Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Your Current Federal Student Loans

Before considering refinancing, it's crucial to fully understand your current federal student loan situation. This involves knowing your interest rates, loan types, and repayment plan. Ignoring this step could lead to regrettable financial decisions.

- Types of Federal Student Loans: Familiarize yourself with the specifics of your loans. Common types include subsidized loans (where the government pays the interest while you're in school), unsubsidized loans (where interest accrues immediately), and Grad PLUS loans (loans for graduate students). Understanding these distinctions is vital for assessing refinancing options.

- Credit Score Check: Your credit score significantly impacts your eligibility for refinancing and the interest rate you'll receive. Check your credit report and score before you begin the refinancing process. Addressing any errors or improving your score can improve your chances of securing a favorable interest rate.

- Loan Balances: The total amount you owe directly influences the refinancing options available to you. Larger loan balances might require a higher credit score or a larger down payment to qualify.

The Allure of Lower Interest Rates with Refinancing

One of the primary draws of refinancing federal student loans is the potential for lower interest rates. This can lead to significantly lower monthly payments and reduced total interest paid over the life of the loan.

- Long-Term Savings: Even a small decrease in your interest rate can result in substantial savings over time. For example, refinancing a $50,000 loan from 7% to 5% could save you thousands of dollars in interest over the loan's term.

- Illustrative Example: Imagine you have a $30,000 federal student loan at 6% interest. Refinancing to a private loan with a 4% interest rate could dramatically decrease your monthly payment and shorten the repayment period, saving you thousands of dollars in interest over the life of the loan.

- Faster Loan Payoff: Lower interest rates often translate to faster loan payoff, allowing you to become debt-free sooner. This allows you to free up more of your budget for other financial goals.

- Rate Comparison is Key: Never settle for the first offer. Compare interest rates from multiple lenders to secure the most competitive terms.

Eligibility Criteria and Considerations for Refinancing Federal Student Loans

Refinancing federal student loans typically involves private lenders, and their eligibility requirements vary. Understanding these requirements is critical before proceeding.

- Common Eligibility Requirements: Private lenders typically consider your credit score, income, debt-to-income ratio, and loan amount. A higher credit score generally qualifies you for better interest rates. A stable income is crucial to demonstrate your ability to repay the loan.

- Loss of Federal Benefits: A significant consideration is the loss of federal student loan benefits when refinancing. This includes income-driven repayment plans, deferment options, and potential forgiveness programs. Weigh the potential benefits of lower interest rates against the loss of these crucial protections.

- Terms and Conditions: Carefully review the terms and conditions of any refinancing loan. Pay close attention to prepayment penalties, late payment fees, and any other potential charges.

Comparing Private Lenders and Choosing the Right Refinancing Option

Once you understand your eligibility, the next step is to compare offers from different private lenders. This involves a thorough comparison of various factors.

- Key Factors to Compare: When choosing a private lender, compare interest rates, fees (origination fees, late payment fees, etc.), repayment terms, and customer service reviews.

- Finding Reputable Lenders: Utilize resources like online comparison tools and independent financial advisors to identify reputable lenders.

- Read Reviews and Fine Print: Thoroughly research lenders and read online reviews to assess their reputation. Don't overlook the fine print; carefully review all terms and conditions before signing any loan agreements.

Making the Right Decision on Federal Student Loan Refinancing

Refinancing federal student loans is a substantial financial decision that demands careful consideration. Weighing the potential benefits of lower interest rates against the loss of federal protections is paramount. Remember to thoroughly research lenders and compare offers to find the best option for your individual circumstances.

Refinancing your student loans can provide substantial relief but requires careful planning. Before making a decision on federal student loan refinancing, ensure you fully understand your current loan situation, the eligibility requirements, and the potential trade-offs. Research reputable lenders and compare their offers thoroughly. Making an informed decision can save you significant money in the long run. Need help navigating this process? Consider consulting a financial advisor. Choose wisely and make the best decision for your financial future!

Featured Posts

-

Analyzing Red Carpet Rule Violations Insights From Cnn

May 17, 2025

Analyzing Red Carpet Rule Violations Insights From Cnn

May 17, 2025 -

Angel Reese Faces Tampering Accusations From Wnba Player

May 17, 2025

Angel Reese Faces Tampering Accusations From Wnba Player

May 17, 2025 -

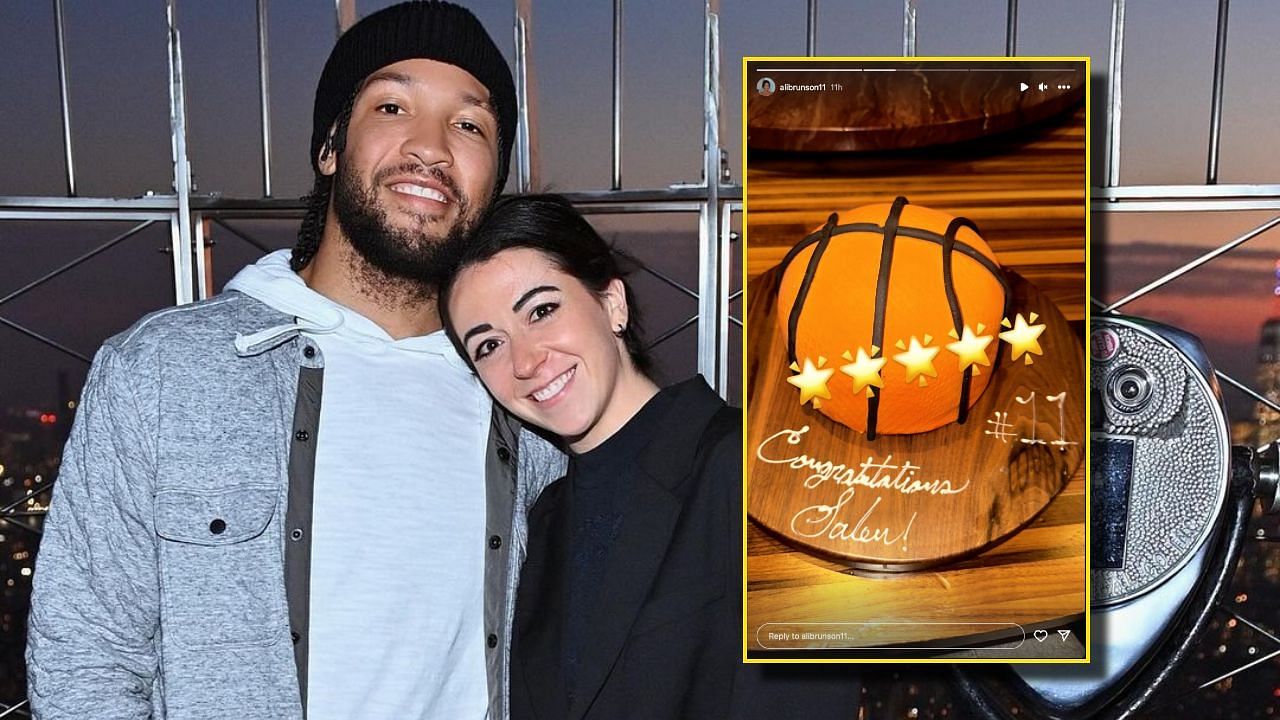

Meet Ali Marks Jalen Brunsons Wife And Partner

May 17, 2025

Meet Ali Marks Jalen Brunsons Wife And Partner

May 17, 2025 -

27 Puntos De Anunoby Impulsan A Knicks A Triunfo 105 91 Ante 76ers

May 17, 2025

27 Puntos De Anunoby Impulsan A Knicks A Triunfo 105 91 Ante 76ers

May 17, 2025 -

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025