Renewed Trade War Tensions Send Dutch Stocks Lower

Table of Contents

The Impact of Renewed Trade War Tensions on the Dutch Economy

The Dutch economy is deeply intertwined with global trade, making it particularly vulnerable to trade war escalations. The Netherlands is a major exporter and relies heavily on international trade for economic growth. Renewed trade tensions create significant uncertainty, impacting various sectors.

- Increased uncertainty impacting Dutch exports: Trade wars lead to unpredictable tariffs and trade restrictions, making it difficult for Dutch businesses to forecast demand and plan their exports. This uncertainty discourages investment and slows economic growth.

- Potential for supply chain disruptions affecting Dutch businesses: The Netherlands is a crucial hub in many global supply chains. Trade disruptions can lead to delays, increased costs, and shortages of essential goods and materials for Dutch companies.

- Decline in investor confidence leading to capital flight: Uncertainty about the future economic outlook can lead to decreased investor confidence, causing investors to pull their money out of the Dutch market, further depressing stock prices.

- Specific examples of Dutch sectors heavily impacted: Sectors such as agriculture (especially horticulture exports), technology (dependent on global supply chains), and logistics are particularly vulnerable to trade war disruptions. The agricultural sector, for example, relies heavily on exports, and increased tariffs can significantly reduce profitability.

The vulnerability of specific Dutch industries to trade wars is evident in recent export figures. Reports from the Netherlands Bureau for Economic Policy Analysis (CPB) show a notable decline in export growth following the escalation of trade tensions. This data highlights the direct link between international trade disputes and the performance of the Dutch economy.

Analysis of the Decline in Dutch Stock Market Indices

The renewed trade war tensions have had a noticeable impact on key Dutch stock market indices, particularly the AEX (Amsterdam Exchange Index), a benchmark for Dutch equities.

- Percentage drop in major indices since the escalation of trade tensions: The AEX has experienced a significant percentage drop since the latest round of trade war escalations began (Insert specific percentage and timeframe here, citing a reputable source like the Amsterdam Stock Exchange website or a major financial news outlet).

- Comparison with other European stock markets: While other European markets have also felt the impact of global uncertainty, the decline in the AEX has been (Insert comparative data, either higher or lower, citing reliable sources).

- Identification of specific companies experiencing significant drops: Certain sectors, like those mentioned above, have seen some of their constituent companies experience particularly sharp drops in their share prices. (Include specific examples, citing reliable sources)

- Technical analysis of market trends: (If applicable, include a brief technical analysis of the market trends based on charts and graphs from reputable financial sources).

[Insert chart or graph illustrating the decline in the AEX and other relevant indices. Source should be clearly cited.]

Investor Sentiment and Future Outlook for Dutch Stocks

Investor sentiment regarding Dutch equities is currently cautious. Many investors are adopting a wait-and-see approach.

- Analysis of investor behavior (e.g., selling, holding, buying): Recent market activity suggests a higher level of selling than buying, indicating a general risk-averse sentiment. (Cite relevant data on trading volumes and investor behavior from reputable sources).

- Prediction of short-term and long-term impacts: The short-term outlook remains uncertain, with further declines possible depending on the evolution of trade tensions. The long-term impact will depend largely on the resolution of trade disputes and the overall global economic climate.

- Discussion of potential government interventions or policies: The Dutch government may introduce fiscal or monetary policies to mitigate the impact of the trade war on the economy. (Discuss potential policies and their potential effectiveness, citing relevant news sources or government publications).

- Expert opinions from financial analysts: (Include quotes from financial experts and analysts offering their perspectives on the situation and future outlook for Dutch stocks. Cite the sources appropriately).

Safeguarding Investments in the Current Climate

Investors concerned about their Dutch stock portfolio should consider implementing the following strategies:

- Diversification strategies to mitigate risk: Diversifying investments across different asset classes (bonds, real estate, etc.) and geographic regions can significantly reduce overall portfolio risk.

- Importance of risk assessment and tolerance: Investors should honestly assess their risk tolerance and adjust their portfolios accordingly. A risk-averse investor may choose to reduce their exposure to Dutch stocks.

- Potential alternative investment options: Explore alternative investment options that may be less susceptible to trade war impacts.

- Recommendations for monitoring market conditions: Regularly monitor market news, economic indicators, and geopolitical developments to stay informed and adapt your investment strategy as needed. Utilize reliable financial news sources and potentially consider professional financial advice.

Conclusion

Renewed trade war tensions have significantly impacted Dutch stocks, creating uncertainty and prompting a decline in key indices like the AEX. The interconnectedness of the Dutch economy with global trade makes it particularly vulnerable to these external shocks. Investors need to carefully assess their risk tolerance and diversify their portfolios to mitigate the potential impact.

Call to Action: Stay informed about the latest developments affecting Dutch stocks and the global economy to make informed investment decisions. Consider consulting a financial advisor to assess your risk tolerance and create a diversified investment strategy. Regularly monitor your portfolio and adapt your strategy as needed to navigate the fluctuating landscape of Dutch stocks. Understanding the intricacies of the Dutch stock market and global economic trends is vital for successful investing.

Featured Posts

-

Penzionerski Raj Luksuzni Zivot I Milionsko Bogatstvo

May 25, 2025

Penzionerski Raj Luksuzni Zivot I Milionsko Bogatstvo

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025 -

Porsche 356 Zuffenhausen Sejarah Produksi Dan Warisan Jerman

May 25, 2025

Porsche 356 Zuffenhausen Sejarah Produksi Dan Warisan Jerman

May 25, 2025 -

Live Update Kapitaalmarktrentes En Euro Dollar Wisselkoers

May 25, 2025

Live Update Kapitaalmarktrentes En Euro Dollar Wisselkoers

May 25, 2025 -

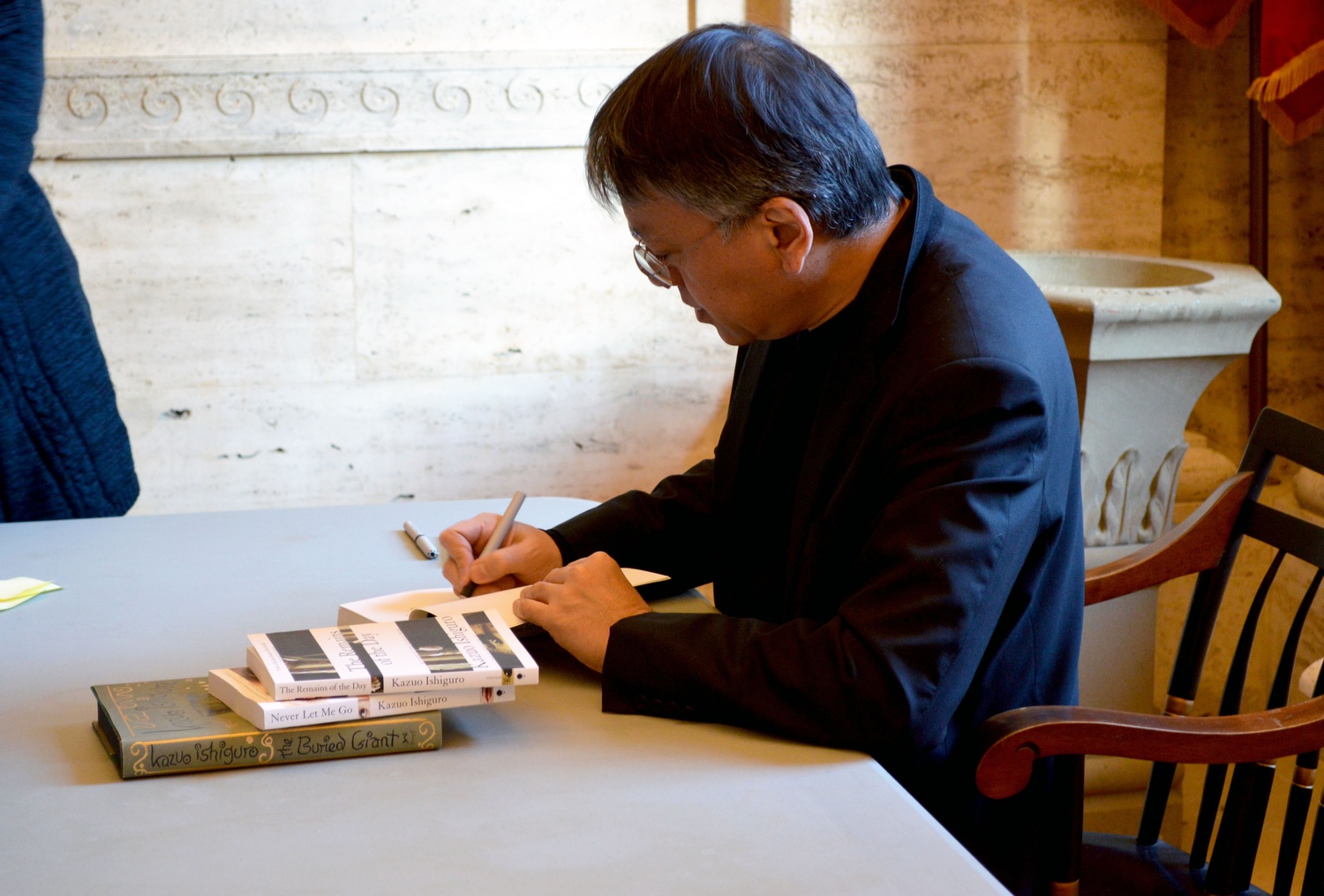

The Role Of Imagination In Kazuo Ishiguros Exploration Of Memory

May 25, 2025

The Role Of Imagination In Kazuo Ishiguros Exploration Of Memory

May 25, 2025