PwC's Retreat From Sub-Saharan Africa: A Nine-Country Case Study

Table of Contents

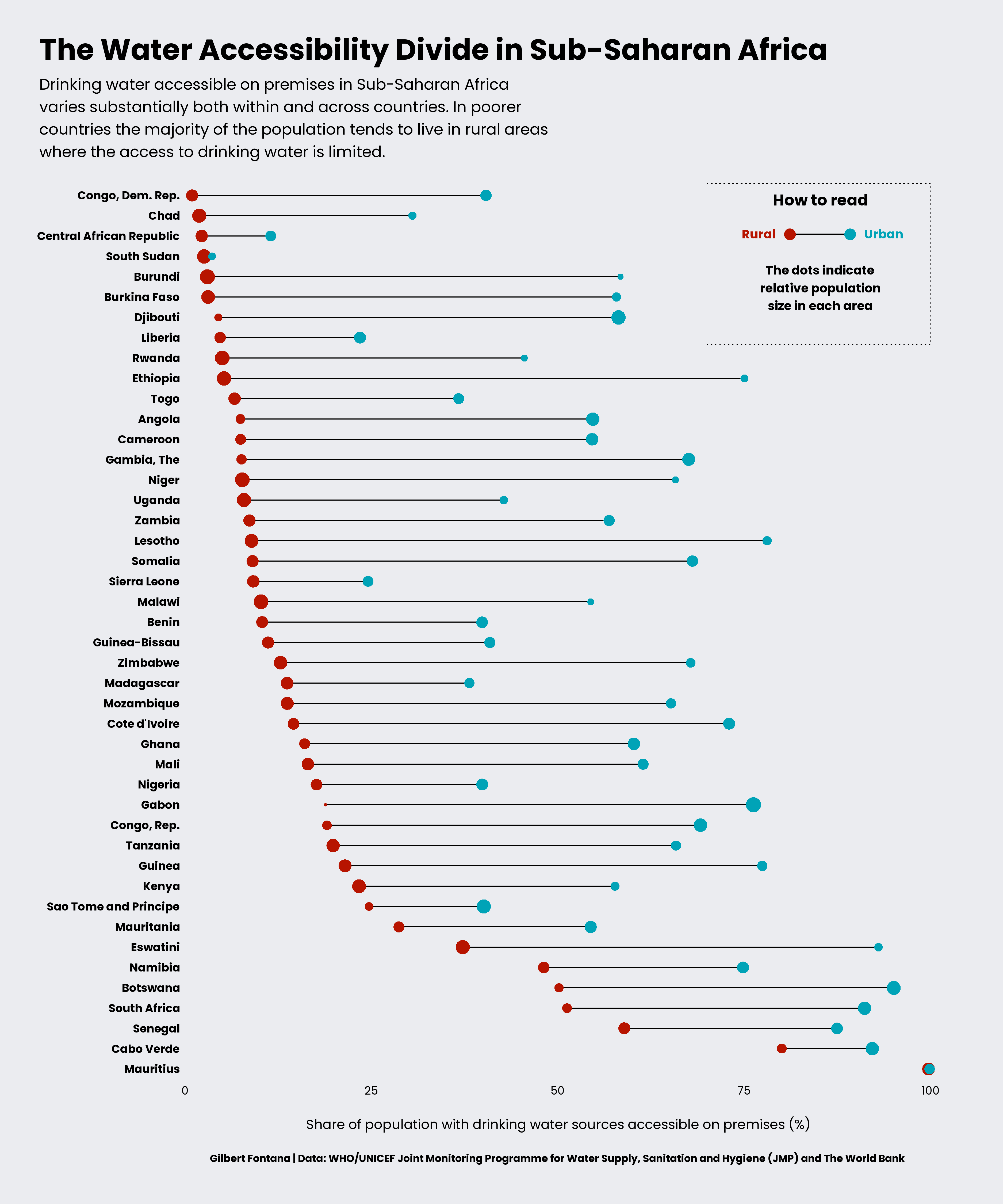

The Nine Affected Countries: A Geographic Overview

PwC's strategic retreat has impacted operations in nine Sub-Saharan African countries. Understanding the economic and political context of each country is crucial to analyzing the reasons for this decision. The countries affected include (but may not be limited to, depending on the most up-to-date information): Nigeria, Kenya, Angola, Ghana, Tanzania, Zambia, Uganda, Mozambique, and South Africa.

-

PwC Nigeria: Nigeria, Africa's largest economy, faces challenges including fluctuating oil prices, infrastructural deficits, and political volatility. These factors can significantly impact the profitability and stability of operating in the country.

-

PwC Kenya: Kenya, a regional economic hub, is grappling with issues such as high public debt and fluctuating exchange rates. These economic realities might have influenced PwC's decision-making process.

-

PwC South Africa: South Africa, while the most developed economy in the region, faces challenges including high unemployment rates, significant inequality, and load shedding (power outages). These factors can contribute to an unpredictable business environment.

-

PwC Angola: Angola, heavily reliant on oil revenue, is susceptible to commodity price fluctuations and struggles with diversification efforts.

-

PwC Ghana: Ghana's economy, once a beacon of growth, has experienced recent challenges, including high inflation and a depreciating currency.

-

PwC Tanzania: Tanzania’s business environment, while generally improving, is not without its challenges related to bureaucratic hurdles and investment climate.

-

PwC Zambia: Zambia's economy is heavily indebted, leading to fiscal instability and affecting investor confidence.

-

PwC Uganda: Uganda faces challenges in diversifying its economy beyond agriculture and attracting large scale foreign direct investment.

-

PwC Mozambique: Mozambique’s economy is sensitive to global commodity markets and has recently faced economic and political uncertainty.

[Insert a map here highlighting the nine countries mentioned]

Reasons Behind PwC's Retreat: Analyzing the Drivers

PwC's decision to scale back operations in Sub-Saharan Africa is likely a result of a complex interplay of factors:

Economic Factors:

- Currency Fluctuations and Inflation: High inflation rates and volatile exchange rates in many Sub-Saharan African countries increase operational costs and reduce profitability for multinational firms like PwC.

- Low Investor Confidence: Political and economic instability can deter investment and create an uncertain business environment.

- Global Economic Downturns: Global economic recessions directly impact the demand for PwC's services, particularly in emerging markets.

Political Instability and Risk:

- Regulatory Changes: Frequent changes in regulations and tax policies can increase operational complexities and costs.

- Corruption: High levels of corruption can create an unpredictable business environment and increase compliance risks.

- Political Risk Assessments: PwC, like other multinational corporations, undertakes rigorous political risk assessments. High-risk environments may lead to strategic decisions to reduce or withdraw operations.

Competitive Landscape:

- Big Four Competition: Intense competition from other Big Four accounting firms (Deloitte, EY, KPMG) and local players for market share necessitates a careful evaluation of profitability.

- Market Saturation: In some countries, the market for auditing, tax, and consulting services may be saturated, limiting growth opportunities.

Internal Strategic Realignment:

- Resource Allocation: PwC's global strategy may involve focusing resources on more profitable or strategically important markets.

- Internal Restructuring: Internal reorganizations and cost-cutting measures could have led to the decision to reduce presence in certain regions.

Impact of PwC's Withdrawal: Consequences for Businesses and the Economy

PwC's retreat has far-reaching consequences:

Effect on Local Businesses:

- Loss of Expertise: Local businesses relying on PwC for auditing, tax, and consulting services may face difficulties finding suitable alternatives.

- Challenges for SMEs: Small and medium-sized enterprises (SMEs) are particularly vulnerable, often lacking the resources to access high-quality services from other firms.

- Brain Drain: The potential loss of skilled professionals from PwC's offices can also impact the overall development of the accounting profession within these nations.

Implications for Economic Development:

- Foreign Direct Investment (FDI): The presence of reputable international accounting firms is crucial for attracting foreign direct investment. PwC's withdrawal may negatively impact investor confidence.

- Economic Growth: Reduced access to high-quality professional services can hinder economic growth and development.

- Governance and Transparency: The absence of a major player like PwC might impact corporate governance and financial transparency in the affected countries.

The Future of the Accounting Profession:

- Increased Competition: The departure of PwC will likely intensify competition among the remaining firms.

- Opportunities for Local Firms: This could create opportunities for growth for local and regional accounting firms to fill the gap.

- Need for Capacity Building: There's an increased need to strengthen capacity building within the accounting profession in these affected countries to maintain standards and confidence.

Conclusion: Understanding PwC's Sub-Saharan African Retreat

This case study reveals the multifaceted reasons behind PwC's decision to scale back its operations in nine Sub-Saharan African countries. Economic instability, political risks, competitive pressures, and internal strategic realignment all played a role. The impact extends beyond PwC itself, affecting local businesses, economic development, and the future of the accounting profession in the region. This situation necessitates further analysis of the underlying factors and their long-term implications for Sub-Saharan Africa. Further research into the dynamics affecting the accounting industry in Sub-Saharan Africa, including the evolution of PwC's Africa strategy and the changing competitive landscape, is crucial to understanding the long-term implications. Understanding the ramifications of this decision requires a deep dive into the future of accounting in Africa and a comprehensive PwC Sub-Saharan Africa analysis.

Featured Posts

-

Exclusive Ivy League Schools Create Coalition To Resist Trump

Apr 29, 2025

Exclusive Ivy League Schools Create Coalition To Resist Trump

Apr 29, 2025 -

London Palladium Jeff Goldblum Spring Concert Featuring Mildred Snitzer Orchestra

Apr 29, 2025

London Palladium Jeff Goldblum Spring Concert Featuring Mildred Snitzer Orchestra

Apr 29, 2025 -

Champions League Ein Rueckblick Auf Die Deutschen Begegnungen

Apr 29, 2025

Champions League Ein Rueckblick Auf Die Deutschen Begegnungen

Apr 29, 2025 -

Analysis Of Pw Cs Decision To Leave Nine Sub Saharan African Markets

Apr 29, 2025

Analysis Of Pw Cs Decision To Leave Nine Sub Saharan African Markets

Apr 29, 2025 -

How To Buy Capital Summertime Ball 2025 Tickets A Comprehensive Guide

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets A Comprehensive Guide

Apr 29, 2025

Latest Posts

-

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Door The Story Of Amanda Clive And Their Children

Apr 30, 2025

Our Farm Next Door The Story Of Amanda Clive And Their Children

Apr 30, 2025 -

Latest News From Ravenseat Amanda Owens Family Update And Farm Struggles

Apr 30, 2025

Latest News From Ravenseat Amanda Owens Family Update And Farm Struggles

Apr 30, 2025 -

A Day In The Life Exploring Our Farm Next Door With Amanda And Clive

Apr 30, 2025

A Day In The Life Exploring Our Farm Next Door With Amanda And Clive

Apr 30, 2025 -

Life On Our Farm Next Door Following Amanda Clive And Family

Apr 30, 2025

Life On Our Farm Next Door Following Amanda Clive And Family

Apr 30, 2025