Refinancing Federal Student Loans With A Private Lender: What You Need To Know

Table of Contents

Understanding the Benefits of Private Student Loan Refinancing

Refinancing your federal student loans with a private lender can offer several advantages, but it's essential to weigh them carefully against the potential downsides.

Lower Interest Rates

One of the primary benefits of private student loan refinancing is the potential for significantly lower interest rates. Federal student loan interest rates can be relatively high, especially for older loans. By refinancing, you could secure a lower Annual Percentage Rate (APR), leading to substantial savings over the life of the loan.

- Example: Let's say you have $50,000 in federal student loans with a 7% interest rate. Refinancing to a 4% interest rate could save you thousands of dollars in interest over the repayment period and significantly reduce your monthly payment.

- Comparison: Average interest rates on federal student loans often hover above 5%, while private loan rates can range from 3% to 10%, depending on your creditworthiness and the lender. A lower APR can translate to considerable long-term savings.

Simplified Payment Plans

Managing multiple student loans with varying interest rates and repayment schedules can be complex and stressful. Refinancing allows you to consolidate multiple federal loans into a single, simplified payment plan.

- Convenience Factor: Instead of juggling multiple payments, you'll only have one monthly payment to track, making budgeting and repayment easier.

- Interest Rate Types: You can choose between a fixed interest rate (consistent payments throughout the loan term) or a variable interest rate (fluctuates based on market conditions). Fixed rates offer predictability, while variable rates might offer lower initial payments but carry more risk.

Flexible Repayment Terms

Refinancing often provides flexibility in repayment terms. You might be able to choose a shorter loan term to pay off your debt faster (resulting in higher monthly payments but less interest paid overall), or a longer loan term for lower monthly payments (although you'll pay more interest in the long run).

- Shorter Term: A shorter repayment term means faster debt payoff, but with potentially higher monthly payments.

- Longer Term: A longer repayment term results in lower monthly payments, but you'll likely pay more in total interest over the life of the loan.

Potential Drawbacks of Refinancing Federal Student Loans

While refinancing offers potential benefits, it's crucial to understand the significant drawbacks.

Loss of Federal Protections

The most critical drawback is the loss of federal protections. Once you refinance federal student loans with a private lender, you lose access to crucial benefits like:

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payment based on your income.

- Forbearance and Deferment: These options temporarily suspend or reduce your payments during financial hardship.

- Public Service Loan Forgiveness (PSLF): This program forgives remaining loan balances after 10 years of qualifying public service.

Losing these protections could have severe financial consequences if you experience unexpected job loss or financial difficulties.

Credit Score Requirements

Private lenders typically require a good credit score to qualify for refinancing, often needing a score above 660 to get the best rates.

- Credit Score and Interest Rate: A higher credit score usually translates to a lower interest rate.

- Minimum Credit Score: Lenders have varying minimum credit score requirements; some may accept borrowers with lower scores, but at potentially higher interest rates.

Risk of Higher Interest Rates (in Certain Situations)

While refinancing can lower your interest rate, it's not guaranteed. In some cases, you might end up with a higher interest rate than your current federal loan rates, especially if:

- Market conditions: Interest rates fluctuate; if rates rise before you refinance, you might not get a lower rate.

- Poor credit: A low credit score will likely result in a higher interest rate.

How to Determine if Refinancing is Right for You

Before making a decision, carefully assess your situation.

Assess Your Current Financial Situation

Evaluate your income, expenses, and debt-to-income ratio to determine if you can comfortably handle higher monthly payments or a different repayment schedule.

- Budgeting Tools: Use budgeting apps or spreadsheets to track your income and expenses.

- Debt-to-Income Ratio: Calculate your debt-to-income ratio to see how much debt you have relative to your income.

Compare Loan Offers from Multiple Lenders

Don't settle for the first offer you receive. Shop around and compare rates, fees, and repayment terms from several private lenders.

- Online Comparison Tools: Use online comparison tools to quickly compare loan offers from different lenders.

- Check Lender Reviews: Research lender reviews to see what other borrowers have experienced.

Consider Your Long-Term Financial Goals

Align your refinancing decision with your broader financial goals. Does refinancing help you achieve your long-term objectives, such as buying a home or investing?

- Financial Planning: Consider how refinancing impacts your overall financial strategy and long-term objectives.

The Refinancing Process: Step-by-Step Guide

Follow these steps to navigate the refinancing process smoothly.

Check Your Credit Report

Review your credit report for any errors that could impact your eligibility for a lower interest rate.

Shop Around for Lenders

Research and compare loan offers from various private lenders to find the best rates and terms.

Apply and Get Approved

Complete the lender's application process and provide all the necessary documentation.

Understand the Loan Documents

Carefully review all loan documents before signing to ensure you understand the terms and conditions.

Conclusion

Refinancing federal student loans with a private lender can offer significant benefits, such as lower interest rates and simplified payment plans. However, it's essential to consider the potential drawbacks, most notably the loss of federal protections. Carefully weigh the pros and cons, compare offers from multiple lenders, and assess your current financial situation and long-term goals before making a decision. Ready to explore your options for refinancing federal student loans with a private lender? Start your research today!

Featured Posts

-

Apple Tv Discount 3 For 3 Months Hurry

May 17, 2025

Apple Tv Discount 3 For 3 Months Hurry

May 17, 2025 -

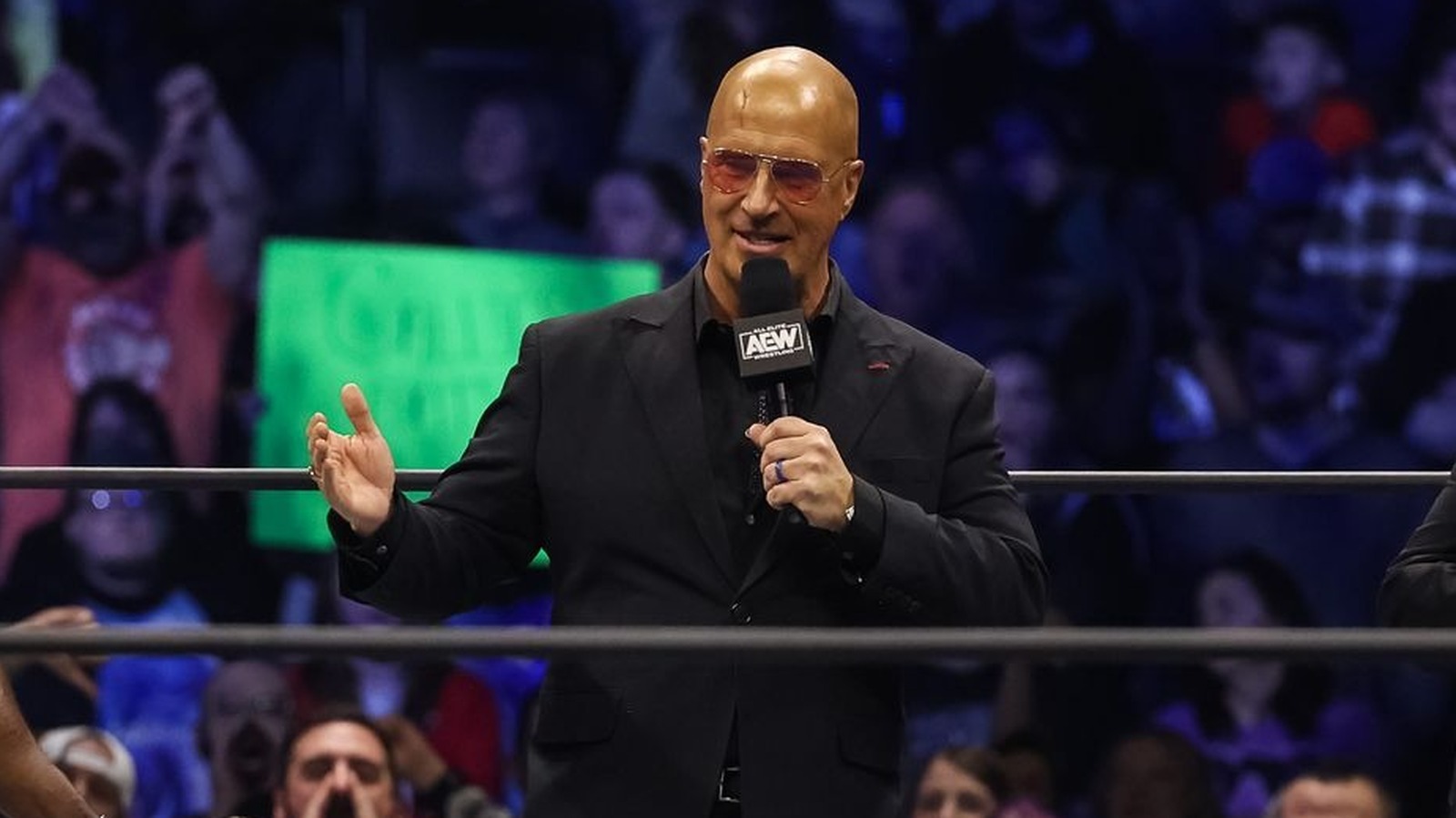

Interview Josh Alexander On Joining Aew His Relationship With Don Callis And More

May 17, 2025

Interview Josh Alexander On Joining Aew His Relationship With Don Callis And More

May 17, 2025 -

Jackbit Casino A Detailed Look At Its Bitcoin Withdrawal Speed

May 17, 2025

Jackbit Casino A Detailed Look At Its Bitcoin Withdrawal Speed

May 17, 2025 -

Lawrence O Donnell Show When Trump Was Humbled On Live Television

May 17, 2025

Lawrence O Donnell Show When Trump Was Humbled On Live Television

May 17, 2025 -

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025