PwC's Strategic Withdrawal: Exiting Multiple Countries To Mitigate Risk

Table of Contents

The Driving Forces Behind PwC's Strategic Exits

PwC's decision to withdraw from certain markets is a multifaceted strategy driven by a confluence of factors, each contributing to a comprehensive risk mitigation plan.

Increasing Regulatory Scrutiny and Compliance Costs

Navigating the increasingly complex global regulatory landscape is proving costly and challenging for large professional services firms like PwC. The rising costs associated with compliance, coupled with stricter auditing standards and heightened penalties for non-compliance, are significant drivers of this strategic shift.

- Examples of specific regulations impacting PwC globally: The EU's General Data Protection Regulation (GDPR), the Sarbanes-Oxley Act (SOX) in the US, and various anti-money laundering (AML) regulations worldwide.

- Examples of fines or penalties: Recent instances of significant fines levied against auditing firms for regulatory breaches underscore the increasing financial risks associated with non-compliance. These substantial penalties directly impact profitability and incentivize strategic withdrawal from higher-risk jurisdictions.

Mitigating Reputational Risk and Protecting Brand Integrity

Past controversies and scandals within the auditing industry have significantly impacted public trust and amplified the importance of maintaining a strong reputation. PwC's strategic exits can be viewed as a proactive measure to limit exposure to potential future reputational damage and protect its brand integrity.

- Examples of past controversies that might have contributed to the decision: High-profile accounting scandals and criticisms of audit quality have heightened scrutiny of the industry, pushing firms like PwC to reassess their global footprint.

- Impact on PwC's brand image: Maintaining a pristine reputation is crucial for attracting and retaining clients in a highly competitive market. By exiting riskier markets, PwC aims to protect its brand value and maintain client trust.

Optimizing Global Footprint and Resource Allocation

PwC's strategic withdrawal also reflects a broader strategy of optimizing its global footprint and allocating resources to more profitable and stable markets. This involves streamlining operations, reducing overhead, and consolidating activities in key strategic locations.

- Examples of countries where PwC is focusing its resources: PwC is likely prioritizing markets with robust regulatory frameworks, strong economic growth, and significant opportunities for professional services.

- Potential cost savings from streamlining operations: Consolidating operations can lead to significant cost reductions through economies of scale, reduced administrative overhead, and more efficient resource allocation.

Impact of PwC's Withdrawal on Affected Countries

PwC's strategic exits have significant implications for the countries affected, creating both economic challenges and opportunities.

Economic Implications for Local Markets

The withdrawal of a major player like PwC can have a ripple effect on local economies. Job losses are a direct consequence, impacting not only PwC employees but also related industries and businesses that rely on their services.

- Specific examples of economic impacts in affected countries: Job losses in the accounting, auditing, and consulting sectors; potential reductions in tax revenue for governments; and the potential for decreased foreign investment.

- Discuss job losses and potential for market disruption: The sudden absence of PwC's services can create uncertainty and disrupt local markets, particularly for businesses that heavily relied on their expertise.

Consequences for Clients and Business Continuity

Clients in affected countries face the challenge of finding alternative audit and advisory services. Transitioning to a new provider can disrupt business operations, create logistical challenges in transferring data, and raise concerns about maintaining service quality.

- Potential challenges for clients: Finding a suitable replacement firm with similar expertise and capacity; potential delays in audit processes; and the potential for increased costs in securing alternative services.

- Strategies for clients to mitigate disruption: Proactive planning, engaging with potential replacement firms early, and ensuring a smooth data transfer process are crucial to mitigate disruption.

Future Outlook and Strategic Implications for PwC

PwC's long-term strategy focuses on consolidating its presence in key markets and enhancing its capabilities in areas like digital transformation and sustainability consulting. Further withdrawals or restructuring are possible as the firm continues to adapt to the evolving landscape of the professional services industry.

- Predictions for future PwC strategies: Further focus on high-growth markets, strategic alliances, and increased investment in technological innovation to maintain competitiveness.

- Potential impact on the broader professional services industry: PwC's actions may trigger similar strategic reviews by other large professional services firms, leading to industry consolidation and a shift in global market share.

Conclusion: Understanding the Significance of PwC's Strategic Withdrawal

PwC's strategic withdrawal represents a significant shift in the global professional services landscape. Driven primarily by risk mitigation— encompassing increased regulatory scrutiny, reputational concerns, and the need for optimized resource allocation—the decision will have lasting implications for both PwC and the countries it is leaving. The potential economic consequences for affected nations and the challenges faced by clients underscore the far-reaching impact of this strategic recalibration. The evolving nature of the professional services industry necessitates continuous adaptation, and PwC's actions serve as a case study in navigating the complexities of a globalized and increasingly regulated business environment.

Stay informed about the evolving implications of PwC's strategic withdrawal and its impact on the global business landscape. Follow reputable news sources and industry publications for updates on this developing story.

Featured Posts

-

Top Universities Create Private Group To Challenge Trumps Education Agenda

Apr 29, 2025

Top Universities Create Private Group To Challenge Trumps Education Agenda

Apr 29, 2025 -

Pw C Exits Multiple Countries A Bangkok Post Report On Accounting Firm Scandals

Apr 29, 2025

Pw C Exits Multiple Countries A Bangkok Post Report On Accounting Firm Scandals

Apr 29, 2025 -

Join The Conversation Open Thread February 16 2025

Apr 29, 2025

Join The Conversation Open Thread February 16 2025

Apr 29, 2025 -

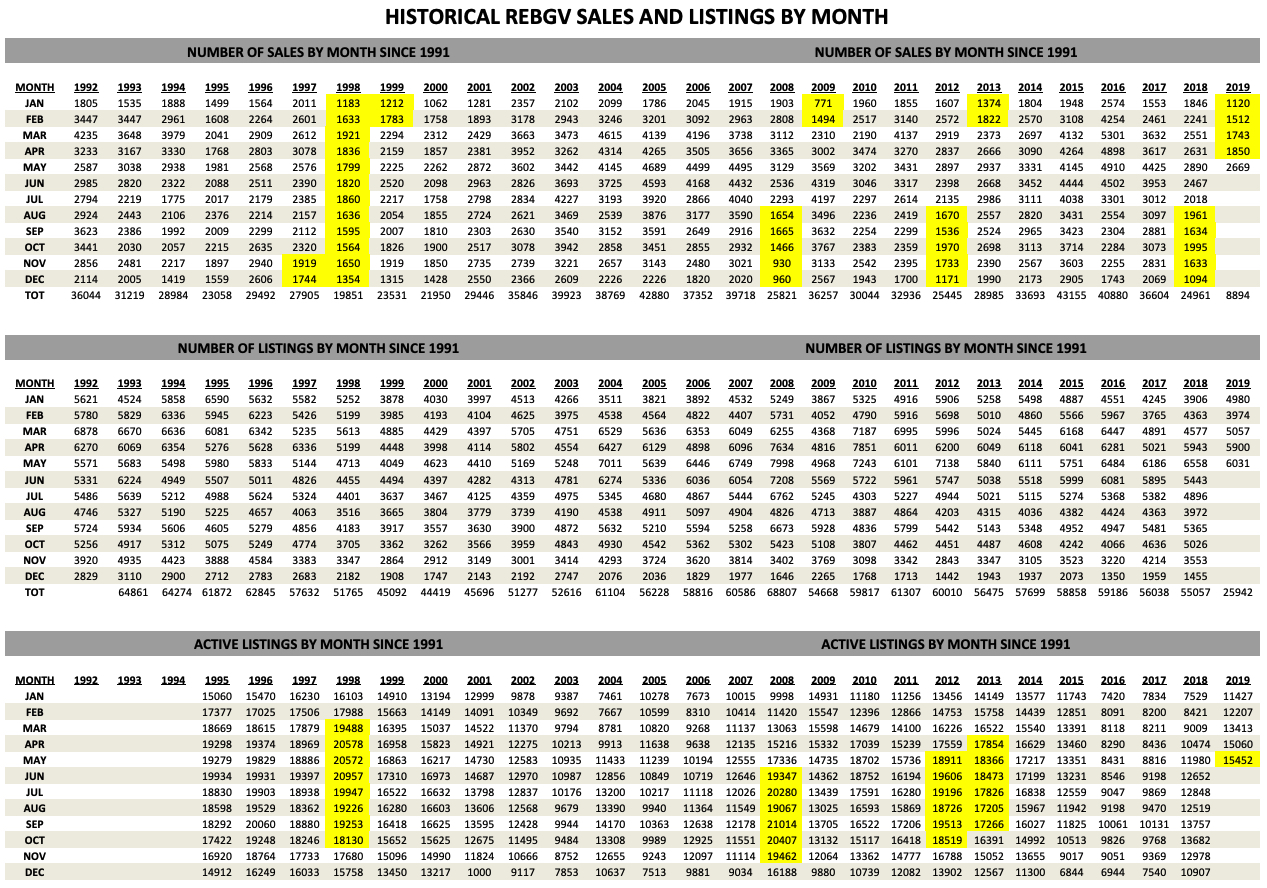

Vancouver Housing Market Update Slower Rent Increases Persistent High Costs

Apr 29, 2025

Vancouver Housing Market Update Slower Rent Increases Persistent High Costs

Apr 29, 2025 -

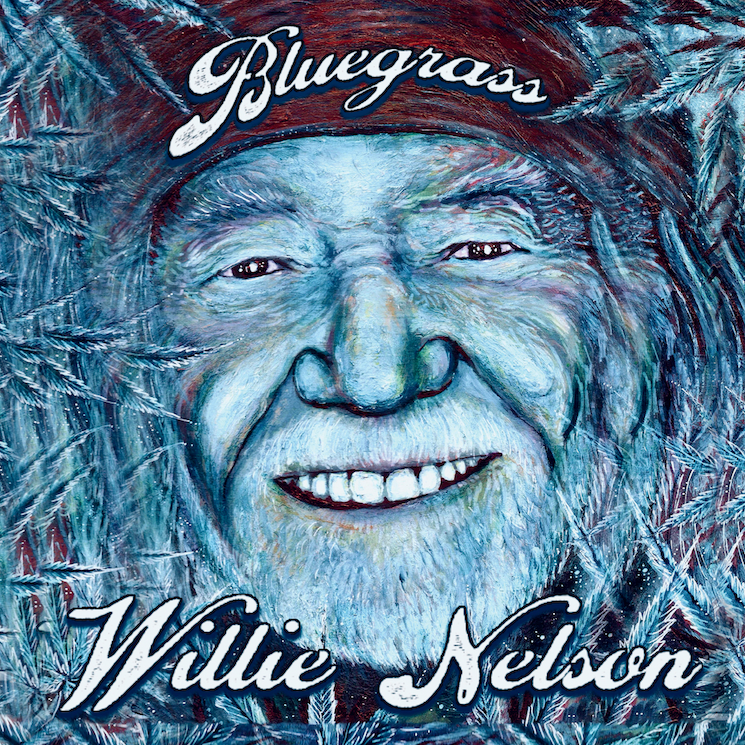

Willie Nelsons New Album Oh What A Beautiful World A Duet With Rodney Crowell And More

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World A Duet With Rodney Crowell And More

Apr 29, 2025