Refinancing Federal Student Loans: Comparing Private And Government Options

Table of Contents

Understanding Federal Student Loan Refinancing

Before diving into private options, it's crucial to understand the implications of refinancing your federal student loans. This process involves replacing your existing federal loans with a new loan, typically from a private lender.

The Basics of Refinancing Federal Loans:

Refinancing your federal student loans offers several potential benefits:

- Lower interest rates: A lower interest rate can significantly reduce your overall interest payments and the total amount you repay.

- Simplified payments: Consolidating multiple loans into one simplifies your repayment process, making it easier to manage your finances.

- Potential for shorter repayment terms: A shorter repayment term can lead to faster debt payoff, but it may also result in higher monthly payments.

However, it's crucial to be aware of the significant drawback: you lose the benefits associated with federal student loans. This includes:

- Income-driven repayment (IDR) plans: These plans adjust your monthly payments based on your income.

- Forbearance and deferment: These options temporarily suspend or reduce your payments during financial hardship.

- Federal loan forgiveness programs: Certain professions or circumstances may qualify you for loan forgiveness. These opportunities are lost upon refinancing to a private loan.

Who is a Good Candidate for Refinancing Federal Student Loans?

Refinancing federal student loans isn't ideal for everyone. The best candidates typically possess:

- High credit score: A good credit score is essential for securing favorable interest rates.

- Consistent employment history: Lenders want to see proof of stable income to ensure you can make your monthly payments.

- Manageable debt-to-income ratio: Your total debt shouldn't significantly outweigh your income. A lower debt-to-income ratio improves your chances of approval.

Before formally applying, consider using pre-qualification tools offered by many lenders. These allow you to check your eligibility without impacting your credit score.

Private Student Loan Refinancing Options

Private student loan refinancing offers several potential advantages, but it's crucial to understand the associated risks.

Advantages of Private Refinancing:

- Competitive interest rates (depending on creditworthiness): Private lenders often offer lower interest rates than federal loans, particularly for borrowers with excellent credit.

- Flexible repayment options: Some private lenders provide a variety of repayment options, such as fixed or variable interest rates, and different repayment term lengths.

- Potential for lower monthly payments: While a shorter repayment term increases monthly payments, a longer term can lower them, though it will increase the total interest paid.

Disadvantages of Private Refinancing:

- Loss of federal benefits: This is the most significant disadvantage. You lose access to income-driven repayment plans, forbearance, deferment, and potential loan forgiveness programs.

- Risk of higher rates if credit score deteriorates: If your credit score drops, your interest rate may increase, significantly impacting your repayment costs.

- Stricter eligibility requirements: Private lenders have stricter eligibility requirements than federal loan programs.

Finding the Best Private Lender:

Choosing the right private lender is crucial. Consider these factors:

- Check interest rates and fees: Compare interest rates and fees across multiple lenders to find the best deal.

- Compare loan terms: Examine repayment terms, including loan lengths and available repayment options.

- Read online reviews: Check independent review sites to gauge customer experiences with different lenders.

- Check lender's reputation and accreditation: Ensure the lender is reputable and accredited to protect yourself from scams.

Government Student Loan Refinancing Options (If Applicable)

While true refinancing of federal student loans to lower interest rates is not generally available through the government, there are options to manage your repayment.

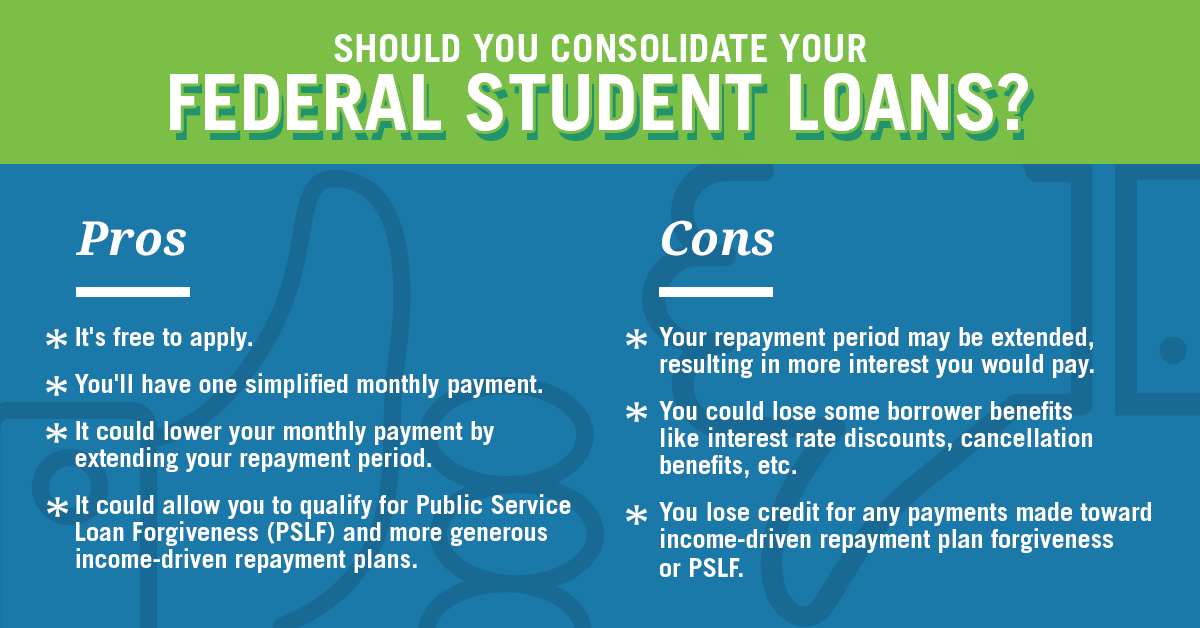

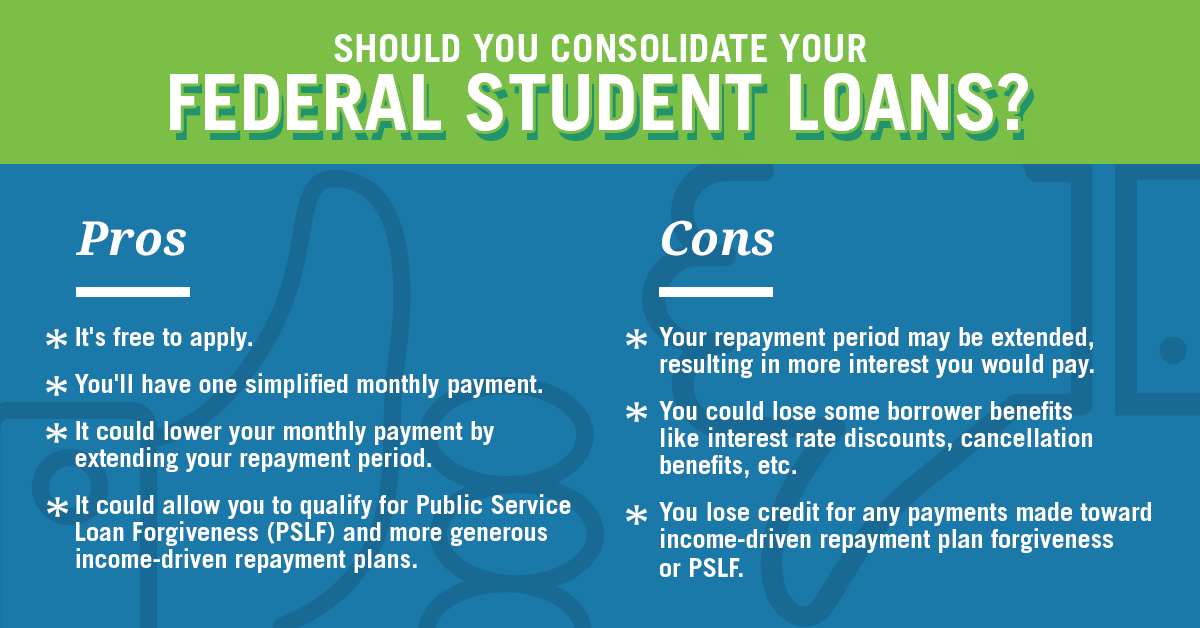

Federal Student Loan Consolidation:

Consolidation combines multiple federal student loans into a single loan with one monthly payment. This simplifies repayment but typically does not lower your interest rate.

- Simplified repayment: One monthly payment makes budgeting easier.

- Single monthly payment: Streamlines your finances.

- No change to interest rate (usually): Your interest rate remains the same, or is a weighted average of your existing loans.

Income-Driven Repayment Plans:

IDR plans adjust your monthly payments based on your income and family size. This is not refinancing, but a repayment plan.

- Lower monthly payments based on income: Makes repayment more manageable during periods of lower income.

- Potential for loan forgiveness after a set period: Some plans offer loan forgiveness after 20 or 25 years of payments, depending on the plan.

Other Government Programs:

Explore other government programs that might offer assistance with student loan repayment, such as temporary hardship programs or assistance for specific professions. These are not refinancing options but may alleviate your current financial burden.

Comparing Private vs. Government Options: A Decision Matrix

| Feature | Private Refinancing | Government Options (Consolidation & IDR) |

|---|---|---|

| Interest Rates | Potentially lower, dependent on credit score | Usually no change, or weighted average |

| Flexibility | More flexible repayment options | Less flexible, based on income and plan type |

| Federal Benefits | Lost | Retained |

| Eligibility | Stricter credit and income requirements | Generally more accessible |

| Risk | Higher risk if credit score deteriorates | Lower risk, but potentially higher payments |

Conclusion

Refinancing federal student loans can significantly impact your financial future, but choosing between private and government options requires careful consideration. Understanding the advantages and disadvantages of each—including the potential loss of federal protections with private refinancing—is crucial. By weighing your credit score, financial goals, and risk tolerance, you can determine the best path toward successful student loan refinancing. Start exploring your options today and discover how you can achieve your financial goals through strategic student loan refinancing. Remember to compare rates and terms carefully before making a decision!

Featured Posts

-

Jalen Brunson Knicks Fans Bold Petition To Replace Lady Liberty

May 17, 2025

Jalen Brunson Knicks Fans Bold Petition To Replace Lady Liberty

May 17, 2025 -

E245 K Spanish Townhouse Alan Carr And Amanda Holdens Renovation Project Listed

May 17, 2025

E245 K Spanish Townhouse Alan Carr And Amanda Holdens Renovation Project Listed

May 17, 2025 -

Rockwell Automation Leads Market Gains Following Positive Earnings Report

May 17, 2025

Rockwell Automation Leads Market Gains Following Positive Earnings Report

May 17, 2025 -

Departamento De Educacion Y La Recuperacion De Prestamos Estudiantiles Impagados

May 17, 2025

Departamento De Educacion Y La Recuperacion De Prestamos Estudiantiles Impagados

May 17, 2025 -

Yaman Houthi Ancam Luncurkan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025

Yaman Houthi Ancam Luncurkan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025