Resorts World Casino Fined $10.5 Million: Money Laundering Case Details

Table of Contents

The Accusations: How Resorts World Casino Allegedly Facilitated Money Laundering

The accusations against Resorts World Casino center on allegations that the casino knowingly or unknowingly facilitated money laundering activities. While specific details of the transactions remain partially undisclosed due to ongoing investigations and legal proceedings, the accusations paint a picture of systemic failures in AML compliance. The regulatory body involved, [Insert Name of Regulatory Body, e.g., the New York State Gaming Commission], alleged a pattern of suspicious activity, indicating a potential breakdown in internal controls.

- Details of suspicious transactions: Reports suggest a series of high-value transactions that lacked the necessary documentation and transparency required for AML compliance. These included instances of structuring transactions (breaking down large sums into smaller deposits to avoid detection) and the use of shell companies to obscure the origin of funds. [Insert more details if publicly available – be cautious about including unsubstantiated claims].

- Alleged methods used to launder money: Investigators reportedly uncovered evidence suggesting the use of various methods, including the purchase of high-value chips with cash, followed by the quick conversion of those chips into less traceable forms of payment.

- The role of specific casino personnel: While the investigation hasn't publicly named specific individuals, the accusations suggest potential complicity or negligence on the part of casino employees responsible for monitoring and reporting suspicious activity.

- Mention of specific regulatory bodies involved in the investigation: The [Insert Name of Regulatory Body] led the investigation, collaborating with other agencies (if applicable) to thoroughly examine the Resorts World Casino's financial transactions and internal controls.

The $10.5 Million Fine: Breakdown and Implications

The $10.5 million fine represents a significant financial blow to Resorts World Casino. While the exact breakdown of the penalty isn't publicly available in full detail, it's understood to be a single, comprehensive penalty addressing the severity of the violations. Beyond the monetary fine, the casino faces potential long-term consequences.

- Specific amounts for each penalty (if applicable): [Insert details if available. If not, state that the exact breakdown is not yet public knowledge].

- How the fine compares to other similar cases in the casino industry: This fine is [insert comparison, e.g., among the largest, comparable to, smaller than] other penalties levied against casinos for similar AML violations, indicating the seriousness of the allegations against Resorts World Casino.

- The financial impact of the fine on Resorts World Casino: The substantial fine will undoubtedly impact the casino's profitability and financial stability. It may necessitate budget cuts, changes to investment strategies, or other measures to offset the loss.

- Potential legal repercussions beyond the fine: Aside from the monetary penalty, the casino may face further legal action, including potential license suspension or revocation, depending on the outcome of any ongoing investigations or lawsuits.

Regulatory Response and Anti-Money Laundering Measures

The regulatory response to the Resorts World Casino money laundering case has been swift and decisive. Beyond the significant financial penalty, the regulatory body is conducting a comprehensive review of the casino’s AML compliance program and internal controls.

- Review of Resorts World Casino's AML compliance program: The regulatory body's investigation likely included a thorough examination of the casino's AML program's effectiveness, identifying weaknesses and areas needing improvement.

- Details of regulatory investigations and audits: The investigation involved detailed scrutiny of financial transactions, employee background checks, and a review of security protocols. Further audits may be conducted to ensure compliance with AML regulations.

- Changes implemented by Resorts World Casino to improve AML compliance: In response to the findings, Resorts World Casino is likely implementing significant changes to bolster its AML compliance, including enhancements to its training programs, technology upgrades, and internal reporting procedures.

- Discussion of broader implications for AML regulations within the casino industry: This case highlights the ongoing need for stronger AML regulations and enhanced oversight within the casino industry to prevent future incidents of money laundering.

Strengthening AML Compliance in the Casino Industry

The Resorts World Casino case serves as a cautionary tale for the entire casino industry. Preventing similar incidents requires a multi-pronged approach focusing on robust compliance programs, employee training, and advanced technological solutions.

- Best practices for AML compliance in casinos: Implementing robust Know Your Customer (KYC) protocols, enhanced transaction monitoring systems, and regular employee training on AML procedures are crucial.

- Importance of employee training and awareness: Casino employees at all levels need comprehensive training to recognize and report suspicious activity effectively.

- Technological solutions for enhancing AML compliance: Utilizing advanced technologies, such as AI-powered transaction monitoring systems, can significantly enhance the detection of suspicious patterns and improve AML compliance.

- The role of regulatory oversight in preventing money laundering: Strong regulatory oversight and consistent enforcement are essential in deterring money laundering activities and ensuring compliance across the industry.

Conclusion

This case against Resorts World Casino underscores the critical importance of robust anti-money laundering measures within the casino industry. The $10.5 million fine serves as a stark reminder of the severe consequences of failing to comply with regulations and the significant financial and reputational risks involved. Understanding the complexities of Resorts World Casino money laundering and similar cases is crucial for all stakeholders. Learn more about AML compliance and its impact on the casino industry by [link to related resource/further reading]. Staying informed about Resorts World Casino money laundering and similar cases is vital for preventing future incidents and ensuring the integrity of the gaming sector.

Featured Posts

-

Stephen Miller A Former Colleague Exposes His Horrible Behavior

May 18, 2025

Stephen Miller A Former Colleague Exposes His Horrible Behavior

May 18, 2025 -

7 Bit Casino Review A Top Choice For New Zealand Players

May 18, 2025

7 Bit Casino Review A Top Choice For New Zealand Players

May 18, 2025 -

Bin Laden A Retrospective On The American Manhunt And Its Aftermath

May 18, 2025

Bin Laden A Retrospective On The American Manhunt And Its Aftermath

May 18, 2025 -

Alcaraz En Montecarlo Celebracion Y Victoria

May 18, 2025

Alcaraz En Montecarlo Celebracion Y Victoria

May 18, 2025 -

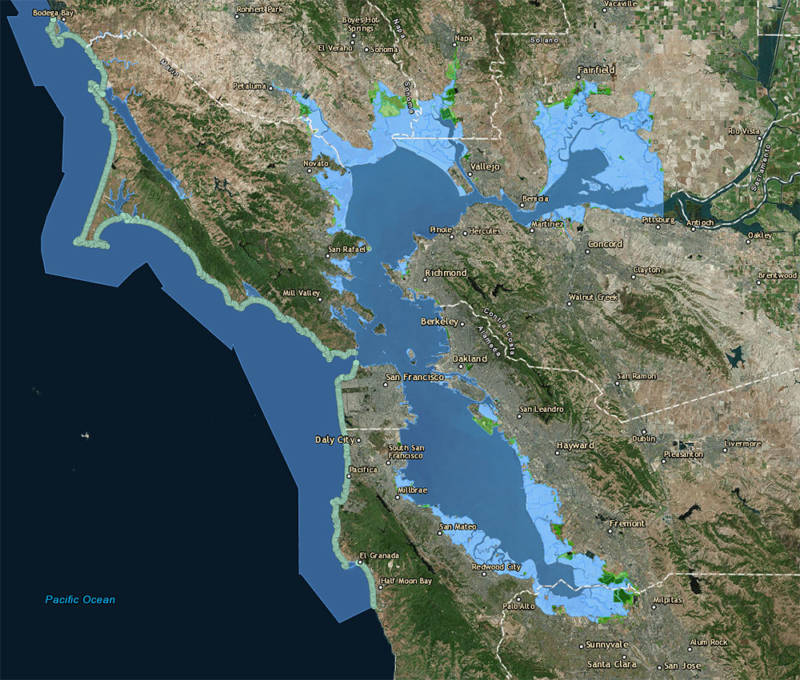

Ocean Current Slowdown Supercharging Us Sea Level Rise

May 18, 2025

Ocean Current Slowdown Supercharging Us Sea Level Rise

May 18, 2025