Recordati: Tariff Volatility Drives M&A Strategy In Italy

Table of Contents

Recordati's Response to Tariff Fluctuations

Tariff instability significantly impacts Recordati's operations. Fluctuations in import and export duties directly affect the cost of raw materials, finished goods, and distribution, ultimately influencing pricing and profitability.

- Impact on import/export costs: Recordati, like many pharmaceutical companies, relies on global supply chains. Tariff changes lead to unpredictable cost increases, impacting margins and requiring constant price adjustments.

- Effect on drug pricing strategies: The need to absorb or pass on tariff-related cost increases necessitates agile pricing strategies, potentially affecting market competitiveness and patient access.

- Pressure on margins: Increased input costs and the need for price adjustments squeeze profit margins, demanding efficient operational management and strategic mitigation.

- Increased operational complexity: Managing tariff-related complexities adds layers to Recordati's operational processes, requiring specialized expertise and increased administrative burdens.

To counteract these challenges, Recordati strategically employs M&A to diversify its supply chains, expand its product portfolio, and strengthen its market position, ultimately reducing its vulnerability to tariff fluctuations.

M&A as a Strategic Tool for Recordati

Recordati has a well-established history of successful M&A activity in Italy, using acquisitions as a cornerstone of its growth strategy. This approach isn't merely reactive; it's proactive, shaping its ability to weather economic storms.

- Examples of successful acquisitions: While specific details of past acquisitions may be confidential, analyzing Recordati's public statements reveals a focus on acquiring companies with complementary product portfolios and established market presence.

- Geographic expansion within Italy: Acquisitions have allowed Recordati to expand its geographic reach within Italy, strengthening its distribution network and enhancing market access.

- Diversification of product portfolio: Acquiring companies with diverse product lines helps reduce reliance on single products and mitigates the risk associated with price fluctuations affecting specific drugs.

- Strengthening market position: Strategic acquisitions consolidate Recordati's position in the Italian pharmaceutical market, providing increased bargaining power and enhanced stability.

These acquisitions collectively contribute to enhanced price stability by diversifying revenue streams and reducing dependence on individual products susceptible to tariff volatility. Increased market share further reinforces Recordati’s position against price pressures.

Analyzing Recordati's Target Companies

Recordati's acquisition targets typically exhibit specific characteristics:

- Company size and market capitalization: While the exact size varies, Recordati generally targets companies that offer a significant strategic fit without being overwhelmingly large, allowing for smooth integration.

- Product portfolio overlap and synergies: Acquisitions often focus on companies with product portfolios that complement Recordati's existing offerings, creating synergistic opportunities for cost savings and market expansion.

- Regulatory compliance and intellectual property: Strong regulatory compliance and a robust intellectual property portfolio are essential considerations to minimize future risks and ensure seamless integration.

- Financial health and growth potential: Target companies are carefully vetted for financial stability and demonstrate a clear potential for future growth and profitability.

Recordati's due diligence process likely involves rigorous financial analysis, thorough market research, and comprehensive assessment of regulatory and legal aspects to minimize potential risks associated with each acquisition.

Future Outlook for Recordati's M&A Activity

Predicting Recordati's future M&A strategy requires considering several factors. The ongoing volatility of tariffs remains a key driver. Furthermore, evolving healthcare regulations in Italy and the EU will significantly impact the landscape.

- Potential target sectors/companies: Recordati might explore acquisitions in specialized therapeutic areas or focus on companies with innovative products and technologies to further enhance its portfolio.

- Impact of evolving healthcare regulations: Changes in pricing and reimbursement policies will shape the attractiveness of potential acquisition targets.

- Opportunities for further market consolidation: Recordati may continue seeking opportunities to consolidate its market position through acquisitions of smaller competitors.

- Anticipated challenges and mitigation strategies: Challenges like integration complexities and regulatory hurdles will need to be carefully managed through effective planning and execution.

Future acquisitions will likely contribute to improved overall performance and sustainable growth for Recordati, enabling them to further solidify their position in the Italian pharmaceutical market and mitigate future risks associated with tariff volatility.

Conclusion

Recordati's strategic use of M&A in Italy has proven instrumental in navigating the turbulent waters of tariff volatility. By diversifying its product portfolio, expanding its market reach, and strengthening its competitive position, Recordati has built a robust foundation for sustainable growth. The key advantages of this approach are improved price stability, enhanced market share, and increased portfolio diversification. Learn more about how Recordati’s strategic use of M&A is shaping the Italian pharmaceutical market and mitigating tariff volatility. Stay informed on Recordati's continued success with its innovative M&A strategy in Italy.

Featured Posts

-

New York Yankees Carlos Rodon Shuts Down Guardians In 5 1 Win

Apr 30, 2025

New York Yankees Carlos Rodon Shuts Down Guardians In 5 1 Win

Apr 30, 2025 -

X Files Reboot Speculation Coogler And Anderson In Talks

Apr 30, 2025

X Files Reboot Speculation Coogler And Anderson In Talks

Apr 30, 2025 -

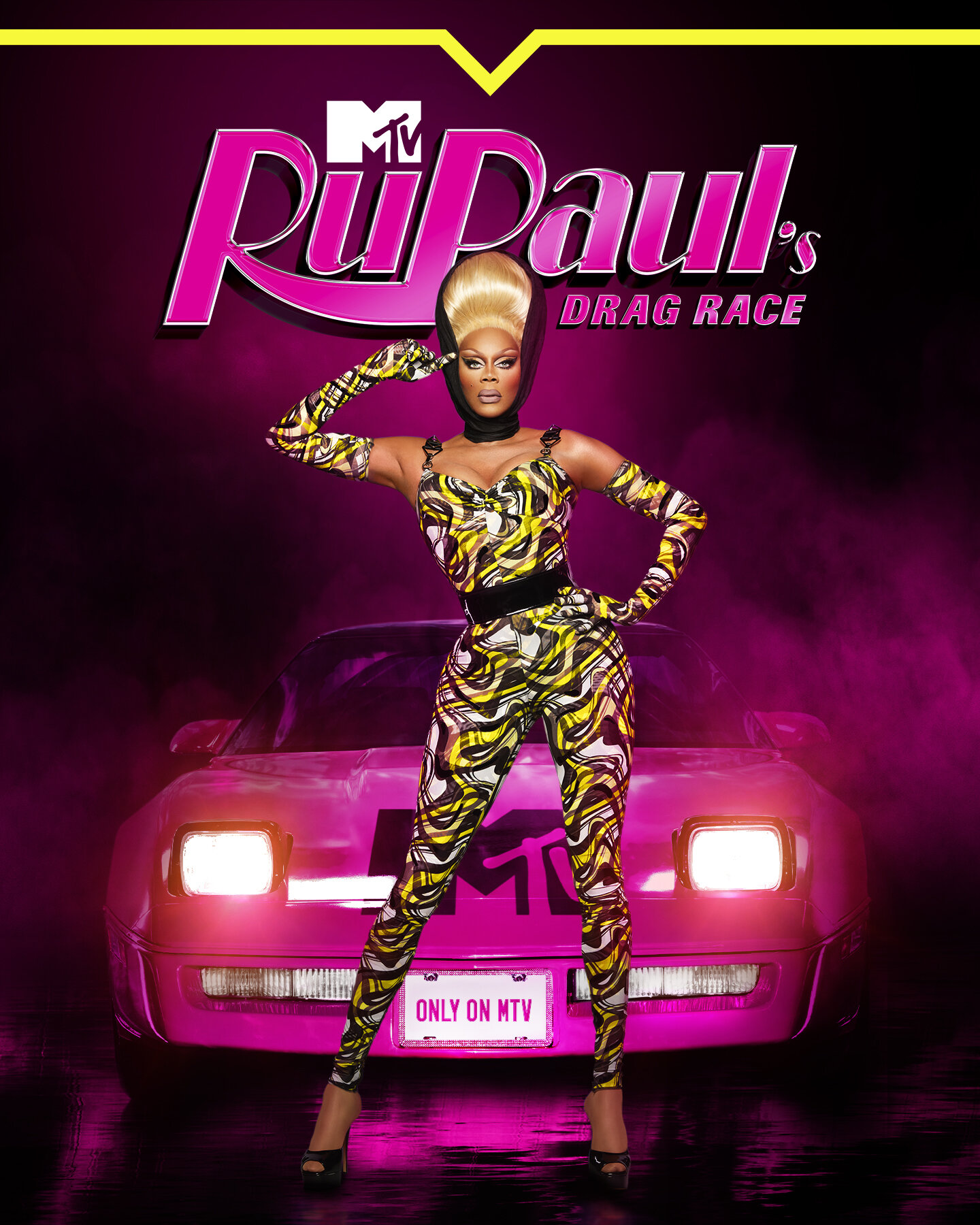

How To Watch Ru Pauls Drag Race Season 17 Episode 9 For Free

Apr 30, 2025

How To Watch Ru Pauls Drag Race Season 17 Episode 9 For Free

Apr 30, 2025 -

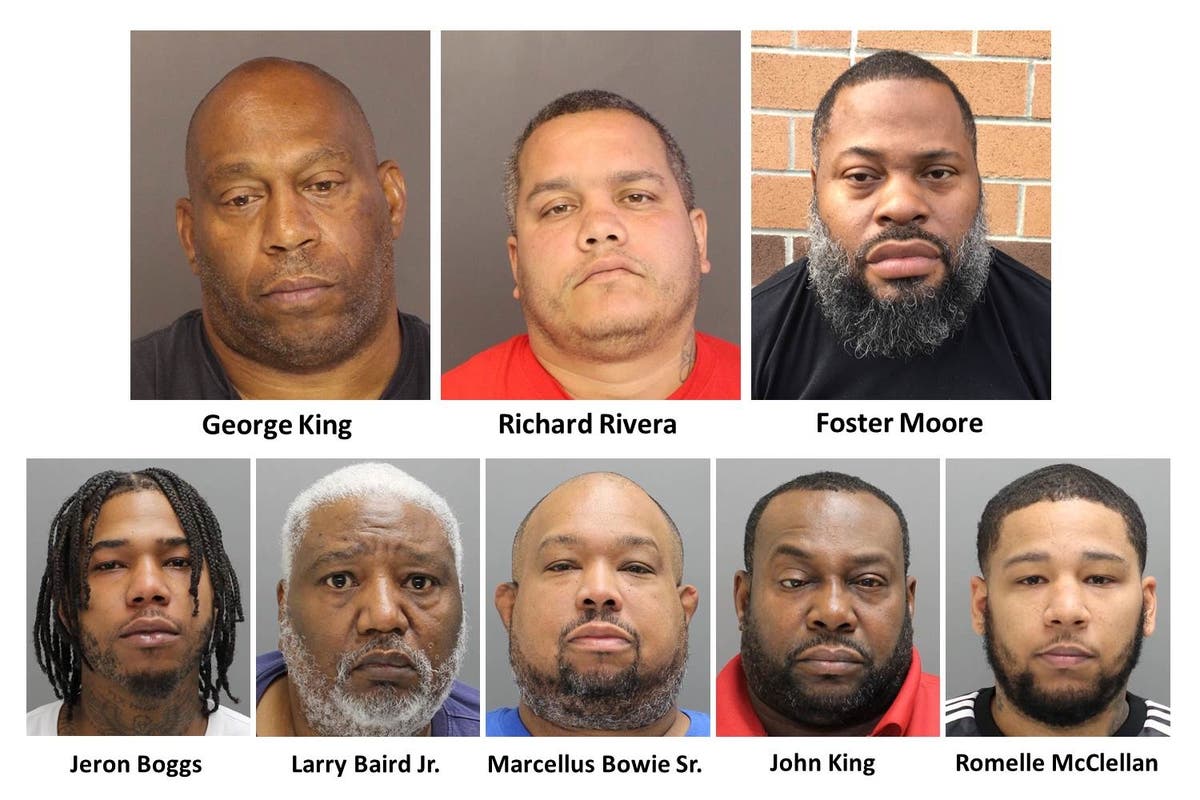

One Week 35 Illegal Refineries Dismantled 99 Arrested Military Operation Update

Apr 30, 2025

One Week 35 Illegal Refineries Dismantled 99 Arrested Military Operation Update

Apr 30, 2025 -

The Story Behind Tina Knowles Eyebrows Blue Ivys Unexpected Role

Apr 30, 2025

The Story Behind Tina Knowles Eyebrows Blue Ivys Unexpected Role

Apr 30, 2025