Recent Spike In Bitcoin Mining: A Deep Dive

Table of Contents

Factors Contributing to the Recent Bitcoin Mining Surge

Several interconnected factors have converged to fuel the recent surge in Bitcoin mining. Understanding these is crucial to grasping the current dynamics of the Bitcoin network.

Increased Bitcoin Price

The most direct driver of increased Bitcoin mining activity is a higher Bitcoin price. As the value of Bitcoin rises, the profitability of mining increases proportionally. Miners, who earn Bitcoin as a reward for validating transactions, are incentivized to invest more in mining operations when the returns are higher.

- Bitcoin's price increased by over X% in the last Y months (insert actual data).

- A strong correlation exists between Bitcoin's price and its hash rate (a measure of the total computational power dedicated to Bitcoin mining). A higher price typically leads to a higher hash rate.

- Price volatility, while risky, also plays a role. Sharp price increases can trigger a rapid influx of miners seeking to capitalize on the opportunity.

Improved Mining Hardware

Advancements in Application-Specific Integrated Circuit (ASIC) technology have significantly improved the efficiency and power of Bitcoin mining rigs. This technological progress makes mining more profitable, even with fluctuating Bitcoin prices.

- Companies like Bitmain and MicroBT have released new ASIC miners with significantly higher hash rates and improved energy efficiency.

- Improvements in energy efficiency translate to lower operating costs, making mining more attractive even in regions with higher electricity prices.

- The increased hash rate directly contributes to the overall increase in Bitcoin mining activity.

Regulatory Changes and Geographic Shifts

Changes in mining regulations across different countries have also influenced the landscape of Bitcoin mining. Miners are increasingly migrating to regions with more favorable regulatory environments.

- Some countries have implemented stricter regulations, leading to a decrease in mining activity within their borders.

- Conversely, other countries have adopted more lenient policies, attracting a significant influx of miners. (Include specific examples of countries and their regulatory approaches).

- This geographic shift impacts the overall distribution of Bitcoin mining power and its decentralization.

Institutional Investment

The growing interest from institutional investors in Bitcoin has indirectly contributed to the increased demand for Bitcoin and, consequently, Bitcoin mining. As more institutional money flows into the market, the price tends to rise, further incentivizing mining activity.

- Several large financial institutions have started investing in Bitcoin, signaling increased confidence in the cryptocurrency's long-term potential.

- These investments not only impact the price but also increase the overall market capitalization, indirectly boosting demand and mining activity.

- The entry of institutional players can lead to more stable and predictable market conditions, potentially encouraging long-term mining investments.

Environmental Concerns and Sustainable Bitcoin Mining

The significant energy consumption associated with Bitcoin mining has raised significant environmental concerns. However, the industry is actively exploring and implementing sustainable practices to mitigate its impact.

Energy Consumption

Bitcoin mining's substantial electricity consumption is a valid concern. The debate surrounding its carbon footprint is ongoing. The total energy consumption of the Bitcoin network is a frequently discussed topic.

- Estimates of Bitcoin's annual energy consumption vary widely depending on the methodology used.

- The carbon footprint of Bitcoin mining depends heavily on the energy sources used. Mining operations reliant on fossil fuels have a considerably higher carbon footprint than those powered by renewable energy.

- Ongoing research and data collection are crucial for accurately assessing and addressing this concern.

Sustainable Mining Practices

Many Bitcoin miners are actively working towards reducing their environmental impact by adopting sustainable practices. This commitment is crucial for the long-term viability and acceptance of Bitcoin.

- Increasingly, mining operations are utilizing renewable energy sources such as hydro, solar, and wind power.

- Some mining companies are investing in carbon offsetting programs to neutralize their carbon footprint.

- The percentage of Bitcoin mining powered by renewable energy is steadily increasing, though data on this remains incomplete and often disputed.

Market Implications of Increased Bitcoin Mining

The recent spike in Bitcoin mining has several key market implications, affecting the security, price, and future outlook of the cryptocurrency.

Network Security and Decentralization

Increased mining activity strengthens the security and decentralization of the Bitcoin network. A higher hash rate makes it computationally infeasible for malicious actors to launch successful attacks on the blockchain.

- The hash rate is a direct measure of the network's security. A higher hash rate makes it exponentially more difficult to alter the blockchain.

- A geographically distributed mining network, with miners operating in diverse locations, enhances the network's decentralization, making it more resilient to censorship or single points of failure.

- Increased mining competition ensures the network operates fairly and transparently.

Bitcoin Price Volatility

The relationship between increased mining activity and Bitcoin price volatility is complex. While increased mining could theoretically lead to increased supply and potentially lower prices, the impact of other factors, like demand and regulatory changes, often overshadows this effect.

- Increased mining difficulty, which automatically adjusts to maintain a consistent block generation time, can impact profitability and influence miner behavior.

- Unexpected changes in mining activity can cause short-term price fluctuations, as the market reacts to shifts in supply and demand.

- Long-term price trends are influenced by a multitude of factors beyond just mining activity, including overall market sentiment and adoption rates.

Future Outlook for Bitcoin Mining

Predicting the future of Bitcoin mining requires considering several key factors, including technological advancements, regulatory developments, and overall market dynamics.

- Further advancements in ASIC technology are expected to continue increasing mining efficiency and profitability.

- Regulatory changes in various jurisdictions will continue to shape the geographic distribution of mining activity.

- The overall adoption of Bitcoin and its role in the broader financial landscape will significantly impact the long-term demand for Bitcoin mining.

Conclusion: The Future of Bitcoin Mining and What it Means

The recent spike in Bitcoin mining is a multifaceted phenomenon driven by several interconnected factors, including increased Bitcoin price, improved mining hardware, regulatory changes, and institutional investment. While environmental concerns remain, the industry is actively striving for sustainability through the adoption of renewable energy sources. The increased mining activity strengthens Bitcoin's network security and decentralization, but its impact on price volatility is complex and depends on various interacting market forces. The future of Bitcoin mining is dynamic and will be shaped by technological advancements, regulatory landscapes, and the overall evolution of the cryptocurrency market. Stay tuned for further updates on the ever-evolving landscape of Bitcoin Mining, and continue to explore the fascinating world of cryptocurrency.

Featured Posts

-

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025

Bbc Strictly Come Dancing Wynne Evans Clarifies Return Rumours

May 09, 2025 -

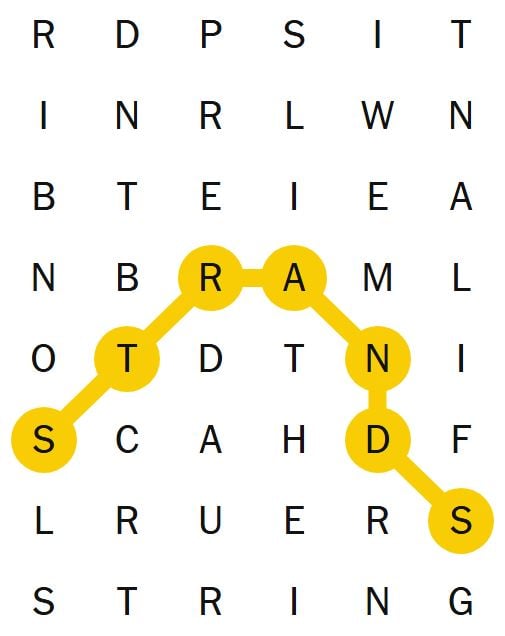

Solve Nyt Strands Tuesday March 4th Game 366 Answers And Clues

May 09, 2025

Solve Nyt Strands Tuesday March 4th Game 366 Answers And Clues

May 09, 2025 -

Dangote And Nnpc The Impact On Petrol Prices In Nigeria

May 09, 2025

Dangote And Nnpc The Impact On Petrol Prices In Nigeria

May 09, 2025 -

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025

The Trade Wars Impact On Crypto One Cryptocurrency That Could Thrive

May 09, 2025 -

Where Will China Source Canola Now Exploring New Trade Partners

May 09, 2025

Where Will China Source Canola Now Exploring New Trade Partners

May 09, 2025