Quantum Stocks 2025: Rigetti, IonQ Lead The Charge

Table of Contents

Rigetti Computing: A Deep Dive into its Potential

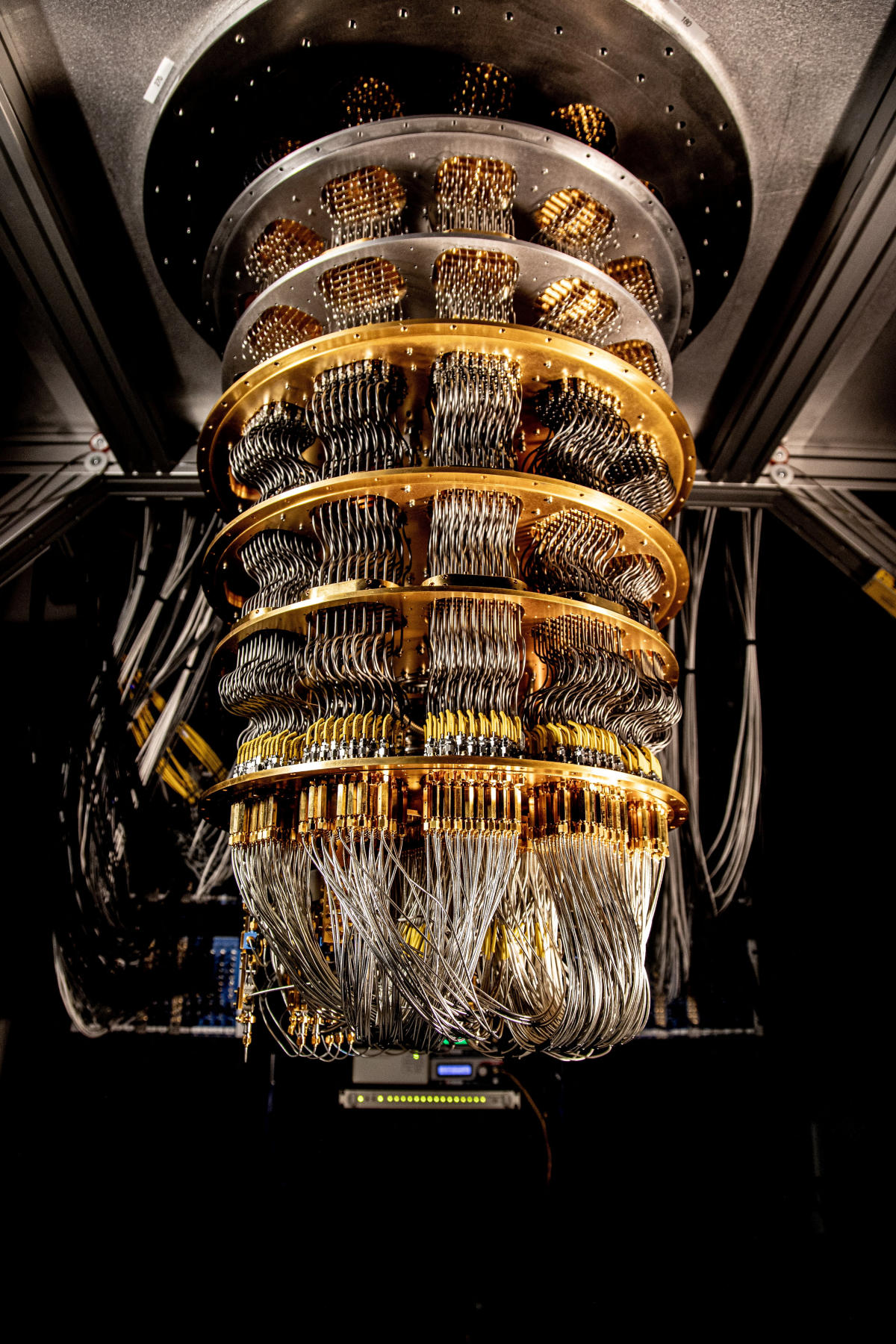

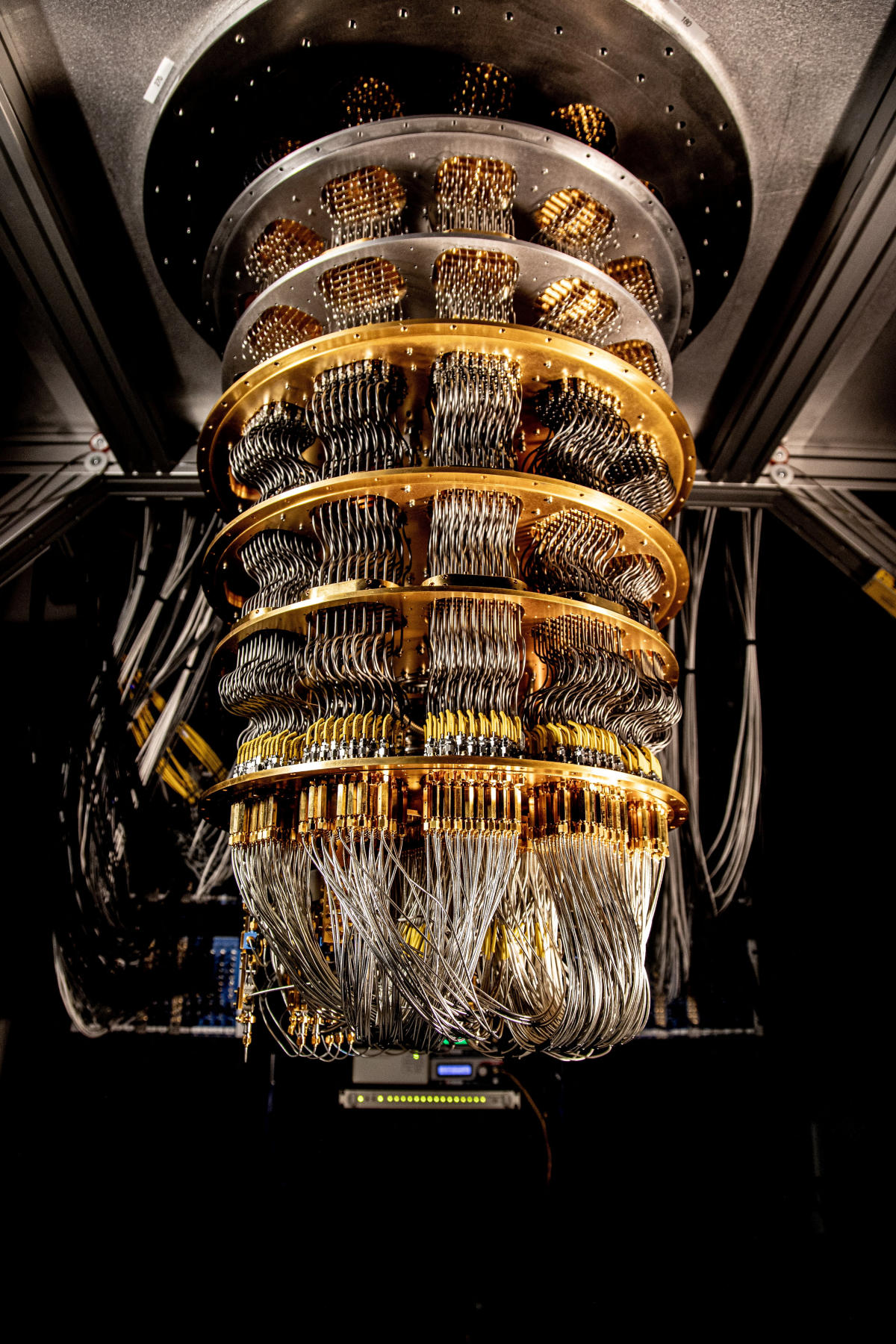

Rigetti Computing is a prominent player in the quantum computing landscape, distinguished by its innovative approach.

Rigetti's Technology and Market Position:

Rigetti employs superconducting qubit technology, a leading contender in the race to build commercially viable quantum computers. This technology offers the potential for scalability and high performance, crucial elements for solving complex computational problems currently intractable for classical computers. While not yet holding the largest market share, Rigetti's strategic partnerships and focus on building a comprehensive quantum computing ecosystem give it a strong competitive advantage. They've collaborated with several institutions and companies to develop applications across various sectors.

- Key Milestones Achieved: Successful fabrication of multi-qubit processors, development of quantum cloud services, significant research publications.

- Future Roadmap Highlights: Continued scaling of qubit numbers, improvement of qubit coherence times, development of advanced quantum algorithms and applications.

- Areas of Potential Growth: Expansion into new industries (e.g., pharmaceuticals, finance), strategic acquisitions, increased adoption of its cloud-based quantum computing platform.

Rigetti's Investment Risks and Rewards:

Investing in Rigetti, like any early-stage technology company, carries inherent risks. Technological hurdles remain, and competition is fierce. The path to profitability for quantum computing companies is still uncertain. However, the potential rewards are substantial.

- Factors Influencing Stock Price: Technological advancements, partnerships and collaborations, market adoption rate, overall economic conditions.

- Potential Return on Investment (ROI): Early investment in a disruptive technology could yield significant returns if Rigetti successfully establishes market leadership.

- Risk Assessment: Consider the long-term nature of the investment, the volatility of the quantum computing sector, and the possibility of technological disruptions from competitors.

IonQ: A Contender in the Quantum Race

IonQ represents a compelling alternative in the quantum computing arena, leveraging a different technological approach.

IonQ's Technological Strengths:

IonQ utilizes trapped ion qubits, a technology known for its high fidelity and long coherence times. This contrasts with Rigetti's superconducting approach, offering a potentially distinct path to building fault-tolerant quantum computers. While both technologies have their advantages and disadvantages, IonQ's focus on precision and control sets it apart.

- Key Technological Achievements: Demonstrated high-fidelity quantum gates, achieved record qubit numbers in trapped ion systems, secured numerous patents related to their technology.

- Patent Portfolio: A strong patent portfolio protects IonQ's intellectual property and secures its competitive position.

- R&D Investments: Significant R&D investments are crucial for continued innovation and improvement of their technology.

IonQ's Growth Prospects and Financial Performance:

Analyzing IonQ's financial performance offers insights into its market traction and growth potential. While still in its early stages, IonQ is actively pursuing revenue generation through partnerships and the sale of quantum computing services.

- Financial Highlights: Observe revenue growth, operating expenses, and progress towards profitability.

- Partnerships: Strategic alliances are crucial for market penetration and technological development.

- Customer Acquisition: Tracking customer acquisition and retention rates will indicate market adoption.

- Market Projections: Analyst predictions on IonQ's future market share and revenue provide crucial information for investment decisions.

Beyond Rigetti and IonQ: Other Promising Quantum Stocks

While Rigetti and IonQ are prominent leaders, the quantum computing industry is dynamic. Several other companies hold considerable promise.

- D-Wave Systems: Focuses on adiabatic quantum computing, a different approach compared to gate-based quantum computing employed by Rigetti and IonQ.

- Quantum Computing Inc. (QCI): Develops quantum software and solutions, targeting various applications.

- Other players: Several other smaller companies are developing quantum computing technologies and software solutions that deserve attention. Thorough due diligence is critical before investing.

Investing in Quantum Stocks: Strategies and Considerations

Investing in quantum stocks requires a long-term perspective and a careful risk management strategy.

- Investment Strategies: Diversify your portfolio to mitigate risk. Consider a blend of long-term and short-term investments.

- Due Diligence: Conduct thorough research, analyze financial reports, and assess technological advancements.

- Risk Management: Understand the inherent risks associated with investing in early-stage companies in a rapidly evolving technological field.

- Resources for Research: Reputable financial news sources, industry research reports, and company filings provide crucial information.

Navigating the Future of Quantum Computing Investments

Rigetti and IonQ stand out as leading contenders in the quantum computing race, offering investors intriguing possibilities. However, remember that the quantum computing sector is high-risk and high-reward. Diversification across several promising Quantum Stocks 2025, including companies beyond Rigetti and IonQ, is crucial for a well-balanced portfolio. The long-term potential of this revolutionary technology is undeniable, but careful research and a considered approach are essential for navigating the exciting yet uncertain landscape of quantum computing investments.

Conduct thorough due diligence before investing. Consider consulting with a qualified financial advisor to assess your risk tolerance and investment goals. Continue to research quantum stocks 2025 and stay updated on the latest developments in this dynamic field to make informed investment decisions.

Featured Posts

-

Video Cum Au Fost Intampinati Fratii Tate La Bucuresti Dupa Eliberare

May 21, 2025

Video Cum Au Fost Intampinati Fratii Tate La Bucuresti Dupa Eliberare

May 21, 2025 -

Is Rtl Groups Streaming Business Finally Profitable An Analysis

May 21, 2025

Is Rtl Groups Streaming Business Finally Profitable An Analysis

May 21, 2025 -

Tigers 8 6 Over Rockies Were Preseason Predictions Wrong

May 21, 2025

Tigers 8 6 Over Rockies Were Preseason Predictions Wrong

May 21, 2025 -

Baggelis Giakoymakis I Tragodia Toy 20xronoy To Bullying Kai Oi Basanismoi

May 21, 2025

Baggelis Giakoymakis I Tragodia Toy 20xronoy To Bullying Kai Oi Basanismoi

May 21, 2025 -

Building A Food Empire Lessons From A Young Louth Entrepreneur

May 21, 2025

Building A Food Empire Lessons From A Young Louth Entrepreneur

May 21, 2025