Quantum Computing Investment: Analyzing Rigetti And IonQ's Market Position In 2025

Table of Contents

Rigetti Computing's Market Position in 2025

Rigetti's Technological Advantages and Challenges

Rigetti Computing employs superconducting qubits, a leading technology in the quantum computing race. This architecture offers several potential advantages:

- Scalability: Superconducting qubits have shown promise in scaling to larger qubit counts, crucial for tackling complex problems.

- Qubit Coherence Times: While improving, coherence times (how long qubits maintain their quantum state) remain a critical factor for Rigetti and the field as a whole. Improvements here are key for reliable computation.

- Modular Architecture: Rigetti's modular approach aims to simplify the scaling process and reduce manufacturing costs.

However, challenges remain:

- Fault Tolerance: Achieving fault tolerance – the ability to correct errors during computation – is a major hurdle for all superconducting qubit approaches, including Rigetti’s.

- Competition: Rigetti faces stiff competition from other companies using superconducting and alternative qubit technologies.

Rigetti's Business Model and Financial Performance

Rigetti generates revenue through several avenues:

- Quantum-as-a-Service (QaaS): Providing cloud access to its quantum computers allows researchers and businesses to experiment with quantum algorithms.

- Hardware Sales: Selling quantum computing hardware directly to clients with specific needs.

- Research Collaborations: Partnering with research institutions and companies to advance quantum computing technology.

Rigetti's financial performance and investment prospects will depend on its ability to secure funding, attract customers, and demonstrate technological breakthroughs. Analyzing their financial statements and assessing their strategic partnerships is vital for any potential investor. Keywords: Rigetti revenue, quantum-as-a-service, financial performance, investment prospects, partnerships.

Market Predictions for Rigetti in 2025

Predicting Rigetti's market share in 2025 is speculative, but several factors will play a crucial role:

- Technological Advancements: Significant progress in qubit coherence times and fault tolerance would significantly boost Rigetti's position.

- Market Demand: The growth of the overall quantum computing market will directly impact Rigetti's opportunities.

- Competition: The actions of competitors and the overall pace of technological advancement will determine Rigetti's competitiveness.

A positive outlook for Rigetti involves maintaining its technological edge, securing key partnerships, and successfully scaling its operations. Keywords: Rigetti market share, market growth, future predictions, 2025 forecast.

IonQ's Market Position in 2025

IonQ's Technological Advantages and Challenges

IonQ uses trapped-ion technology, offering distinct advantages:

- High Fidelity: Trapped-ion qubits generally exhibit high fidelity, meaning they maintain their quantum state accurately.

- Long Coherence Times: IonQ's technology boasts impressive coherence times, enhancing the reliability of computations.

However, challenges exist:

- Scalability: Scaling trapped-ion systems to large qubit counts poses significant engineering challenges.

- Cost: Trapped-ion systems can be more expensive to manufacture and maintain compared to some alternative technologies. Keywords: IonQ, trapped ion, qubit fidelity, coherence times, scalability, cost.

IonQ's Business Model and Financial Performance

IonQ's revenue streams and business strategies are similar to Rigetti's, focusing on:

- Quantum-as-a-Service (QaaS): Providing cloud access to its quantum computers.

- Hardware Sales (limited): Potentially selling hardware directly to specific clients.

- Strategic Partnerships: Collaborations with major companies to develop quantum applications.

Analyzing IonQ's financial performance, investor relations, and strategic alliances will provide valuable insights for prospective investors. Keywords: IonQ revenue, business strategy, financial performance, investment, partnerships.

Market Predictions for IonQ in 2025

IonQ's market share in 2025 will depend on several interconnected factors:

- Technological Advancements: Improvements in scalability and cost-effectiveness will be crucial for IonQ's growth.

- Market Adoption: The rate at which businesses and researchers adopt quantum computing will influence IonQ's success.

- Competitive Landscape: IonQ's performance will be affected by developments in competing technologies and companies.

A successful outcome for IonQ hinges on overcoming scalability hurdles, demonstrating a strong return on investment, and solidifying its position in the quantum computing ecosystem. Keywords: IonQ market share, market growth, future predictions, 2025 forecast.

Comparative Analysis: Rigetti vs. IonQ in 2025

Direct Comparison of Technologies and Business Models

| Feature | Rigetti | IonQ |

|---|---|---|

| Qubit Technology | Superconducting | Trapped Ion |

| Scalability | High potential, but challenges remain | Significant scalability challenges |

| Qubit Fidelity | Improving | Generally high |

| Coherence Times | Improving | Generally long |

| Revenue Model | QaaS, hardware sales, partnerships | QaaS, potential hardware sales, partnerships |

Identifying Potential Investment Opportunities

Based on the analysis, the "better" investment opportunity depends heavily on individual risk tolerance and investment goals. Rigetti's scalability challenges are significant, but their potential market reach is potentially larger. IonQ boasts higher fidelity and coherence times, but faces steeper scalability challenges and potentially higher costs. A diversified approach, spreading investment across both companies, could mitigate individual company-specific risks. Keywords: Rigetti vs IonQ, comparison, technology, business model, market analysis.

Conclusion: Investing in the Future of Quantum Computing: Rigetti and IonQ's Path Forward

This analysis has compared the market positions of Rigetti and IonQ in 2025, highlighting their technological strengths and weaknesses, business models, and projected market growth. Both companies present significant investment opportunities but carry inherent risks. The quantum computing sector is still nascent, and future market share will depend on technological breakthroughs, market adoption, and successful business strategies. Further research, including detailed financial analysis and examination of industry reports, is strongly recommended before making any investment decisions. Consider your risk tolerance and investment goals before investing in quantum computing stocks like Rigetti or IonQ. Consult with a qualified financial advisor to make informed investment decisions in this exciting, yet volatile, sector. Keywords: quantum computing investment, investment opportunities, stock analysis, risk assessment.

Featured Posts

-

Success At The Wtt Understanding Aimscaps Trading Strategies

May 21, 2025

Success At The Wtt Understanding Aimscaps Trading Strategies

May 21, 2025 -

21 Year Old Peppa Pig Mystery Finally Explained Fans React

May 21, 2025

21 Year Old Peppa Pig Mystery Finally Explained Fans React

May 21, 2025 -

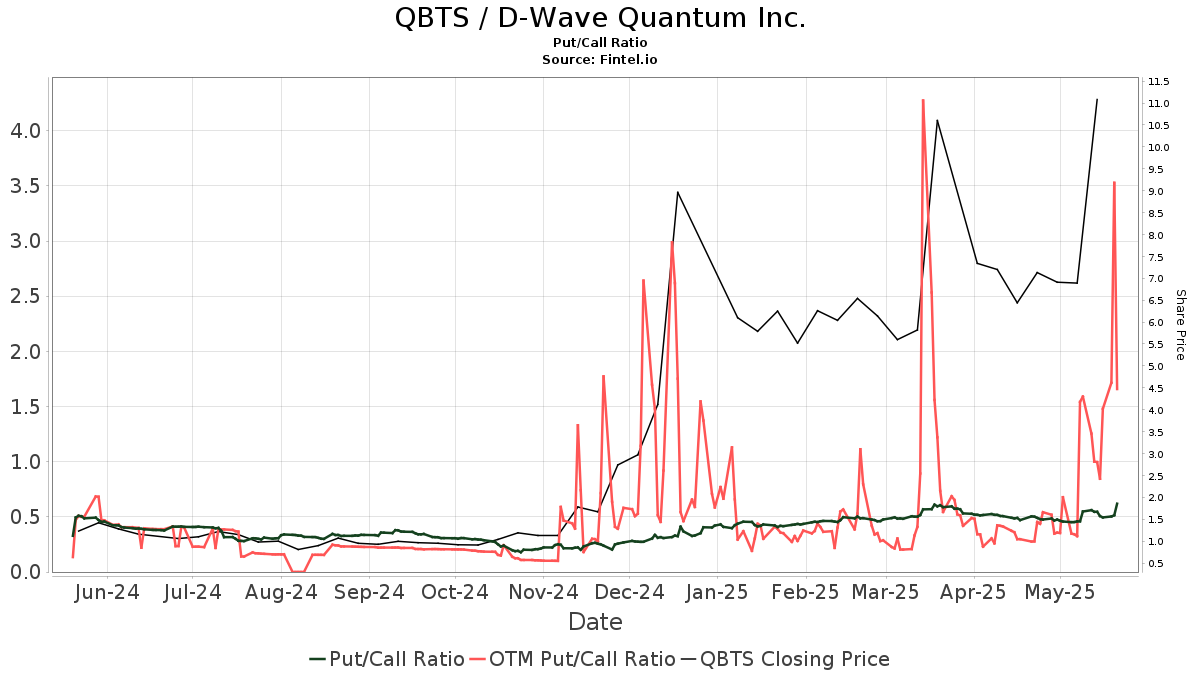

D Wave Quantum Inc Qbts Stock Fridays Price Rise And Its Implications

May 21, 2025

D Wave Quantum Inc Qbts Stock Fridays Price Rise And Its Implications

May 21, 2025 -

Succesvol Verkoop Van Abn Amro Kamerbrief Certificaten Tips En Advies

May 21, 2025

Succesvol Verkoop Van Abn Amro Kamerbrief Certificaten Tips En Advies

May 21, 2025 -

I Pretended To Be A Missing Girl A Viral Reddit Story And Its Path To A Sydney Sweeney Movie

May 21, 2025

I Pretended To Be A Missing Girl A Viral Reddit Story And Its Path To A Sydney Sweeney Movie

May 21, 2025