Reciprocal Tariffs And The Indian Economy: A Sectoral Analysis

Table of Contents

Impact on the Agricultural Sector

Indian agriculture, employing a substantial portion of the population, is highly vulnerable to fluctuations in international markets. Reciprocal tariffs significantly affect import and export prices of key agricultural products.

- Impact on specific crops: Tariffs on rice, wheat, and cotton, for instance, can lead to price increases for consumers if imports are restricted. Conversely, export tariffs can reduce the competitiveness of Indian agricultural products in global markets, impacting farmer incomes.

- Effect on farmer incomes and livelihoods: Fluctuations in prices directly affect farmer incomes. Increased import tariffs might protect domestic farmers from cheaper imports, but export tariffs can limit access to global markets. This dual effect needs careful consideration when formulating agricultural trade policy.

- Potential for increased domestic production or decreased exports: Higher import tariffs could incentivize domestic production, potentially leading to import substitution. However, higher export tariffs could discourage exports, reducing foreign exchange earnings and potentially harming overall economic growth.

- Analysis of government support mechanisms and their effectiveness: Government support mechanisms, such as farm subsidies and minimum support prices, play a crucial role in mitigating the impact of reciprocal tariffs. The effectiveness of these mechanisms needs ongoing evaluation and adaptation. The balance between protecting domestic farmers and ensuring fair trade practices is a key challenge. Keywords: agricultural tariffs, farm subsidies, food security, agricultural exports, import substitution.

Effects on the Manufacturing Sector

The Indian manufacturing sector is also significantly affected by reciprocal tariffs. The impact varies across different sectors, such as textiles, pharmaceuticals, and automobiles.

- Increased costs for imported inputs: Many manufacturing processes rely on imported inputs. Reciprocal tariffs increase the cost of these inputs, potentially increasing production costs and reducing competitiveness.

- Potential for reduced competitiveness in global markets: Higher production costs due to tariffs can render Indian manufacturers less competitive globally, leading to reduced export volumes and market share.

- Opportunities for domestic manufacturing growth through import substitution: Conversely, increased tariffs might offer opportunities for domestic manufacturing to grow by replacing imports. This, however, requires careful analysis of its economic viability and potential costs.

- Job creation and loss analysis: The impact on employment is complex. While import substitution might create jobs in domestic industries, reduced exports might lead to job losses in export-oriented manufacturing units. A comprehensive job impact assessment is crucial for informed policy decisions. Keywords: manufacturing tariffs, import substitution, industrial growth, global competitiveness, supply chain disruptions.

Influence on the Service Sector

While less directly impacted, India's booming service sector – including IT and tourism – also experiences the indirect consequences of reciprocal tariffs.

- Indirect effects through reduced demand from other sectors: Reduced activity in manufacturing or agriculture due to tariffs can decrease demand for services, impacting the service sector's growth.

- Impact on export-oriented service industries: Export-oriented service industries, such as IT outsourcing, might face reduced demand if reciprocal tariffs harm the global economy or lead to trade disputes.

- The role of international trade agreements and their influence on service sector tariffs: International trade agreements significantly influence the structure of tariffs across all sectors, including services. The impact of reciprocal tariffs must be analyzed within this broader framework of international agreements. Keywords: service sector tariffs, international trade agreements, export of services, IT sector, tourism industry.

Macroeconomic Implications of Reciprocal Tariffs

Reciprocal tariffs have broader macroeconomic implications for India, affecting GDP growth, inflation, and foreign investment.

- Effect on inflation rates: Increased import tariffs can lead to higher prices for consumers, contributing to inflation. This necessitates careful monitoring and potentially counteractive fiscal or monetary policies.

- Impact on foreign direct investment (FDI) flows: Uncertainty created by reciprocal tariffs can negatively affect investor confidence, potentially reducing FDI flows.

- Overall impact on GDP growth: The net effect on GDP growth is complex and depends on the interplay of various factors, including the magnitude of the tariffs, the responsiveness of domestic industries, and the effectiveness of government policy responses.

- Analysis of government policy responses to mitigate negative effects: The government can employ various fiscal and monetary policies to mitigate negative effects, such as targeted subsidies, infrastructure investments, or adjustments to monetary policy. The effectiveness of these measures needs careful assessment. Keywords: GDP growth, inflation, foreign direct investment, macroeconomic stability, fiscal policy, monetary policy.

Case Studies and Examples

Analyzing specific instances of reciprocal tariffs provides a clearer understanding of their impact. For example, reciprocal tariffs on steel imports could lead to higher steel prices for domestic industries, impacting construction and automobile manufacturing. Similarly, textile tariffs could affect the clothing industry, impacting employment and export competitiveness. Detailed case studies on specific industries, analyzing the impact of tariffs on prices, production, and employment, are essential for evaluating the effectiveness of trade policies. Keywords relevant to the specific examples chosen (e.g., "steel tariffs," "textile tariffs," etc.) would be used within these case studies.

Conclusion: Navigating the Challenges of Reciprocal Tariffs for the Indian Economy

This analysis reveals the diverse and complex impacts of reciprocal tariffs on different sectors of the Indian economy. Agricultural, manufacturing, and service sectors each experience unique challenges and opportunities. Understanding these impacts is crucial for effective policymaking. While reciprocal tariffs might offer some protection to domestic industries, they also carry the risk of reduced competitiveness, higher prices, and decreased economic growth. Further research focusing on the specific implications of reciprocal tariffs within various sectors is essential. Open policy discussions and a nuanced, strategic approach are crucial for harnessing the benefits of international trade while mitigating the potential negative effects of reciprocal tariffs on the Indian economy's sustainable economic growth. The effective management of reciprocal tariffs requires a balanced approach, prioritizing long-term economic growth and the welfare of all stakeholders.

Featured Posts

-

Fentanyl Crisis Ex Us Envoy Holds China Accountable

May 15, 2025

Fentanyl Crisis Ex Us Envoy Holds China Accountable

May 15, 2025 -

Steam Sale 2025 Dates Times And Everything You Need To Know

May 15, 2025

Steam Sale 2025 Dates Times And Everything You Need To Know

May 15, 2025 -

Cavaliers Vs Celtics Prediction Will Boston Bounce Back At Home

May 15, 2025

Cavaliers Vs Celtics Prediction Will Boston Bounce Back At Home

May 15, 2025 -

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Results

May 15, 2025

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Results

May 15, 2025 -

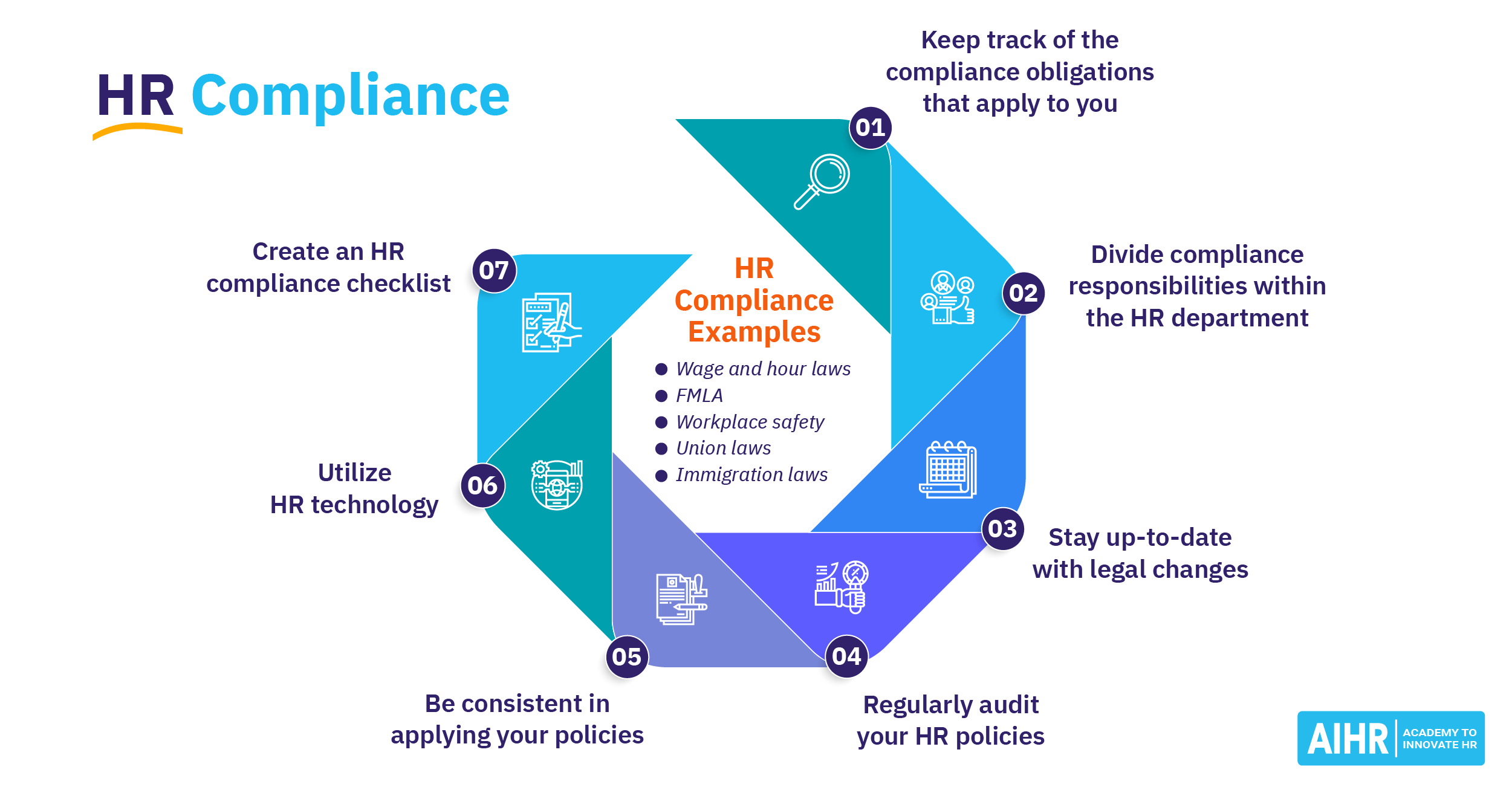

Understanding Indian Crypto Exchange Compliance A 2025 Overview

May 15, 2025

Understanding Indian Crypto Exchange Compliance A 2025 Overview

May 15, 2025