Rate Cut Optimism Among Bond Traders Subdued By Powell's Stance

Table of Contents

Powell's Hawkish Stance Dampens Rate Cut Expectations

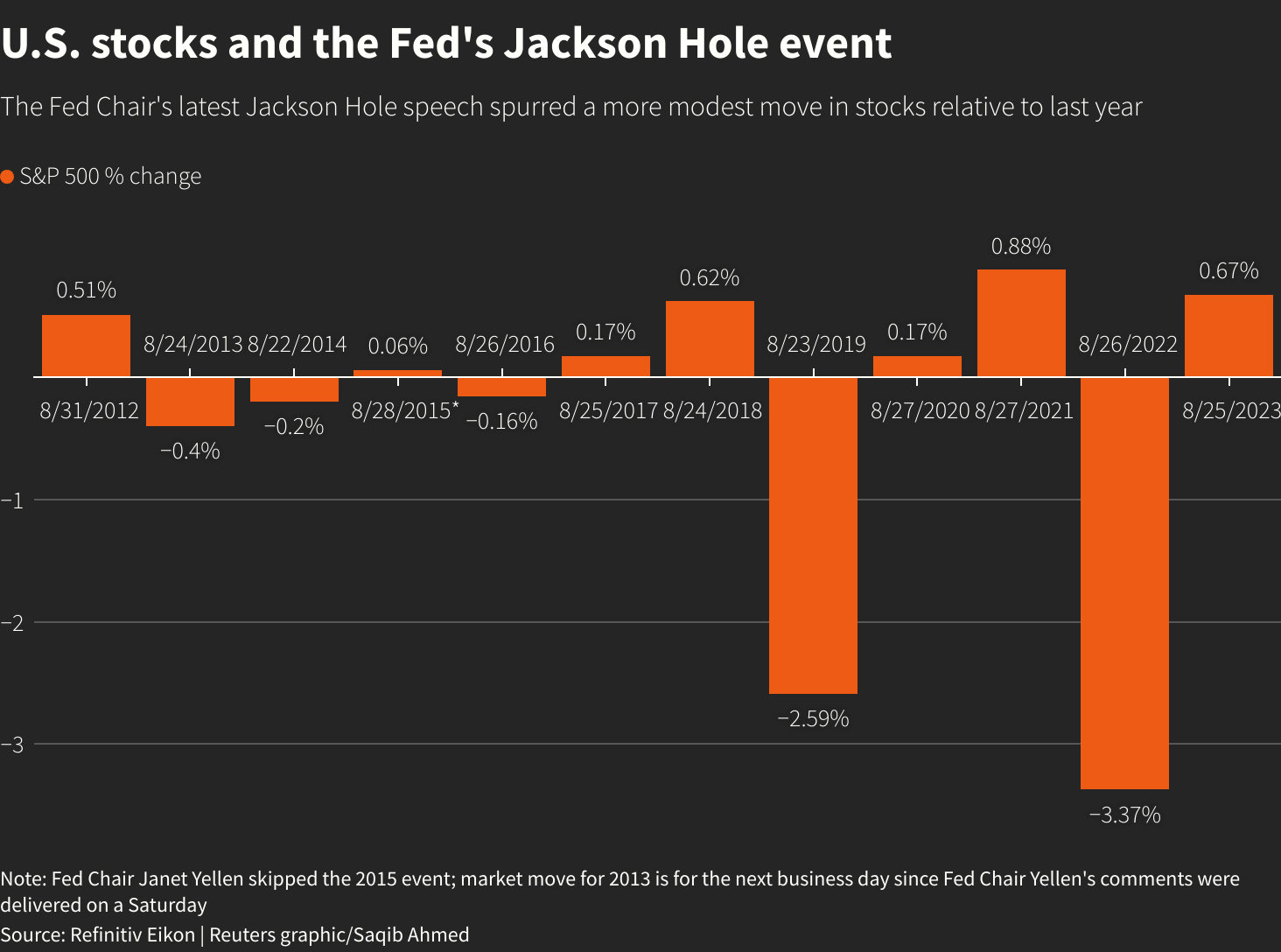

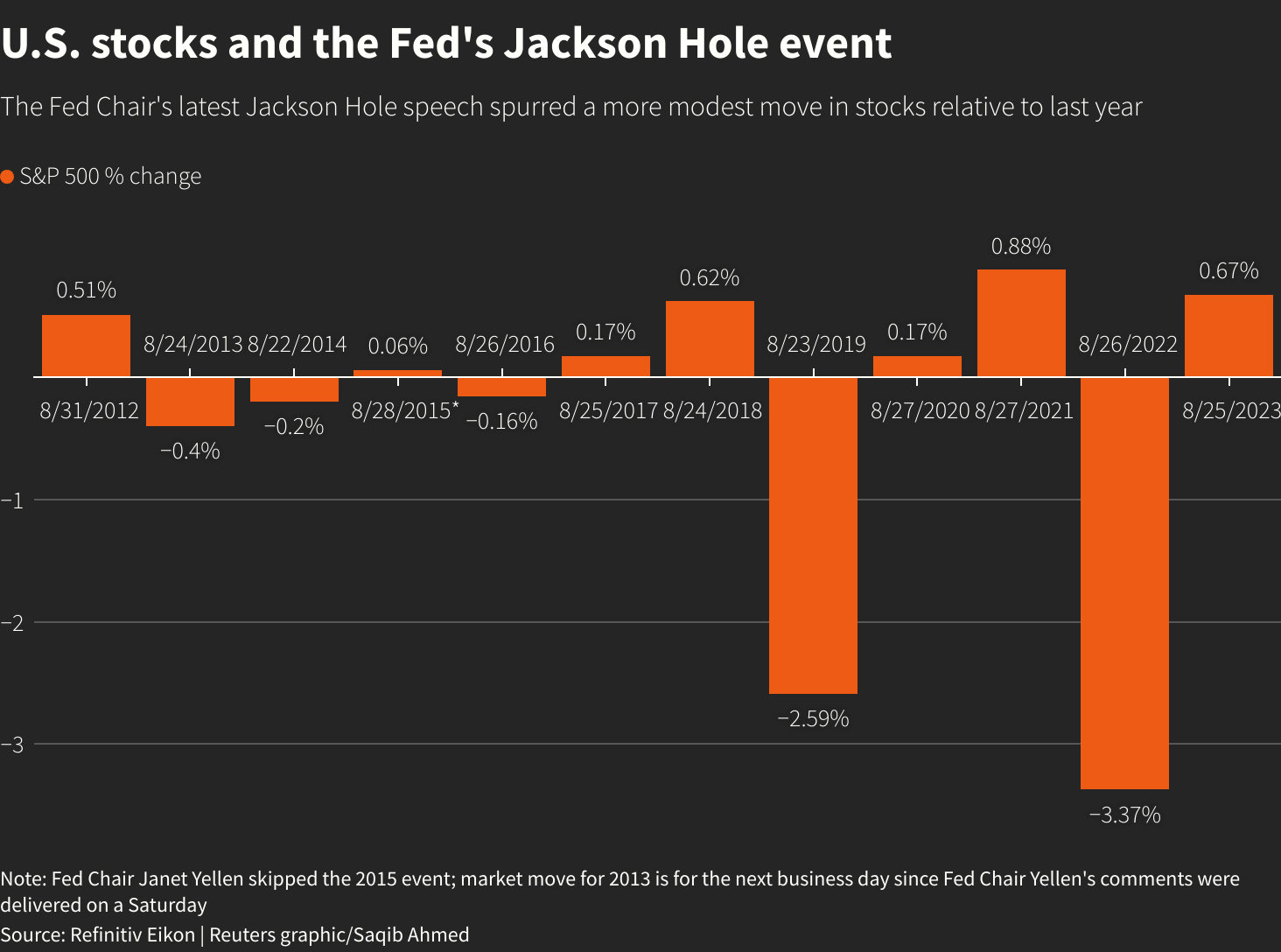

Jerome Powell's recent comments have significantly impacted rate cut expectations. His consistently hawkish stance, emphasizing the ongoing fight against inflation, has cast doubt on the likelihood of imminent interest rate reductions. This less-dovish approach directly contradicts the hopes of many bond traders who were anticipating a more accommodative monetary policy.

- Specific quotes from Powell: Powell has repeatedly stressed the Fed's commitment to bringing inflation down to its 2% target, even if it means enduring some economic pain. Statements such as "[Insert a direct quote from Powell emphasizing the ongoing inflation fight]" clearly indicate a less flexible approach to monetary policy than previously expected.

- Analysis of the Fed's commitment: The Fed's unwavering commitment to its inflation targets suggests that rate cuts are unlikely until substantial progress is made in reducing inflation. This commitment overrides concerns about potential economic slowdowns.

- Data points cited by Powell: Powell often cites persistent inflation figures, strong labor markets, and resilient consumer spending as justification for maintaining a tighter monetary policy. These data points, while positive in some aspects, contribute to the reduced "rate cut expectations" amongst traders.

The Federal Reserve policy, as communicated by Powell, has become a crucial factor in shaping the market's perception of rate cut probabilities. This firm stance against inflation is the primary driver behind the subdued optimism.

Inflation Remains Stubbornly High, Fueling Uncertainty

Persistent inflationary pressures represent another major hurdle to rate cut optimism. Inflation remains stubbornly high, deviating significantly from the Federal Reserve's target rate, thereby reducing the probability of near-term rate cuts. This sustained high inflation creates uncertainty and influences investor decisions, impacting both bond yields and overall market sentiment.

- Current inflation figures: [Insert current inflation figures and compare them to the Fed's target]. The significant divergence between the actual inflation rate and the target rate highlights the challenge the Fed faces and casts doubt on the possibility of immediate rate cuts.

- Contributing factors to inflation: Several factors contribute to this persistent inflation, including ongoing supply chain disruptions, robust wage growth, and strong consumer demand. Addressing these underlying factors is crucial before the Fed can consider easing monetary policy.

- Impact on consumer spending and economic growth: High inflation erodes consumer purchasing power and dampens economic growth. The Fed's focus on controlling inflation, even at the expense of short-term economic growth, further reduces the likelihood of imminent rate cuts. The resulting uncertainty around economic growth is directly impacting the "rate cut probability."

Bond Market Volatility and Shifting Investor Sentiment

The bond market is currently experiencing considerable volatility, directly reflecting the uncertainty surrounding rate cut expectations. This volatility is a consequence of the conflicting signals from economic data and the Fed's hawkish stance. The resulting uncertainty is driving shifts in investor sentiment and strategies.

- Trends in bond yields: Bond yields are closely correlated with rate cut expectations. Currently, [describe the trends in bond yields and explain their correlation with rate cut expectations]. This movement demonstrates the direct impact of the Fed’s pronouncements and the persistence of inflation on bond market behavior.

- Investor strategies: Investors are adopting diverse strategies to navigate this uncertainty. Some are adopting a wait-and-see approach, while others are shifting their investments towards alternative asset classes perceived as less sensitive to interest rate changes. This indecisiveness fuels further market volatility.

- Bond market trading volumes and activity: [Discuss any notable changes in bond market trading volumes or activity, connecting these changes to the current uncertainty]. Increased volatility often corresponds to increased trading activity as investors try to react and adjust their portfolios.

Alternative Investment Strategies Amidst Uncertainty

Given the subdued rate cut optimism and the resulting volatility, bond traders are exploring alternative investment strategies to mitigate risk and potentially enhance returns.

- Alternative asset classes: Investors are considering diversifying into alternative asset classes such as stocks, real estate, or commodities, which may offer better returns or less sensitivity to interest rate changes.

- Risk mitigation strategies: Hedging strategies are becoming increasingly popular as investors seek to protect their portfolios from potential losses arising from unexpected interest rate movements or inflation. These strategies aim to minimize potential risks associated with bond market volatility.

- Risk and reward analysis: Each alternative investment strategy carries its own set of risks and rewards. A thorough analysis of these factors is crucial for making informed investment decisions in this uncertain market environment. Understanding the interplay between risk and reward is vital for navigating "bond market volatility."

Conclusion

The subdued rate cut optimism amongst bond traders is a direct consequence of several interconnected factors. Powell's hawkish stance, fueled by persistent high inflation, has created significant uncertainty within the bond market, leading to increased volatility. This uncertainty is pushing investors to reassess their strategies and consider alternative investment options. To effectively manage risk and potentially capitalize on evolving market conditions, it is crucial to stay informed about the evolving situation. Continue monitoring "Rate Cut Optimism" and improve your understanding of "rate cut probabilities" and strategies for "navigating the bond market volatility" by subscribing to our updates, reading further analysis, or following reliable financial news sources.

Featured Posts

-

Match Bayern Inter Performance Et Analyse Du Jeu De Mueller

May 12, 2025

Match Bayern Inter Performance Et Analyse Du Jeu De Mueller

May 12, 2025 -

Lily Collins Chic Bob Hair Brows And Nude Lips

May 12, 2025

Lily Collins Chic Bob Hair Brows And Nude Lips

May 12, 2025 -

Andrea Love And Neal Mc Clellands Ill House U A Deep Dive Into The Track

May 12, 2025

Andrea Love And Neal Mc Clellands Ill House U A Deep Dive Into The Track

May 12, 2025 -

34 Cars Set For Indy 500 As Satos Entry Confirmed

May 12, 2025

34 Cars Set For Indy 500 As Satos Entry Confirmed

May 12, 2025 -

Jessica Simpson And Jeremy Renner A Look At Their Past And Present Interactions

May 12, 2025

Jessica Simpson And Jeremy Renner A Look At Their Past And Present Interactions

May 12, 2025