Reliance Industries' Earnings: Implications For Indian Large-Cap Equities

Table of Contents

Analyzing Reliance Industries' Recent Earnings Report: Decoding RIL's Q[Quarter] Earnings: Key Financial Highlights

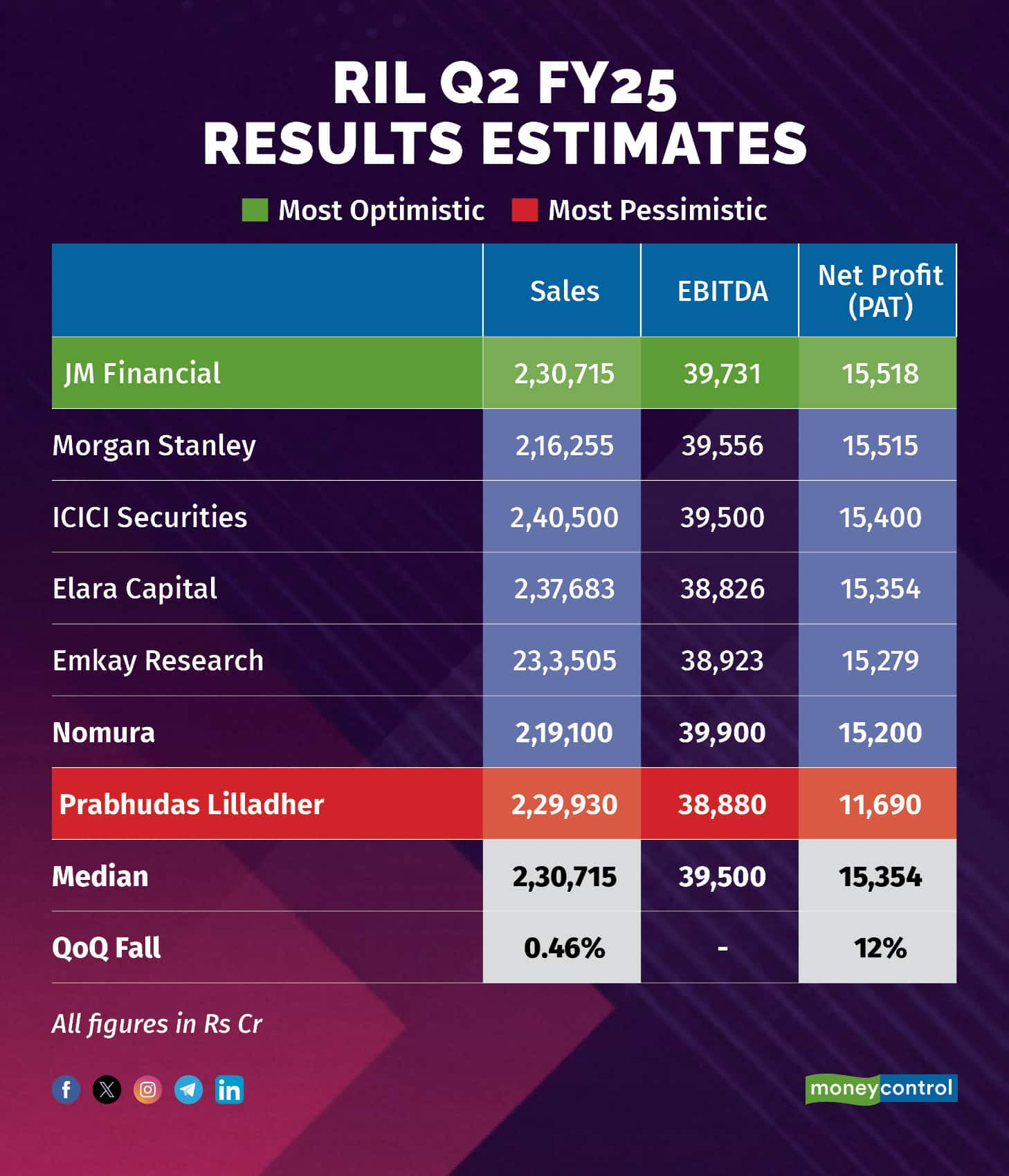

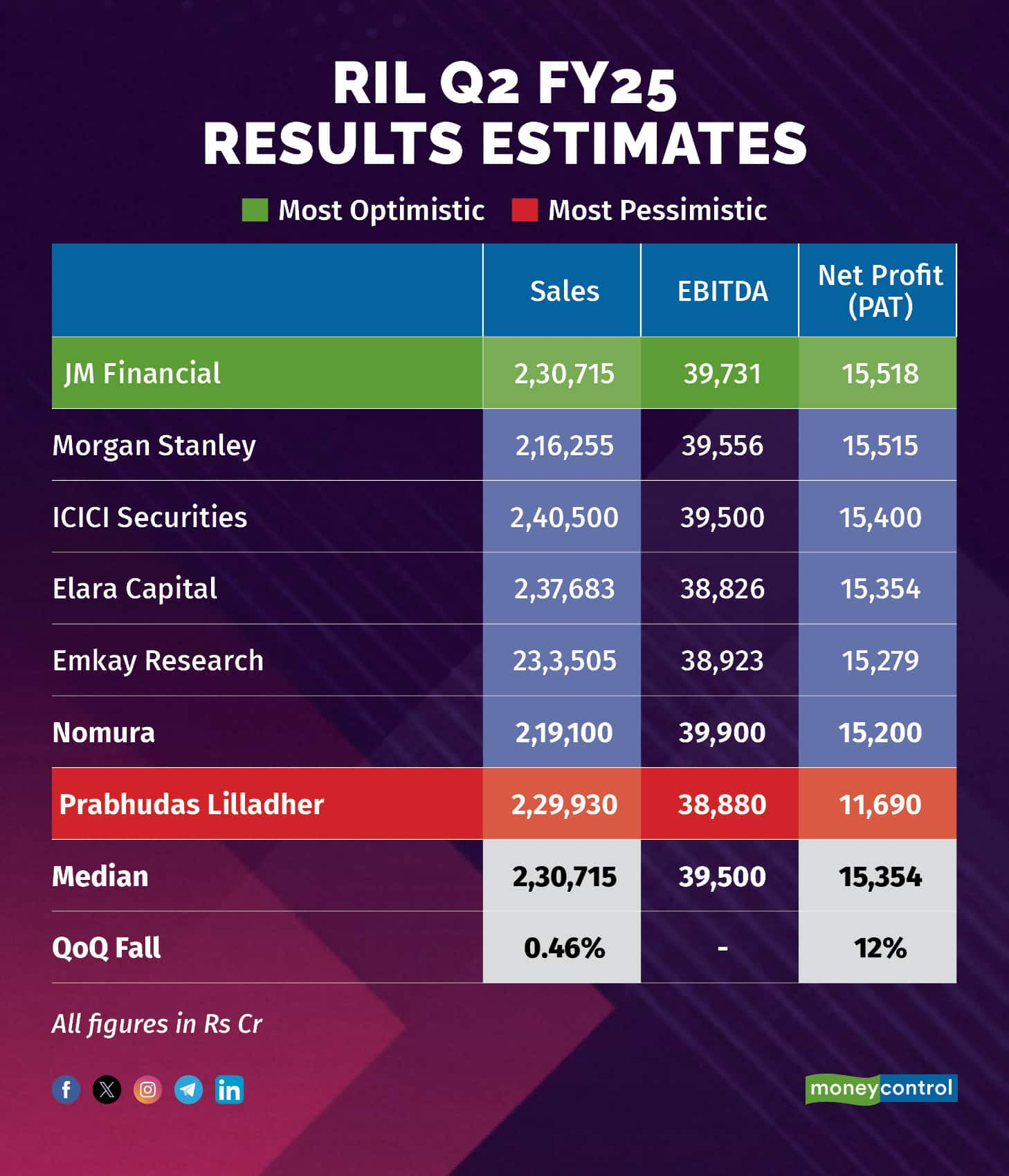

RIL's Q[Quarter] earnings provide valuable insights into the performance of its diverse business segments. Analyzing key performance indicators (KPIs) is essential for understanding the overall health of the company and its future prospects.

- Revenue Growth: [Insert actual revenue growth percentage and compare it to the previous quarter and the same quarter last year. Explain the factors contributing to this growth, e.g., strong performance in Jio Platforms or Reliance Retail.]

- Profit Margins: [Discuss profit margins for the quarter, comparing them to previous periods and industry benchmarks. Analyze any changes and their underlying reasons.]

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): [Present the EBITDA figures and compare them to previous quarters. Highlight any significant changes and provide context.]

- Debt Levels: [Discuss RIL's debt position and any significant changes compared to previous quarters. Analyze its impact on the company's financial health.]

- Segment-wise Performance:

- Reliance Retail: [Analyze Reliance Retail's revenue growth, profitability, and expansion plans. Highlight any key initiatives driving growth.]

- Jio Platforms: [Analyze Jio Platforms' subscriber growth, ARPU (Average Revenue Per User), and profitability. Discuss the impact of 5G rollout and other strategic initiatives.]

- Other Business Segments: [Briefly analyze the performance of other segments, providing relevant data and insights.]

[Insert charts and graphs visually representing the key financial highlights. Clearly label all axes and provide a concise title for each chart.] Understanding RIL's financial performance requires a deep dive into these key figures. Analyzing RIL financial performance data is crucial for informed investment decisions.

Impact on Investor Sentiment and Market Reaction: Market Response to RIL Earnings: Stock Price Movement and Investor Confidence

The market's reaction to RIL's earnings announcement provides valuable insights into investor sentiment and confidence.

- Stock Price Movement: [Describe the immediate impact of the earnings release on RIL's stock price. Quantify the changes (percentage increase or decrease) and analyze the trading volume.]

- Investor Sentiment: [Analyze how the earnings announcement affected investor confidence in RIL. Were investors pleased with the results or disappointed? Mention any news articles or analyst comments reflecting the prevailing sentiment.]

- Analyst Ratings: [Mention any changes in analyst ratings following the earnings release. Did analysts upgrade or downgrade their recommendations? What were their justifications?]

- Market Volatility: [Discuss the impact of the earnings announcement on market volatility. Did the news cause significant fluctuations in the broader market or was the impact limited to RIL's stock?] Tracking RIL stock price fluctuations is crucial to understanding the market’s reaction to the Reliance Industries revenue figures.

The analysis of RIL stock price and market volatility provides a clear picture of the immediate market impact of the earnings report. This data is crucial for understanding investor sentiment.

Broader Implications for Indian Large-Cap Equities: Ripple Effects: How RIL Earnings Affect the Indian Large-Cap Index

RIL's substantial market capitalization and influence on various sectors make its performance highly relevant to the overall health of the Indian large-cap equity market.

- Interconnectedness: [Explain how RIL's performance affects other large-cap companies, particularly those in related sectors like telecom, retail, and energy.]

- Spillover Effects: [Discuss the potential spillover effects on other large-cap companies. For instance, strong performance in Reliance Retail might positively influence other retail stocks.]

- Impact on Indices: [Analyze the impact of RIL's earnings on major market indices like the Nifty 50 and Sensex. How much did RIL's performance contribute to the overall index movement?]

- Macroeconomic Factors: [Discuss any macroeconomic factors that might influence the impact of RIL's earnings on the broader market. For example, overall economic growth, inflation, or global market conditions.]

The interconnectedness between RIL and the Indian stock market index (such as the Nifty 50 and Sensex) cannot be ignored. Understanding the sectoral impact is crucial for assessing the overall health of the large-cap stocks.

Future Outlook and Investment Strategies: Looking Ahead: Investment Strategies in Light of RIL's Performance

Based on the recent earnings report and current market conditions, it's crucial to assess the future outlook for RIL and its implications for investment strategies.

- Future Outlook: [Discuss the future prospects for RIL, considering its ongoing initiatives and the competitive landscape. Are there any potential headwinds or tailwinds?]

- Investment Strategies: [Offer some potential investment strategies for investors interested in RIL or other large-cap equities. This could include buy, hold, or sell recommendations, depending on the analysis. Disclaimer: This information is for educational purposes only and should not be considered financial advice.]

- Risks and Opportunities: [Highlight the potential risks and opportunities associated with investing in RIL and the broader Indian large-cap market. Factors such as economic uncertainty, geopolitical risks, and regulatory changes should be considered.]

Conclusion: Reliance Industries' Earnings and their Significance for Indian Large-Cap Equities

RIL's earnings significantly impact the Indian large-cap equity market. Analyzing Reliance Industries earnings provides crucial insights into the overall health and future prospects of the Indian economy. The recent report revealed [summarize key findings, including revenue growth, profit margins, and impact on investor sentiment]. Understanding RIL's performance is crucial for investors interested in Indian large-cap equities. Stay tuned for our next analysis on Reliance Industries' performance and its continuing impact on the Indian large-cap market. Understanding Reliance Industries earnings is key to making informed investment decisions within the dynamic Indian stock market.

Featured Posts

-

Will Netflix Release A Tremor Series What We Know So Far

Apr 29, 2025

Will Netflix Release A Tremor Series What We Know So Far

Apr 29, 2025 -

Australias Lynas Needs Us Assistance For Texas Rare Earths Refinery Project

Apr 29, 2025

Australias Lynas Needs Us Assistance For Texas Rare Earths Refinery Project

Apr 29, 2025 -

Yukon Mining Inquiry Contempt Motion Looms Over Uncooperative Manager

Apr 29, 2025

Yukon Mining Inquiry Contempt Motion Looms Over Uncooperative Manager

Apr 29, 2025 -

Trump Condemns Mlbs Pete Rose Decision Vows Posthumous Pardon

Apr 29, 2025

Trump Condemns Mlbs Pete Rose Decision Vows Posthumous Pardon

Apr 29, 2025 -

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025