Record High For Canada's S&P/TSX Composite Index: Intraday Update

Table of Contents

Factors Contributing to the S&P/TSX Composite Index Record High

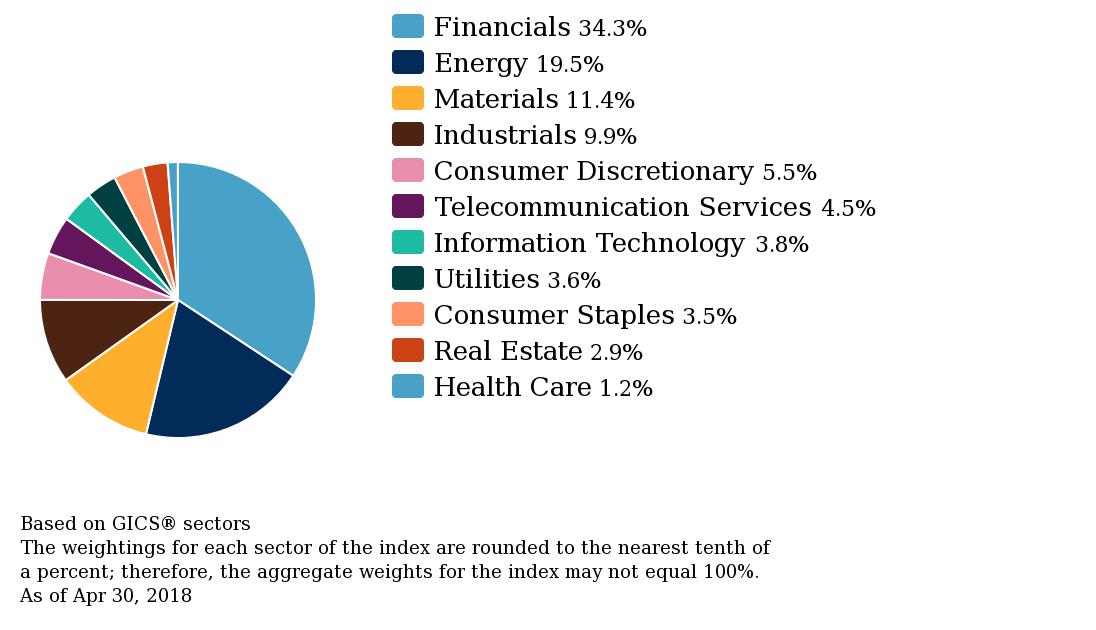

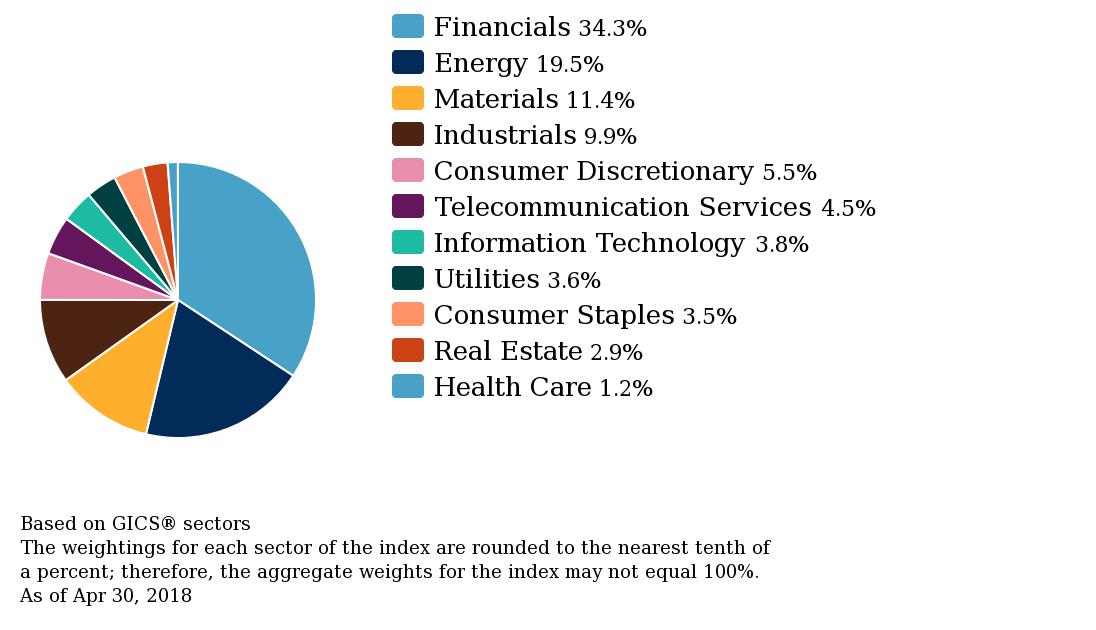

Several key factors converged to propel the S&P/TSX Composite Index to its record high. A confluence of strong corporate earnings, positive economic indicators, and favorable global market influences all played a significant role.

Strong Corporate Earnings

Robust performance across various sectors fueled the index's ascent. Many Canadian companies reported exceeding expectations, boosting investor sentiment and driving up stock prices.

- High-Performing Sectors: The energy, technology, and financial sectors were particularly strong contributors. The energy sector, buoyed by high commodity prices, saw significant gains. Technology companies also performed well, driven by innovation and strong demand. Financial institutions benefited from a healthy economy and increased lending activity.

- Specific Company Contributions: [Insert examples of specific companies and their percentage stock price increases. For example: "Royal Bank of Canada (RY) saw a 3% increase, while Shopify (SHOP) experienced a 5% jump."]. These impressive performances significantly impacted the overall index performance. Further research into individual company earnings reports will offer a more granular understanding of this sector-wide success.

Positive Economic Indicators

Positive economic data released recently reinforced investor optimism. Several key indicators pointed to a healthy and growing Canadian economy.

- Key Indicators: Recent data showed strong GDP growth, robust employment numbers, and inflation rates that, while elevated, are showing signs of moderating. These positive trends signaled a strong foundation for continued market growth.

- Influence on Investor Sentiment: These positive economic indicators significantly boosted investor confidence, encouraging further investment in the Canadian stock market. The perception of a stable and growing economy directly translates into higher demand for Canadian stocks. [Link to relevant Statistics Canada report].

Global Market Influences

While the Canadian market's performance is largely domestically driven, global trends also played a role.

- Global Market Trends: Positive performance in other major global markets, particularly the US market, often has a positive spillover effect on the TSX. Furthermore, stable or increasing commodity prices positively impacted Canadian energy companies.

- Correlation and Risks: The correlation between global events and the TSX's performance is complex. While positive global trends generally benefit the Canadian market, negative global events, such as geopolitical instability or a significant downturn in major global markets, pose a risk.

Intraday Volatility and Trading Activity

While the S&P/TSX Composite Index reached a record high, intraday trading exhibited some volatility.

Trading Volume and Price Fluctuations

The index experienced significant price fluctuations throughout the trading day.

- Peak Values and Percentage Changes: [Insert data points illustrating peak values and percentage changes throughout the day. Include a visual representation like a chart or graph if possible.] This illustrates the dynamic nature of intraday trading and the factors influencing short-term price movements.

- Visualizing the Data: [Include a chart or graph showing the intraday price fluctuations of the S&P/TSX Composite Index. Label the axes clearly and provide a concise caption.] This visualization will greatly enhance understanding.

Investor Sentiment and Market Reactions

Investor sentiment shifted throughout the day, reflecting the dynamic nature of the market.

- Analyst Opinions: [Mention analyst opinions and predictions about the market's future performance. Include quotes if available.] These perspectives offer valuable insights into how market professionals interpret the day's events.

- Impact of Investor Behavior: Investor behavior, driven by news, economic data, and sentiment, directly impacted the index's movement. Understanding these dynamics is crucial for navigating the complexities of the stock market.

Implications and Future Outlook for the S&P/TSX Composite Index

The record high for the S&P/TSX Composite Index presents both opportunities and challenges.

Potential for Continued Growth

Several factors suggest potential for further growth in the Canadian stock market.

- Factors Contributing to Further Increases: Continued economic growth, supportive government policies, and strong corporate earnings all contribute to a positive outlook. Further innovation and expansion within key sectors will also play a crucial role.

- Cautious Outlook: While the outlook is positive, it's essential to maintain a cautious perspective. Unforeseen economic shifts or global events could impact market performance.

Risks and Challenges

Potential headwinds could affect the index's future performance.

- Potential Risks: Inflation, interest rate hikes by the Bank of Canada, and geopolitical instability all represent significant risks. These factors could negatively impact investor confidence and dampen economic growth.

- Impact Analysis: It's crucial to monitor these factors closely, as they could significantly influence the S&P/TSX Composite Index's performance. A comprehensive risk assessment is vital for informed investment decisions.

Conclusion

Today's record high for the S&P/TSX Composite Index is a significant milestone driven by a combination of strong corporate earnings, positive economic indicators, and supportive global market trends. While intraday volatility highlights the inherent risks of the market, the overall outlook remains cautiously optimistic. However, investors should remain aware of potential challenges such as inflation and geopolitical uncertainty. Staying informed about the S&P/TSX Composite Index and the Canadian stock market is critical for making sound investment decisions. Monitor key economic indicators and corporate earnings regularly to navigate the market effectively. Learn more about investing in the Canadian market and managing your portfolio effectively by [link to relevant resource/website].

Featured Posts

-

Miami Acik Ta Djokovic Finalde

May 17, 2025

Miami Acik Ta Djokovic Finalde

May 17, 2025 -

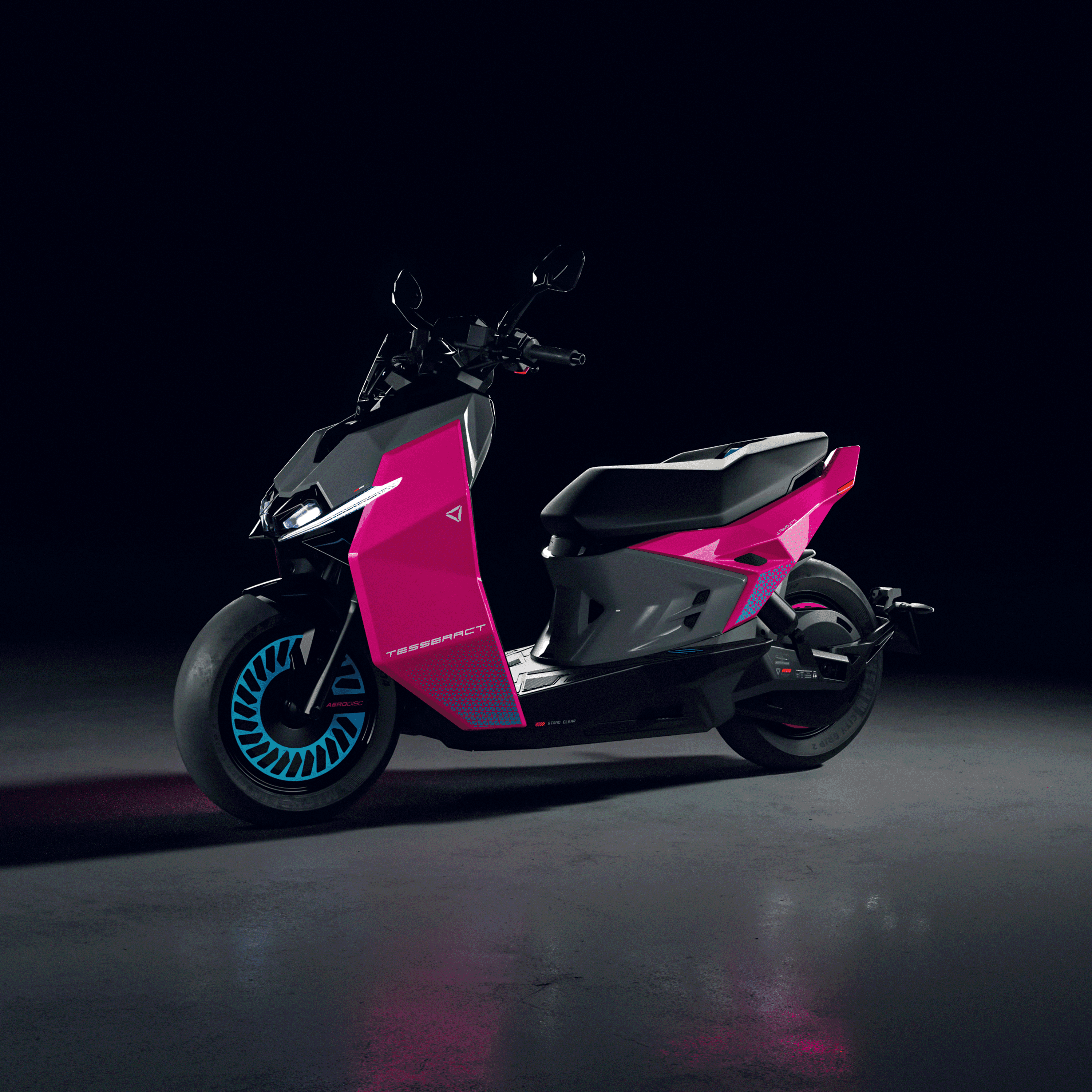

Top 3 Reasons To Choose The Ultraviolette Tesseract Electric Scooter

May 17, 2025

Top 3 Reasons To Choose The Ultraviolette Tesseract Electric Scooter

May 17, 2025 -

Angelo Stiller Transfer Interest From Barcelona And Arsenal

May 17, 2025

Angelo Stiller Transfer Interest From Barcelona And Arsenal

May 17, 2025 -

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025 -

Arenda Ploschadey V Industrialnykh Parkakh Tseny I Usloviya

May 17, 2025

Arenda Ploschadey V Industrialnykh Parkakh Tseny I Usloviya

May 17, 2025