QBTS Stock: Predicting The Earnings Reaction

Table of Contents

Analyzing Past QBTS Earnings Reports

Analyzing historical QBTS earnings reports is the cornerstone of predicting future earnings reactions. By identifying trends and patterns, investors can gain valuable insights into how the market typically responds to the company's performance.

Identifying Trends and Patterns

Identifying recurring trends in QBTS's earnings announcements is key. Does the company consistently deliver positive surprises? Are negative surprises usually followed by a period of recovery? Understanding these patterns can help anticipate future reactions.

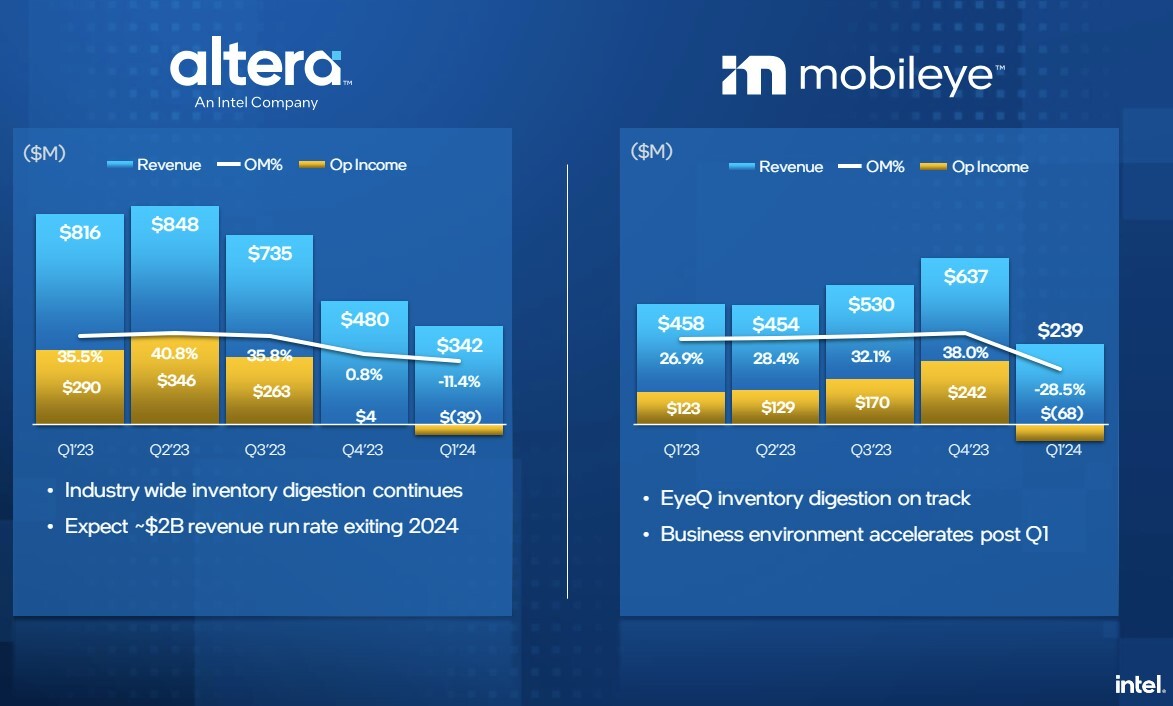

- EPS Growth: Analyze the trend in earnings per share (EPS) growth over several quarters or years. Is it accelerating, decelerating, or consistent?

- Revenue Growth: Examine the pattern of revenue growth. Are there seasonal variations? How does revenue growth compare to previous years?

- Guidance Changes: Pay close attention to any changes in the company's future guidance. Upward revisions usually signal positive sentiment, while downward revisions often lead to negative reactions.

Visualizing these trends using charts and graphs can significantly enhance your understanding. Comparing QBTS's performance to its key competitors provides crucial context and highlights areas of strength or weakness.

Understanding Market Sentiment

Market sentiment—the collective feeling of investors towards QBTS—heavily influences the stock price reaction to earnings. Positive sentiment can amplify positive earnings results, while negative sentiment can exacerbate negative news.

- Financial News Websites: Monitor major financial news outlets for articles and analysis related to QBTS earnings.

- Social Media Sentiment Analysis: Utilize tools that analyze social media sentiment to gauge investor opinions.

- Analyst Ratings: Track changes in analyst ratings and price targets, as these reflect professional assessments of the company's prospects.

Interpreting positive and negative sentiment requires careful consideration of various sources. The impact of short-selling activity, where investors bet against the stock, should also be considered as it can influence price movements, especially around earnings announcements.

Factors Influencing QBTS Earnings Reaction

Several factors beyond the company's performance influence the market's reaction to QBTS earnings. Understanding these factors is vital for accurate prediction.

Company Performance

The company's financial performance is, of course, paramount. Key performance indicators (KPIs) provide crucial information about the health and profitability of QBTS.

- Revenue Growth: Strong revenue growth indicates healthy demand and market position.

- Net Income: Net income reflects the company's overall profitability after all expenses.

- Operating Margin: Operating margin indicates the efficiency of the company's operations.

Exceeding expectations on these KPIs generally results in positive market reactions, while falling short usually leads to negative reactions. The magnitude of the deviation from expectations also influences the severity of the market's response.

Macroeconomic Factors

Broader economic conditions significantly affect investor behavior and the stock market as a whole.

- Interest Rates: Rising interest rates can increase borrowing costs for companies, impacting profitability and investor sentiment.

- Inflation: High inflation can erode purchasing power and impact consumer spending, affecting QBTS's revenue.

- Recessionary Fears: Concerns about a potential recession can lead investors to become more risk-averse, potentially negatively impacting even strong companies like QBTS.

Assessing the overall economic climate is crucial. A strong economy generally supports positive market reactions, while economic uncertainty can lead to heightened volatility.

Industry Trends and Competition

Industry-specific trends and competitive pressures profoundly impact QBTS's performance and the market's response to earnings.

- Technological Advancements: Disruptive technologies can significantly impact QBTS's market share and profitability.

- Regulatory Changes: New regulations can affect the company's operating costs and revenue streams.

- Competitive Landscape: Intense competition can squeeze profit margins and affect investor confidence.

Understanding the dynamics of QBTS's industry is essential for assessing the company's long-term prospects and predicting market reactions to earnings.

Tools and Resources for Predicting QBTS Earnings Reaction

Several tools and resources can aid in predicting the QBTS stock earnings reaction. Combining different approaches provides a more comprehensive understanding.

Financial News and Analyst Reports

Reliable sources of information are crucial for informed decision-making.

- Financial News Websites: Websites like Bloomberg, Yahoo Finance, and MarketWatch provide valuable financial news and analysis.

- Analyst Reports: Research reports from investment banks and financial research firms offer in-depth analysis and forecasts.

- Earnings Call Transcripts: Review transcripts from QBTS's earnings calls to gain direct insights from management.

Technical Analysis

Technical analysis uses charts and historical price data to predict future price movements.

- Support and Resistance Levels: Identifying key support and resistance levels can help anticipate price reversals.

- Moving Averages: Moving averages can smooth out price fluctuations and identify trends.

However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Fundamental Analysis

Fundamental analysis focuses on the intrinsic value of QBTS by examining its financial statements and other qualitative factors.

- Valuation Metrics: Metrics like Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can help assess whether the stock is overvalued or undervalued.

- Financial Statements: Review QBTS's balance sheet, income statement, and cash flow statement to understand its financial health.

Conclusion: Making Informed Decisions on QBTS Stock

Predicting the QBTS stock earnings reaction requires a comprehensive approach. Analyzing past QBTS earnings reports, understanding market sentiment, considering macroeconomic factors, and assessing industry trends are all crucial steps. By carefully analyzing past QBTS earnings reports, understanding market sentiment, and considering macroeconomic factors, you can improve your ability to predict the earnings reaction and make informed decisions about your QBTS stock investments. Remember to utilize the tools and resources mentioned above to conduct thorough research before investing in QBTS stock. Don't rely solely on any single indicator; a balanced approach that considers all relevant factors is essential for successful QBTS stock investment strategies and navigating the QBTS stock earnings reaction.

Featured Posts

-

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025 -

Ing Group Publishes 2024 Financial Results Form 20 F Analysis

May 21, 2025

Ing Group Publishes 2024 Financial Results Form 20 F Analysis

May 21, 2025 -

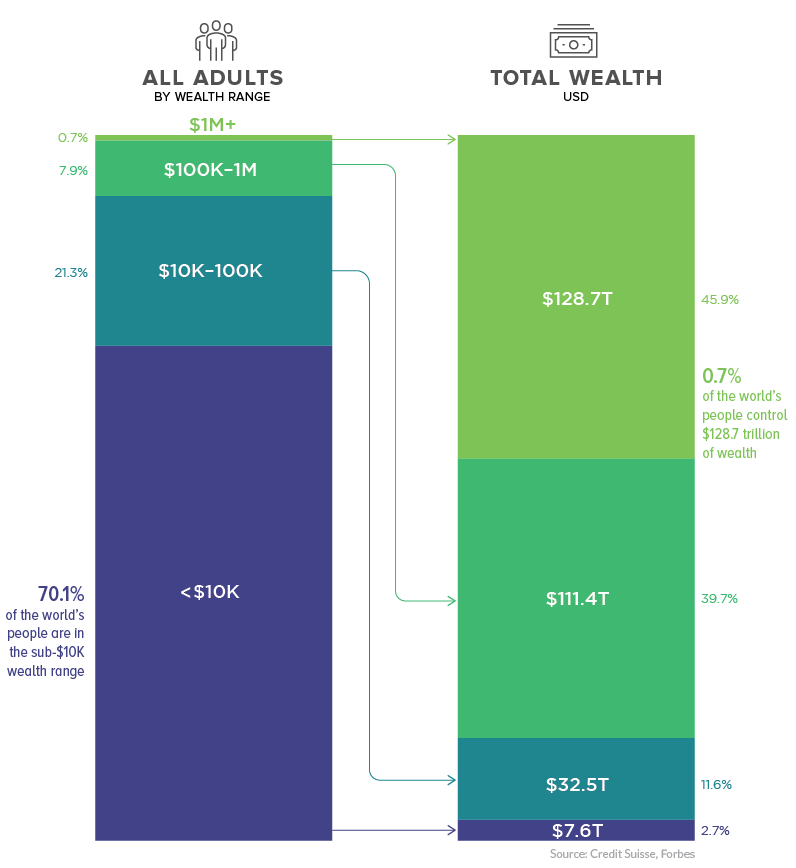

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 21, 2025

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 21, 2025 -

Why Did D Wave Quantum Qbts Stock Price Increase Today

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Increase Today

May 21, 2025 -

Cassis Blackcurrant Liqueurs Production Methods And Popular Brands

May 21, 2025

Cassis Blackcurrant Liqueurs Production Methods And Popular Brands

May 21, 2025

Latest Posts

-

Cubs Fans Share A Lady And The Tramp Moment With A Hot Dog

May 22, 2025

Cubs Fans Share A Lady And The Tramp Moment With A Hot Dog

May 22, 2025 -

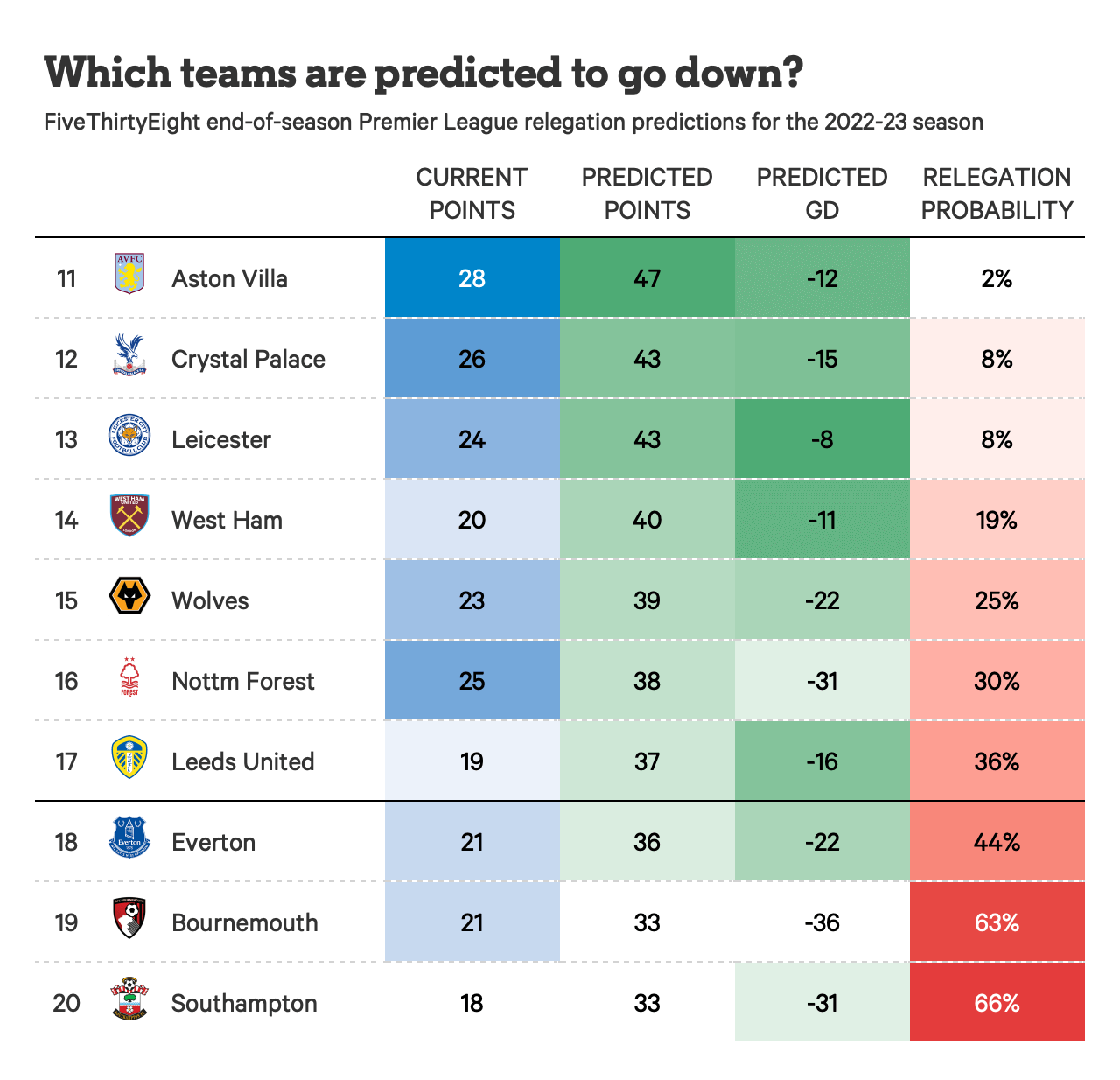

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 22, 2025

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 22, 2025 -

Sejarah Dan Statistik Juara Premier League Data Seputar Liverpool Dan Rivalnya

May 22, 2025

Sejarah Dan Statistik Juara Premier League Data Seputar Liverpool Dan Rivalnya

May 22, 2025 -

Analisis Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 22, 2025

Analisis Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 22, 2025 -

Beklenen Doenues Juergen Klopp Bir Dev Kuluebe Mi Geliyor

May 22, 2025

Beklenen Doenues Juergen Klopp Bir Dev Kuluebe Mi Geliyor

May 22, 2025