QBTS Earnings Report: What Investors Should Expect

Table of Contents

Analyzing Past Performance and Trends

Analyzing QBTS's historical performance is vital for predicting future results and understanding the company's overall health. This involves a thorough examination of the QBTS stock chart and key financial metrics found in past QBTS earnings reports and financial statements. We'll look at several key indicators to establish a baseline for forecasting.

-

Review of QBTS's previous earnings reports: A detailed review of past reports reveals trends in revenue growth, earnings per share (EPS), and profit margins. Analyzing these trends helps to identify consistent growth or potential areas of concern.

-

Analysis of key financial metrics (revenue, EPS, net income): Tracking revenue growth, EPS, and net income over several quarters and years provides a clear picture of QBTS's financial performance. This data reveals whether the company is consistently profitable and experiencing sustainable growth.

-

Identification of significant trends and patterns: Identifying consistent upward or downward trends in key financial metrics provides valuable insight into the company’s long-term trajectory and future potential. Are there seasonal variations or other notable patterns to consider?

-

Comparison with industry benchmarks and competitors: Benchmarking QBTS's performance against its competitors allows us to assess its relative strength and identify areas where it excels or lags behind. This provides context and helps identify opportunities and challenges.

-

Discussion of any notable one-time events impacting past performance: Understanding the impact of any unusual events (acquisitions, legal settlements, etc.) helps to separate normal operating performance from anomalies.

Key Factors Influencing the Upcoming Report

The upcoming QBTS earnings report will be influenced by a range of external factors. Understanding these factors is crucial for formulating realistic expectations for the QBTS financial results.

-

Impact of current market volatility on QBTS: Market conditions, including overall economic trends and investor sentiment, significantly influence stock performance. Increased volatility can affect investor confidence and ultimately impact QBTS's stock price.

-

Analysis of QBTS’s competitive landscape: The competitive landscape, including the actions of competitors and the emergence of new technologies, will influence QBTS's market share and revenue growth. Analyzing the competitive pressures provides valuable insight.

-

Discussion of relevant industry trends and their potential effects: Analyzing relevant industry trends, such as technological advancements or shifts in consumer preferences, helps assess the future prospects of the company.

-

Assessment of macroeconomic factors (interest rates, inflation, etc.): Broader macroeconomic factors, such as interest rates and inflation, impact business costs and consumer spending, directly influencing QBTS's performance.

-

Evaluation of any significant regulatory changes or policy shifts: New regulations or policy shifts impacting QBTS's industry could significantly influence its operations and profitability.

Assessing QBTS's Growth Strategy and Outlook

Understanding QBTS's growth strategy and long-term outlook is critical for making informed investment decisions. This involves examining the company's strategic initiatives and plans for future expansion.

-

Overview of QBTS's strategic plans and initiatives: Understanding QBTS’s overarching strategy reveals management’s vision for growth and future profitability.

-

Discussion of any new product launches or expansions: New products or expansion into new markets can significantly impact future revenue and growth prospects.

-

Evaluation of the effectiveness of QBTS’s current growth strategies: Assessing the past success of current strategies provides insight into the likelihood of future success.

-

Analysis of the potential for future growth and market share gains: Analyzing market size and QBTS's competitive advantage helps predict the company’s future growth potential.

-

Assessment of risks and challenges to QBTS’s growth: Identifying potential risks and challenges allows for more realistic projections and informed investment decisions.

Interpreting the QBTS Earnings Report and Implications for Investors

Interpreting the QBTS earnings report requires careful analysis of key metrics and understanding their implications for investors. This section provides guidance on how to assess the results and their impact on your investment strategy.

-

Explanation of key performance indicators (KPIs) to watch: Understanding key performance indicators (KPIs) such as revenue growth, EPS, and profit margins is critical for evaluating QBTS's performance.

-

Potential market reactions to various earnings outcomes: Different earnings outcomes will likely trigger different market reactions. Understanding these potential reactions can help investors prepare for different scenarios.

-

Discussion of investment strategies based on the earnings results: Based on the reported earnings, investors may adjust their strategy. This could involve holding, buying, or selling QBTS stock.

-

Recommendations for investors (buy, hold, sell): While not financial advice, based on the analysis, we'll offer potential investment recommendations.

-

Overview of potential risks and uncertainties: Understanding the inherent risks and uncertainties associated with investing in QBTS stock is crucial for making informed decisions.

Conclusion

The QBTS earnings report is a significant event for investors. By thoroughly analyzing past performance, understanding key influencing factors, and carefully interpreting the results, investors can make more informed decisions regarding their QBTS stock holdings. Remember to conduct your own thorough due diligence and consult with a financial advisor before making any investment choices. Stay informed on future QBTS earnings reports and market developments to make optimal investment decisions. Stay tuned for our next analysis of the QBTS earnings report and its implications for QBT investment analysis.

Featured Posts

-

Wnba Probes Reports Of Racial Abuse Against Angel Reese

May 20, 2025

Wnba Probes Reports Of Racial Abuse Against Angel Reese

May 20, 2025 -

Cnn Reports Record Viewership For Snls 50th Season Finale Episode

May 20, 2025

Cnn Reports Record Viewership For Snls 50th Season Finale Episode

May 20, 2025 -

Dusan Tadic Bir Efsanenin Dogusu Mu

May 20, 2025

Dusan Tadic Bir Efsanenin Dogusu Mu

May 20, 2025 -

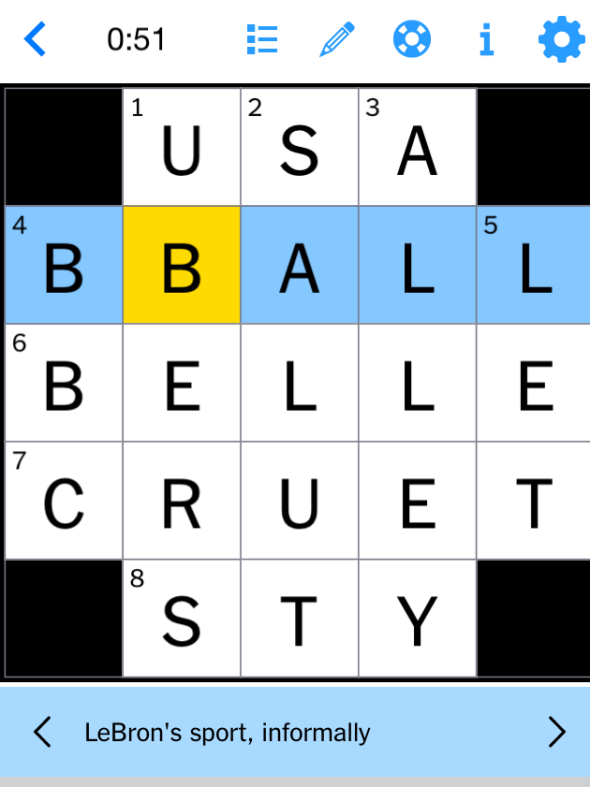

Nyt Mini Crossword April 18 2025 Answers And Helpful Hints

May 20, 2025

Nyt Mini Crossword April 18 2025 Answers And Helpful Hints

May 20, 2025 -

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 20, 2025

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 20, 2025