood

Apr 29, 2025

Is This The New Quinoa Exploring The Latest Superfood

Apr 29, 2025 -

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025 -

Understanding The Tik Tok Adhd Connection Fact Vs Fiction

Apr 29, 2025

Understanding The Tik Tok Adhd Connection Fact Vs Fiction

Apr 29, 2025 -

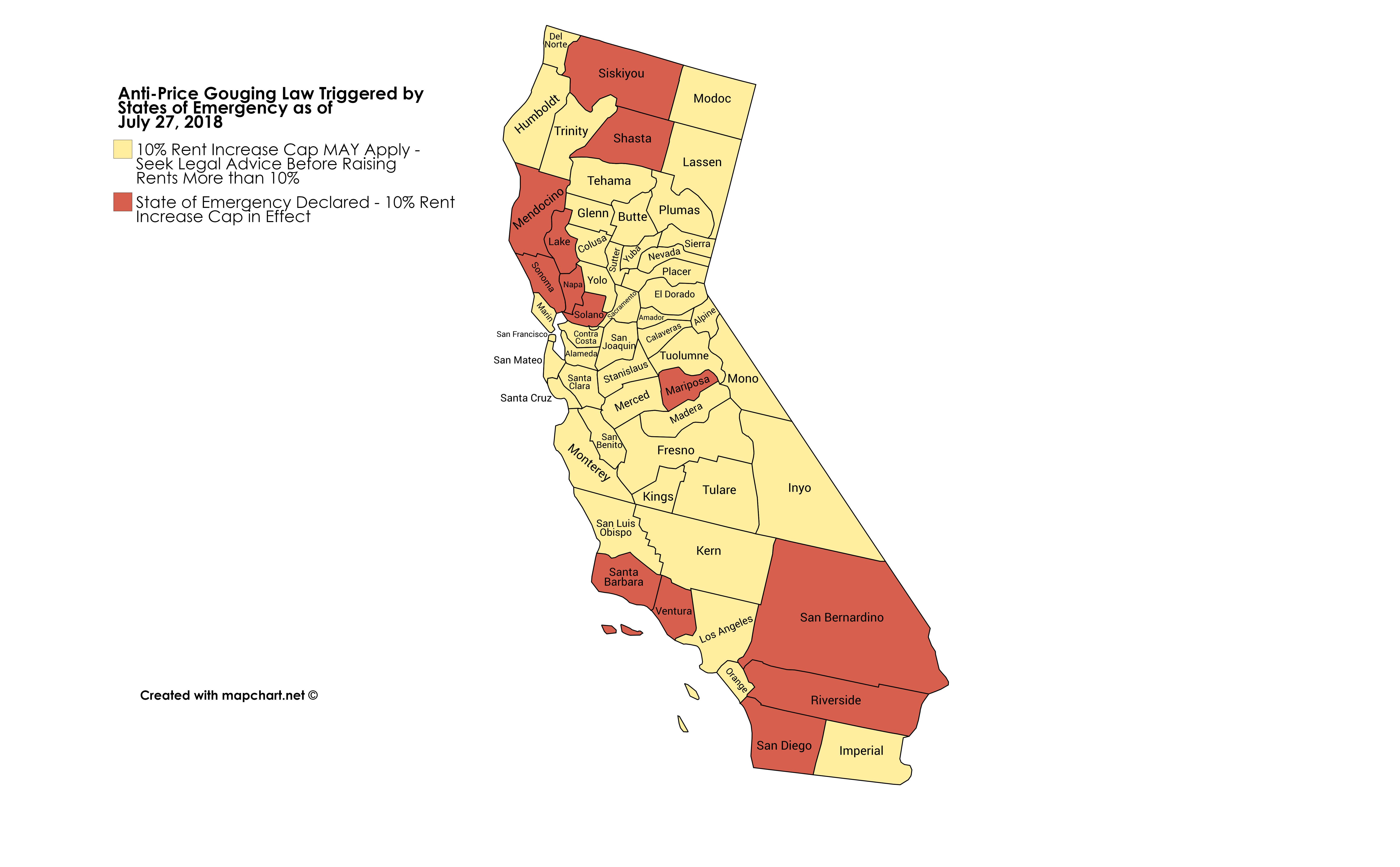

La Fires Price Gouging Allegations Surface Amid Housing Crisis

Apr 29, 2025

La Fires Price Gouging Allegations Surface Amid Housing Crisis

Apr 29, 2025