Relaxing Regulations: The Indian Insurers' Bond Forward Plea

Table of Contents

The Current Regulatory Landscape for Indian Insurers

The current regulatory framework governing Indian insurers, primarily overseen by the Insurance Regulatory and Development Authority of India (IRDAI), significantly impacts their investment strategies. Insurance Regulation in India, while designed to protect policyholders, has inadvertently imposed limitations on the utilization of sophisticated financial instruments, including bond forwards. These IRDAI regulations restrict insurers' ability to fully optimize their investment portfolios and effectively manage risk. Specific restrictions include:

- Restriction on exposure to specific asset classes: Indian insurers face limitations on the proportion of their assets that can be invested in certain asset classes, including derivatives.

- Limitations on leverage: Regulations restrict the level of leverage insurers can employ, thereby limiting their ability to amplify returns (and potentially losses).

- Compliance requirements and reporting burdens: The extensive compliance procedures and reporting requirements associated with current regulations place a significant administrative burden on insurers.

These Investment restrictions, while well-intentioned, stifle innovation and hinder the sector's competitiveness in the global insurance market. The existing framework often fails to adequately acknowledge the potential benefits of modern risk management tools.

The Case for Relaxing Regulations: Benefits of Bond Forwards

Bond forwards are derivative contracts that allow investors to agree on a future price for a bond. For Indian insurers, this offers a compelling tool for managing risk and enhancing investment returns. Understanding how bond forwards work is key to grasping their potential benefits: the buyer agrees to purchase a bond at a predetermined price on a future date, while the seller agrees to sell it. The key benefits for Indian insurers include:

- Improved risk management: Bond Forward Hedging allows insurers to mitigate interest rate risk, protecting their investment portfolios from fluctuations in bond yields.

- Enhanced investment returns: By strategically using bond forwards, insurers can potentially optimize their investment returns and achieve superior performance.

- Increased liquidity: Accessing bond forwards can improve the liquidity of an insurer's investment portfolio, enabling easier and quicker transactions.

- Better hedging capabilities: These instruments provide superior hedging capabilities against various market risks, enhancing the overall stability of the insurer's financial position.

Specifically, this allows for:

- Hedging against interest rate risk: Protecting against losses caused by interest rate volatility.

- Managing portfolio duration effectively: Fine-tuning the maturity profile of their investment portfolio to better align with their liabilities.

- Accessing broader investment opportunities: Participating in a wider range of investment opportunities not accessible through traditional bond investments.

- Improving capital efficiency: Optimizing capital allocation to maximize returns while maintaining a strong solvency position. This all contributes to Investment Optimization.

Addressing Concerns and Potential Risks

While the potential benefits are significant, the increased use of bond forwards also introduces potential risks that require careful consideration. These include:

- Counterparty risk: The risk that the other party to the contract will default on their obligations.

- Market risk: The risk of losses due to adverse movements in market prices.

- Liquidity risk: The risk of not being able to easily buy or sell the bond forward contract.

- Operational risk: The risk of losses due to failures in internal processes or systems.

However, these risks can be mitigated through appropriate regulatory oversight and robust risk management frameworks. Stricter supervision, increased transparency in the bond forward market, and improved risk assessment methodologies are crucial to ensuring financial stability. The implementation of stringent reporting requirements and regular audits can also help to minimize potential risks. The focus should be on enabling responsible innovation, not stifling it. This requires a proactive approach to Regulatory Oversight and Risk Mitigation.

The Insurers' Plea and Potential Outcomes

The insurers' plea for regulatory relaxation centers on gaining greater flexibility in utilizing bond forwards and similar derivative instruments. Granting this plea could significantly reshape the Indian insurance market landscape, with both positive and negative economic impacts.

- Increased competition within the Indian insurance market: Greater investment flexibility could lead to increased competition and innovation.

- Impact on policyholder premiums: Improved risk management and investment returns could potentially translate into lower premiums for policyholders.

- Potential for greater foreign investment in the sector: A more liberalized regulatory environment could attract greater foreign investment.

- Potential implications for macroeconomic stability: Increased financial stability of insurance companies could contribute positively to macroeconomic stability. But conversely, poorly managed risk could negatively impact financial stability.

The response from regulatory bodies like the IRDAI will be pivotal. A balanced approach that carefully weighs the potential benefits against the risks is essential. Any IRDAI Policy Changes must prioritize consumer protection while fostering growth and innovation within the industry. The path forward requires careful consideration of the Government Regulation and its potential effects on the Financial Market Reform.

Conclusion: A Call for Action: Moving Forward with Relaxed Regulations

Relaxing regulations on bond forwards presents both opportunities and challenges for the Indian insurance sector. While potential risks exist, these can be effectively mitigated through careful oversight and robust risk management frameworks. The potential benefits—improved risk management, enhanced investment returns, and increased competitiveness—significantly outweigh the risks. The debate around relaxing regulations for Indian insurers using bond forwards needs further attention. The future of the Indian insurance sector depends on striking a balance between prudent regulation and enabling the industry to utilize modern financial tools to optimize its performance. We encourage readers to engage in further discussions on this crucial topic and advocate for responsible regulatory reform that supports the growth and stability of the Indian insurance industry. A progressive approach to Relaxing Regulations is crucial for the future of the Indian insurance sector.

Featured Posts

-

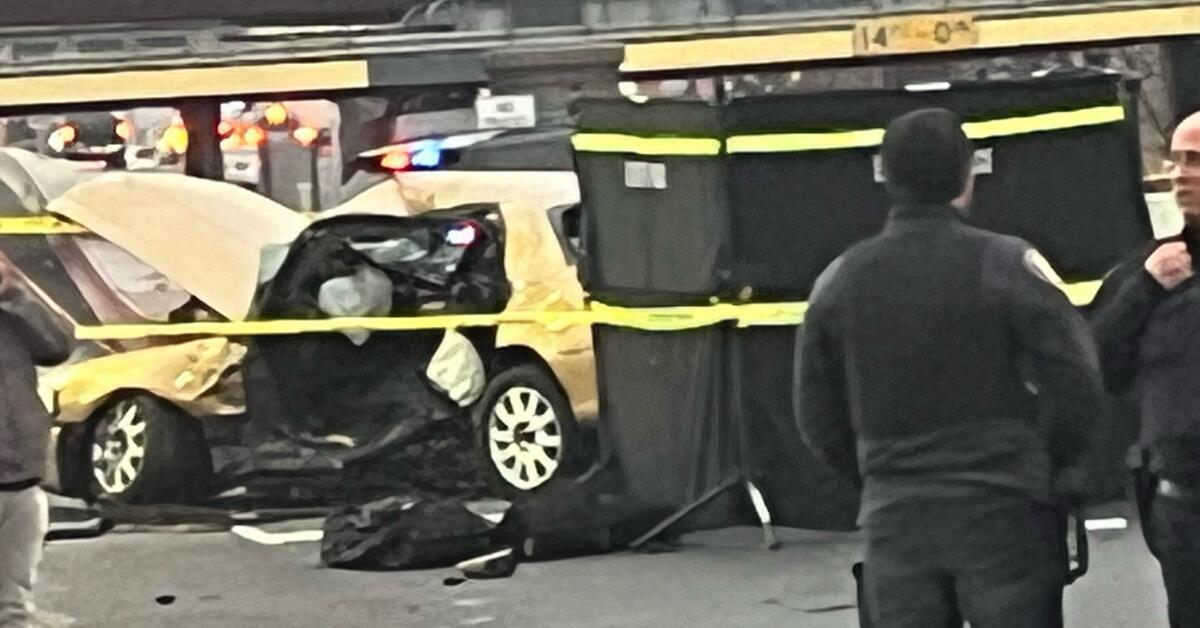

Two Dead After Being Struck By Vehicle In Elizabeth City

May 09, 2025

Two Dead After Being Struck By Vehicle In Elizabeth City

May 09, 2025 -

Scaling Tech And Innovation In Edmonton The New Unlimited Strategy

May 09, 2025

Scaling Tech And Innovation In Edmonton The New Unlimited Strategy

May 09, 2025 -

Unveiling Jeanine Pirros Fox News Persona A Behind The Scenes Look

May 09, 2025

Unveiling Jeanine Pirros Fox News Persona A Behind The Scenes Look

May 09, 2025 -

Njwm Krt Alqdm Waltbgh Qst Idman Wnjah

May 09, 2025

Njwm Krt Alqdm Waltbgh Qst Idman Wnjah

May 09, 2025 -

The Attorney General And Fox News Context And Concerns

May 09, 2025

The Attorney General And Fox News Context And Concerns

May 09, 2025