Q1 2024 Fremantle Financial Results: 5.6% Revenue Decline Explained

Table of Contents

Analyzing the 5.6% Revenue Decrease: Key Factors

Fremantle's Q1 2024 financial results revealed a complex picture beyond the headline 5.6% revenue decrease. While precise profit margin figures may require further analysis from official reports, the overall financial picture points to several interconnected challenges. Several factors contributed to this downturn:

-

Reduced Advertising Revenue: The decline in traditional advertising revenue streams significantly impacted Fremantle's overall income. The shift towards digital advertising and the increased competition for ad dollars played a crucial role. This trend reflects a broader issue impacting many media companies.

-

Increased Production Costs: Rising production costs, encompassing talent fees, crew salaries, and post-production expenses, squeezed profit margins. The global economic climate and inflationary pressures likely exacerbated this challenge.

-

Intense Market Competition: Fremantle operates in a fiercely competitive entertainment landscape. The proliferation of streaming services and the constant influx of new content have increased the pressure to deliver high-quality programming at competitive prices.

-

Global Economic Conditions: The overall economic slowdown impacted consumer spending, influencing demand for entertainment content and impacting advertising budgets across various sectors. This macroeconomic factor cannot be ignored when evaluating Fremantle's performance.

-

Specific Program Performance: While Fremantle hasn't publicly detailed specific underperforming programs, the overall revenue decline suggests that some projects may not have met their projected returns. A thorough review of individual project performance is essential for future planning.

The Impact of Streaming Services and Content Consumption Shifts

The shift in content consumption towards streaming platforms is a major factor impacting Fremantle's performance. This change presents both opportunities and challenges.

-

Changing Content Distribution: The traditional broadcast model is evolving rapidly, with streaming services dominating the market. Fremantle needs to adapt to this new landscape and secure favorable distribution deals with various streaming platforms.

-

Competition with Streaming Giants: Competition from established streaming giants like Netflix, Amazon Prime Video, and Disney+ is intense. These platforms command significant budgets and resources, making it challenging for Fremantle to stand out.

-

Content Strategy Adaptation: Fremantle needs to evolve its content strategy to cater to the diverse preferences of streaming audiences. This involves understanding viewer demographics, trends, and demands on various platforms.

-

Fremantle's Streaming Strategies: The effectiveness of Fremantle's own streaming strategies will play a crucial role in its future success. Data-driven insights on audience engagement and content performance are essential for refining their approach.

Fremantle's Strategic Response to the Revenue Decline

In response to the Q1 2024 revenue decline, Fremantle has likely initiated several strategic initiatives. While specifics may not yet be publicly available, anticipated actions could include:

-

Cost-Cutting Measures: Streamlining operations, reducing non-essential expenditure, and optimizing production budgets are likely key areas of focus.

-

New Content Development Strategies: Investment in innovative content formats, genres, and collaborations will be critical to attracting and retaining audiences. Exploring new and emerging markets is crucial for growth.

-

Expansion into New Markets and Platforms: Reaching wider audiences by expanding into new geographical regions and collaborating with emerging platforms is a viable strategy. Global reach is key in the competitive entertainment world.

-

Focus on Successful Content Genres: Leveraging data-driven insights to identify high-performing content genres and investing more resources in those areas is a logical approach.

-

Potential Mergers, Acquisitions, or Partnerships: Strategic alliances and acquisitions could broaden Fremantle's content library and expand its market reach. This is a common strategy among media companies facing similar challenges.

Looking Ahead: Future Prospects for Fremantle's Financial Performance

Predicting Fremantle's future financial performance requires considering various factors. While the Q1 2024 results present challenges, the company's long-term prospects depend on its ability to adapt and innovate.

-

Potential Future Revenue Streams: Exploring new revenue streams, such as licensing deals, branded content, and interactive experiences, can improve financial stability.

-

Projected Growth Areas: Focus on digital content, interactive formats, and international expansion presents opportunities for future growth.

-

Risks and Challenges: Maintaining a competitive edge, managing production costs, and adapting to evolving audience preferences remain significant risks.

-

Overall Outlook: The outlook for Fremantle is contingent on its ability to implement its strategic responses effectively. Success requires agility, innovation, and a keen understanding of the evolving entertainment landscape.

Conclusion: Understanding the Fremantle Q1 2024 Financial Results – Key Takeaways and Future Outlook

The 5.6% revenue decline in Fremantle's Q1 2024 financial results stemmed from a confluence of factors including reduced advertising revenue, increased production costs, intensified market competition, and broader economic conditions. Fremantle’s strategic responses, likely including cost-cutting measures, new content strategies, and market expansion, will be crucial in determining its future performance. The overall outlook remains uncertain but hinges on the company’s ability to adapt to the changing media landscape and leverage new opportunities. Stay informed on Fremantle's financial performance and industry trends by following [your website/news source] for future updates on Fremantle's Q2 2024 financial results and beyond.

Featured Posts

-

Abn Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

May 21, 2025

Abn Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

May 21, 2025 -

I Katarrakosi Tis Aksias Toy Alloy I Periptosi Toy Baggeli Giakoymaki

May 21, 2025

I Katarrakosi Tis Aksias Toy Alloy I Periptosi Toy Baggeli Giakoymaki

May 21, 2025 -

Behind The Scenes The David Walliams And Simon Cowell Bgt Dispute

May 21, 2025

Behind The Scenes The David Walliams And Simon Cowell Bgt Dispute

May 21, 2025 -

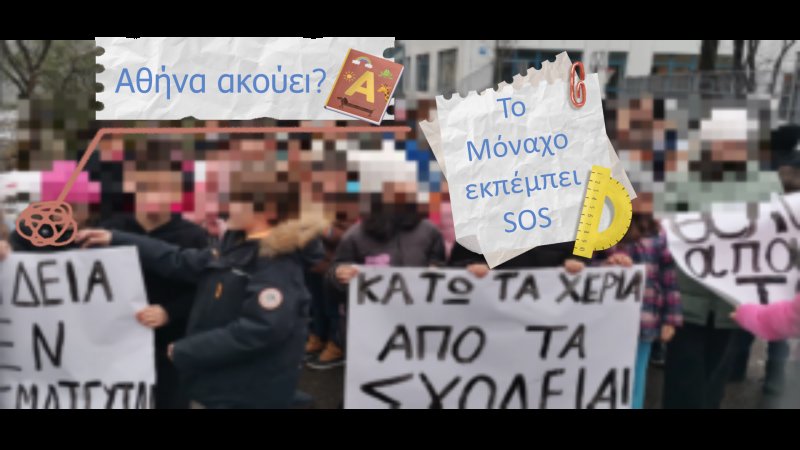

Understanding The Recent Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025

Understanding The Recent Rise In D Wave Quantum Inc Qbts Stock

May 21, 2025 -

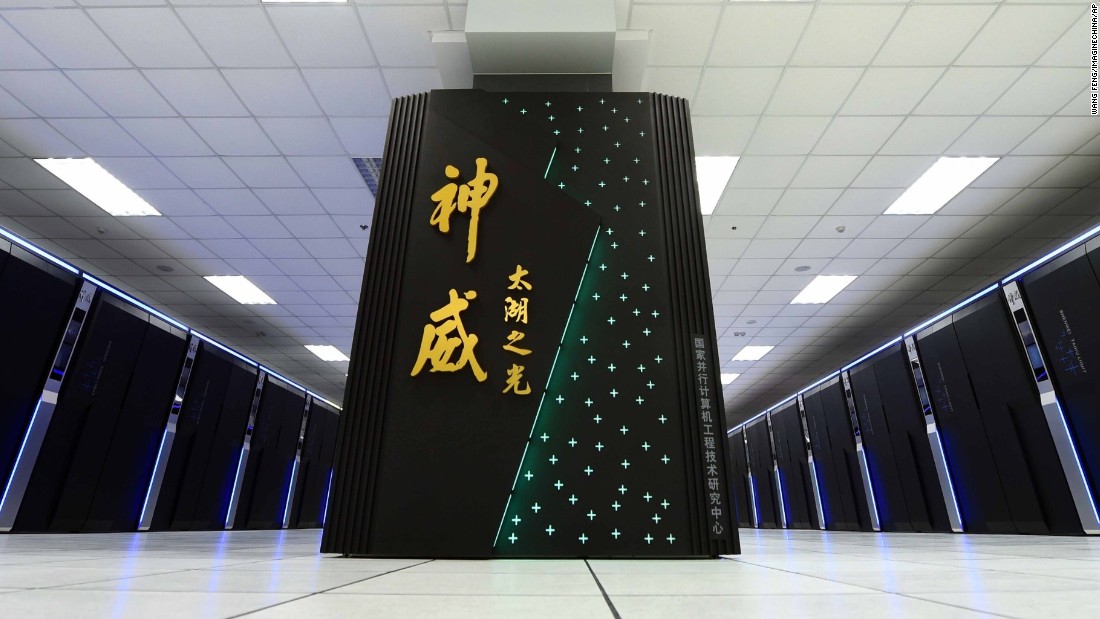

A Supercomputer In Space Chinas Innovative Approach To Computing

May 21, 2025

A Supercomputer In Space Chinas Innovative Approach To Computing

May 21, 2025