Republican Revolt: Will Trump's Tax Plan Face Defeat?

Table of Contents

The Sources of Republican Opposition to Trump's Tax Plan

The Republican party is far from unified on Trump's tax plan. Several factions harbor serious reservations, creating a potent source of opposition that could prove insurmountable. These disagreements stem from a variety of concerns, ranging from fiscal responsibility to ideological differences.

- Fiscal Conservatism: A significant segment of Republicans, particularly those with a strong fiscal conservative stance, express deep concern about the plan's potential to exacerbate the national debt. They argue that the proposed tax cuts, while potentially stimulating short-term economic growth, are not fiscally sustainable in the long run.

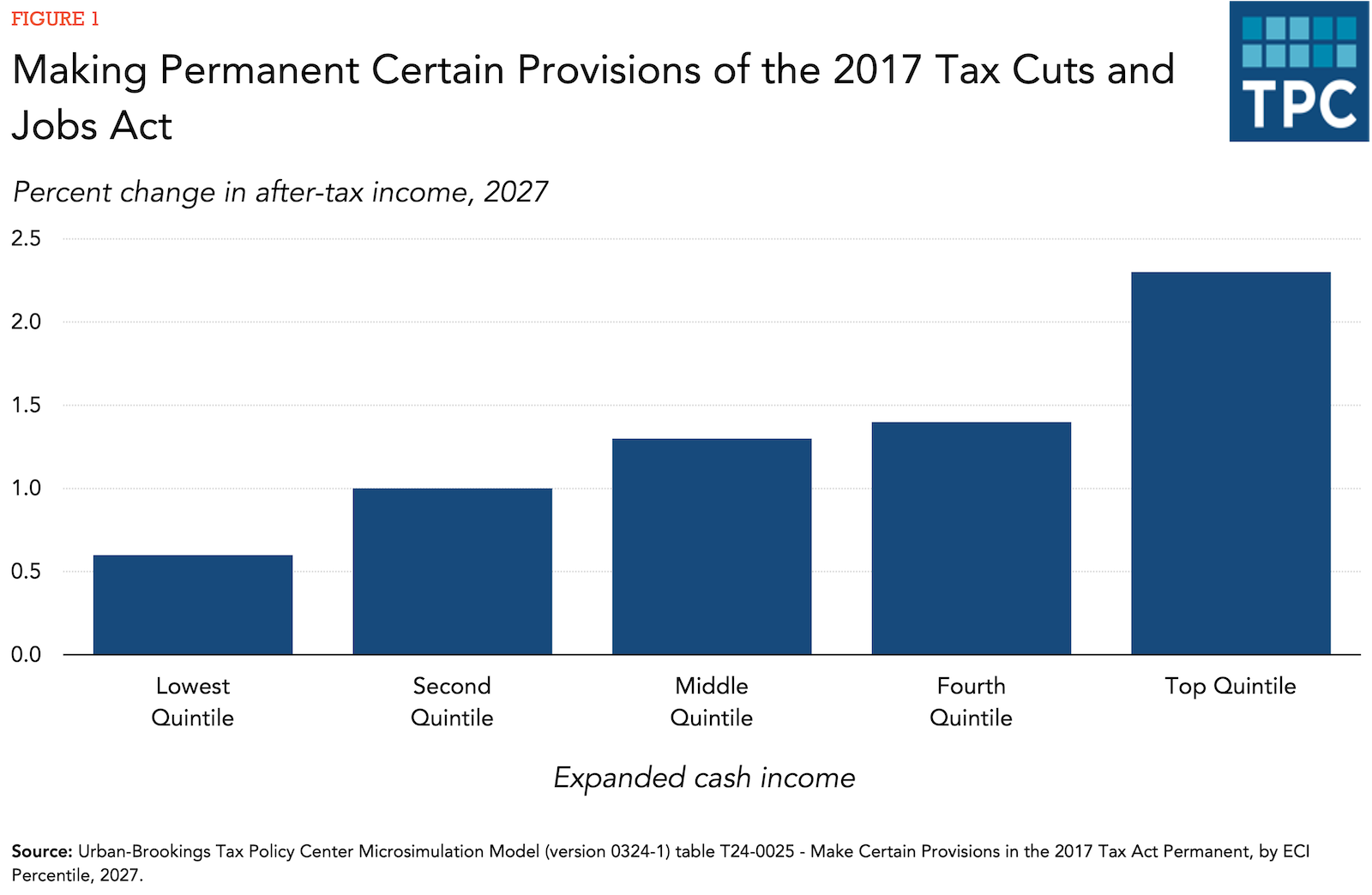

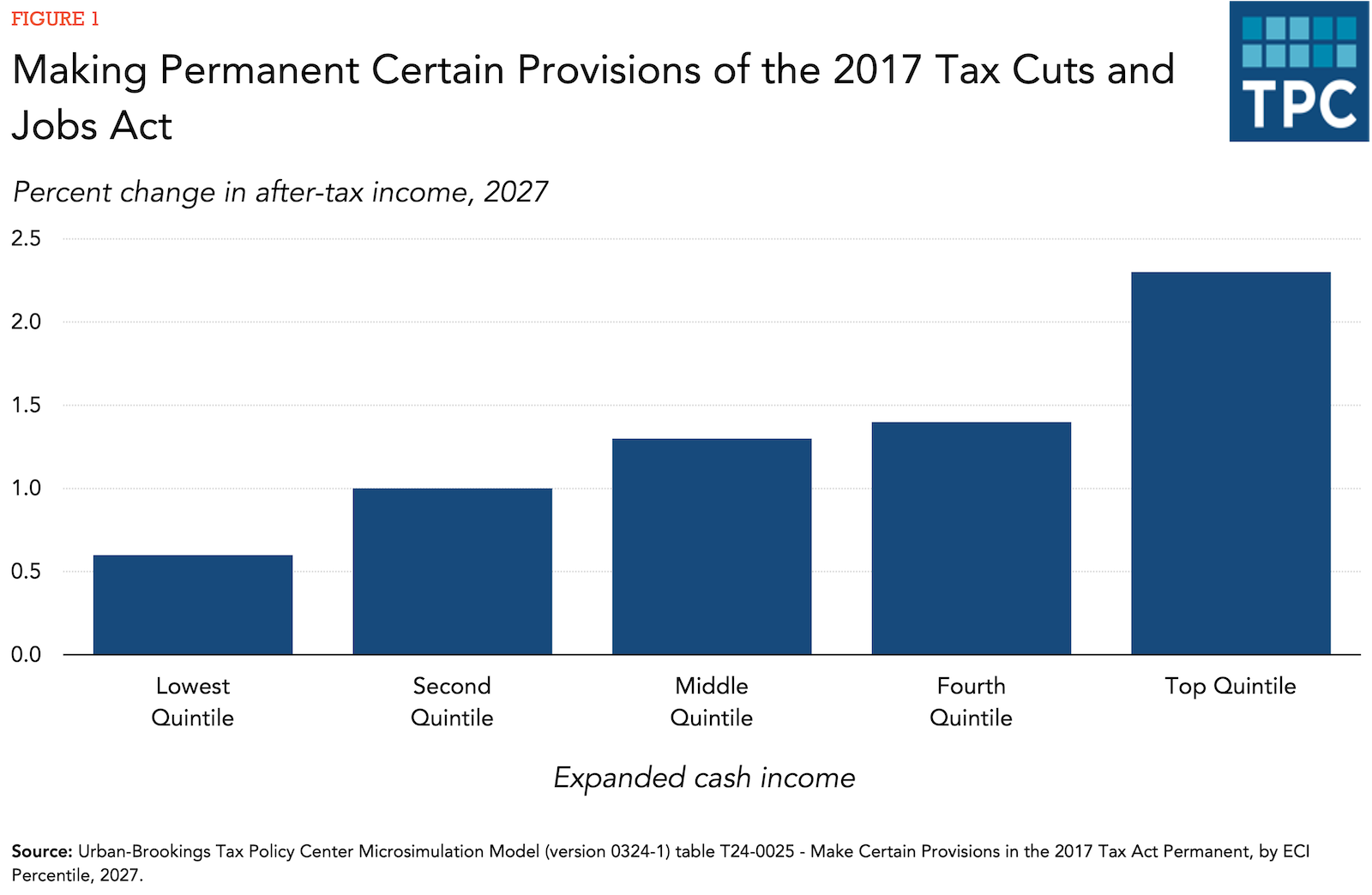

- Distribution of Tax Benefits: Another point of contention is the distribution of tax benefits. Critics argue the plan disproportionately favors corporations and the wealthy, while offering limited relief to middle- and lower-income families. This disparity has sparked outrage amongst some Republicans who champion a more equitable tax system.

- Ideological Objections: Certain aspects of the plan, such as proposed loopholes or preferential treatment for specific industries, clash with the core principles of some Republicans. These ideological objections represent a powerful impediment to securing unanimous party support.

- Economic Sustainability: Beyond the national debt, concerns exist regarding the plan's overall economic sustainability. Some economists argue that the proposed cuts could lead to inflation or other negative economic consequences, undermining the very economic growth it aims to stimulate.

Prominent Republican figures like Senator [Insert Name and State] have publicly voiced their concerns, stating [Insert Quote expressing opposition to a specific aspect of the plan]. This internal dissent significantly complicates the path towards legislative success for Trump's tax plan.

The Potential Consequences of a Failed Trump Tax Plan

The failure of Trump's tax plan would carry significant political and economic consequences. The repercussions extend far beyond the immediate legislative defeat.

- Political Ramifications: A failed tax plan would represent a major political setback for President Trump and the Republican party. It would erode public trust and potentially damage the party's standing heading into the next election cycle. The loss of political capital could cripple the administration's ability to push through other legislative priorities.

- Economic Fallout: Economically, a failed tax plan could negatively impact investor confidence and lead to market volatility. Uncertainty surrounding tax policy could discourage investment and hinder economic growth, potentially triggering a slowdown.

The potential consequences are severe:

- Significant loss of political capital for President Trump and the Republican party.

- Negative impacts on investor confidence and potential economic downturn.

- Increased political polarization and further legislative gridlock.

- Damage to the Republican party's image and credibility among voters.

Strategies Trump Might Employ to Secure Passage of His Tax Plan

Despite the challenges, the Trump administration may still employ several strategies to salvage the tax plan. The path to success, however, requires deft political maneuvering.

- Negotiation and Compromise: Trump might need to negotiate significant compromises with dissenting Republicans, potentially scaling back certain aspects of the plan to garner sufficient support. This approach requires a willingness to compromise and a nuanced understanding of the political landscape.

- Public Relations Campaign: A well-orchestrated public relations campaign designed to highlight the supposed benefits of the plan could sway public opinion and pressure wavering Republicans to support the measure. Effectively showcasing the plan's potential positive impact is crucial.

- Executive Orders: In some areas, Trump might attempt to achieve some of the plan's objectives through executive orders, bypassing the need for Congressional approval. However, this strategy has limitations and might face legal challenges.

- Bipartisan Support: While unlikely, seeking support from Democratic lawmakers could provide the crucial votes needed to pass the tax plan. This would require significant concessions and a willingness to work across the aisle.

Predicting the Future of Trump's Tax Plan

Predicting the fate of Trump's tax plan is challenging, given the multitude of conflicting factors at play. However, considering the deep divisions within the Republican party and the significant economic and political risks associated with the plan, the likelihood of its complete passage in its current form appears low.

Several scenarios are plausible:

- Scenario 1 (Low Probability): The plan passes largely unchanged, securing enough Republican support to overcome Democratic opposition. This would require significant concessions from the President.

- Scenario 2 (Medium Probability): The plan is significantly amended through negotiations and compromises, resulting in a watered-down version that secures passage.

- Scenario 3 (High Probability): The plan fails to pass Congress, leading to significant political and economic consequences. Key provisions are abandoned, or the entire bill is withdrawn.

Conclusion

The Republican revolt against Trump's tax plan presents a significant hurdle to its passage. The sources of opposition are diverse, ranging from fiscal concerns to ideological objections. The potential consequences of failure are substantial, encompassing both political damage and economic uncertainty. While the administration might employ various strategies to secure passage, the likelihood of the original plan surviving in its current form seems slim. The coming weeks will be crucial in determining the ultimate fate of Trump's tax plan. Stay informed about the latest developments on Trump's tax plan and share your thoughts in the comments below!

Featured Posts

-

Securing Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

Securing Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025 -

Estudio Del Gol De Alberto Ardila Olivares Tecnica Y Eficacia

Apr 29, 2025

Estudio Del Gol De Alberto Ardila Olivares Tecnica Y Eficacia

Apr 29, 2025 -

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

Apr 29, 2025

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

Apr 29, 2025 -

Us Shoppers Bear The Brunt How Trump Tariffs Inflate Temu Prices

Apr 29, 2025

Us Shoppers Bear The Brunt How Trump Tariffs Inflate Temu Prices

Apr 29, 2025 -

Ohio Doctors Murder Conviction Son Grapples With Impending Parole Hearing

Apr 29, 2025

Ohio Doctors Murder Conviction Son Grapples With Impending Parole Hearing

Apr 29, 2025