Recent Developments Affecting CoreWeave Stock

Table of Contents

CoreWeave's Recent Financial Performance and its Impact on Stock Price

CoreWeave's financial performance is a primary driver of its stock price. Analyzing recent quarterly earnings reports, revenue growth, and key financial metrics offers crucial insights into the company's health and future prospects. While specific numbers will change based on the release of future reports, let's consider a hypothetical example to illustrate the analysis:

-

Hypothetical Example: Suppose CoreWeave reported a Q3 2024 revenue exceeding expectations by 15%, driven by strong demand for its AI-focused cloud solutions. This positive news likely boosted investor confidence and led to a surge in CoreWeave stock. Conversely, if the company had missed revenue targets or reported increased operating expenses, the impact on the CoreWeave stock price would likely be negative.

-

Key Metrics to Watch: Investors should closely monitor CoreWeave's Earnings Per Share (EPS), revenue growth rate, gross margins, and debt levels. These metrics provide a holistic view of the company's financial strength and sustainability. Access to CoreWeave's official SEC filings (link to SEC EDGAR database) is essential for detailed analysis.

-

Bullet Points:

- Positive financial news, such as exceeding revenue projections or reporting increased profitability, generally leads to positive stock price movement.

- Negative financial news, including missed earnings, lowered guidance, or increased debt, typically results in a decrease in stock price.

- The company's guidance for future performance is a critical indicator of investor sentiment and anticipated future growth.

Impact of the Broader Market and Economic Conditions on CoreWeave Stock

CoreWeave stock, like other technology stocks, is susceptible to broader market trends and macroeconomic factors. The overall performance of the tech sector significantly influences investor sentiment toward CoreWeave.

-

Macroeconomic Influences: Rising interest rates can dampen investor appetite for growth stocks like CoreWeave, as higher rates increase borrowing costs and reduce the present value of future earnings. Similarly, fears of a recession can lead to decreased investor risk tolerance and lower valuations for technology companies.

-

Bullet Points:

- Rising interest rates typically lead to decreased valuations for growth stocks.

- Economic uncertainty can increase market volatility and negatively impact investor confidence in CoreWeave.

- Sector-specific trends, such as increased competition or changes in cloud computing regulations, can significantly affect CoreWeave’s stock price.

Competitive Landscape and Strategic Partnerships: Their Influence on CoreWeave Stock

CoreWeave operates in a competitive landscape, vying for market share with established cloud computing giants and emerging AI infrastructure providers. Strategic partnerships and collaborations play a significant role in shaping its growth trajectory and competitive position.

-

Competitive Analysis: Identifying key competitors (e.g., AWS, Google Cloud, Microsoft Azure) and analyzing their strategies is vital for understanding CoreWeave's market position. Assessing the competitive pressures and CoreWeave's ability to differentiate itself is key to evaluating the stock’s future performance.

-

Bullet Points:

- New strategic alliances or partnerships can significantly expand CoreWeave's market reach and capabilities.

- Competitive pressures, such as price wars or the emergence of new technologies, can negatively impact CoreWeave's profitability and stock price.

- Successful product launches and innovations help CoreWeave maintain its competitive edge.

Analyst Ratings and Future Outlook for CoreWeave Stock

Analyst ratings and price targets provide valuable insights into the market's overall sentiment towards CoreWeave stock. While these should be considered alongside your own research, they offer a collective perspective from industry experts.

-

Analyst Consensus: A summary of analyst ratings (buy, hold, sell) and their corresponding price targets gives a general outlook on the stock's potential. Note that analyst opinions often differ, reflecting varying perspectives on CoreWeave's future prospects.

-

Bullet Points:

- Bullish ratings usually indicate positive expectations for future growth and stock price appreciation.

- Bearish ratings suggest concerns about the company's performance or the overall market conditions.

- Analyzing the rationale behind different analyst ratings helps understand the factors driving their predictions.

Conclusion: Understanding Recent Developments Affecting CoreWeave Stock

In summary, CoreWeave stock's performance is influenced by a complex interplay of factors: its own financial performance, broader market conditions, competitive pressures, and analyst sentiment. Understanding these dynamics is essential for making informed investment decisions. While positive financial results and strategic partnerships can boost CoreWeave stock, macroeconomic headwinds and intense competition present challenges. Staying informed on these developments is crucial for navigating the complexities of investing in CoreWeave. Stay informed on the latest developments affecting CoreWeave stock by regularly checking reputable financial news sources and analyst reports. Understanding these factors will empower you to make more informed decisions regarding your investments in CoreWeave.

Featured Posts

-

Allentown Boys Shatter Penn Relays Record With Sub 43 4x100m Time

May 22, 2025

Allentown Boys Shatter Penn Relays Record With Sub 43 4x100m Time

May 22, 2025 -

Poraka Od Ronaldo Do Kho Lund Po Kopiranjeto Na Slav Eto

May 22, 2025

Poraka Od Ronaldo Do Kho Lund Po Kopiranjeto Na Slav Eto

May 22, 2025 -

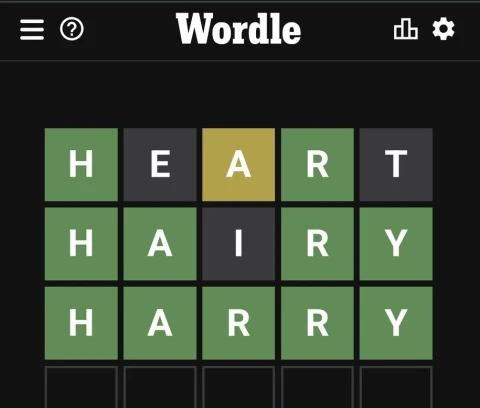

Wordle Help Hints Answer And Solutions For Todays Nyt Wordle March 18 1368

May 22, 2025

Wordle Help Hints Answer And Solutions For Todays Nyt Wordle March 18 1368

May 22, 2025 -

Discover Provence A Self Guided Walking Tour From Mountains To Coast

May 22, 2025

Discover Provence A Self Guided Walking Tour From Mountains To Coast

May 22, 2025 -

Dc Shooting Near Jewish Museum Two Israeli Embassy Employees Dead Ap Photos

May 22, 2025

Dc Shooting Near Jewish Museum Two Israeli Embassy Employees Dead Ap Photos

May 22, 2025