Real Estate Market In Crisis: Realtors Report Record Low Home Sales

Table of Contents

High Interest Rates: The Primary Culprit

Rising interest rates are undeniably the most significant factor contributing to the current real estate crisis. These increases dramatically impact mortgage affordability, pricing many potential buyers out of the market. The Federal Reserve's aggressive interest rate hikes throughout 2022 and into 2023 have resulted in significantly higher mortgage rates compared to the historically low rates seen in recent years. For example, a 30-year fixed mortgage rate that averaged around 3% in 2020 has now climbed to over 7% in many areas, representing a substantial increase in monthly payments.

- Increased monthly payments deter potential buyers. A higher interest rate translates directly into significantly higher monthly mortgage payments, making homeownership less attainable for many.

- Higher rates reduce purchasing power. With higher interest rates, buyers can afford to borrow less money, effectively shrinking their purchasing power and limiting their choices in the market.

- Fewer buyers lead to a decreased demand for homes. As affordability decreases, the demand for homes naturally falls, contributing directly to the record low sales figures reported by realtors.

[Insert chart/graph here illustrating the correlation between interest rate increases and home sales decline]

Inflation's Impact on Buyer Confidence and Spending

Inflation further exacerbates the crisis by eroding purchasing power and dampening consumer confidence. Rising prices for essential goods and services, including groceries, energy, and building materials, leave less disposable income for large purchases like homes. This uncertainty makes buyers hesitant to commit to significant financial obligations.

- Buyers are hesitant to commit to large purchases due to economic uncertainty. The fear of further economic downturns and potential job losses makes buyers more cautious about taking on substantial debt.

- Increased living costs leave less disposable income for home purchases. With inflation impacting daily expenses, potential homebuyers find themselves with less money available for a down payment and ongoing mortgage payments.

- Inflation contributes to a more cautious market sentiment. The overall economic uncertainty fostered by inflation creates a climate of apprehension, leading to decreased activity in the real estate market.

For example, the cost of lumber, a key component in new home construction, has skyrocketed in recent years, contributing to higher home prices and further reducing affordability.

Inventory Shortage: A Persistent Problem

The current real estate crisis is not solely driven by affordability issues; a persistent shortage of homes for sale significantly compounds the problem. This imbalance between supply and demand pushes prices upward, making it even more challenging for buyers. The limited supply stems from various factors, including a slowdown in new home construction and a reluctance by existing homeowners to sell due to the difficulty of finding suitable replacement properties.

- Limited inventory drives up prices. When demand outstrips supply, prices naturally increase, creating a competitive market that favors sellers.

- Fewer homes on the market restrict buyer choices. Buyers have fewer options to choose from, making it more difficult to find a property that meets their needs and budget.

- The shortage exacerbates the impact of high interest rates. The combination of high interest rates and limited inventory creates a perfect storm, drastically reducing the number of successful transactions.

According to the National Association of Realtors, inventory levels remain historically low, exacerbating the affordability challenges faced by buyers.

Impact on Different Market Segments

The current crisis impacts various buyer segments differently. First-time homebuyers are arguably the most affected, facing significant affordability challenges. Investors are also more cautious due to economic uncertainty, potentially leading to a decrease in investment activity. While luxury home sales may be less impacted, they are still showing signs of a slowdown.

- First-time homebuyers face significant affordability challenges. The combination of high interest rates and rising prices makes it extremely difficult for first-time buyers to enter the market.

- Investors are more cautious due to economic uncertainty. The current economic climate makes investors hesitant to commit large sums of money to real estate investments.

- Luxury home sales may be less impacted but still show some slowdown. Even the luxury market is feeling the pressure, with some slowdown observed as high-net-worth individuals become more selective in their purchases.

Real estate professionals across the board are reporting a noticeable shift in market dynamics, reflecting the challenges faced by all segments.

Conclusion: Navigating the Real Estate Market Crisis

The record low home sales are a clear indication of a crisis in the real estate market, driven by a confluence of high interest rates, rampant inflation, and persistent inventory shortages. These factors have created a challenging environment for both buyers and sellers, with potential long-term effects on the economy. While predicting the future is always challenging, experts anticipate a continued period of adjustment as interest rates stabilize and inflation hopefully eases. This may lead to a more balanced market in the future.

Understanding the current real estate market crisis is crucial for both buyers and sellers. Stay informed about the latest trends and consult with a qualified real estate professional to navigate this challenging market. For expert advice on the real estate market in crisis, contact us today!

Featured Posts

-

S10 Fe

May 31, 2025

S10 Fe

May 31, 2025 -

Constance Lloyd The Untold Story Of Oscar Wildes Wife And Her Sacrifice

May 31, 2025

Constance Lloyd The Untold Story Of Oscar Wildes Wife And Her Sacrifice

May 31, 2025 -

Miley Cyrusin Bruno Mars Plagiointijuttu Jatkuu Syytteitae Ei Hylaetty

May 31, 2025

Miley Cyrusin Bruno Mars Plagiointijuttu Jatkuu Syytteitae Ei Hylaetty

May 31, 2025 -

Down East Bird Dawgs Inaugural Game Preparations Underway

May 31, 2025

Down East Bird Dawgs Inaugural Game Preparations Underway

May 31, 2025 -

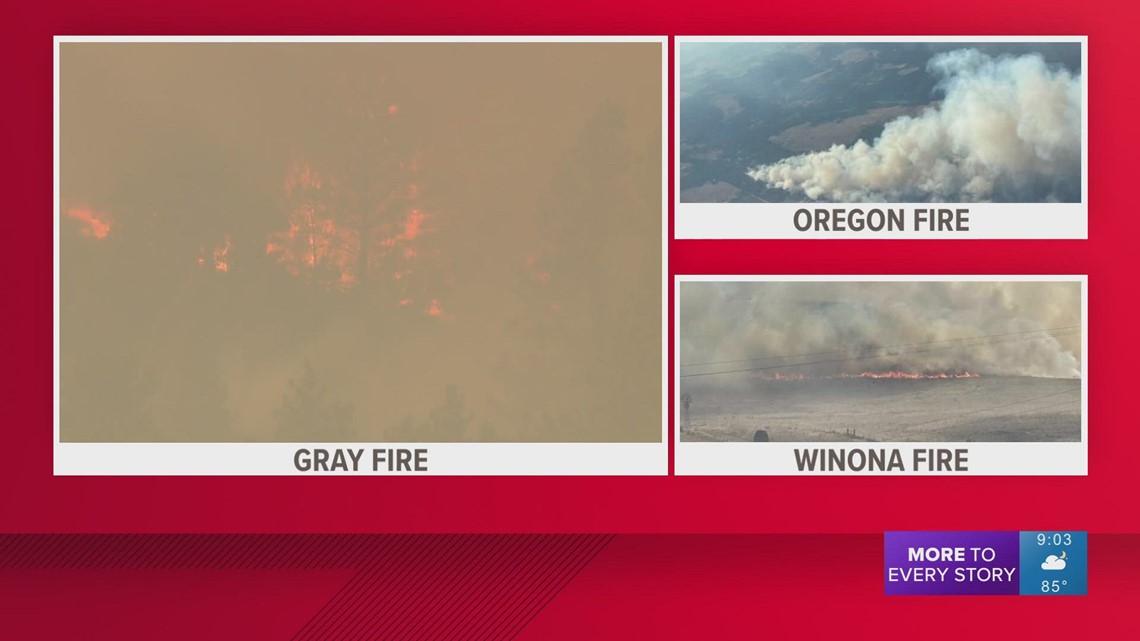

Emergency Evacuations As Wildfires Consume Homes In Eastern Newfoundland

May 31, 2025

Emergency Evacuations As Wildfires Consume Homes In Eastern Newfoundland

May 31, 2025