Regulatory Nod For Hengrui Pharma's Hong Kong Listing

Table of Contents

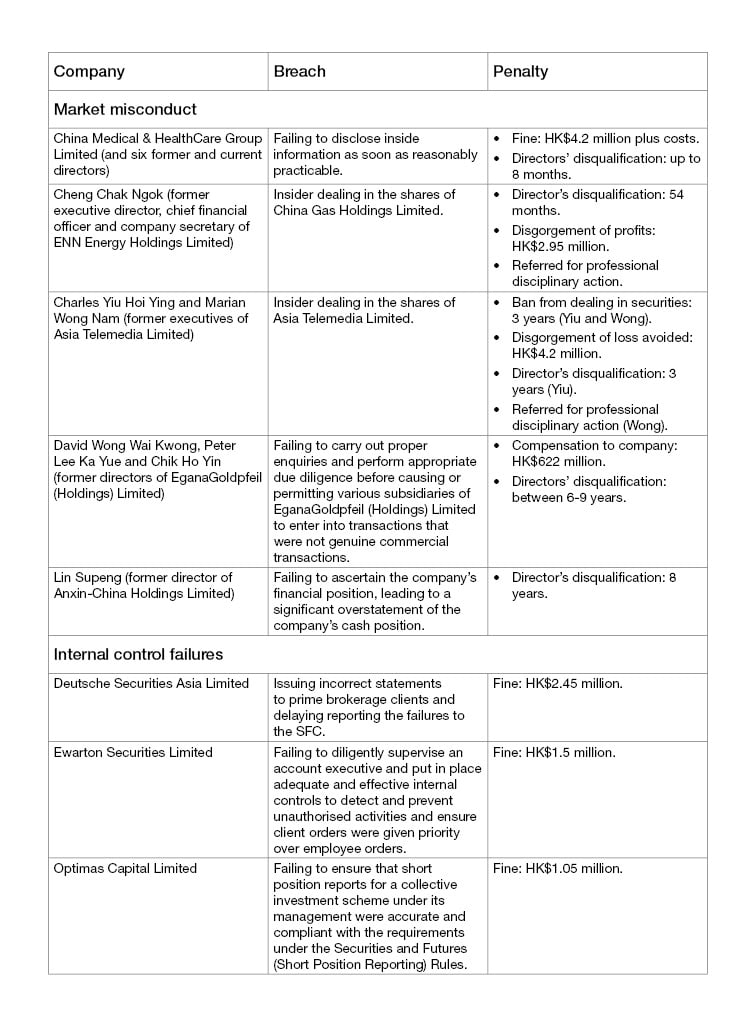

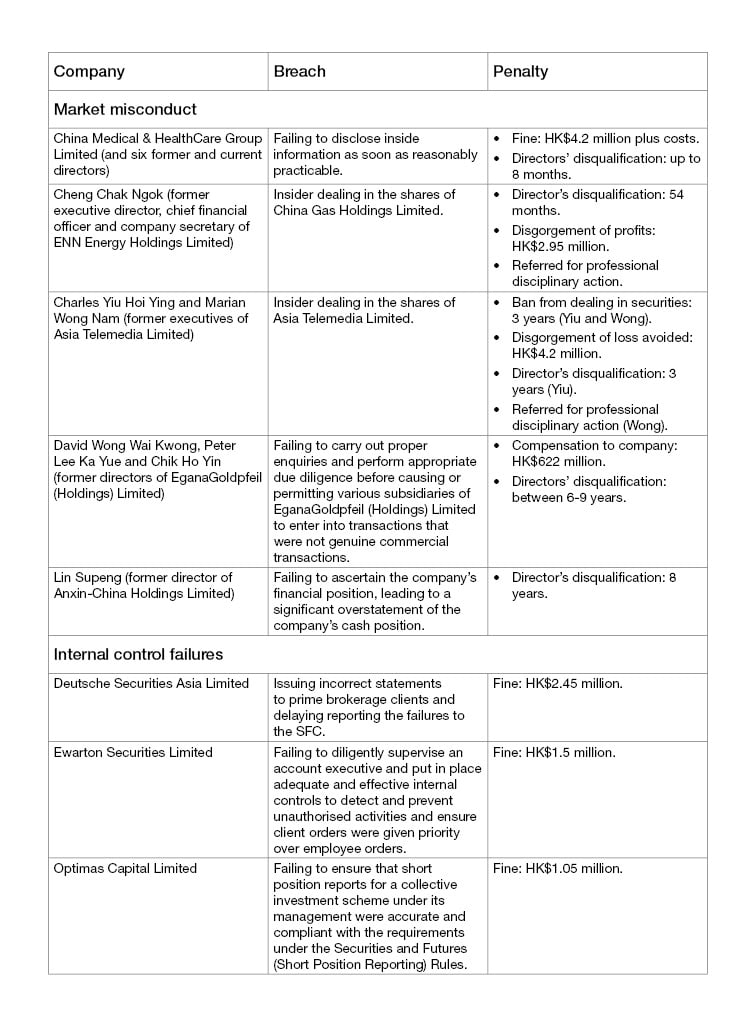

Details of the Hong Kong Listing Approval

The Hong Kong Stock Exchange (HKEX) has officially granted Hengrui Pharma the green light to proceed with its initial public offering (IPO). The rigorous application process, which involved comprehensive scrutiny of the company's financials and operations, concluded successfully. While the exact date of the approval isn't publicly available, the announcement marks the culmination of months of preparation and negotiation. The specifics of the offering, including the number of shares and the expected listing date, will be revealed in subsequent announcements. However, market analysts anticipate a substantial offering, given Hengrui Pharma's size and reputation.

- Regulatory Body: Hong Kong Stock Exchange (HKEX)

- Date of Approval: [Insert Date Once Available]

- Number of Shares to be Offered: [Insert Number Once Available]

- Expected Listing Date: [Insert Date Once Available]

- Specific Requirements Imposed: [Insert Details Once Available – e.g., disclosure requirements, corporate governance standards]

Implications for Hengrui Pharma

This Hong Kong listing presents a wealth of strategic advantages for Hengrui Pharma. The primary benefit lies in accessing a significantly larger pool of capital, crucial for fueling research and development (R&D) initiatives and facilitating further expansion, both domestically and internationally. The diversified funding sources will enhance financial flexibility and reduce reliance on domestic markets.

- Access to New Capital for R&D and Expansion: The IPO will provide substantial funding to accelerate the development of innovative drugs and expand its manufacturing capabilities.

- Diversification of Funding Sources: Reducing reliance on Chinese markets and opening access to a wider investor base mitigates risk.

- Enhanced International Profile and Market Reach: Listing on the HKEX dramatically increases Hengrui Pharma's global visibility and attracts international investors.

- Potential for Increased Valuation: The increased investor interest and enhanced market presence are expected to lead to a higher overall company valuation.

Impact on the Hong Kong Stock Exchange and Market

Hengrui Pharma's listing is poised to inject considerable dynamism into the Hong Kong Stock Exchange. The influx of a major player from China's pharmaceutical sector will likely increase trading volume and liquidity, attracting further investment into the HKEX. This event is also likely to serve as a catalyst, encouraging other Chinese pharmaceutical companies to consider similar listings, thereby bolstering Hong Kong's position as a leading global financial center.

- Increased Trading Activity and Liquidity: The substantial trading volume associated with a large IPO like Hengrui Pharma's will increase market liquidity.

- Attracting Further Investment into the Hong Kong Market: The success of this listing could serve as a powerful incentive for other Chinese firms to consider HKEX.

- Boost to Hong Kong's Position as a Global Financial Center: This further strengthens Hong Kong's reputation as a premier destination for international IPOs.

- Potential Impact on Related Sectors: The listing could have a positive ripple effect on related sectors in the Hong Kong market.

Investor Perspective and Stock Market Predictions

The market reaction to Hengrui Pharma's Hong Kong listing is anticipated to be positive. Many analysts predict strong investor interest, particularly from Asian and international institutional investors seeking exposure to the rapidly growing Chinese pharmaceutical market. However, potential investors should conduct thorough due diligence and assess the inherent risks associated with any investment.

- Analyst Predictions for Stock Price Performance: [Insert Analyst Predictions Once Available]

- Potential Investor Interest from Various Regions: Anticipated interest from Asia, Europe, and the United States.

- Risk Assessment for Potential Investors: Standard investment risks, including market volatility and company-specific factors.

- Comparison to Similar Pharmaceutical Listings: Benchmarking against comparable pharmaceutical IPOs on the HKEX can provide valuable insights.

Conclusion: Hengrui Pharma's Hong Kong Listing – A New Chapter

Hengrui Pharma's successful securing of regulatory approval for its Hong Kong listing represents a momentous occasion, not only for the company itself but also for the Hong Kong Stock Exchange and the wider investment community. The strategic advantages for Hengrui Pharma are clear, including access to substantial capital, a diversified investor base, and enhanced global brand recognition. This milestone is likely to have a significant and positive impact on the Hong Kong market, attracting further investment and solidifying its status as a global financial hub. Follow the Hengrui Pharma Hong Kong listing closely for updates and stay informed on the latest developments in Hengrui Pharma's Hong Kong IPO to capitalize on this exciting investment opportunity.

Featured Posts

-

Car Dealers Intensify Fight Against Electric Vehicle Regulations

Apr 29, 2025

Car Dealers Intensify Fight Against Electric Vehicle Regulations

Apr 29, 2025 -

Como Alberto Ardila Olivares Asegura El Gol Estrategia Y Tecnica

Apr 29, 2025

Como Alberto Ardila Olivares Asegura El Gol Estrategia Y Tecnica

Apr 29, 2025 -

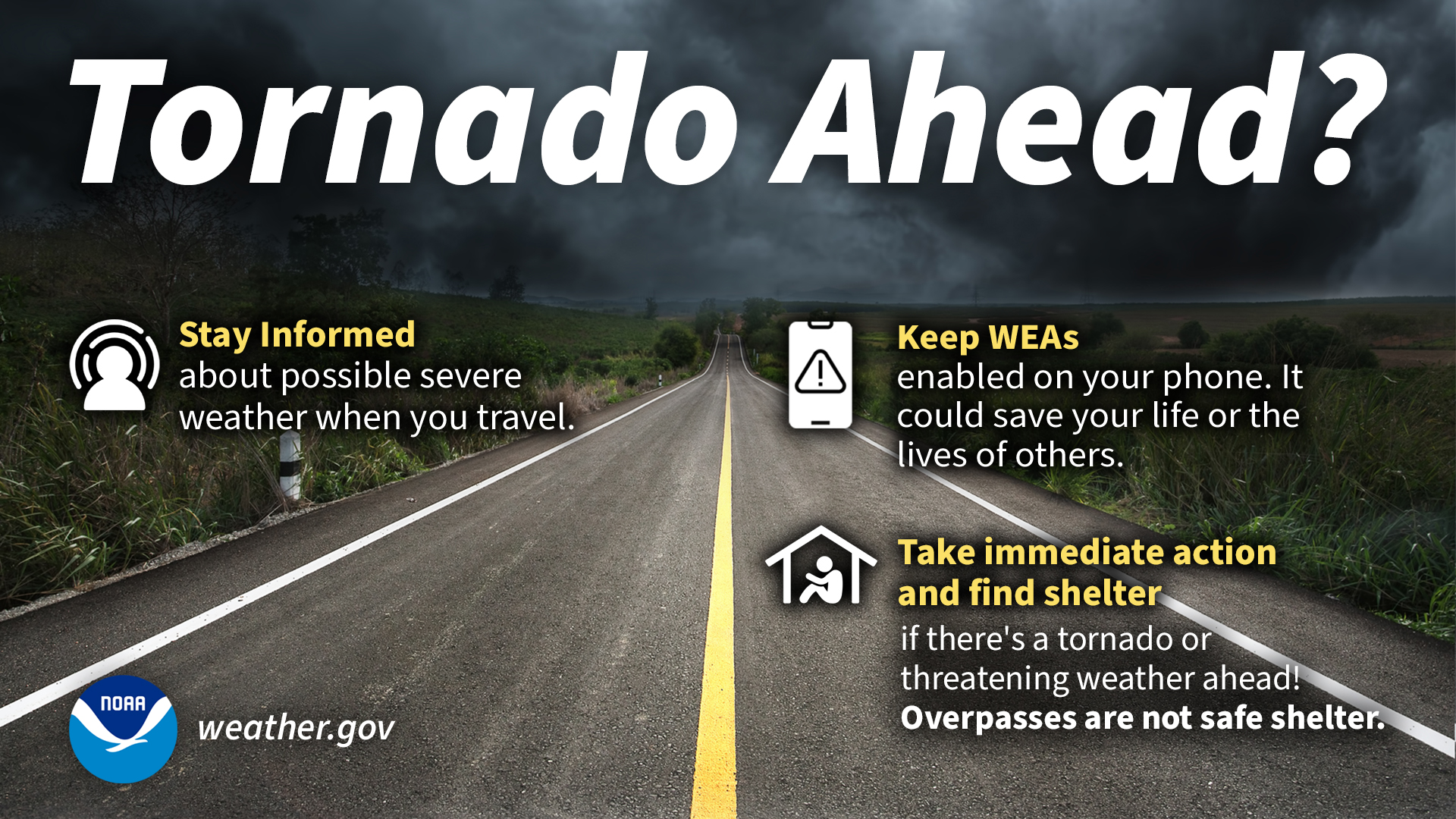

Kentuckys Severe Weather Awareness Week What The Nws Wants You To Know

Apr 29, 2025

Kentuckys Severe Weather Awareness Week What The Nws Wants You To Know

Apr 29, 2025 -

Effective Adhd Management Through Group Support

Apr 29, 2025

Effective Adhd Management Through Group Support

Apr 29, 2025 -

From Street Sweeper To Celebrity The Inspiring Journey Of Macario Martinez

Apr 29, 2025

From Street Sweeper To Celebrity The Inspiring Journey Of Macario Martinez

Apr 29, 2025