QBTS Stock And Upcoming Earnings: What To Expect

Table of Contents

Analyzing QBTS's Recent Performance and Market Trends

Understanding QBTS's recent performance is critical to predicting its upcoming earnings and formulating an informed investment strategy. This involves examining key financial metrics, comparing its performance to industry benchmarks, and analyzing the overall market sentiment.

Key Financial Metrics to Watch:

Investors should closely monitor several key financial metrics when assessing QBTS's performance:

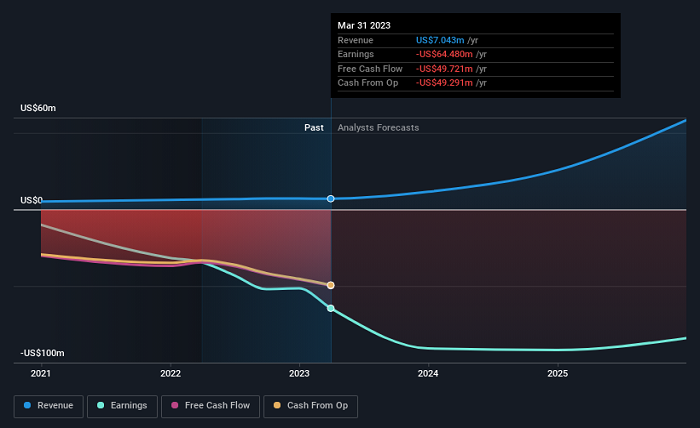

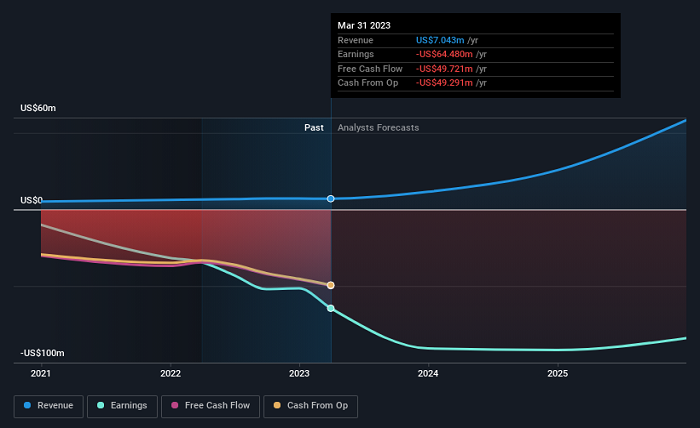

- Revenue growth (YoY and QoQ): Year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth reveals the company's sales momentum and overall health. Significant increases indicate strong market demand and potentially positive future earnings.

- Earnings per share (EPS): EPS directly impacts stock valuation and investor sentiment. A higher EPS typically translates to a higher stock price.

- Profit margins: Profit margins (gross, operating, and net) reflect QBTS's profitability and efficiency. Improving margins suggest better cost management and potential for increased earnings.

- Debt levels: High debt levels can indicate financial strain and risk. Analyzing QBTS's debt-to-equity ratio and interest coverage ratio helps assess its financial stability.

- Cash flow: Positive cash flow indicates the company's ability to generate cash from operations, which is crucial for growth and investment.

Industry Benchmarks and Comparisons:

Comparing QBTS's performance against its competitors provides valuable context. Consider analyzing key metrics like revenue, market share, and profitability relative to industry leaders. Industry trends, such as technological advancements or regulatory changes impacting the sector, can significantly affect QBTS’s performance. Any recent acquisitions, partnerships, or regulatory changes impacting QBTS should also be carefully evaluated.

Sentiment Analysis and News Coverage:

Understanding market sentiment towards QBTS is crucial. This involves reviewing recent analyst ratings and price targets, which can indicate overall confidence in the company's future performance. Furthermore, paying attention to significant news coverage, both positive and negative, affecting QBTS stock will paint a clearer picture.

Predicting QBTS Earnings: Factors to Consider

Predicting QBTS earnings with accuracy requires considering multiple factors, including historical trends, management guidance, and macroeconomic conditions.

Historical Earnings Trends:

Analyzing past earnings reports can reveal patterns and seasonal trends. Identifying any recurring highs or lows in QBTS's earnings can help predict future performance. Examining the consistency (or inconsistency) of past results will contribute to your predictive model.

Management Guidance and Expectations:

Prior statements by QBTS management regarding future performance provide valuable insights. Pay close attention to any forecasts or projections they've made, and consider any potential challenges or opportunities they've highlighted.

Macroeconomic Factors:

Broader economic conditions heavily influence corporate performance. Factors like interest rates, inflation, and geopolitical events can all impact QBTS's earnings. A thorough analysis of these factors is crucial for a complete outlook.

Investment Strategies for QBTS Stock Post-Earnings

The QBTS earnings announcement will significantly influence the stock price. Investors should have well-defined strategies based on the results.

Buy, Sell, or Hold: Strategies Based on Earnings Results:

- Earnings Beat: If QBTS surpasses expectations, a "buy" strategy might be appropriate for investors with a high-growth outlook.

- Earnings Meet Expectations: A "hold" strategy may be suitable if earnings meet expectations, indicating stability but not necessarily significant growth potential.

- Earnings Miss: If QBTS misses expectations, a "sell" or "hold (and wait for further information)" strategy might be considered, depending on the severity of the miss and overall market sentiment. Risk tolerance plays a key role in determining appropriate action.

Technical Analysis: Chart Patterns and Indicators:

Technical analysis involves examining price charts and indicators (like moving averages and RSI) to predict future price movements. Observing chart patterns can offer insights into potential support and resistance levels for QBTS stock.

Risk Management and Diversification:

Diversification is crucial for mitigating risk. Investors should never put all their eggs in one basket. Using stop-loss orders can help limit potential losses.

Making Informed Investment Decisions on QBTS Stock

The upcoming QBTS earnings report will significantly influence the stock's short-term and long-term performance. Understanding QBTS's recent financial performance, industry trends, and macroeconomic factors is crucial for making informed investment decisions. Thorough research is paramount before investing in QBTS stock or any other asset. Remember to carefully consider your risk tolerance and investment goals before making any investment decisions concerning QBTS stock investment. Analyze QBTS earnings thoroughly, and create a QBTS stock outlook based on your research and risk assessment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Natural Disaster Prediction In Manga Leads To Travel Cancellations

May 21, 2025

Natural Disaster Prediction In Manga Leads To Travel Cancellations

May 21, 2025 -

Benjamin Kaellman Uusi Aikakausi Huuhkajissa

May 21, 2025

Benjamin Kaellman Uusi Aikakausi Huuhkajissa

May 21, 2025 -

Rashfords Brace Propels Aston Villa Past Preston In Fa Cup

May 21, 2025

Rashfords Brace Propels Aston Villa Past Preston In Fa Cup

May 21, 2025 -

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025

Abn Amro Potential Fine From Dutch Central Bank Over Bonuses

May 21, 2025 -

Ai Powered Coding Chat Gpts Integrated Agent Explained

May 21, 2025

Ai Powered Coding Chat Gpts Integrated Agent Explained

May 21, 2025