Rate Cut Expectations Rise As Thailand Experiences Deflation

Table of Contents

Understanding Thailand's Deflationary Spiral

Causes of Deflation in Thailand:

Thailand's deflation isn't an isolated incident; it's a complex issue stemming from a confluence of factors. Global economic uncertainty plays a significant role, impacting consumer confidence and spending. The post-pandemic recovery has been uneven, with decreased tourism revenue – a major pillar of the Thai economy – further dampening growth. Lower commodity prices, especially affecting agricultural exports which are a cornerstone of the Thai economy, have also contributed significantly to the deflationary trend. Finally, the relatively strong Thai Baht has reduced the competitiveness of Thai exports in the global market.

- Specific examples of price decreases: Food prices, particularly rice and other agricultural products, have shown significant declines. Energy prices, influenced by global fluctuations, have also contributed to the overall deflationary pressure. The cost of certain manufactured goods has also fallen due to decreased demand.

Economic Indicators Pointing to Deflation:

The evidence of deflation in Thailand is clear in several key economic indicators. The Consumer Price Index (CPI) has consistently shown negative growth for several months, confirming a sustained period of deflation. The Producer Price Index (PPI), which measures the average change in prices received by domestic producers for their output, is also reflecting a downward trend. Furthermore, the overall GDP growth rate has slowed, further highlighting the fragility of the Thai economy and the pressure of deflation.

The Bank of Thailand's Response: Imminent Rate Cuts?

Analyzing the Bank of Thailand's Current Monetary Policy:

The Bank of Thailand has been closely monitoring the situation. Their past actions have primarily focused on maintaining stability, but the persistent deflation is forcing a reconsideration of their monetary policy. Current interest rates remain relatively low, but the question remains whether further cuts are necessary to stimulate the economy. Recent meetings and press releases from the Bank of Thailand haven't explicitly committed to rate cuts, but the possibility is being widely discussed.

Arguments for and Against an Interest Rate Cut:

The debate surrounding interest rate cuts is complex.

-

Arguments for: Proponents argue that a rate cut is essential to stimulate economic growth, combat deflation, and provide support to struggling businesses. Lower interest rates could incentivize borrowing and investment, boosting consumer spending.

-

Arguments against: Opponents caution against potential inflationary risks in the long term. A rate cut could also potentially weaken the Thai Baht, impacting imports and potentially jeopardizing foreign investment.

Market Expectations and Predictions:

Market analysts are divided on the likelihood of an imminent rate cut. Some predict a significant reduction in interest rates, while others believe the Bank of Thailand will remain cautious, preferring to monitor economic indicators further before making a decision. Various financial news sources offer different forecasts, highlighting the uncertainty surrounding the situation. Charts and graphs showcasing predicted interest rate trajectories are widely available in financial publications.

The Impact of Rate Cuts on the Thai Economy

Potential Benefits of Rate Cuts:

The potential benefits of interest rate cuts are significant, potentially leading to:

- Increased consumer spending: Lower interest rates make borrowing cheaper, encouraging consumers to spend more.

- Boost to business investment: Reduced borrowing costs can incentivize businesses to invest in expansion and new projects.

- Stimulation of economic growth: A combination of increased consumer spending and business investment could lead to a significant boost in economic growth.

Potential Risks of Rate Cuts:

However, rate cuts also carry potential risks:

- Increased inflation in the long term: If the rate cuts are too aggressive, they could lead to an increase in inflation down the line.

- Potential devaluation of the Thai Baht: Lower interest rates can make the Thai Baht less attractive to foreign investors, potentially leading to devaluation.

- Impact on foreign investment: The potential devaluation of the Thai Baht could deter foreign investment, impacting economic growth.

Conclusion:

Thailand's deflationary spiral is a complex issue driven by a combination of global and domestic factors. The debate surrounding interest rate cuts as a response highlights the delicate balancing act faced by the Bank of Thailand. While rate cuts could stimulate the economy, they also carry potential risks. The situation surrounding Thailand deflation and the potential for interest rate cuts remains fluid. Staying informed on further developments by following reputable financial news sources and monitoring the Bank of Thailand's announcements is crucial. Understanding the dynamics of Thailand deflation and the potential impact of future monetary policy decisions is crucial for navigating the evolving economic landscape. Learn more about how Thailand deflation may impact your investments and financial strategies.

Featured Posts

-

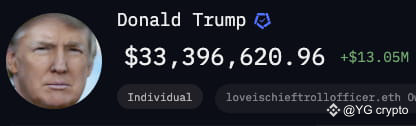

Trumps Crypto Fortune From Scoffing To Millions

May 07, 2025

Trumps Crypto Fortune From Scoffing To Millions

May 07, 2025 -

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025 -

Happy And Healthy Lewis Capaldis Uncommon Outing With A Towie Star

May 07, 2025

Happy And Healthy Lewis Capaldis Uncommon Outing With A Towie Star

May 07, 2025 -

This Weeks Nhl 25 Update The Arcade Is Back

May 07, 2025

This Weeks Nhl 25 Update The Arcade Is Back

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025