Reduced Steel Production In China: How It Affects The Iron Ore Market

Table of Contents

The Impact of Reduced Steel Production on Iron Ore Demand

The relationship between steel production and iron ore consumption is directly proportional. China's reduced steel output directly translates to lower demand for iron ore, the primary raw material in steelmaking. This fundamental link drives many of the market fluctuations we observe. This reduced demand is a consequence of several factors:

-

Decreased construction activity in China impacting steel demand: A slowdown in China's real estate sector and infrastructure projects directly reduces the need for steel, and therefore, iron ore. This decrease in construction activity is a significant contributor to lower overall steel consumption.

-

Government policies aimed at reducing carbon emissions impacting steel production: China's commitment to environmental sustainability has led to policies aimed at curbing carbon emissions, including stricter regulations on steel production. These policies, while environmentally beneficial, directly impact the volume of steel produced.

-

Slower economic growth in China leading to lower infrastructure projects: As China's economic growth slows, there's a corresponding reduction in large-scale infrastructure projects, a key driver of steel demand. This reduced investment in infrastructure directly impacts iron ore demand.

-

The shift towards higher-quality, lower-carbon steel impacting raw material needs: The increasing focus on producing higher-quality, lower-carbon steel necessitates changes in the steelmaking process, potentially altering the demand for specific types of iron ore. This shift towards sustainable practices modifies the overall raw material needs.

Fluctuations in Iron Ore Prices Due to Reduced Chinese Demand

Reduced Chinese demand for iron ore significantly impacts global iron ore prices. The basic principles of supply and demand come into play: lower demand leads to lower prices, creating significant volatility in the market.

-

Price volatility and its impact on iron ore producers: The fluctuating iron ore price creates uncertainty and risk for iron ore producers. Price drops can severely impact profitability and investment decisions. Smaller operations are particularly vulnerable.

-

Impact on smaller mining operations and their profitability: Smaller mining operations often lack the financial reserves to withstand prolonged periods of low iron ore prices, potentially leading to closures and job losses. Maintaining profitability in a volatile market is a significant challenge.

-

The role of speculation and market sentiment in price fluctuations: Market sentiment and speculation play a crucial role in price volatility. Negative news regarding Chinese steel production or economic growth can lead to immediate price drops.

-

Potential for price recovery depending on Chinese economic recovery: The potential for iron ore price recovery is directly linked to a resurgence in Chinese economic activity and a consequent increase in steel production. A robust economic recovery is key to restoring demand.

Geopolitical Implications of Reduced Chinese Steel Production

The reduced Chinese steel production has significant geopolitical implications, impacting major iron ore producers and global trade routes.

-

Australia's reliance on Chinese iron ore demand: Australia, a major iron ore exporter, is heavily reliant on the Chinese market. Reduced Chinese demand significantly impacts Australia's economy and its trade relationships.

-

Impact on Brazil and other major iron ore exporters: Brazil and other major iron ore exporters also experience reduced demand, affecting their economies and prompting diversification strategies. The impact is felt throughout the global iron ore industry.

-

Potential for increased competition among producers: As demand falls, competition among iron ore producers intensifies, potentially leading to price wars and further market instability. Producers need to find ways to differentiate their product and secure contracts.

-

Diversification strategies adopted by iron ore exporting nations: Many iron ore exporting nations are now actively pursuing diversification strategies, seeking new markets and developing new products to lessen their dependence on China. This reflects a broader geopolitical shift in the industry.

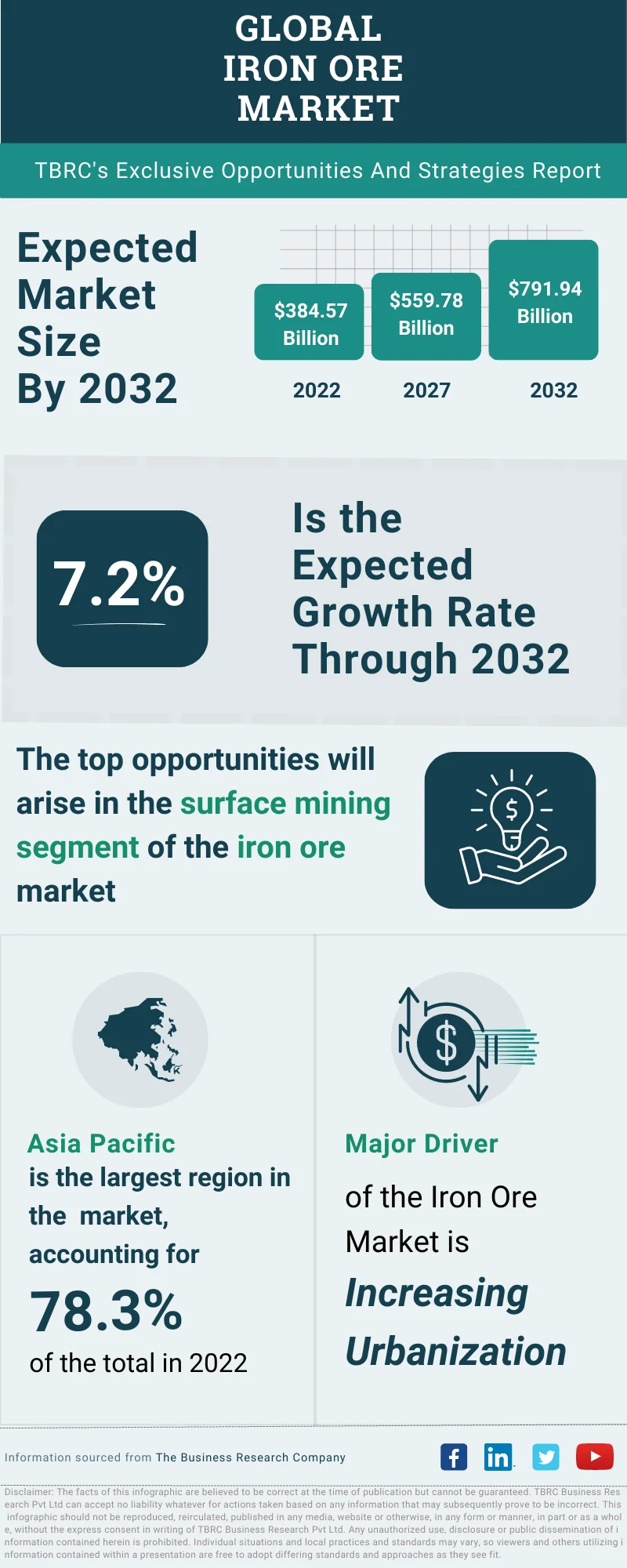

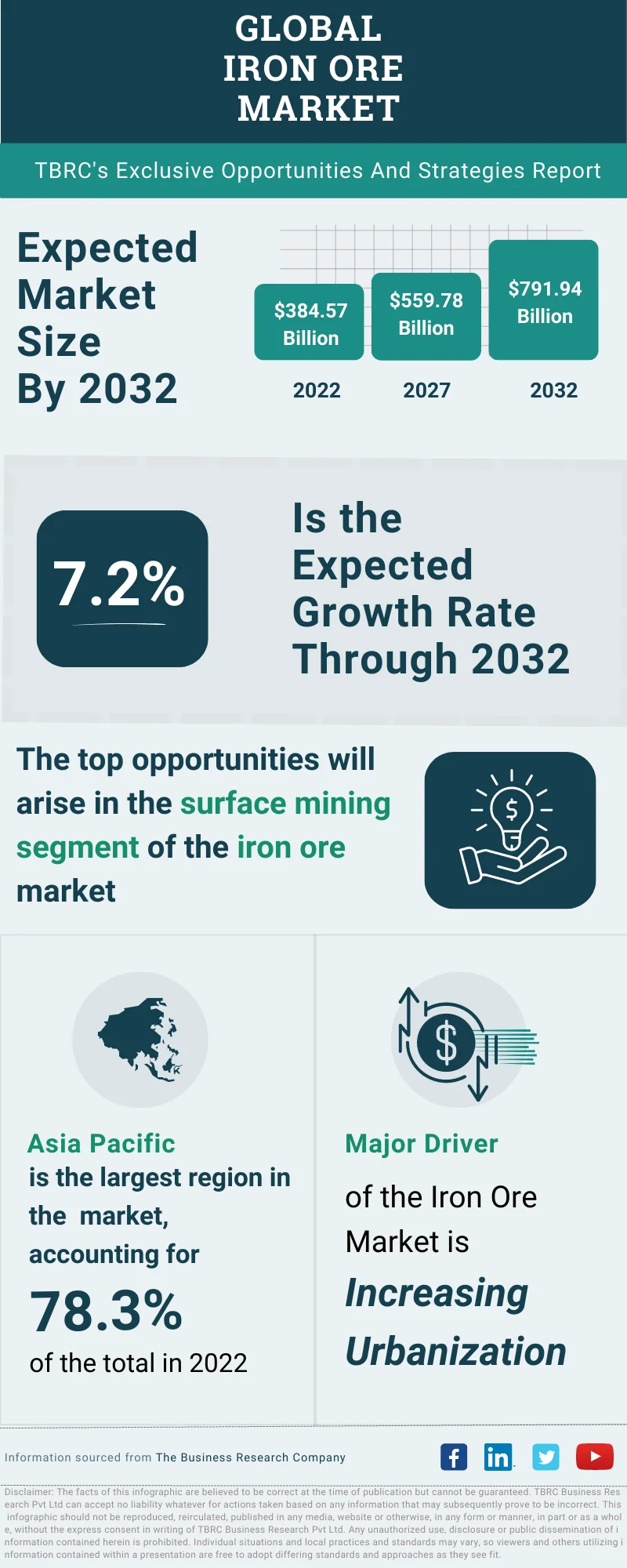

The Future of the Iron Ore Market in Relation to Chinese Steel Production

Predicting the future of the iron ore market is inherently challenging, but understanding future trends in Chinese steel production is crucial.

-

Forecasts for Chinese steel production in the coming years: Various forecasts exist regarding China's future steel production, but most suggest a period of slower growth or even slight decline, at least in the short to medium term.

-

Potential for technological advancements impacting steel production and iron ore demand: Technological advancements, such as the development of more efficient steelmaking processes and the use of alternative raw materials, could impact future iron ore demand.

-

Long-term strategies for iron ore producers to adapt to changing market conditions: Iron ore producers need to adopt long-term strategies to adapt to the changing market conditions, including diversification, cost reduction, and investments in sustainable practices.

-

The role of sustainable and green steel production in shaping future demand: The growing focus on sustainable and green steel production will likely influence the type and quantity of iron ore demanded in the future, emphasizing environmentally friendly practices and production methods.

Conclusion

Reduced steel production in China has undeniably created significant challenges for the iron ore market, impacting prices, supply chains, and global trade dynamics. The interconnectedness of these two markets highlights the importance of understanding the factors influencing Chinese steel production and their subsequent effect on iron ore demand. Stay informed on the latest developments in reduced steel production in China and its impact on the iron ore market. Understanding these dynamics is crucial for investors, industry professionals, and policymakers alike to make informed decisions and adapt to the changing global landscape. Continue researching the complexities of the reduced steel production in China and its far-reaching consequences.

Featured Posts

-

Pakistan Stock Exchange Downtime Market Instability Amidst Rising Tensions

May 10, 2025

Pakistan Stock Exchange Downtime Market Instability Amidst Rising Tensions

May 10, 2025 -

Palantir Stock Forecast 2025 Is A 40 Increase Realistic

May 10, 2025

Palantir Stock Forecast 2025 Is A 40 Increase Realistic

May 10, 2025 -

Jogsertes Transznemu No Letartoztatasa Floridaban A Noi Mosdo Hasznalataert

May 10, 2025

Jogsertes Transznemu No Letartoztatasa Floridaban A Noi Mosdo Hasznalataert

May 10, 2025 -

Improving Accessibility For Wheelchair Users On The Elizabeth Line

May 10, 2025

Improving Accessibility For Wheelchair Users On The Elizabeth Line

May 10, 2025 -

Jeanine Pirros Dc Appointment Analyzing Trumps Choice And Fox News Connection

May 10, 2025

Jeanine Pirros Dc Appointment Analyzing Trumps Choice And Fox News Connection

May 10, 2025