Real Estate Market Crash: Home Sales Plummet To Crisis Levels

Table of Contents

Keywords: Real estate market crash, home sales plummet, housing market crisis, real estate downturn, housing market collapse, property market crash, falling house prices, real estate crisis.

The real estate market is facing its most significant challenge in years. Home sales are plummeting, reaching crisis levels not seen since the 2008 financial crisis. This dramatic downturn, characterized by a real estate market crash in many areas, is raising serious concerns for homeowners, buyers, and investors alike. This article will explore the factors contributing to this crisis, analyze the current market conditions, and offer insights into what the future might hold for those navigating this challenging real estate downturn.

Factors Contributing to the Real Estate Market Crash

Several interconnected factors have converged to create the current real estate crisis and cause home sales to plummet. Understanding these is crucial to grasping the severity of the situation and predicting future trends.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes to combat inflation have significantly impacted the housing market. Increased borrowing costs translate directly into higher mortgage payments, reducing the affordability of homes for many potential buyers.

-

Impact: A 1% increase in interest rates can drastically reduce the amount a buyer can borrow, effectively shrinking the pool of qualified buyers. Data from the National Association of Realtors consistently shows a strong negative correlation between interest rate hikes and decreased home sales. Mortgage rates, which were historically low for years, have now surged, making homeownership less attainable for a large segment of the population.

-

Effects on Buyer Demand:

- Increased mortgage payments

- Reduced purchasing power

- Fewer qualified buyers

- Increased competition for lower-priced homes

Inflation and Economic Uncertainty

Soaring inflation is eroding purchasing power, making it harder for people to afford not just homes but also essential goods and services. Coupled with fears of a recession, this has led to decreased consumer confidence and a reluctance to make large financial commitments like buying a home.

-

Impact: Reduced consumer spending directly impacts the housing market as potential buyers postpone or cancel their purchase plans. The uncertainty surrounding the economy and job market further dampens demand. Analysis of consumer sentiment indices reveals a significant drop in confidence, reflecting this anxiety.

-

Effects on Housing Demand:

- Reduced consumer spending

- Increased uncertainty

- Decreased investment in real estate

- Higher prices for building materials

Overvalued Housing Market

In the years leading up to the current downturn, many housing markets experienced significant price appreciation. This created an overvalued market, leaving many properties vulnerable to correction as interest rates rose and affordability declined. This overvaluation fueled a property market crash in some areas.

-

Impact: As the market adjusts, prices are now correcting to more sustainable levels. The resulting imbalance between supply and demand further contributes to the real estate crisis. Areas with previously inflated prices now see significant price drops, while areas with more stable prices see less drastic impacts.

-

Effects on Market Dynamics:

- Price corrections

- Decreased demand

- Inventory surplus in some areas

- Increased competition among sellers

Geopolitical Factors

Global events, such as the ongoing war in Ukraine and supply chain disruptions, have added to the economic uncertainty and further destabilized the housing market. These factors contribute to increased material costs and delays in construction projects, limiting the supply of new homes.

-

Impact: Geopolitical instability creates uncertainty in global markets, impacting investor confidence and increasing the risk associated with real estate investments. Supply chain bottlenecks lead to higher costs for building materials, further impacting affordability.

-

Effects on Real Estate:

- Uncertainty in global markets

- Increased material costs

- Delays in construction projects

- Reduced housing inventory

Current Market Conditions and Predictions

Analyzing current home sales data and forecasting future trends is crucial for navigating this real estate downturn.

Analyzing Current Home Sales Data

Home sales figures are significantly down compared to previous years. This decline is visible across many regions, although the severity varies. The average days on market are increasing, indicating slower sales and a buyer's market in many areas. Inventory levels are rising in some locations. This data confirms the severity of the real estate market crash.

- Key Indicators:

- Sales figures (year-over-year comparison)

- Inventory levels (supply and demand)

- Average days on market

- Price reductions

Forecasting Future Trends

Experts offer varied predictions, but many anticipate a prolonged period of adjustment before a market recovery. Potential scenarios range from a slow, gradual recovery to further price declines, depending on economic conditions and interest rate movements. The potential for a housing market collapse in certain segments remains a concern. However, opportunities may also emerge for savvy buyers.

- Future Scenarios:

- Potential for further price declines

- Timeline for market recovery (months to years)

- Long-term outlook (potential for growth after correction)

- Risks and opportunities for investors and buyers

Strategies for Navigating the Real Estate Market Crash

The current real estate market requires strategic planning and adaptability. Different strategies are necessary depending on whether you’re a buyer or a seller.

Advice for Home Buyers

This is a buyer's market, presenting opportunities for those who can act strategically.

- Strategies:

- Secure favorable mortgage rates by shopping around and considering different loan programs.

- Negotiate aggressively, leveraging the increased inventory and decreased buyer competition.

- Conduct thorough due diligence to identify undervalued properties.

- Patience is key; don't rush into a purchase.

Advice for Home Sellers

Selling in a downturn requires careful planning and realistic pricing.

- Strategies:

- Price your home competitively to attract buyers.

- Implement a strong marketing campaign to reach potential buyers.

- Be flexible in negotiations and consider offering concessions to close a deal.

- Manage expectations; a quick sale may not be possible.

Conclusion

The real estate market crash is a significant event with far-reaching consequences. Rising interest rates, economic uncertainty, and overvalued properties have all contributed to plummeting home sales, creating a real estate crisis. While the future remains uncertain, understanding the factors driving this downturn and employing appropriate strategies is crucial for both buyers and sellers. Navigating this challenging period requires careful planning, informed decision-making, and a realistic assessment of market conditions. Don't let the current state of the real estate market crash discourage you. Stay informed, seek professional advice, and make strategic moves to achieve your real estate goals. By understanding the current housing market crisis, you can position yourself for success even in a volatile market. Learn more about mitigating risk in the face of the ongoing real estate downturn and discover ways to leverage opportunities presented by the falling house prices.

Featured Posts

-

The Role Of Algorithms In Radicalization A Mass Shooter Case Study

May 30, 2025

The Role Of Algorithms In Radicalization A Mass Shooter Case Study

May 30, 2025 -

2 37 23

May 30, 2025

2 37 23

May 30, 2025 -

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025 -

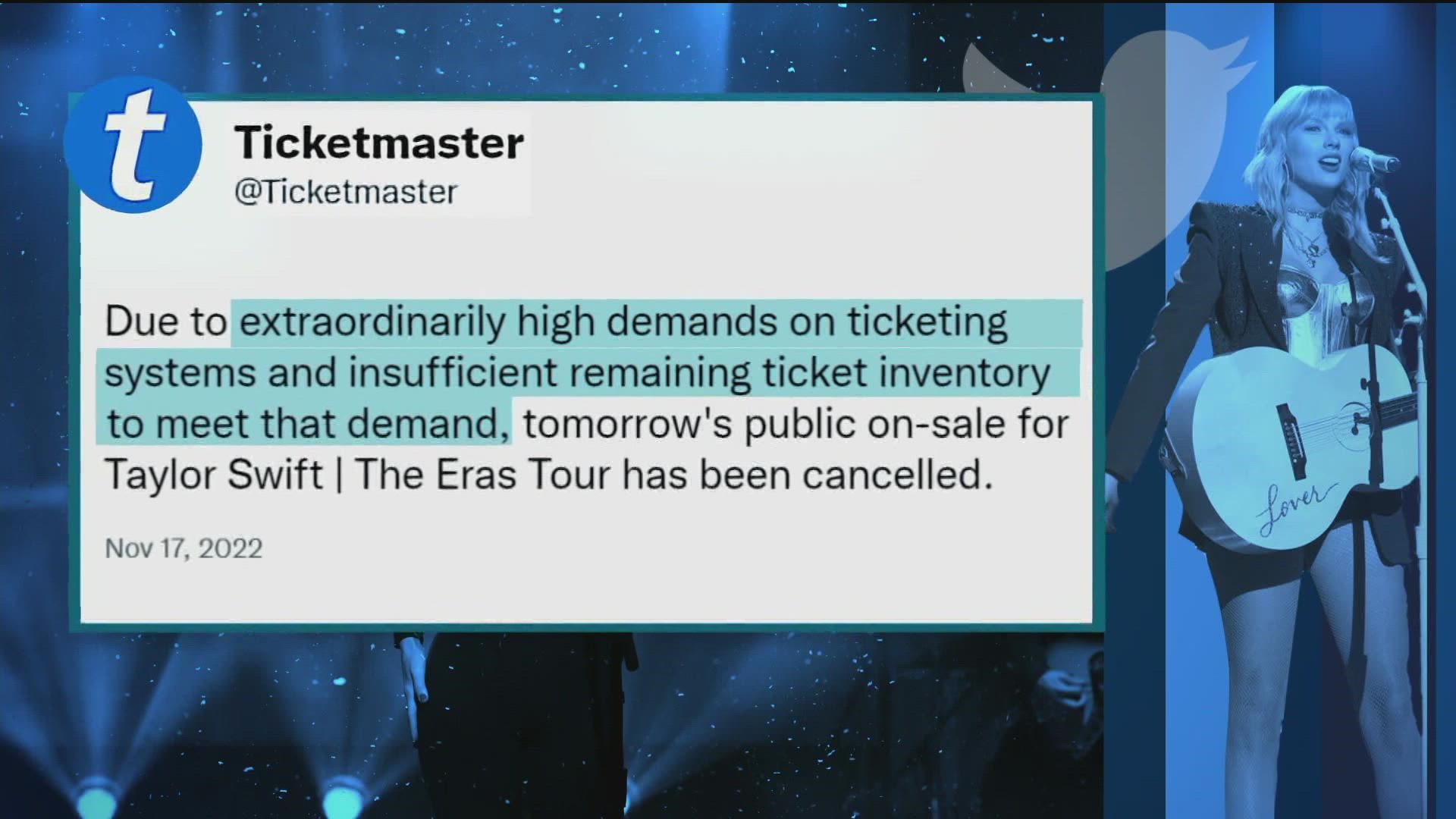

Ticketmasters Oasis Tour Ticket Sales A Consumer Protection Law Audit

May 30, 2025

Ticketmasters Oasis Tour Ticket Sales A Consumer Protection Law Audit

May 30, 2025 -

School Bus Crash Near Pella Two Injured

May 30, 2025

School Bus Crash Near Pella Two Injured

May 30, 2025